The Bureau of Labor and Statistics (BLS) releases the inflation numbers for July [LINK HERE] showing massive U.S. inflation continues to crush the working class. Massive increases in domestic food staples (+10%), energy (+23%) and regular unleaded gasoline (+43%) are hitting the middle-class exceptionally hard [See Table 2].

No middle-class Americans are having their wages increase even close to the scale of price increases for basic purchases. This outcome results in massive drops in “real wages” (wages minus inflation), and eliminates disposable income entirely. These outcomes are not due to COVID-19 or any recovery therein. These outcomes are a direct result of Joe Biden economic and monetary policy. {Go Deep – and – Go Deep}

The White House responds to inflation by saying the Biden administration is attempting to directly subsidize the middle-class inflation they are creating by giving Americans money to pay for higher prices through COVID bailouts. Yes, the administration admits they are exploding the dependency state, WATCH:

The White House solution is to create dependency on the government for income. This is exactly intended as government subsidies are used to keep the pitchforks at bay and simultaneously keep people dependent on government to sustain themselves [expand the political base].

Also, please understand when they say “inflation is transitional” or “inflation will spike and then come down to normal levels” what they are saying is that prices will massively increase right now, and then normal or slow price increases will return next year. This does not mean prices will come down, ever; a key distinction.

Inflation is the comparative measure of price increases now compared to a prior time (last year), usually expressed as a percentage. Ex. A lemon cost $0.49 cents last year (2020), and jumps to $0.89 cents this year (2021). The lemon may only jump to $0.99 in 2022 (.10 more) and that is significantly lower inflation, but the price spike is perpetually built in. The same is true for gasoline, electricity, energy, etc.

A reminder of two primary precursor articles [Primary One and Primary Two] which outline the economic dynamic in play, and how we can look forward with accuracy to what is likely to happen. Despite the deflective talking points by the professional financial pundits, this massive spike in inflation is entirely predictable due to Biden economic policy and Biden monetary policy.

Keep in mind, the FED already said in April they would “support inflation”, that’s because – while they will not say it openly, they know there’s no way to stop it. The massive inflation is a direct result of the multinational agenda of the Biden administration; it’s a feature not a flaw, and it has nothing whatsoever to do with COVID. Also keep in mind the first group to admit what is to come are banks, specifically Bank of America, because the monetary policy is the cause.

There’s no way around this. Despite the pundit and financial class selling a counter-narrative, home prices will crash and unemployment will go up. I know this is directly against the current talking points, but the statistical reality is clear. CTH was the first place that said months ago that new home sales will plummet, that is starting to happen right now. There’s no way for it not to happen, the big picture tells us why.

