Jumpin’ ju-ju-bones, CTH did not expect the BEA to admit the U.S. economy was in recession. CTH originally predicted the BEA would use lower import data as the primary tool to modify the GDP result.

Jumpin’ ju-ju-bones, CTH did not expect the BEA to admit the U.S. economy was in recession. CTH originally predicted the BEA would use lower import data as the primary tool to modify the GDP result.

Factually, in this report, import data -in combination with lower consumer spending- was the primary sector that led to the result. However, even with drops in the valuation of imports which lift GDP calculations, the economy still contracted.

Things must be much worse than officially admitted (details below), if the BEA is going to admit things are bad.

Gross Domestic Product (GDP) is the dollar value of all goods and services produced in the economy, minus the dollar value of goods and services we import. The percentages discussed are percentages of change over time.

The Bureau of Economic Analysis (BEA) released their first estimate of the second quarter GDP [Data Here] reflecting a 0.9% drop in U.S. economic activity. The second quarter contraction follows a 1.6% drop in the first quarter, which means we now have two consecutive quarters of declining economic activity, the technical definition of a recession.

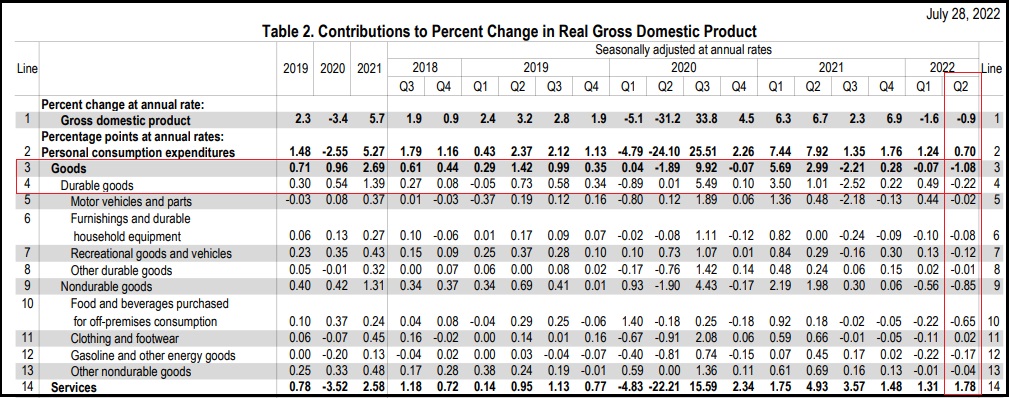

The two primary data points which show the economic contraction are: (1) Lowered consumer spending; and (2) much lower imports as a result of lower consumer spending on durable goods and non-essential items. High Q1 inventories of goods were also flushed out by companies and not replaced. Starting with the consumer spending, here’s the data [Table-2, BEA report]:

Consumer spending, also called “personal consumption expenditures” declined 1.08% for goods overall in the second quarter.

Consumer spending represents two-thirds of all GDP in the United States. Americans buy lots of stuff, and when Americans stop spending on goods the economy stalls. As you can see in Table-2, consumer spending on goods dropped 1.08% and spending on services increased 1.78%. The net difference is 0.70%, a massive drop in consumer spending compared to prior quarters/years.

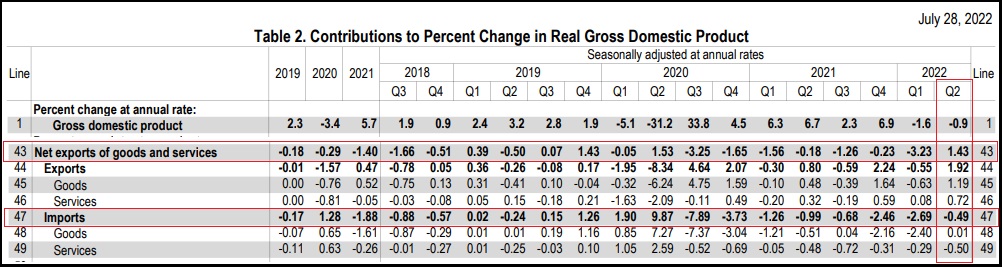

The next component with major impact is the result of the drop in spending.

