They have proposed and refined so many of the carbon trading schemes, it becomes difficult to remember which iteration each new formula replaces. Heck, I’ve lost track of how many of the individual components of the larger plan are already in place. However, John Kerry has introduced the western elites at COP27 to the latest acceptable proposal surrounding coal fired energy.

Against the backdrop of sped-up Build Back Better urgency, this coal-based carbon trading platform is called the Energy Transition Accelerator (ETA).

When you stay elevated to the larger way the Energy Transition Accelerator works you can clearly see the transferring of wealth from your bank account to the global control mechanism that will eventually determine your energy allotment. The companies that provide energy are simply the collectors for the fees you will pay to the World Economic Forum income disbursement group.

(Reuters) – […] The scheme, known as the Energy Transition Accelerator (ETA), was launched at the United Nations’ COP27 conference this week by John Kerry, the United States’ climate envoy, in collaboration with the Rockefeller Foundation and the Bezos Earth Fund.

[…] Voluntary carbon markets, in which companies get emissions credits in return for channeling cash to poor countries that cut their carbon output, have often been riddled with fraud and double-counting. Many critics think rich countries should just fork out the cash themselves to close coal plants – or tax fossil fuel companies to get the money. (read more)

There’s the system in a nutshell. Energy providers must purchase emission credits from the ‘carbon market’ (govt); in the U.S. likely the EPA as they do with RIN credits. The electricity provider puts the carbon purchase credit fee in your electricity bill.

The money generated from that credit purchase system is then delivered to the government who take a cut; then pass along the balance to the central climate control unit who take a cut; then forward the remaining balance to the third-world government who also take a cut; and then the remainder is used to develop clean energy systems; which returns to the starting point with the energy providers.

See how that works?

That’s the basic operational model of all the carbon-trading platforms.

Widget Corp (energy provider) is forced to purchase a credit. Widget Corp. get the fee for the credit from the customers (you). The fee is passed on to govt, then passed on to central control, then passed on to foreign govt, then passed on to Widget Corp. for building the new clean energy system.

Yes, it’s a Build Back Better circle.

The only way to avoid the Carbon-Trading Exchange is not to join the carbon trading system.

Well, that said, what does not joining the carbon trading system look like?

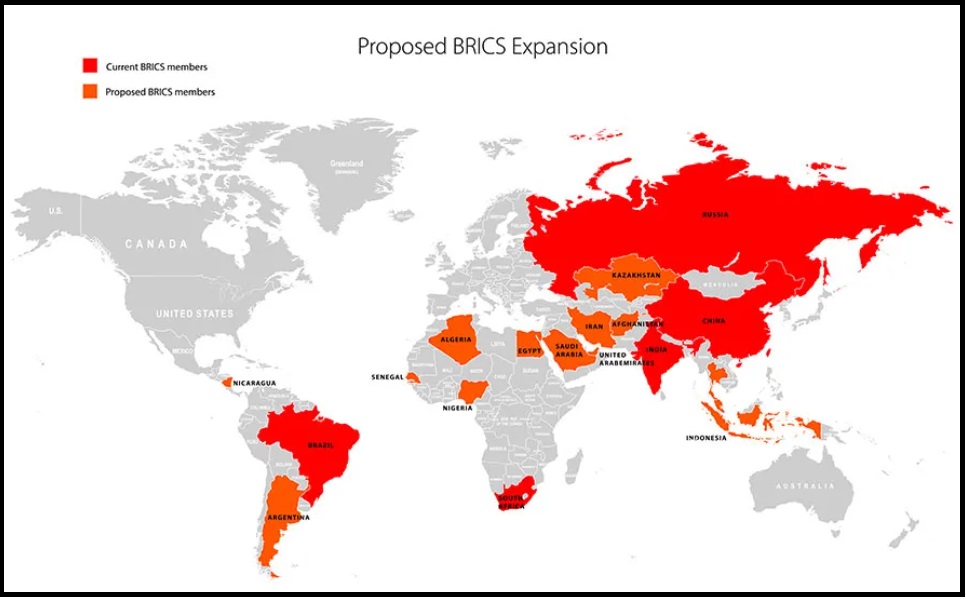

(Silk Road) – The Russian Foreign Minister, Sergey Lavrov has stated that ‘over a dozen’ countries have formally applied to join the BRICS grouping following the groups decision to allow new members earlier this year. The BRICS currently includes Brazil, Russia, India, China and South Africa.

It is not a free trade bloc, but members do coordinate on trade matters and have established a policy bank, the New Development Bank, (NDB) to coordinate infrastructure loans. That was set up in 2014 in order to provide alternative loan mechanisms from the IMF and World Bank structures, which the members had felt had become too US-centric.

The Asian Infrastructure Investment Bank (AIIB) was set up by China at about the same time for largely the same reasons and to offer alternative financing than that provided by the IMF and World Banks, which were felt to impose political reform policies designed to assist the United States in return for providing loans. Both the NDB and AIIB banks are Triple A rated and capitalised at US$100 billion. The NDB bank shares are held equally by each of the five members.

In total, the BRICS grouping as it currently stands accounts for over 40% of the global population and nearly a quarter of the world’s GDP. The GDP figure is expected to double to 50% of global GDP by 2030. Expanding BRICS will immediately accelerate that process.