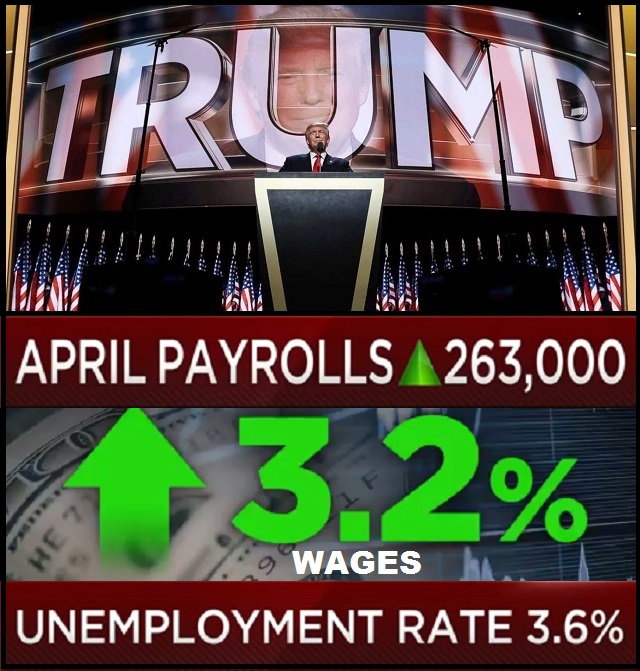

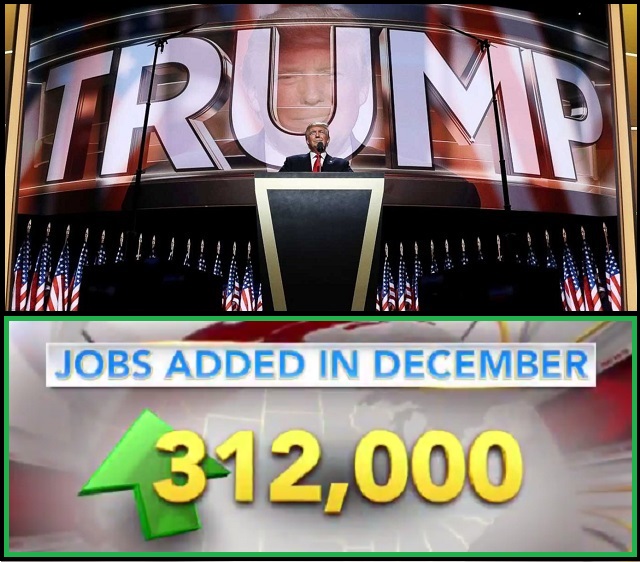

You might remember, when President Trump initiated tariffs against China (steel, aluminum and more), Southeast Asia (product specific), Europe (steel, aluminum and direct products), Canada (steel, aluminum, lumber and dairy specifics), the financial pundits screamed at the top of their lungs that consumer prices were going to skyrocket. They didn’t. CTH knew they wouldn’t because essentially those trading partners responded in the exact same way the U.S. did decades ago when the import/export dynamic was reversed.

Trump’s massive, and in some instances targeted, import tariffs against China, SE Asia, Canada and the EU not only did not increase prices, the prices of the goods in the U.S. actually dropped. Trump’s policies led the largest deflation in consumer prices in decades. At the same time, Trump’s domestic economic policies drove employment and wages higher than any time in the past forty years. With Trump’s policies we were in an era where job growth was strong, wages were rising and consumer prices were falling. The net result was more disposable income for the middle class, more demand for stuff, and ultimately that’s why the U.S. economy was so strong.

♦Going Deep – To retain their position, China and the EU responded to U.S. tariffs by devaluing their currency as an offset to higher prices. It started with China, because their economy is so dependent on exports to the U.S.

♦Going Deep – To retain their position, China and the EU responded to U.S. tariffs by devaluing their currency as an offset to higher prices. It started with China, because their economy is so dependent on exports to the U.S.

China first started subsidizing the targeted sectors hit by tariffs. However, as the Chinese economy was under pressure, they stopped purchasing industrial products from the EU, that slowed the EU economy and made the impact of U.S. tariffs, later targeted in the EU direction, more impactful.

When China (total communist control over their banking system) devalued their currency to avoid Tariff price increase, it had an unusual effect. The cost of all Chinese imports dropped, not just on the tariff goods. Imported stuff from China dropped in price at the same time the U.S. dollar was strong. This meant it took less dollars to import the same amount of Chinese goods; and those goods were at a lower price. As a result, we were importing deflation…. the exact opposite of what the financial pundits claimed would happen.

In response to a lessening of overall economic activity, the EU then followed the same approach as China. The EU was already facing pressure from the exit of the U.K. from the EU system; so when the EU central banks started pumping money into their economy and offsetting with subsidies, they essentially devalued the euro. The outcome for U.S. importers was the same as the outcome for U.S-China importers. We began importing deflation from the EU side.

In the middle of this there was a downside for U.S. exporters. With China and the EU devaluing their currency the value of the dollar increased. This made purchases from the U.S. more expensive. U.S. companies who relied on exports (lots of agricultural industries and raw materials) took a hit from higher export prices. However, and this part is really interesting, it only made those companies more dependent on domestic sales for income. With less being exported, there was more product available in the U.S for domestic purchase…. this dynamic led to another predictable outcome, even lower prices for U.S. consumers.

