Our own analysis of U.S. consumer prices in 2019 showed that prices of imported goods actually declined despite the tariffs. A recent report from CPA takes a look at the impact to Chinese exports to the U.S. [SEE DATA HERE] Bottom line, the tariffs worked to reduce Chinese imports.

CPA – […] Since the Section 301 tariffs were imposed, the share of imports from China has steadily declined from 21.6% in 2017 the year prior to the tariffs to 16.5%, a decline of 5.1%. No other country has lost as much share of total U.S. import penetration over the past five years.

In terms of total import value, Mexico gained the most from the tariffs, adding $110.8 billion. Vietnam gained the second most in import value by $78.4 billion and by far gained the most of total share of U.S. imports. In 2017, Vietnam accounted for about 2% of U.S. imports at $46.5 billion. In 2022, the U.S. imported $127.5 billion in goods from Vietnam, and the share of the total nearly doubled to 3.9%. Other countries in Southeast Asia such as Thailand, Cambodia, and Indonesia all saw significant increases in their value of imports by the U.S. (read more)

With the 2024 election rapidly coming, it is worth revisiting the actual tariff outcome to American consumers in order to dispel the popular myths about tariffs raising prices here at home. This might be the cited data you want to bookmark for later reference.

It was the Fourth Quarter of 2019…..

Right before the pandemic would hit a few months later, despite two years of doomsayer predictions from Wall Street’s professional punditry, all of them said Trump’s 2017 steel and aluminum tariffs on China, Canada and the EU would create massive inflation – it just wasn’t happening!

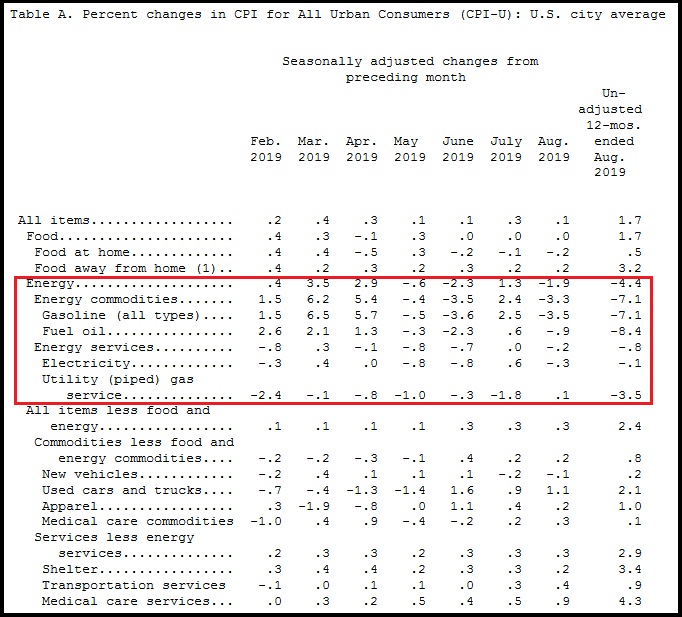

Overall, year-over-year inflation was hovering around 1.7 percent [Table-A BLS]; yup, that was our inflation rate. The rate in the latter half of 2019 was firmed up with less month-over-month fluctuation, and the rate basically remained consistent. [See Below] The U.S. economy was on a smooth glide path, strong, stable, and Main Street was growing with MAGAnomics at work.

A couple of important points. First, unleashing the energy sector to drive down overall costs to consumers, and industry outputs was a key part of President Trump’s America First MAGAnomic initiative. Lower energy prices help the worker economy, middle class and average American more than any other sector.

Which brings us to the second important point. Notice how food prices had very low year-over-year inflation – 0.5 percent. That is a combination of two key issues: low energy costs, and the fracturing of Big Ag’s hold on the farm production and the export dynamic:

(BLS) […] The index for food at home declined for the third month in a row, falling 0.2 percent. The index for meats, poultry, fish, and eggs decreased 0.7 percent in August as the index for eggs fell 2.6 percent. The index for fruits and vegetables, which rose in July, fell 0.5 percent in August; the index for fresh fruits declined 1.4 percent, but the index for fresh vegetables rose 0.4 percent. The index for cereals and bakery products fell 0.3 percent in August after rising 0.3 percent in July. (link)

For the previous twenty years, food prices had been increasingly controlled by Big Ag, and not by normal supply and demand. The commodity market became a ‘controlled market’. U.S. food outputs (farm production) was controlled and exported to keep the U.S. consumer paying optimal prices.