Concerning a BRICS expansion, Lavrov stated that Algeria, Argentina, and Iran had all applied, while it is already known that Saudi Arabia, Türkiye, Egypt and Afghanistan are interested, along with Indonesia, which is expected to make a formal application to join at the upcoming G20 summit in Bali.

Other likely contenders for membership include Kazakhstan, Nicaragua, Nigeria, Senegal, Thailand and the United Arab Emirates. All had their Finance Ministers present at the BRICS Expansion dialogue meeting held in May. (more)

Can you see it now?

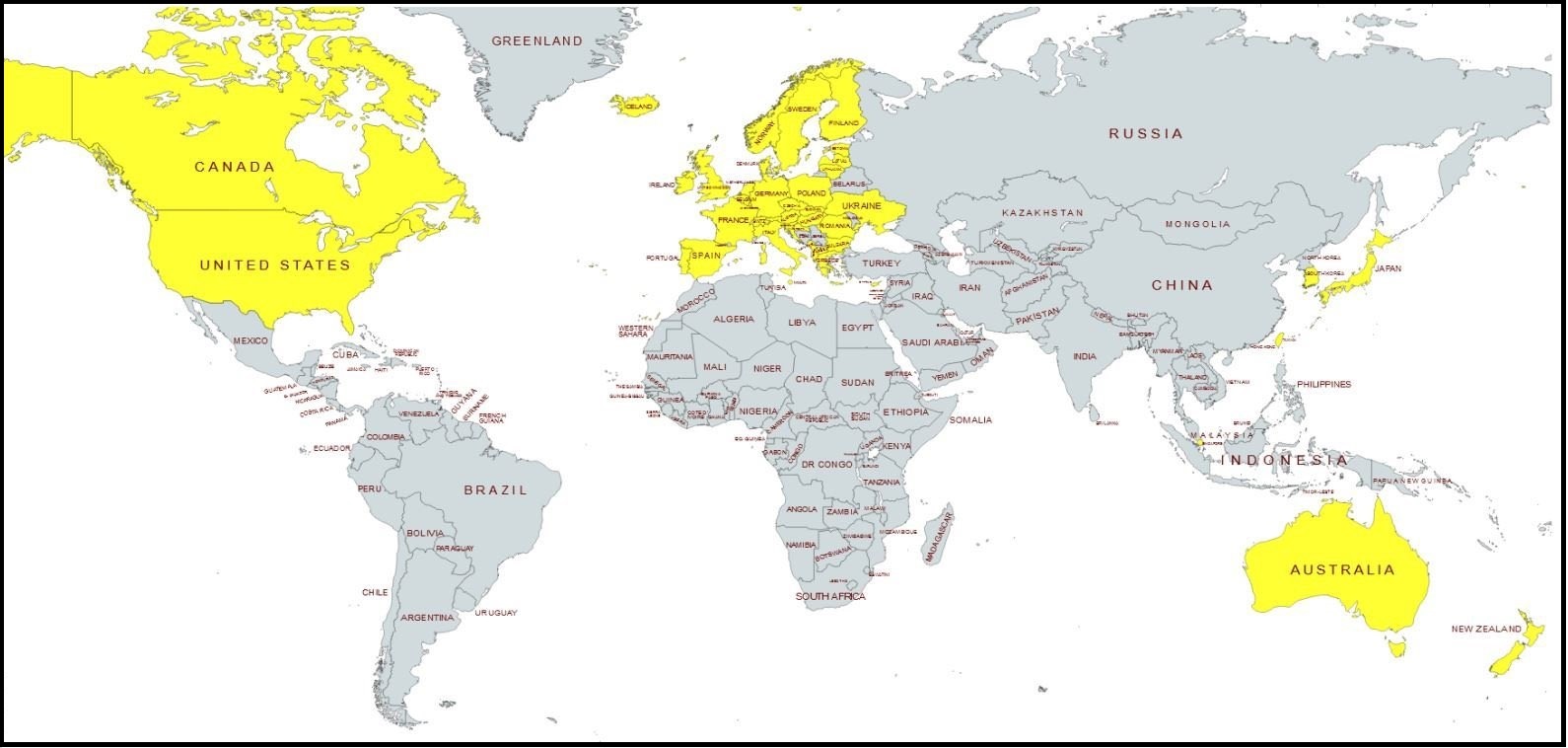

This is the global trade and finance system cleaving as a result of western government’s chasing climate change.

There will eventually be two systems of finance, banking, investment and energy use.

Can you see it now?

Right now, the ‘western’ team is not going to allow any ally to join the BRICS team without punishment.

It’s a battle for global wealth using energy development as the tool.

Last point. With this in mind, does the multinational opposition to President Trump carry a new “trillions at stake” context for you?

.

I wish these busy body masters of the universe types had to work for a living – they have too much time on their hands to come up with garbage like this. Most of them probably couldn’t grow a tomato if they had to.

The busy body masters should all get aboard Elon’s rocketship and launch themselves on a mission to Mars.

You know.. to prove to humanity that it’s feasible to get there.

We’ll worry about getting them back to Earth later.. A LOT later..