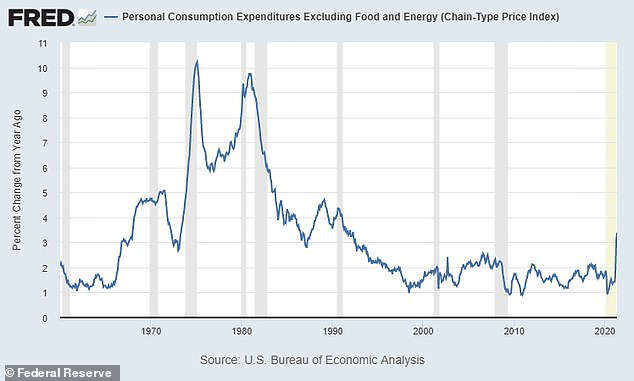

From 2017 through early 2020 U.S. consumer prices were dropping. We were in a rare place where deflation was happening. Combine lower prices with higher wages, and you can easily see the strength within the U.S. economy. For the rest of the world this seemed unfair, and indeed they cried foul – especially Canada.

From 2017 through early 2020 U.S. consumer prices were dropping. We were in a rare place where deflation was happening. Combine lower prices with higher wages, and you can easily see the strength within the U.S. economy. For the rest of the world this seemed unfair, and indeed they cried foul – especially Canada.

However, this was America First in action. Middle-class Americans were benefiting from a Trump reversal of 40 years of economic policies like those that created the rust belt.

Industries were investing in the U.S., and that provided leverage for Trump’s trade policies to have stronger influence. If you wanted access to this expanding market, those foreign companies needed to put their investment money into the U.S. and create even more U.S. jobs. This was an expanding economic spiral where Trump was creating more and more economic pies. Every sector of the U.S. economy was benefiting more, but the blue-collar working class was gaining the most benefit of all.

♦ REVERSE THIS… and you now understand where we are with inflation. The Joebama economic policies are exactly the reverse. The monetary policy that pumps money into into the U.S. economy via COVID bailouts and ever-increasing federal spending drops the value of the dollar and makes the dependency state worse.

With the FED pumping money into the U.S. system, the dollar value plummets. At the same time, JoeBama dropped tariff enforcement to please the Wall Street multinational corporations and banks that funded his campaign. Now the value of the Chinese and EU currency increases. This means it costs more to import products, and that is the primary driver of price increases in consumer goods.

Simultaneously, a lower dollar means cheaper exports for the multinationals (Big AG and raw materials). China, SE Asia and even the EU purchase U.S. raw materials at a lower price. That means less raw material in the U.S. which drives up prices for U.S. consumers. It is a perfect storm. Higher costs for imported goods and higher costs for domestic goods (food). Combine this dynamic with massive increases in energy costs from ideological policy, and that’s fuel on a fire of inflation.

Annualized inflation is now estimated to be around 8 percent, and it will likely keep increasing. This is terrible for wage earners in the U.S. who are now seeing no wage growth and higher prices. Real wages are decreasing by the fastest rate in decades. We are now in a downward spiral where your paycheck buys less. As a result, consumer middle-class spending contracts. Eventually, this means housing prices drop because people cannot afford higher mortgage payments.

Gasoline costs more (+50%), food costs more (+10% at a minimum) and as a result, real wages drop; disposable income is lost. Ultimately this is the cause of Stagflation. A stagnant economy and inflation. None of this is caused by COVID-19. All of this is caused by economic policy and monetary policy sold under the guise of COVID-19.

This inflationary period will not stall out until the U.S. economy can recover from the massive amount of federal spending. If the spending continues, the dollar continues to be weak, as a result the inflationary period continues. It is a spiral that can only be stopped if the policies are reversed…. and the only way to stop these insane policies is to get rid of the Wall Street democrats and republicans who are constructing them.

Hope that makes sense, and love to all.

~ Sundance

.

