Last week, South Dakota Governor Kristi Noem broadcast a warning on the Tucker Carlson show about a bill that passed her State House and Senate that she was forced to veto because it changed the definition of money and banned non-govt-issued cryptocurrency like Bitcoin. {Broadcast Warning Here}

The bill stems from the generally innocuous Uniform Commercial Code (UCC), which Daniel Horowitz describes as, “a set of standards to facilitate interstate sales and commercial transactions such that all definitions pertaining to such commerce are uniform and clearly understood.” It looks like Horowitz was the first to transmit the public warning, as identified by two members of the South Dakota House Freedom Caucus, and then Kristi Noem became aware – thus the veto.

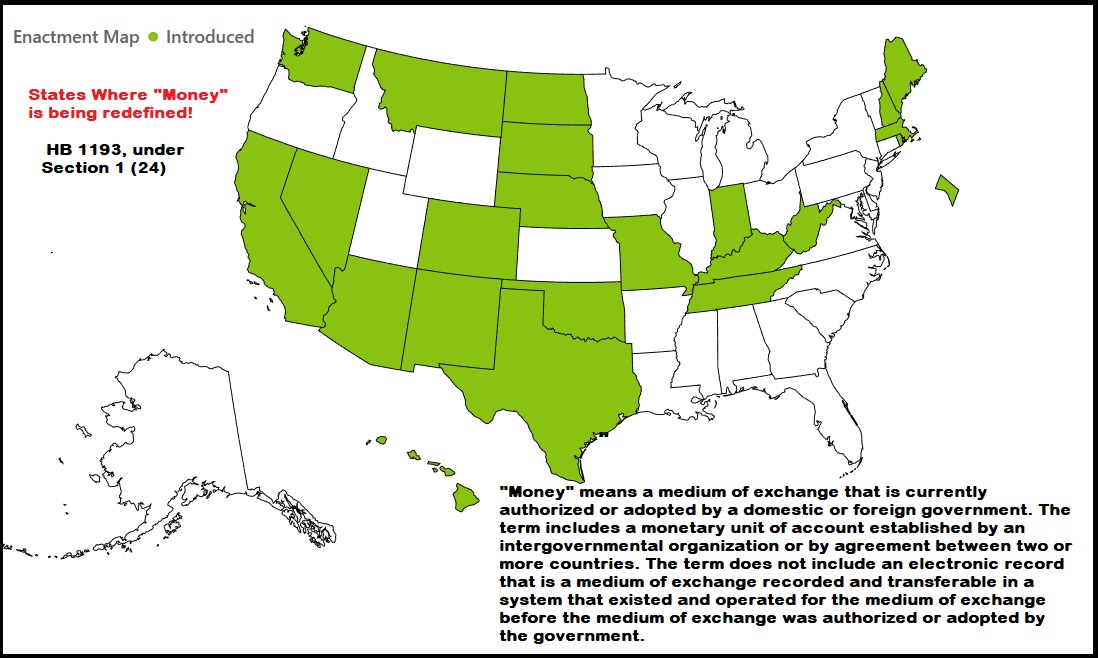

Governor Noem warned that the bill was already passing through several states, and if you look at the UCC Amendment tracking page [DATA HERE], she is correct. The states in green on the map below are states where the UCC revision bill has already been introduced.

As Daniel Horowitz notes in his initial warning dated March 2, 2023:

“The revisions to Article I are very clear now that Bitcoin will not be money, because even though the definition provides for electronic money … it says that an asset that is adopted by a government as its medium of exchange will not qualify as money … if the electronic asset, such as Bitcoin, existed before it was adopted by the government. So Bitcoin, of course, exists today; it existed before El Salvador adopted it as its currency … so it will never be money for UCC purposes. The same for other kinds of crypto currencies.” So there you have it. Officials clearly mean to pave the way for CBDC while explicitly barring all competition. (more)

This is obviously alarming.