Enquiring minds want to know:

What is the carbon footprint of a rocket launch?

I would donate my own carbon credits to put ’em all on a one way rocket trip to Mars!

They will NEVER stop until we force them to stop.

Scarlett : THE BIG THEY do not concern themselves with growing food . They set a scenario where what ever is grown they take or destroy it . Should you grow for your self they kill you !

Lenin , Stalin , Mao , Pol Pot …..BIDEN SUPPORTERS

…did John Kerry not ‘achieve’ his wealth via a ‘marriage of convenience’ to the Heinz heiress?

Leave it to an idle, lazy, destructively narcissistic wealthy boys’ cabal, to meddle in the affairs of many and get away with it.

On the other hand, I am not good at gardening and can’t grow a tomato….am thinking I better learn!

I encourage every single one of us to try. There’s a learning curve, so start asap. Be as self-sufficient as possible.

Yes, Lurch did that to offset part of his lineage that came from the “poor” side of the Forbes family.

I wish we could get rid of all the billionaires who meddle in this country’s affairs….that includes biden and the one who said “you didn’t build that”.

Leaf miners are eating all the leaves on my cherry tomato. They are beginning to attack my romaine. I have used NEEM, did not read the directions, so maybe not often enough. My cherry is running out of leaves… It is full of green tomatoes. They do not like hot peppers so those are safe and I surrounded my bell in time with the hot ones. This is all in containers. Outside of the containers, my sandy acidic soil is not sufficient to support any plants that are not weeds, not even peppermint which is known for its aggressiveness. Also, outside of containers the slugs and snails and ants are everywhere. I can’t fight all those animals at once, so containers until I can build some raised beds.

The red fire ants attacked me while picking up my gate that Ian and Nicole took down. I might be able to put it back up with 6 new screws.

In my youth, I helped my aunt weed the tomatoes by pulling up all the young shoots. I know better now. I am also not handy. I amaze my son at my inability to naturally comprehend how things go together. It’s okay, my second year calculus teacher wrote on my final that physics was not my thing. So, I married one, had his son and divorced him. I learned a lot, but, I am still not handy. If it can be put together upside down, backwards, etc. I will find that way and then pull it apart and try again. I do not attempt anything serious, just small stuff.

I will continue gardening against the odds. But, I am not gardening thinking I can grow cheaper than Walmart. I am gardening for the day when Walmart runs out of fresh produce like they ran out of formula.

I am also going to try one layer when I have the side yard growing something other than weeds and ant hills again.

I will build a tractor of hardware wire and PVC and galvanized wire and a couple of hinges with a tarp on top for it.

My side yard is big enough that it can keep one chicken busy moving daily week after week. Later I will be able to grow some shade crops there.

Even one layer will not be cheaper than Walmart. However, without freeze drying, it is difficult to store eggs (from the grocery) for years, unlike rice, beans, oats, wheat berries, honey and dried milk. Freeze dried anything is expensive and freeze dryers are thousands. So, again, for the day when the store is empty. This might be cheaper at today’s prices than when I first investigated. But, the feed will cost more now as well.

The learning curve on each animal is huge. Even for worms. I have a worm bin from Urban worms. They will eat many veggie leftovers and provide a renewable fertilizer in a small space (2 foot cube). They need regular infusions of shredded cardboard and newspaper as well as leftovers. What the worms can’t eat, a chicken can minus the bones. Setting up their bedding requires a little bit of expensive stuff if you don’t want flies. I bought the smallest quantity of worms for $25. That means it will be 6 to 9 months before they are producing enough castings regularly for my small garden produce.

John Kerry and a horse walk into a bar and the barman says, “Why the long face?”

The horse answers, “He’s with me”

I read “John Kerry introduces” and I didn’t need to read any further. I automatically knew the rest was going to be complete BS. I guess you could say he has incredible branding in that sense. Total Soy Boy phony.

“Can I get me a hunting license here?” -Kerry during Presidential run

Find the picture of Lurch attempting to eat a Philly cheesesteak.

Kinda hard to believe Theresa Heinz fell for this creep!

May have thought she would be First Lady one day.

Or maybe just liked the insider trading benefits being married to a senator.

You know what is really amazing? We talk and and complain and spew fact after fact. We realize our destruction is the grand prize and we do nothing. Our elections are stolen, our fuel is in short supply our children have been conditioned to accept the most bazaar lies and we set back and complain some more. This will not end well unless we grow a set. Like the founding fathers, like Trump. Willing to risk it all. How many more concessions will we make to appease our masters?

They are counting on a bunch of hotheads going for a frontal assault, guns blazing. Not a smart strategy to walk in a trap set for the impatient.

One needs to be bit wiser than that, by not conceding terms of engagement to the enemy.

They want a disorganized mob to cause trouble, as to enact more oppressive measures in a show of force.

And to rid us of our 2nd amendment rights, they already have taken our 1st and 4th rights away

We need an IRISH DEMOCRACY

Exactly, ungovernable, unruly, fiery.

I have no intention to go out with guns ablaze. I’ve served 2 tours in Vietnam. I carried a gun and protected my community while wearing blue. But I say to RFBurns, you can’t avoid our fate by claiming we’re egging for a fight. I’m an Irish Jew. My mother was a Jew. Family died in camps in Poland. I refuse to believe all we can do is complain. Tell me Mr. Burns, how much skin do you have in the game.