Be patient, be respectful, be kind and caring toward all. Don’t look for trouble. However, when the time comes to get in the fight, drop the rules and fight for your family with insane ferocity. Fight like you are the third monkey on the ramp to Noah’s Ark…. and damned if it ain’t starting to rain.

Support CTH HERE

Prior References:

♦The Modern Third Dimension in American Economics – HERE

♦How Multinationals have Exported U.S. Wealth – HERE

♦The “Fed” Can’t Figure out the New Economics – HERE

♦The FED Begins to Question the Economic Assumptions – HERE

♦Treasury Secretary Mnuchin begins creating a Parallel Banking System – HERE

♦Proof “America-First” has disconnected Main Street from Wall Street – HERE

By design…

Indeed. You have to be especially confident that there is no consequence to your pain inflicting to beg OPEC to grow output when there is an easy, readily available source of unlimited petroleum in your backyard that would give millions of people great paying jobs.

When China is eating your lunch, the best way to replace your lunch is to use helicopter money through deficit spending.

Smart tactic to hide the loss of GDP. When China starts eating your dinner it will take further deficit spending to hide the GDP losses to China . All the Biden administration has to do is point to the GDP number and say it is all in your head. Then Obama can throw another lallapaloosa tent party.

bertdilbert,

Don’t forget one of the “secret ingredients”… covid….

Inflation takes on another meaning, when you have just lost a $10k-$15K contract to “jab or job”.. Damn kool-aid drinkers!! (no offense intended to the “injected”, we all gotta do what we all gotta do)

I think something is “gonna give” before long. I wouldn’t want to be the grocery store manager who has to tell the wrong person.. “No jab, no mask, no FOOD”!

Anger as cold as dry ice……….

Best,

skipper

There will be a black market, vax’d shopping for unvax’d at high cost.

Me too Skipper!

Of course. But let’s be accurate. Biden has no policy or ideas. He is utterly devoid of anything resembling them. His handlers do his 5thinking for him he just parrots their lines. His handlers have wishes and aspirations. They are setting “policy”. But it’s not a benign one it’s a power play. Biden is an empty shell made2irse by his encroaching cognitive decline.

Indeed. He’s doing what he always has done, looting.

Dairy farm report:

The price we receive for our milk went from $18/100lbs to $14/100lbs the first part of July.

And the retail price of milk is nearly 3 times what it was just a few years ago.

This is an amazing amazing presentation. I know container costs have been 750 to 1500% above where they were a year ago. So something has to give.

This administration is not concerned about inflation. They have acres of money trees.

They are certainly not concerned about slowing it.

When the criminals are able to steal a presidential election (not to mention senatorial and congressional seats), the last thing they are worried about is inflation or the American people. That’s why NUTHIN these treasonist _ucks do should be surprising.

Agreed. These greedy globalist pig elitists want the entire country broke and dependent, unable to resist when we become an inevitable client state of a global corporate technocracy. Americans will have to kill their way out of this, make no mistake. They’re counting on inaction and disorientation from an enraged populace.

Interesting about the feeling of the average American out here.

For a while I felt some bewilderment among a lot of people about what was happening to people in their daily lives when they watched Biden steal the election and they wondered if they were just too dumb to figure national politics out.

Then I was seeing and I heard a bit of fear creep into them as they watched things look as though our government was indeed pushing us all around with open borders, this covid from China and all of the lying about it, the political elite demanding masks for the plebes but not for themselves etc.

No one seemed to know quite what to do or think, we had not seen anything like this in our life times before and needed time to find our feet.

Now I am sensing a very slow very hot anger growing among the what is considered “middle class” and it is picking up steam.

I do not know exactly where this will go in respect to national politics but I am wondering if it will be more difficult for the powers that be to wipe our the American middle class than they think it will be.

We will not go down without a big stinking fight of some kind and I am seeing a lot of the younger people, parents with children getting very riled up.

It is dawning on many that this nasty business of government over reach is not going away and it can not be ignored because it is going to reach out and bite every one.