As you can see in the imports/exports section the net dynamic is positive 1.43%. That is very unusual. Imports are a deduction to GDP because the imports reflect the value of goods that are not made inside the U.S. economy. Exports are a positive to the GDP because the exports reflect the value of goods and services we make in the U.S. that are shipped overseas.

In the second quarter, according to the BEA data, the percentage change in the value of our exports (+1.92%) was higher than the percentage change in the value of our imports (-0.49%). The net result is a positive percentage of change of 1.43%.

The second quarter net import percentage of change at +1.43%, means in this quarter we were exporting at a higher rate than we were importing. We were selling more food and energy products to other nations at a higher rate (+1.19) than normal, AND we were importing durable goods at a much lower rate than normal. The positive net result is an unusual dynamic.

If you put lower consumer spending together with the lowered import of goods, you can easily see how they are cause and effect. When Americans buy less, overseas manufacturers send less stuff. There is a lag of around 90 days (+/-) in this process from when consumers stop buying, to when manufacturers stop shipping. Inside the lag is when inventories build up in U.S. wholesale and retail warehouses. With that lag in mind, does the high inventory in Q4 2021 make more sense?

Q4 of 2021 was unusually high GDP of +6.9% because imported durable goods inventories from Q3 (June, July August 2021) were filling warehouses in preparation for Christmas sales that never came. Despite the claims to the contrary (which CTH has shown in the declining port container data), we exited the 2021 holiday season with lots of extra finished durable goods that Americans were not purchasing (financial inflation squeeze).

This multi-quarter dynamic (the lag in the trans-pacific shipping and purchasing) led to a Q1 2022 GDP result of -1.6%. The sale of durable goods dropped 0.07%, and the imported replacement goods were still coming (-2.69), which led to a significant reduction in the GDP (-3.23). Simply put, low U.S. sales and high imports arriving, equals negative GDP.

We exit the first quarter with this dynamic rolling forward. Inflation on essential items (food, fuel, energy) continues crushing U.S. consumers, as a result spending on non-essential items continues dropping. Warehouses are full of unsold goods, and replacement orders are cancelled. The arrival of new goods slows, imports drop, and combined with the continued drop in sales, we have a second negative quarter.

That’s the big picture as it relates to the largest two factors, retail sales and imported goods.

The big picture shows the demand side of the justification for inflation is false. However, the central banks and politicians cannot admit the demand side inflation doesn’t exist because they are continuing to raise interest rates to support the Green New Deal energy policy.

The Federal Reserve cannot admit that economic demand has dropped; it is against their legislative mandate to raise interest rates into a recessionary economy. Therefore they must pretend demand is still a part of the inflation dynamic. As you can see from all of the data, that claim is demonstrably false.

The Biden administration and all of the monetary and regulatory policy makers must pretend that consumer demand is strong in order to provide cover for monetary policy that is against the legislative mandate of the Federal Reserve and Treasury Dept.

‘Pretending’ is how they can justify the raising of interest rates into a recession.

This is why the administration must deny a recession exists. Please understand this.

The politicians are protecting the bankers.

By claiming there is not a recession, the Federal Reserve can continue taking action that lowers economic activity. The lowering of economic activity drops the use of energy inside the economy. They are managing the economic transition inside the Build Back Better or Green New Deal agenda. They are managing a purposeful decline in economic activity in order to support the energy transition.

The only way the Federal Reserve and central banks can raise interest rates into a recession, is if they deny a recession exists.

That is why they are denying a recession exists.

And yet Wall Street today: “This is fine.”

Today’s announcement is another one of those “Knock me over with a feather” moments. The bullshit is being slathered throughout the legacy media, such as these gems from CNBC: “Investors are looking past recession fears”, “GDP fell 0.9% in the second quarter, the second straight decline and a strong recession signal”, “The economy may look like it’s in a recession, but we don’t know for sure” and “Yellen says the economy is not in a recession”.