Enough. I’ve served, as several of my relatives have. But, that is beside the point.

I’m just saying one has to be more deliberate. No sense in attacking an enemy where they are strong. The art of war and all.

There’s a time for violence and a justifiable point for defending the welfare of your family. Sooner or later one has to make a choice for themselves what that line is.

Duty still compels me to vigilance for my community. The fight will come soon enough. I will prepare to do as I must, as you will for your family.

Targeted elimination.

Personally I see this as a spiritual battle. Evil is usually the most obvious, as this current state of affairs is evidence of. No nation in history survived turning it’s back on God without very destructive consequences. Any government that allows its kids to be killed, teaches and advocates sexual perversion and openly lies and steals from it’s citizens is destined to be destroyed. The only question is if the whole nation suffers the judgment or just it’s leaders. Sadly, if half of the population is openly rebelling against God, I’m having a hard time seeing that nation as a whole escaping judgement. As America was founded as a Christian nation, but now seems to want to promote evil over good, not really a big surprise it finds itself being destroyed economically. The US could be looking at devastating conditions in the near future if something doesn’t change quickly.

What you stated is the root cause of our problems and the situation that we find ourselves in.

We are individuals, including those who compose “the government.”

As individuals we have been blessed by our Creator.

We have given the ability to make choices on what we believe, what we do, and who we follow.

I don’t see a distinction being made between individuals based upon station in life.

Individuals choose Good, or they choose Evil.

Their fate is in their own hands in that regard.

God will judge, but we choose.

I choose to follow and obey our Lord.

Like Pompeii.

Good question. Many people can’t see the big picture. They will wake up quickly only when their financial pain becomes overwhelming. Of course, by that time it may be too late to save the country.

We must have unity, with simple goals. Be the example. And not back down. Even if we become the targeted one.

Sunlight and share the simple truths, and not tire of it. Be prepared to hold those accountable even when it becomes tough.

I am still astonished by the amount of people who aren’t aware or care for the facts…. Every one who even starts to see, is one more and will add to the united MAGA group.

I hear your point though, and agree that it frustrating.

I will bow before only one master.

And like that Tom Petty song…. You can stand me at the gates of hell, but ill stand my ground. I wont back down…

In good news – pretty sure Trump would be happy to know he has a solid set of supporters; also with balls! 🙂

What do you suggest? The only thing I can think of is a national strike. Will we get what Trudeau did to the truckers? We’d have to be ready for a long seige.

How about we all leave the large banks, those using ESG scores, for smaller local ones? It’s a start.

Same for companies that go along with it.

That is a great idea!

Yes, this administration would do to US truckers what Trudeau did. Think guerilla, small, specific target, not big and disorganized.

Jesus Christ and his apostles set the example we must follow. The apostles endured all kinds of humiliation, were treated as filth, and instead of fighting back they responded with love toward their persecutors—all for the joy of serving Christ and reconciling the world to God.

Jesus said his disciples would have to turn their ploughs into swords after he was gone. Most of the apostles if not all died martyrs. There is a time for peace and a time for war. Be cunning, do not comply.

The only response outside of a united legal, voting front that will be effective is guerilla, also known as putting sand in the gears.

There are violent and peaceful revolts all over the world. Most of them are not accomplishing their goals, some are. We are up against something larger than one country, very well funded with advanced biological, chemical and traditional weapons at its finger tips. Ultimately, they can not jail us all. They are as dependent as we are on the functional parts of our societies or they too will experience 18th century lifestyles. Simple non-compliance is the most effective least costly weapon at our disposal. It requires big numbers.

A mild supervolcanic eruption would shut these Greeniacs up for a few days.

Limit poor and third world countries access to energy by paying them not to use energy. This limits their level of competition with first world countries and makes them dependent. Welcome to the establishment of a forever first world – third world caste system or Owells’s example: “Imagine a Boot Stamping on a Human Face – for Ever”

I wish John Kerry would be eaten alive by a pod of killer whales while sale boarding.

I wish he’d catch a flesh eating disease. Something incurable.

Biden Regime Plans to Extend Covid-19 Public Health Emergency Through Spring of 2023

Vote Harder ; )

Adam Laxalt (Nevada) went from 3% ahead, to 2% ahead, to 1% ahead, and now, with another batch of votes just in, is ahead by .1%.

That looks rigged.

Because it is.

Mitch really, REALLY doesn’t want to win, does he?

The Senate, ie RINOs, ie uniparty, do not want MAGA in the senate. Too many MAGA can expose and disrupt the corruption. Watch Lake win and Masters lose in Arizona.

Democrats are printing ballots as fast as they can. The steal is in full swing!

Nevada is a special case. There will be lawsuits.

Taking our money and our liberty is getting to be too much work for them. I mean, they have to create a crisis, fear monger the threat, and then declare “war” to transfer the needed wealth. With the climate, they have created a permanent crisis that they can crank up, down or sideways at will, skimming any amount of money from anywhere or anyone they like.

And the herd lines up for more

This song is from 1988. So, there are way morethan 1 million now :-(:

Tom Paxton – One Million Lawyers

Humankind has survived some disasters, I’m sure.