When the government starts messing with children and religion people get ready to fight.

welll the PRIVATE bankers at the FED do anyway…ever hear of Cloward & Piven…they promoted a financial collapse in the US to usher in Marxism

Inflation is an important tool in their box.

What kind of effer do you have to be to enjoy this? That’s half of our nation.

I believe there is only a quarter of the population who believe in socialism/Marxism. Then there are those who

don’t know what is going on and don’t care to know. Then there are the rest of us. No idea of the last

two percentages.

.

There are a lot of ignorant people, apathetic people, and low-IQ people.

I’m blown away by how often I hear someone say something like public libraries and roads are “socialism”. Or pass on some bs meme on social media about how some American is thrilled to be living in England or Germany where they have real access to medical care.

The globalists have to degrade the quality of life in rich, developed nations for their plan of global government and control to work. As the quality of life has improved dramatically in both the 2nd and 3rd world in the last 30 years, the quality of life in Europe and the US has declined. This is all part of the plan:

The master planners devised the strategy of a merger – a Great Merger – among nations. But before such a merger can be consummated, and the United States becomes just another province in a New World Order, there must at least be the semblance of parity among the senior partners in the deal. How does one make the nations of the world more nearly equal? The Insiders determined that a two-prong approach was needed; use American money and know-how to build up your competitors, while at the same time use every devious strategy you can devise to weaken and impoverish this country [the U.S.]. The goal is not to bankrupt the United States. Rather, it is to reduce our productive might, and therefore our standard of living, to the meager subsistence level of the socialized nations of the world. The plan is not to bring the standard of living in less developed countries up to our level, but to bring ours down to meet theirs coming up… It is your standard of living which must be sacrificed on the altar of the New World Order.”

—Gary Allen in his book “The Rockefeller File”,1976

We are at present working discreetly with all our might to wrest this mysterious force called sovereignty out of the clutches of the local nation states of the world. All the time we are denying with our lips what we are doing with our hands.”

–Professor Arnold Toynbee, in a June 1931 speech before the Institute for the Study of International Affairs in Copenhagen.

Having lived through the Carter years, I am not eager to see it happen again, even worse this time around. With the revelations coming out of the Cyber Conference I expect major administrative backlash. Let’s see about watering the Tree of Liberty.

“I prefer peace, but if trouble must come, let it be in my time that my children may know peace.”

– Thomas Payne

Exactly, Rob.

Inflation, pshaw. I’ve got sixteen cents saved up from July 4th so I can ride this out easily.

I lost 32 cents on gasoline to hit the grocer with hot dogs on sale.

There’s talk of impeachment. I’ve got the pen ready. If anyone reads or finds where a person can sign on the dotted line, please let me know. I can’t wait to do it.

Is that wishful thinking on your part,Jayne?

“There’s talk of impeachment.”

Boy do I wish, however, Bonjino keeps talking about it and I thought he said he was putting up a site for people to sign. Of course, sometimes I don’t listen to Dan kept as well as I should and might be remembering it wrong. Don’t think I’m asking anyone to do the work for me. I study several news sites on our side but I hadn’t seen anything. Just thought if someone saw it, it would be a help.

Just got back from my local Jewel, (major Cicagoland grocery conglomerate). Empty food shelves, empty freezer shelves.

A bottle of pop at the gas station, used to be 1.99 is now 2.29. No more pop for me.

same here. Store shelves empty.

Only things in shortage in SW Missouri is potato chips and bagged dog food. Grocery clerk mentioned it is a truck driver shortage more than anything

Why work when you can get covid welfare.

Farm to Families food program?…ended.

Rent moratorium?…extended.

Legal plunder…

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.” — Frederic Bastiat, Economic Sophisms, 1848

“But how is this legal plunder to be identified?

“Quite simply. See if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime.” – Frederic Bastiat, The Law, 1850

Sundance’s figures don’t even factor in the anticipated massive drop to “real wages” that will result from the tax increases in the spending bills moving through Congress as we write here. When those tax increases hit, the bottom will fall out entirely, and it will be lights out….literally for many people.