President Trump’s trade reset was disrupting this process. As farm products were less exported, the cost of the food in our supermarket became reconnected to a ‘more normal’ supply and demand cycle. Food prices dropped, and our pantry costs were lowered.

The Commerce Dept. then announced that retail sales climbed by 0.4 percent in August 2019, twice as high as the 0.2 percent analysts had predicted. The result highlighted retail sales strength of more than 4 percent year-over-year. These excellent results came on the heels of blowout data in July, when households boosted purchases of cars and clothing.

The better-than-expected number stemmed largely from a 1.8 percent jump in spending vehicles. Online sales, meanwhile, also continued to climb, rising 1.6 percent. That’s similar to July 2019, when Amazon held its two-day blowout Prime Day sale. (link)

Despite the efforts to remove and impeach President Trump, it did not look like middle class America was overly concerned about the noise coming from the pundits. Likely that’s because blue collar wages were higher, Main Street inflation was lower, and overall consumer confidence was strong. Yes, MAGAnomics was working.

Additionally, remember all those MSM hours and newspaper column inches where the professional financial pundits were claiming Trump’s tariffs were going to cause massive increases in prices of consumer goods?

Well, exactly the opposite happened [BLS report] Import prices were continuing to drop:

This was a really interesting dynamic that no one in the professional punditry would dare explain.

Donald Trump’s tariffs were targeted to specific sectors of imported products. [Steel, Aluminum, and a host of smaller sectors etc.] However, when the EU and China responded by devaluing their currency, that approach hit all products imported, not just the tariff goods.

Because the EU and China were driving up the value of the dollar, everything we were importing became cheaper. Not just imports from Europe and China, but actually imports from everywhere. All imports were entering the U.S. at substantially lower prices.

This meant when we imported products, we were also importing deflation.

This price result is exactly the opposite of what the economic experts and Wall Street pundits predicted back in 2017 and 2018 when they were pushing the rapid price increase narrative.

Because all the export dependent economies were reacting with such urgency to retain their access to the U.S. market, aggregate import prices were actually lower than they were when the Trump tariffs began:

[…] Prices for imports from China edged down 0.1 percent in August following decreases of 0.2 percent in both July and June. Import prices from China have not advanced on a monthly basis since ticking up 0.1 percent in May 2018. The price index for imports from China fell 1.6 percent for the year ended in August.

[…] Import prices from the European Union fell 0.2 percent in August and 0.3 percent over the past 12 months.

So yes, we know President Trump can save Social Security and Medicare by expanding the economy with his America First economic policy. We do not need to guess if it is possible or listen to pundits theorize about his approach being some random ‘catch phrase’ disconnected from reality. Yes folks, we have the receipts.

This was MAGAnomics at work, and this is entirely what created the middle class MAGA coalition. No other Republican candidate has this economic policy in their outlook, because all other candidates are purchased by the Wall Street multinationals.

America First MAGAnomics is unique to President Trump, because he is the only one independent enough to implement them.

That’s just the reality of the situation. They hate him for it…

Tariffs not taxes!

I love that guy and it makes me sick to see what they have done to him. He has been loyal all the way.

Shameful what the Xiden junta is doing to Navarro.

This is TRUE. Bigly

Tariff everything from everyone and watch them all (foreign powers and multinationals) go to their knees and beg for mercy, where they need to be and deserve.

America 🇺🇸 First!

Exactly.

We all know this stuff. Try explaining how this works to the rabid dumb down communists.

If the Republi-cons actually wanted to win and strongly wield power, IMHO they could do so easily by constantly comparing the strong, good for the common-man economy in 2020 against the current plight of the same person today under this regime. Ex: gas at the nearby corner was $2.35/gal. on Jan 5, 2021 but currently it’s $3.65/gal. Are you better off?

The whole problem with thinking established politicians will respond honestly overlooks who their paymasters and puppet masters are.

I think those at the treehouse aren’t foolish enough to expect anything approaching honesty from politicians. I was only voicing how simple it would be to convince the majority of working folk how badly this regime needs to go.

And it will be back above $4 in no time. And god forbid we are stuck with this coup puppet we will easily see an average of $6. Build Back Better is only building back better the bank accounts of globalist billionaires. As if they don’t have enough already… These people are greedy rapacious psychopaths.

What’s the secret to breaking away from from the coin flip? Take the 3rd side… stand it on its edge. President Trump is the edge of the coin.

Both sides hate him. The people love him.

Significant quantities of Chinese products are transshipped thru Mexico, particularly wearing apparel. Other countries too, particularly those that are granted GSP (General System of Preferences).

We NEED to get Prez DJT back in action as the US Prez~!