Like locusts and flash floods and flu.

There’s never a moment when we’ve been secure

From the ills that the flesh is heir to.

If it isn’t a war, it’s some gruesome disease.

If it isn’t disease, then it’s war.

But there’s worse still to come, and I’m asking you please

How the world’s gonna take any more?

Chorus:

In ten years we’re gonna have one million lawyers,

One million lawyers, one million lawyers.

In ten years we’re gonna have one million lawyers.

How much can a poor nation stand?

The world shook with dread of Attila the Hun

As he conquered with fire and steel,

And Genghis and Kubla and all of the Kahns

Ground a groaning world under the heel.

Disaster, disaster, so what else is new?

We’ve suffered the worst and then some.

So I’m sorry to tell you, my suffering friends,

Of the terrible scourge still to come.

Chorus

Oh, a suffering world cries for mercy

As far as the eye can see.

Lawyers around every bend in the road,

Lawyers in every tree,

Lawyers in restaurants, lawyers in clubs,

Lawyers behind every door,

Behind windows and potted plants, shade trees and shrubs,

Lawyers on pogo sticks, lawyers in politics!

Chorus

In spring there’s tornadoes and rampaging floods,

In summer it’s heat stroke and draught.

There’s Ivy League football to ruin the fall,

It’s a terrible scourge, without doubt.

There are blizzards to batter the shivering plain.

There are dust storms that strike, but far worse

Is the threat of disaster to shrivel the brain,

It’s the threat of implacable curse.

In ten years we’re gonna have one million lawyers,

One million lawyers, one million lawyers.

In ten years we’re gonna have one million lawyers.

How much can a poor nation stand?

How much can a poor nation stand?

Trump is a massive threat to the WEF, who I think oversees this climate change nonsense. Trump believes in being oil independent and certainly not in the build back better globalist scheme.

So its basically a “new and improved!” renamed carbon credits scheme.

Which instantly proved to be corrupt. Think of it was the new globalist Value Added Tax. If it only applies to energy at first, it will soon apply to the energy content of everything.

Yessss….and see the company I just presented. Like I said make money off this ridiculous shit if you can. Understand you are in Clown World and learn to laugh as much as you can. It might bring you solace and peace of mind.

One thing is for sure Trump/DeSantis yada yada matter not…..we are not voting our way out of this I promise. No need to fight amongst ourselves.

Lol my old man found this obscure piece (below) about investing in Vision Hydrogen domiciled in NJ. Its a micro cap stock. I have to buy/sell stocks for dad because he’s technologically inept lol. I tried to talk him out of it but ended up settling on a smaller amount. Next day the stock froze and I assumed trading had been halted. Turns out they tweaked the name and ticker symbol to VIHDD and also split the stock 2 for 1. He had made money so on Wednesday I jumped in with a larger amount. Yesterday and today it was 10% each day. They make hydrogen power plants and are setting their sights on Europe.

Why do I mention this to you….because it hedges my paranoia and if the worst should happen well we’re all screwed anyhow. But I contend if this Greenie crap does prevail might as well make some money on it. This thing has been going up like nuts since Oct 27ish. I know its probably a pump n dump. If I was smart (I’m not) I would take my $1300 profit and fly. But I just can’t and I think its like I mentioned it eases my paranoia. Approach with caution.

https://world-financial-times.com/?p=4012

Hydrogen as a primary fuel is the one technological development that climate change hucksters and oil companies fear the most. Once the storage and transport problems are addressed effectively, you have a fuel that is inexhaustible, non-polluting, and can be produced and used on any scale almost anywhere in the world.

I have no doubt that great efforts are expended to impede any attempts at advancing hydrogen technology.

Sundance you’re a brilliant Man….

This is just an old idea repackaged.

It’s the modern day version of buying indulgences.

“The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.”

Ecclesiastes 1:9 KJV

Amen.

The fog comes

on little cat feet.

It sits looking

over harbor and city

on silent haunches

and then moves on

to sell Carbon Offsets

to the next city full of gullible rubes.

The Settled is Science!

I’m crying like Tater Stetler having an existential panic attack when they closed the All-Night Krispy Kreme drive-thru.

Not because that was so funny; but because I’ll never get to see Al Gore try to sell a Carbon Offset to Mark Twain.

You remember Carbon Offsets, don’t you? That’s what Democrats sold before Russian Onsets.

Twain and Tesla

Mark Twain was a Leftist. He was an anti-Colonialist, anti-Classist, anti-Racist, anti-War and anti-Imperialist.

Today’s Globalists want to colonize all the earth. They’re addicted to War–including Bio-Weapon Attacks on the populace, with a poisonous Vaxx Chaser. And Empires don’t come any more Imperial than a One-World Government run by and for the Oligarch Class.

I like to think Twain’s Bullshit Meter would have pegged out on these damned lying, murdering weasels.

Mine sure does. Especially when you finally realize that all their seemingly disparate policies are “a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism”.

Climate Change. Endless War. The COVID Bio-Weapon. Crashing the Economy. Energy Shortage. The Genetic Jab. Open Borders.

They seem different, but they are One Thing. A Design to Kill or Enslave you –while robbing you first, of course. Depopulation and Death, but Money First.