Additionally, with the timing of this national revision taking place very quietly; and with the failure of SVB and Signature Bank following a few weeks later; and with specific impacts to the cyptocurrency market; one is left wondering if the current bank “failure” and Biden team intervention was not an intentional crisis with a motive to push government controlled central bank digital currencies into the mainstream.

In essence, was the SVB banking collapse, a designed crisis? And as a result, was the federal government response predetermined and just waiting to be triggered?

When asked last week why her legislature would do this, Noem responded the state politicians likely did not read the bill as it was constructed by lobbyists. Noem is exactly correct and hits on a subject we have discussed here frequently {GO DEEP}. However, one of the more alarming aspects to Noem’s discussion of the issue is that around 20 other states are considering similar legislation. WATCH:

A state cannot define money! This is crazy…

Correct. I think in my copy of the Constitution, it defines what LEGAL TENDER is comprised of. Thanks I give to the Universe that there are not any insects flying around in the cold and snow here, because I am walking around with my mouth hanging open. Can’t quite comprehend that the “leaders” of our country are destroying it under the cloak and dagger of ESG “principles.” It is all inconceivable .

By making sure that whatever definition of money is accepted in the future by the Fed and the Treasury, they make sure that the new version of money is instantly acceptable for use in commerce. It’s a done deal at that point. Digital currency is already being tested in some banks in the northeast.

The US Constitution, in Article 1 section 8, specifies that Congress is authorized to COIN money. Not print it. Some of the colonies had switched to printed money prior to the revolution, and in every colony that did it, hyperinflation was the result. So the founders were aware of the dangers of a printed currency. Since it is a basic principle of constitutional law that the government can’t have a private entity do at its behest what it cannot do itself (like sensor the people), this would mean that all the dollars printed by the Federal Reserve Bank (a private entity controlled by the government) are counterfeit (not legal tender), despite what is printed on them.

Seems to me that the intent was “create money” not merely physical coins . Checks certainly must have been in service at that time.

But the little “state” does in its various codes/administrative structures & regulations…. Just revising a few sub-sub paragraphs & tiny word definitions… in som obscure Uniform Commercial thingy…

They can’t define what a woman is or a man male or female for fear of giving some mentally unstable or sexual deviant an anxiety stroke as they look for a corner to hide in from climate change ! Now it’s money 🤡💸🤡It’s 5 o’clock somewhere 🥃🍻

I have composed and sent the following to my WA state Senate and House representatives. Feel free to adopt, edit and send to your state representatives.

—————————————————————————-

This proposed legislation SB5077 has recently come to my attention.

(The following is excerpted from the link

https://trackbill.com/bill/washington-senate-bill-5077-concerning-the-uniform-commercial-code/2291475/ )

“On February 22, 2023 in the Senate: Third reading, passed; yeas, 49; nays, 0; absent, 0; excused, 0. (View Roll Calls)”

I am not well versed in WA state Senate procedures, but since all 49 WA state Senators voted “yea”, I am assuming this Senate bill was approved and sent to the House Civil Rights and Judiciary Committee for consideration.

What concerns me is the text from page 5 of SB5077:

” “Money” means a medium of exchange that is currently

authorized or adopted by a domestic or foreign government. The term

includes a monetary unit of account established by an

intergovernmental organization or by agreement between two or more

countries. The term does not include an electronic record that is a

medium of exchange recorded and transferable in a system that existed

and operated for the medium of exchange before the medium of exchange

was authorized or adopted by the government. ”

The newly added sentence, “The term does not include an electronic record that is a

medium of exchange recorded and transferable in a system that existed

and operated for the medium of exchange before the medium of exchange

was authorized or adopted by the government” is sly legalese which would exclude Bitcoin from their definition of money.

The first block in the Bitcoin blockchain was created on Jan 3, 2009, a date which plainly precedes any pending governmental electronic medium of exchange, such as the widely touted “Central Bank Digital Currency” (CBDC), currently being studied by the US Federal Reserve.

CBDCs are a horrific tool which could/would be used to enforce economic and social engineering widely, across the entire country. Adoption of any CBDC in this country would be disastrous for freedom.