The country NEEDS to get back on the right track & the current clown show & circus needs to end~! ASAP!

MAGA~!

GOD Bless us all~!

Pres Trump also believed in manufacturing as a strategic military advantage long term. Another driver of tariffs and closing off our economy, lost on the nimrods who believe they can convince foreign rulers to be good worldly citizens.

Thank You President Trump, and a very grateful Thank You Sundance! What a one-two punch!

This reader grew up watching the Vietnam war on tv news every night. (Another long, no-win war brought to you by the deep state). Blows my mind that we are trading bigly with them. I know some Vietnamese folks here in Houston. Very industrious, likeable people.

Such a shame the deep state wanted its blood money profits by killing Vietnamese along with a lot of Americans who died there, or came home to suffer PTSD, Agent Orange injury, etc., etc. and for what?

I might suggest that the increase is actually rebranded Chinese goods.

We have also seen that reality.

Great stuff here. A question. The BLS link for inflation goes to the current time of 2024 when some energy inflation is “-6.9%”……..of course after going up and staying dozens of percent up. Does the BLS link have a sort of function to look into certain time/month/year ranges? Kind of user defined range? Would be great to show the 2018/19 low inflation carve out and the huge inflation of 2021, etc.

Ok, I think I found it on the menu tab. Just need to do it on the laptop with 2nd screen to really navigate thru. A bit tiny on this phone.

The 2017-2020 economy….ahhhh the good old days! 💥🇺🇸TRUMP 2024🇺🇸💥

Shipwreckedcrew has responded to Sundance’s tweet about food prices, etc., with a one word response: ‘Gibberish’. Will there be a further discussion about this??

Crew ? Crew Has had his ego bruised by Sundance’s command of the facts in several little clashes through the years.

Note that he doesn’t really engage with facts of his own? Just a drive by ……

Very true, I might remind Shipwrecked there was no such thing as BRICS before the Ukraine situation occurred and our (US) attempts to hammer the Russian economy with sanctions! It didn’t quite work out that way and we are staring at a conglomeration of Countries trying to eliminate or at least diminish the US dollar as the Worlds reserve currency!!! 🥴

Our Chinese capitalists have slated Peter Navarro for 4 months in prison and Stephen Bannon for 2 months. In the meantime our J6 patriots are rotting in the D.C./DoJ Gulag. Cohn and Romney and Goldman Sachs are very powerful enemies.

Tariffs are a normal and natural way for governments to support themselves. At its essence, a tariff is simply a continuing fee for access to a market. No fee, no access. Toll roads work the same way, and look how they have proliferated. What is abnormal and unnatural is the concept of the income tax. As evidenced by our massive deficits and the dismal state of our economy, it has become crystal clear that 100+ years of the Marxist inspired income tax has produced a complete failure.

Drill baby drill and tax China!

I was a LOT better off during POTUS 45 yrs. That is my empirical data and all else is BS.

Thank you for the education and inspiration!

MAGA 👊👊🇺🇸🇺🇸❤️❤️🙏🏻🙏🏻

Trump’s tariffs are why China and the US government party released COVID. They had lost the trade war.

Also: the United States easily has the ability to be a completely self-contained economic ecosystem. We have our own energy within our borders. We have all the natural resources necessary. We could stop all immigration today, and do the work ourselves.

I’m not against trade where it makes sense, but it is not a requirement for us to have a strong economy.

The United States has many of the natural resources needed for a policy of autarky.

There are however some key minerals and elements that have no real substitute due to their unique properties. Vanadium is just the first one that comes to mind for making various alloys of steel.

What President Trump did for our country and citizens was PURE GENIUS!!!

Sundance, I heard Trump make a comment about bringing the tariffs up from 25% to 60%. First, do you think he’ll do that large of a jump and, second, do you think that large of a jump would result in the same sort of thing that played out in 2019?

Mnuchin and Cohn engaged in pitched battles with Peter Navarro during the four years of the first Pres DJT term and thank goodness Dr. Navarro won the day with tartifs, particularly on China and his tough stance on the CCP!!! Part of the situation China finds itself in today with economic turmoil is thanks to Navarro, who the leftist Marxists are fixing to put in jail for the next four months because they have to appease their Chinese Sugar Daddies!!! 🥴

I know this is off topic….. but Donald Trump’s support and positive views regarding the Covid vaccine released this weekend are beyond appalling! Anyone with half a scintilla of consciousness knows these vaccines have maimed and killed thousands. Trump should keep his GD mouth shut regarding this issue! It’s beyond disgusting. If he continues in this vain I will NOT vote for him….

People are divided on this. I don’t know.