Like Haman, they have thereby constructed their own gallows. GOD’s Word. Amen.

Rest in the Vine: Mark Twain vs. the Neo-Evil Empire Globalists

Look at BE Bloom energy(as a comparison) which is much further along in development of Hydrogen Fuel cell technology for the Green revolution. This was related to the Post by Luke.

I’ve yet to be convinced of the cost effectiveness of a hydrogen fuel cell.

It takes a *lot* of mols of hydrogen for useful amounts of energy. Laws of thermodynamics and physics at work with energy conversions.

Hydrocarbons already do that cheaper. Their fuel cell would probably be more efficient with methane anyway.

There are other issues with hydrogen as a fuel, but I digress.

Along with PLUG, Ballard, Fuel Cell along with all the other multi powered Mega Corps.

Here’s then real deal, we live in Clown World and Clown just doubled down.

A MARK Twain was also an agnostic, sadly.

I wonder if Samuel (“God has heard”) Clemens (“merciful”) knew he was mentioned in the Bible? That’s the kind of thing that could mess with your head!

Perhaps the Lord had a word with him…

Super, the roi on my solar lifepo4 system just halved. Can be completely off grid. Also wonder if a new system imposed without congress will pass scotus.?

So what does all this mean for us, individually?

HIgher utility bills. Higher gas prices. HIgher everything. Less wealth.

We produce wealth that is taken from us in the form of carbon-debt: e.g. ,taxes, fees and penalties put on any and everything we need to live and work. That money is collected by carbon producers and put it into Central Carbon Banks. The elites then launder that money through a network of shady entities which produce offsets (carbon credits) using magic tricks.

Third world despots are allowed to produce carbon credits by eliminating growth, energy use, and land development. This is where the currency is “created”

So how’s the scam work? Let’s say John Kerry wants to boast that his private jet and yachts are carbon neutral.

Kerry texts President Odinga, who clicks on his Central Carbon Banking app to generate a certificate in the amount of one jazillion carbon credits for not cutting down a rain forest. He deposits it in the Central Carbon Bank.

Kerry texts the President of the local coal fired power plant who is sitting on hundreds of millions of dollars in carbon penalties taken from Utility customers. The Utility Prez deposits one million dollars into the Central Carbon Bank to buy Odinga’s jazillion carbon credits, offsetting the coal plant’s carbon emissions.

Kerry then borrows a jazillion carbon credits from the Carbon bank and puts Carbon-Neutral stickers on his plane and yachts.

Odinga get a $100K deposited in his private bank account. The Central Carbon banks sits on the other $9ooK.

Basically, they laundered a million dollars of wealth stolen from Utility customers.

When will Carbon Credit Markets be created to trade & purchase Soylent Green?

Long crickets & tree bark …

Isn’t it time for Kerry to fall off his bike, again?

Unfortunately this is going to happen people. The GOP is a fake opposition party run by a bunch of traitors. They aren’t going to save the USA.

They are already doing something similar with wind and solar.

The feds take money from us and give it to monopolies to build wind and solar farms.

The local Utility company is required to tie them into the grid and are allowed to raise utility rates as high as the want to pay for it without having to get the rate hike approved. After higher taxes to pay for the equipment, we get utility rate increases to pay for the integration.

Once on the grid the wind and solar farms can sell the electricity on the open market.

We pay for it all front. They pay nothing, sell the electricity, then raise our utility rates anyway, and skim off the top.

I have a message for John “Effing” Kerry, 🖕

And that’s being polite…..

Kerry is just one of the dynasty family members in climate Monarchy. Kinda like a head of state in this game.

https://www.dailymail.co.uk/news/article-9885049/John-Kerrys-wife-millions-dollars-Chinese-investments.html

https://www.couriermail.com.au/news/national/john-kerry-heckled-during-announcement-at-cop27/video/580fa9e99e3ca8f475c7e87194a3cd5c

A heckler interrupted US Special Presidential Envoy for Climate John Kerry as he announced a new initiative at the COP27 climate summit on November 9. Kerry announced the “Energy Transition Accelerator,” which he said would “catalyze private capital to accelerate the energy transition in developing countries.” Footage by Colin Christensen shows a heckler yelling at Kerry during the announcement. The heckler could be heard saying, “John Kerry, you’re promoting false solutions.”

I have also seen the comments and articles on other sites that during G20 more countries will be putting applications in to join BRICS + .

The Greenie narrative seems to be a–look Squirrel– to keep the attention from BRICS +.

I also saw an article where Canada and US are trying to get “bossy” with Mexico regarding their Climate Change hoax.

Don’t think Mexico is going to play their game.

And I will not be surprised if Mexico joins BRICS +.

It’s interesting…….

They claim that there is global warming going on and yet they want to take our warming sources (gas/electric) away so that we can all freeze to death.

Something I don’t see spelled out clearly enough in this thread is that carbon trading will massively enrich the left. Al Gore and a lot of other democRATS expected to personally make billions of dollars EACH YEAR from the carbon credit system they promoted so heavily. They were going to do this through ownership of the carbon credit exchanges that were being established in anticipation of passage of Cap And Trade, an idea first proposed during the Clinton years.