Therefore, if this legislation passes in its current form, Bitcoin would (effectively) be legislatively banned as a money in WA State, as it preceded any CBDC.

I don’t know who wrote this legislation, but their intent was/is to block Bitcoin’s adoption, in a round-about, surreptitious way, in my opinion.

Unlike a CBDC, Bitcoin is an open protocol, not controlled by any state or entity, global in reach, having no address or headquarters or CEO, which anyone, anywhere can freely participate in and representing a neutral reserve asset suitable for worldwide adoption as money.

Bitcoin is a radical departure from our conventional notions of what “money” is, but by earnestly studying it, one realizes that it is one of the great innovations in history, capable of removing the control of money from corrupt governments worldwide and re-establishing sound money, while being free from political machinations and debasement.

This being so, I strongly oppose the attack that SB5077 brings against Bitcoin, this legislation evidently birthed by Bitcoin’s political enemies, enemies who understand the threat that widespread adoption of Bitcoin poses to their hammerlock on the manipulated and corrupt fiat currency that we are forced to use as dictated by legal tender laws.

SB5077 should therefore be rejected, as based on these arguments.

Thank you. Regards,

xxxxxxxx xxxxxxx

Thank you!!

.

Bitcoin et al. isn’t being “banned”. It is being excluded as “money” under the definition of the UCC and clarified to be what it is — a negotiable instrument subject to the UCC.

No state or private person has the authority to create new forms of “money”. That is the province of the federal government in the USA. State-created legal tender was one of the reasons the Articles of Confederation failed.

Moreover, this change in the UCC does not implement a Central Bank Digital Currency, however the interpretation that it’s paving the way for it by explicitly stating that bitcoin etc. are not “money” (which save for El Salvador, these cryptocurrencies aren’t in the first place).

CBDCs are a separate very bad idea still needs to be lobbied against.

.

Ty, OC, that’s what I got out of it, but I’m almost totally ignorant about anything crypto.

Thanks for the clarification. Particularly about the part that crypto is not money in the first place and, as far as I understand, currently needs to be exchanged for dollars or some recognized currency in order to be used as money.

I know Lagarde has said that crypto is a problem for Davos because it creates an escape hatch, which means they would try to close it before implementing a CBDC, but their whole project is looking more and more like a pipe dream, and if this is related to their Holy Grail, the CBDC, it looks to be some kind of rear guard action that will mean nothing on the ground in the end.

he who controls the blockchain controls the banks.

a modern twist…

The definition of money as a “medium of exchange” falls far short of what is considered money. First and foremost, it must be an ACCEPTED medium of exchange. If I as one of the parties doing the bargaining do not accept your money, then, for all intents and purposes, it is not money to me, at least.

Also, to be counted as money, it must have intrinsic value, i.e., value in and of itself, not on someone’s say-so, like our fiat money. E.g., gold and silver. The fact that the aforementioned are easily transportable and transferable, as well as malleable and convertible and widely accepted, is what made them the primary choice for coinage in the first place.

When you barter, anything can be money.

Do legislatures ever read bills written by ‘popular” lobbyists?$?$?$?

States need tp reject digital currencies period.

Just sent to my Senator in Ohio. Do the same thing in your state!

It’s not Bitcoin. It’s Shitcoin!

In West Virginia, identical bills were introduced in the senate (SB 549) and house (HB 3212) on February 2, 2023. The bills went straight to the judiciary committee in both chambers, where there was zero action. The Legislature main web site shows the bills introduced and sent to committee, but I cannot find even mention of them in the minutes from either committee, including on Feb 2, which is good news. The WV Legislative session ended Saturday 3/11, so for now, this is DOA in WV.

It is interesting that the identical language Sundance mentions appeared in the WV bills that was in the SD bill. It is likely that the entire bill was identical in all 20 states. These NGOs pushing these agendas are despicable.

In good news WV passed, and signed into law, three 2A friendly bills. A fourth, the 2A Financial Security Act (HB 2004) has been passed and awaits the governor’s signature.