Well when bottom falls out of the tax paying public, where they going to get the money than. That is why they are pushing digital currency,debits and credits.

On the upside, the wages of sin are holding steady.

CFR , central bankers , Fabian Socialist Society all pushing ahead with what they call ” The Great Work ”

a New World Order

CFRmedia.com

SparrowHawk,

I believe that the catch phrase is… “Build back better”?

I can’t stand listening to peppermint patty

Inflation? What’s that? Does that require knowledge of basic maths? History? or English? Because my school district no longer requires that kind of (White man) knowledge to graduate … so I don’t understand. But FREE STUFF from the government!? Now THAT I understand …

That will slow down consumption, therefore is very “green” and “good for the planet” never mind stores closing, people losing jobs, suffering.

That’s indeed, what they think. Electric cars means few folks have cars.

Good time to stock up on non-perishables.

Also seeds and gardening supplies.

That well fine and dandy. What you going to do with hordes coming out of the cities.You should always live at least one tankful of gasoline from any big city.

On a mountain…They won’t want to climb

Not only is the inflationary price spike “built in”, but it will compound with the “regular” inflation that follows. Its like compounding interest, only in reverse. If something costing a dollar increases to $1.50, and then there is, say 4% inflation after that, then that extra 50 cents inflates as well as the original dollar, and the new price will then inflate, and on and on…

A tax on the poor.

But the rich will get richer.

I ask for God’s forgiveness everyday but I hate these people more every day. They are flooding this country with illegals, pushing a fake shot, destroying the economy and the Fake Media and The Fake GOP cheer them on. God is our only hope and our prayers are needed, it is our best weapon. When you are totally surrounded by evil your only hope is to look up.

I believe there are many who have ‘covid-blindness’ . They believe anything Fauci and friends spew out…

Everything is blamed on Covid and Pres. Trump. It is so mind-boggling how many are so clueless.

“Everyone wants to live at the expense of the state. They forget that the state lives at the expense of everyone.”

– Frederic Bastiat

Seniors will get 2% more on Social Security next year.

Inflation is a form of tax.

By next year, those of us seniors who will not get vaxxed will probably not be getting their Soc Security Checks!

Goodbye America. Hello Venezuela.

I do NOT mean this is a condescending way whatsoever. Yes this is inflation but is it enough? What we need is Weimar Republic Inflation now. As bad as it would suck I believe; honestly, it is about the only thing that can save us. There may be a few more Hail Mary’s too. We are now deep in the 4th quarter and I do not believe we are winning. Hey if there’s some kind of secret plan then the joke’s on me. I’ll take it!!! We are surrounded by a nation of, as Bongino puts it, Smart/Stupid people. The only way they will snap out of it is severe pain. I see it every day. Slow drips of information and education will not suffice. Nothing less than a tidal wave will do. If it ever comes it will cause them shell shock.; maybe to the point of irreparable harm.

I assume TPTB know this as well. They are doing everything in their power to awaken the masses BUT only after they have prepped the battlefield. They will control the people’s descent just like everything else. I really hate putting outcomes in the hands of God/Universe/Mother Nature but I am stuck here. I am pretty certain of what’s going on (G Reset) but not much in the way of ideas to stop it.

I know what you mean, run-away Inflation would be rough but like all hardships in life it would also be a blessing in disguise. It would paralyze the Democrat’s ability to Print money and coopt countries, organizations, and people. We’re not a little banana republic – China’s not going to be able to come along and subsidize their operations.

Under the Biden administration, farmers are presented with checks if they plow their crops under. Given that Bill Gates owns 1/4th the farm land in America, I wonder how much he is getting from this wondrous entitlement program.

Meanwhile in the pear capital of the world, Northern Calif pears are showing up at the pear processing plants, which are staffed by skeletal crews. Just who would show up to work in 95% temps for ten hour days, to make less than Gavin Newsom’s weekly “COVID unemployment” checks?

Next year the problem will be tremendous food shortages. Even for those who can manage the wallop of 2022’s inflation.