For example, the CCX … Chicago Climate Exchange … was the entity created and owned by AGWSupporting democRats. It was the brainchild of a Democrat named Richard Sandor. Sander owned a firm called Environmental Financial Products (EFP). He knew a little known Democratic Illinois Senator named Barack Obama. In 2001, Obama helped Sandor’s EFP company get awarded a $350,000 grant from the leftist run Joyce Foundation, in which Obama just happened to be a board member.

The Joyce Foundation’s president, Paula DiPerna, was a Democrat. She stated that the grant was to “support the design of a pilot phase for a carbon dioxide emissions trading market”, the CCX. And then, based on the results of that design, the Joyce Foundation later provided the seed money (well over a million dollars) that set up CCX. So you could reasonably say Obama was at the ground floor of CCX’s creation.

Now, if the Cap And Trade bill had passed, the CCX was going to trade A LOT of carbon credits. In fact, it was estimated by Sandor himself that the CCX would trade over $10 TRILLION each year in carbon credits. That’s right … $10 TRILLION … EACH YEAR. And here’s the kicker. They’d charge for each of those trades. At a commission rate of just 2%, the exchange would have generated about $200 BILLION dollars a year for it’s owners.

But, of course, CCX didn’t have 2% commissions at the time. Commissions were more like 5% in 2005. Before the collapse of the carbon tax *dream* #1 began, they’d reached 7%. That adds up to a LOT of money going to whoever owned CCX, even if you ignore the billions in interest the exchange would probably make on the trillions or dollars flowing through their coffers. And never mind that CCX also owned 51% of the European Climate Exchange (ECX).

So who were CCX’s owners? The folks creating the Global Climate hysteria. One of them was Al Gore, Mr “Global Warming” himself. In fact, Gore’s London-based Generation Investment Management (GIM) company was the fifth largest shareholder in CCX. It was a 3% shareholder. That doesn’t sound like much, but 3% of $200 billion a year would have earned GIM 6 BILLION dollars EACH YEAR if Sandor’s projections were right.

And 3% of $500 billion in trades (that’s assumes a 5% commission rate) would have earned GIM $15 BILLION dollars A YEAR. Now granted, not all of that would have gone to Al Gore, weasel that he is. But GIM was a privately owned company with less than 30 owners, of which Gore was one of just 2 co-founders. So you can be sure that Gore, as a cofounder, would have received a large fraction of that 6-15 billion … every year. Easily a billion or more a year.

It’s ironic, isn’t it, that the very first year after Cap and Trade passed, Gore would have become one of those BILLIONAIRES that the leftist base so hate. And even though the Cap and Trade bill failed to get approved at the time (thank goodness), Al Gore still managed to make out like a bandit. And of course, carbon credits was just too good a scam to abandon.

And do you want to know Richard Sandor’s stake in CCX? 16.5% In other words, had the Cap and Trade bill passed, he expected to make over $30 BILLION A YEAR (MINIMUM) from his CCX exchange. And there were other top democRATS in on the scam as well. DiPerna, in November 2001, left the Joyce Foundation and joined the upper management of CCX. Bet she had a stock option agreement potentially worth hundreds of millions, if not billions, as part of that new job.

Remember Franklin Raines? He was the corrupt former CEO of Fannie Mae which in large part caused the housing market crash in 2008. Well guess who acquired the patent for the software that CCX would use to monitor the trading of carbon credits? Yep. Franklin Raines. He stood to make a tidy sum too. Then there were the democrRATS who owned Shorebank, which was designated the “banking arm” of the CCX. It was also one of the largest shareholders in CCX. And most of its executives were closely tied to Obama and other top Democratic Party leaders. And don’t forget the democRATS at Goldman Sacks (another key Obama supporter and recipient of Obama largess). They were contracted to run the investment trading floor of CCX. Run the scam. Plus they had a 10% stake in CCX, ensuring they’d end up VERY, VERY wealthy, too.

Now the thing is, I don’t see a whole lot of difference between the new Carbon Credit Exchange (like CTX) and the now defunct Carbon Climate Exchange. Both trade/traded Carbon Credits. Both charge fees per trade. And I suspect the scam is basically the same. So maybe it’s about time someone took a very close look at who owns and runs these modern day carbon credit exchanges, and how much they charge per transaction. Bet they are mostly owned by leftists and the transaction fees are as just as high as CCX’s were back in the 2005- 2010 timeframe.

Can’t speak much about the former, but yes to the latter. For example, this link (https://www.business2community.com/trading/carbon-credit-trading) indicates that at the “Carbon Trade Exchange” (CTX), which was founded in 2009, and which is just one of MANY exchanges that have been established to trade carbon credits, “sellers receive 95% of proceeds when selling carbon credits, which equates to a 5% selling fee.” 5%!!!

And note that the Executive Chairman of CTX is Wayne Sharpe, who also founded Global Environmental Markets (GEM) in the UK back in 2009. CTX is a subsidiary of GEM. It’s curious how close the acronyms CTX and GEM are to CCX and GIM. But I don’t know if there’s a connection. Investments in these carbon exchanges by today’s democrats may not be as blatant and public as what democRATS did in the early 2000s, but I wonder how much they are secretly investing in such exchanges?There has to be some reason they are pushing the idea of trading Carbon Credits so passionately. It’s NOT the science.