News flash to Janet Yellen – Try telling that lie at any gas pump or grocery store in the country. You’ll be pimp slapped into the next century by some women twice your age.

Today’s BEA numbers are like when you tell the cop you’ve only had 3 beers.

In my 25 year career it was always “a couple” or “two”. Maybe things have inflated in your area 🤣

We have been in a recession since last quarter (December) 2021. But what do I know, I barely got out of high school, that Janet Yelland is so much smarter than I. /sarc

I believe that Janet Yellen is so much smarter than you just like I believe that Anthony Fauci had nothing to do with the China virus development and that Nancy Pelosi had nothing to do with the J6Insurrection. The recession actually started on 1/20/21 when Bozo Joe started his plethora of Executive Orders illegally. It has been all downhill since he raised his hand on his Communist Manifesto (yes, he told us it was a family Bible but BozoJoe hasn’t done anything Christian for years and years!

https://news.yahoo.com/biden-suddenly-winning-just-dont-151658653.html

Did I miss something this week?

If you are waiting for unemployment to rise, typically that is a lagging indicator. In Fact the recession is often long over by the time unemployment hits its lowest point. I might see the first layoffs around this Christmas and New Years. So the Democrats will be able to point the stable unemployment numbers for midterms. also no more GDP numbers till right before the election day (November 8th).

sorry meant “Highest point” on unemployment rates.

Putin’s Recession = Obama’s Transformation = Biden’s Greater Depression = Schwab’s Great Reset = We Are Slaves!

I don’t give a crap what they call it. I’m not shopping unless it’s “essential” and can’t refill my gas tank til next payday. FJB, the bike he fell off, and everyone else involved in wrecking my children’s future.

It depends on what your definition of “is” is. Oh wait, wrong president. Same tactic.

And we all know that at the end of August, those numbers will be revised to show Humpty Dumpty Biden’s numbers will be even more broken!

ah, I forgot about that part of the two-step

if the fed continues (they will) to raise rates and not take action …we will see this recession enter depressionary scale…we are already operating in various forms of depressionary economic crisis.

it will take at least two more years for these “actions’ by the fed to truly impact the lives of Americans.

Take heed.

the worst has not even happened yet. Total economic meltdown coming in waves, in your town, in your worlds.

Stay frosty…it’s going to get very ugly very soon.

God Bless America

“if the fed continues (they will) to raise rates and not take action …”

what is this “action” you speak of them not taking?

I don’t know what the big deal is about this. Since 1871, the US has been in recession 30% of the time. This is a nothingburger, like having a hot summer.

I will admit they have been fewer lately.

My wife was at a number of stores yesterday shopping for a house warming gift. When she got home she said the malls and every store she went in was like a ghost town. No customers and very few workers.

Sound Bite today from a gov’t slug: “It’s NOT a recession because consumer spending actually increased last quarter.” Well, do ya think a 9% inflation rate might have anything to do with that??? They think we actually wait for them to instruct us on how to form an opinion.

We are actually in a financial condition known as stagflation(recession + inflation), which is worse than a recession, and one step above a depression. The Senate Tax and Spend budget reconciliation bill they will approve with 51 votes will make stagflation much worse.

Anyone have a link that substantiates this:

“The Federal Reserve cannot admit that economic demand has dropped; it is against their legislative mandate to raise interest rates into a recessionary economy.”

I think it would be quite helpful.

These are all internal, self-inflicted, economic concerns. Yes, your government spent monies it did not have 30 trillion times, 6-8 trillion in last few years causing your currency to be devalued.

But the REAL HURT is still to come. When the dollar reserve system implodes, that’s when it all goes to hell.

And we don’t control that.

It’s not about Ukraine folks.

This destruction of the USA from within is all planned and coordinated by the globalists in our government who have sold us out for their own personal gain. When will the military trials for treason begin?

They massaged it as best as they could. Now the correction downward to -1.3% or so.