Just curious. Haven’t watched a press conference since Psaki started. Watched all of McInenany’s

Its not just the inflation. That adds to the other trends:

The hollowing out of real value-add economy, without which no recovery is possible and all other economic metrics worsen as we become a vassal state of the CCP.

The accelerating federal debt with the executive and legislative branches vying to outspend each other. Their behavior is puzzling, unless they have a plan to default – and maybe they do, perhaps using covid as an excuse.

The all-seeing and hearing surveillance state, coupled with de facto government censorship and propaganda by tech media.

Racialist Marxist demagogues poisoning and dividing society at all levels, indoctrinating youth in education.

And, most serious of all, the grave plandemic harms including coerced “vaccines” that are now revealed as both ineffective and seriously harmful, and completely unnecessary for a virus with the same 99.9% survival rate as flu. These shots have pressured the virus to mutate into more virulent strains that cause the most serious illness in the “vaccinated”, as predicted by the more honest experts. While the authorities continue to falsely claim the shots are “safe and effective” and push even harder to inject every American. Can simple greed and stupidity loading the groupthink really be the explanation for this? Or is there something much darker behind all of it?

https://www.timesofisrael.com/over-5000-new-coronavirus-cases-confirmed-monday-as-new-limits-mulled/

https://noqreport.com/2021/08/04/media-blackout-renowned-german-pathologists-vaccine-autopsy-data-is-shocking-and-being-censored/

https://thelibertydaily.com/must-watch-dr-dan-stock-delivers-a-masterclass-on-the-real-science-behind-covid-and-vaccines-to-the-mt-vernon-school-board/

https://journals.plos.org/plosbiology/article?id=10.1371/journal.pbio.1002198

Considering everything that is going wrongfully wrong, can we turn the ship back to a right direction? It really is hard to avoid a foreboding sense that this truly is the end times.

Is it unjustified “gloom and doom” negativity to have this sense, with so many things on the same trend line?

The vax alone is enough by itself: If it turns out to manifest the long-term harm that some experts predict based on known pathologies, it won’t matter if you are one of the top 5% affluent. Especially if you took the shot. With the official lies pushing the shots, this looks like a very great evil falling down on us.

Never blame on government conspiracy what you can blame on government incompetence.

When you have Biden and Company handing out Trillions to their supporters, $1000+ per month in food stamps and more in welfare yet the common man woman who works can still barely make any money. So Happens People start to wake up and nothing makes sense anymore….. we are pretty much there. The only person guaranteed to get paid is the Taxman who is Ki_ll_ing us all with Onerous Taxes.

everything is high price right now Than last years,

our country is really going wrong way again,

The president Trump leadership and he’s policy was much better for American people,

the Joe B and socialism Dem and GOP swamp need to be hold accountable,

I though press secretary was gonna crap herself…. it’s one thing to screw over millions, its another to have to look em in the eye as you do so….

Empty stomachs, consistently, are the triggers for many a revolution. If the elites are not careful and the common American feels the empty growl to the point that can’t be taken anymore…

… as they say in Mexico, “May God catch them after confession”…

In the last 90 days, my food and energy costs have risen 20%. At least.

Nobody will hire me at my age. I can’t even work my way out of this.

BiteMe has run out of My money as of now. Time to hunker down for the storm that’s coming.

It’s bad when you are highly skilled and in many areas Yet nothing makes sense anymore. Money is still scarce even though Biden is Printing Trillions and handing it out. We know one thing for sure Obama and his People are living high on the hog…. that tells you where most of this loose Money is flowing.

Disgusting bitch.

Bacon, $7 a pound.

Build Back Beijing

I just spent $82 to fill up my ram rebel. Before 01/20/21, it was $40-$45

It’s 07-08 all over again…. but worse with the high inflation in everything. I think the economy already rolled over… thanks to Biden & Company. They don’t care their investments already paid off, all they had to do was invest in the oil industry, lumber, pharma etc. The Democrat big donors networths are up 20-30 billion since January.

