The backstory is so transparently corrupt it requires an explanation, so we’ll go down the full rabbit hole and explain how China knew – to a demonstrable certainty – their multi-billion dollar investment in Mexican EV plants would be useful.

Always remember, there are trillions at stake.

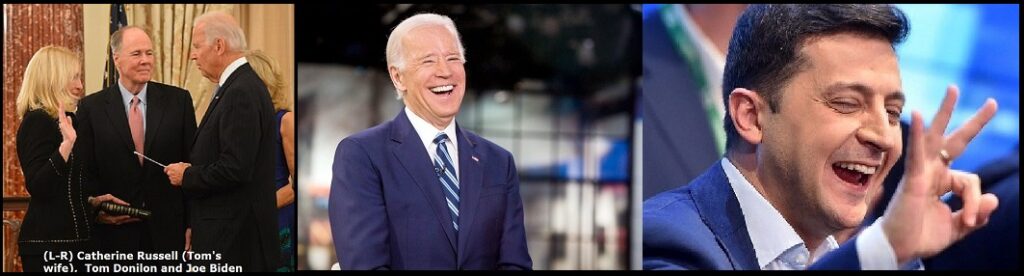

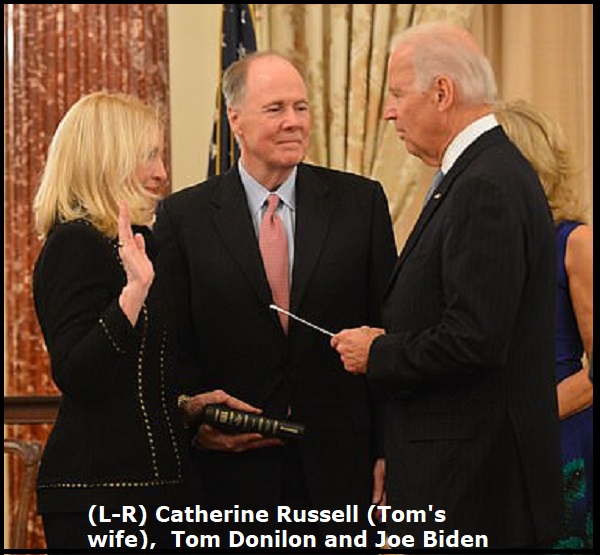

First, who was installed in the Biden White House in charge of all personnel and staffing? Catherine Russell. {SEE HERE} Who is Catherine Russell? She’s the wife of Tom Donilon, a long-time aid and advisor to Joe Biden who served in the Obama White House.

First, who was installed in the Biden White House in charge of all personnel and staffing? Catherine Russell. {SEE HERE} Who is Catherine Russell? She’s the wife of Tom Donilon, a long-time aid and advisor to Joe Biden who served in the Obama White House.

After serving as Obama’s National Security Advisor (prior to Susan Rice), Tom Donilon then went on to become “Chairman of the BlackRock Investment Institute {SEE HERE}.” His job was literally to “leverage the firm’s expertise and generate proprietary research to provide insights on the global economy, markets, geopolitics and long-term asset allocation.”

In essence, the Donilon family represented the interests of Blackrock in the White House.

Second, Tom Donilon’s brother, Mike Donilon is a Senior Advisor to Joe Biden {link} providing guidance on what policies should be implemented within the administration. Mike Donilon guides the focus of spending, budgets, regulation and white house policy from his position of Senior Advisor to the President.

In June of 2022, Blackrock’s Tom Donilon was then appointed to be co-chair of U.S. Department of State’s Foreign Affairs Policy Board {SEE HERE}, in charge of U.S-China policy. Can you see where this is going?

Blackrock, a massive multinational investment firm with assets in the tens-of-trillions, was essentially guiding/constructing the policymaking of the White House, through Tom Donilon, Mike Donilon and Catherine Russell (Tom’s wife). Blackrock then took out massive investment stakes in China, including in the Chinese auto-making industry, with specific focus on EVs. Tom Donilon, now shifting to the State Dept and guiding US-China policy, was the Blackrock government embed, ensuring policy that would keep their investments lucrative.