I’d like to know when Morocco is joining BRICS.

The last country on earth with enough phosphates to feed the planet! You die without it.

Why don’t “energy providers” just say Foxtrot Uniform, and refuse to participate? All they have to do is refuse to ship energy till this malarkey is staked through the heart. Then wha, the Kerry, Pelosi, and Biddn spawn gonna go run on the Clean Energy treadmill to power their Lear jets?

Climate change-what a bunch of bs!

Like seed change-a plant develops or doesn’t.

Of course climate change exists;

WE ARE DEPENDENT ON THAT BEING THE CASE!

Open your brains & close your ears to the ketchup leech & his merry bunch of billionaires.

Video of Maduro and Kerry mucking it up at Cop27 like old friends. The scam is on.

Kraft and Heinz merged in 2015.

Kraft has 200 or so products. Heinz, 5700 products sold globally.

That is why even an extended targeted boycott will have difficulty in gaining traction. It would have to outlast the long term business plans of these multinationals Target Profits business plan.

These multi nationals are not going away anytime soon.

The absurdity of COP27 reps coming to Egypt in 400 private planes, and eating a lavish dinner of beef, chicken and other meat, and then telling the peasants to live differently. I listened to the head of the Irish government, Micheal Martin, speak yesterday. In Ireland, new homes are not allowed to be built with chimneys….no fireplaces and no way to use solid fuels. The West, while putting together all these economic ‘ideals’ is also in the business of totally destroying itself. Europe is in serious decline, as is the US.

No chimneys?!

Unreal. I had not heard that.

Simply look at Graphic 4.4, we are more likely to fall into an ice age than have continued non-existent global warming. https://wattsupwiththat.com/wp-content/uploads/2022/11/Vinos-CPPF2022.pdf

With the above in mind, WHY didn’t Pres. Trump submit the Paris Climate Accord to the Senate for ratification? Why didn’t he call on Mitch MicChao to bring it up for a vote? Why didn’t McChao bring it up for a vote? Since the Paris Climate Accord is a treaty, shouldn’t it be subject to Senate ratification? Just some questions I have….

It was/is an agreement with no enforcement mechanism.

It doesn’t look that way to me! Even so, my original questions still stand.

It’s the same “Frog in the Pot” situation.

They turn up the heat so slowly that we (The Frog) don’t notice until it’s too late. Been going on for a long time.

Fortunately for us they had to turn up the heat too quickly recently to crush the Trump/MAGA storm. It was turned up so quickly that The Frog is now aware of what’s going on.

They overplayed their hand and exposed themselves.

Like in the movie Hunt for Red October, the missile they launched is turning back on them. They will be destroyed by their own weapon.

“Those who do not learn from history…”

Only ultra narcissists can envision their type of world. The committee of 300 actually believes they are in charge. Harari, Schwab, CHYna, with their Belt and Road agenda, believe themselves gods. Are they ever in for a surprise!

in the meantime, the peasants suffer and only want to return to being We, the People under the Laws of Almighty God and the nature He created.

As Neil notes, it’s an age-old scheme with the usual plots and machinations. Would be puppet masters such as Kerry, full of delusions, diligently fashion the shackles, realizing not they’re only subjects of a far superior malevolent intelligence. Seems to me they’ve always had the desire for their plans, but with the advent of the means–digital identification–they now have the means to do them. No one can hide anywhere, anonymity exists only as long as one is insignificant to their objectives.

I suspect that the day and the hour draws near.

This isn’t new, it’s the original idea behind the scam. This is merely the latest incarnation.

If more people understood what people like Al Gore were up to with this stuff, the people behind this would have had their heads chopped off a couple decades ago.

You get to freeze your family while the wealthy pay credits into a company they make money from. Get it?

None of this rot will supplant the Constitution. Meaning the EPA is on thin ice and will be defunded and dissolved. Nuclear was the answer and in the 70’s over 65 plants were scheduled to be built and all were stopped by the government. So the EPA had the answer in hand and instead went with OIL and COAL.

Also, there is no such thing as Fossil fuel. Fossils don’t burn or produce anything. Rockefeller coined that term to scare people into believing there was a limited supply.

There is no climate crisis. It is a completely fabricated delusion for political gain and the stealing of money from the American people. It is designed to subjugate all of humanity for all eternity.

People may not realize this but cars account for only 10% of petroleum use. We are being sold a BIG LIE! It is promulgated day and night, yet many poeple see through this toxic cloud of mendacity.

I walk outside every day for two hours and empirically have not witnessed one change to the planet. I see Coyotes and exotic birds living their lives without a care about what these radical maniacs have to say about saving the planet. Like these frauds give one shit about the state of the planet. All they care about is the state of their bank accounts!

Do no obey these illegal dictates that are being imposed on us through surrepitious means, banks and corporations working on tandem with this fascist system to enslave us all. The jig is up! Our eyes are wide open. We shall never surrender!

Long live the individual. I sing the body electric!

I think Biden just said we have just 9 years to save the World. I’m still waiting for someone to show me how CO2 is killing us?

I always look forward to your interesting posts. Thank you and HNY