And with the obvious election fraud, they will be able to stay in power forever until Patriots stand up. Unfortunately, Americans are too comfortable in their ways. They won’t sacrifice their lifestyle and risk losing everything to fight the government.

I visited a large city recently and needless to say the economy was Hot….. hot in the sense of overheating. Lots of people out, but nobody was making money. Very much 2007-2008 ish. You can just feel it…. something is not right, Lol.

Inflation is a tax on the poor.

The swamp is making us pay for their extravagant spending.

The elites shower their friends with $$$ and now they are sending us the bill to pay for it.

Consumer Prices Rose at Highest Levels Since 2008 Last Month—Again

Excerpt:

Altogether, last month’s high rate of consumer price inflation matches June’s price gains and ties the record for the biggest 12-month spike recorded since 2008. As the below graph makes clear, this is becoming a broader trend, not just a one-or-two month “temporary” uptick like so many claimed.

https://fee.org/articles/consumer-prices-rose-at-highest-levels-since-2008-last-month-again/?fbclid=IwAR0Vyt-3wQ3kAlNvYOcf_OlgnWrh1_F3ioKOBCtTE1cq0Z_XRU7aUdGysco

And most are too stupid to realize any of this…

My top of the class at UVA sister in law argues with me about this- she blames covid and Trump. Calls this a correction..

Yeah, this from a person who makes 200k and her husband makes millions on DC contracts. They live in N. VA and love Biden.

I don’t get it. I ask what has Biden done- i hear ges fighting bigotry and global warming. i kid you not.

DD,

Your sister is benefiting from this. As Upton Sinclair wrote, “It’s hard to make a man understand something when his continued financial well-being depends on him not understanding it.”

You would do well to cut your sister loose. She’s clearly one who doesn’t give a damn about anything as long as she’s “getting hers.”

So sad but very true. The family divisions started when ‘they’ shut-down the US and my family had aunts / uncles, etc. telling us “too bad if you lose your job, house, etc. because people are dying…”.

That was the line in the sand in which we replied: “f-off”. In about 40 days time, tens of millions of Americans stuck their heads up their rears without questions. We always feared a conflict would arise during our lifetime, but April 2020 clearly pointed-out to my family chaos was coming much faster.

But yes, unfortunately some people cannot stay in the: “Well we get along on most topics; except politics.”. You have to be able to cut them out of your life…just like an addict that won’t ever changer their ways.

I am dumber for listening to Jen psycho.

Her logic train derails into the ditch almost immediately when she starts talking but she keeps shoveling coal into the burner and spinning the wheels. It makes my brain hurt.

Jens not much on fashion is she what on Earth is that costume. If she has a friend can they take her to Target or something and help her buy normal clothing.

Who are you going to believe, Wendy or your own lying eyes. Now go back to work sheeple, and creepy joe is the most popular president ever too!!

Do you understand that this is all about government control. Do you understand. There is only one way to stop these Marxist totalitarian controllers and now that they control the ballot counting machines it’s down to the next revolution. Do you understand!

Sundance “The White House solution is to create dependency on the government for income. This is exactly intended as government subsidies are used to keep the pitchforks at bay and simultaneously keep people dependent on government to sustain themselves [expand the political base].”

https://thepeoplescube.com/peoples-karaoke/addicted-to-gov-t22363.html

Grocery stores near me are already scaling way back the on help and raising prices significantly to maintain their bottom lines. Gas is up over a buck a gallon. Do not even think about needing lumber around here, one 8 foot 2×4 is topping $15.00.

Can’t even cut a tree on my property to make one, the huggers will have you locked up.

Thank you Biden’s $hite Show.

How would the people on Biden’s staff know there is inflation?

They don’t pay for anything with their own monies.

Learned well from their master and son.

The Roman Empire didn’t fall until they destroyed the middle class, take heed.

So how long will it take for the middle class to say F it, give me my money? Hopefully never and this corrupt government (DEM, GOP, DS) get put out of their misery soon. Can’t believe the true America First military men and women can let this go on for longer.