Here’s the sponsors for the (HB 3212). https://legiscan.com/WV/sponsors/HB3212/2023 Here’s the sponsors for (SB 549) https://legiscan.com/WV/bill/SB549/2023. Looks like the both bills died in committee.

Well we had the war between the north and south and this time the east and west!

More accurately, the war between the gigantic and the small. Progressives, like termites, live in colonies across the fruited plain.

With Progressives, it’s not just the plain that’s “Fruited.”

Maybe the motivation to retire the dollar and other currencies and go to a digital ”currency” is a slick way to just declare bankruptcy by the banking systems and bury the worthless dollars and euros etc. That’s the reset. The players used zero interest and an endless supply of credit to buy up every asset they wanted. After the current system is Nord Streamed they will still own the assets, and our ”savings” in the banks will be dust. The great reset and the Green New Deal have nothing to do with man-made global warming. That isn’t the threat, that is just the BS cover story they are feeding us. They want to stick us into 15 minute cities,and control us with digital currency. We will be magically transported back to serfdom and the Middle Ages. We need Wat Tyler now, not after we have all been fitted with the electronic equivalent of a farm animal’s nose ring. The stubborn will also be gelded. There are other facets in play as well. A made up war against a nation that just wanted to get along may have been a bridge too far. I’d like to load the masterminds and their thugs into tumbrels on their way to madame guillotine, but a life sentence of hard labour would be best for most of them. One lifetime is not enough for them to expiate their sins. They are truly evil.

The best solution is civil dissolution.

The American Historical Precedent of Starting Over With A New Constitution.

Daniel Horowitz asks: What’s Next?

Laurie Thomas Vass, http://www.civildissolution.com

March 15, 2023.

Note to readers: This is the introduction of a much longer article available on Substack. http://www.civildissoution.substack.com

The sections of the longer article include:

Section 1. Madison’s Historical Precedent of Starting Over.

Section 2. The Two Defective Amendment Clauses in Article V of Madison’s Document.

Conclusion: It’s time for MAGA voters to follow Madison’s example of starting over, with a brand new state sovereignty natural rights constitution.

Introduction: Do Not Resuscitate.

It is time to admit that the American government is a failure and, start over, with new two constitutions.

One for the Marxist Democrats, who desire to live under a communist regime.

And, one for the natural rights MAGA conservatives.

Madison’s constitution, of 1789, is a failure because it failed to prevent an unelected centralized elite tyranny from exercising dictatorial powers over citizens.

Trust no scheme that allows democrat and progressive involvement or control over the medium of exchange or store of value. See SVB, SB and FTX for the reasons why.

Nevada AB231 passed out of assembly committee yesterday, March 14, headed to Senate committee before final vote.

This economic thread is perhaps a good place to post this interview.

It is a 1 1/2 hour interview of Professor Richard Werner, where excellent questions are asked — and some surprising answers follow.

“Covid Measures & the Central Controls Over the Economy”

https://www.thelastamericanvagabond.com/richard-werner-interview-covid-measures-and-the-central-controls-over-the-economy/

Description: Joining me today is Professor Richard Werner, here to discuss COVID-19 from an economic perspective, and the role central banks are playing in this rapidly shifting financial and societal landscape.

I truly liked & appreciated what Richard Werner, economist, had to say in the interview — and will now search for more of his discussions. (Hint: He is not a fan of central banks, the WEF, etc.)

It’s a bigger issue than legislators not reading the Bill. Don’t get me wrong, those b*s*a*rds are fat and lazy but the corrupt banking system and USDC cannot compete with private enterprise ergo, OUTLAW competition.

And we all thought we lived in a free country.

Fat Fn chance.

This all must be stopped.

Sorry for my anger.

They’re biden’ their time waitin’ for us to beg for a bailout…like beggin’ for security and givin’ up our Rights…

Fool me once…NO knee jerkin’ ~

Annnd, there it is. Step 1 Announced Today…

Look how they’re trying to distance it from CBDC.

—–

https://www.cnbc.com/2023/03/15/long-awaited-fed-digital-payment-system-to-launch-in-july.html

excellent post on zerohedge that goes into the weeds on cbdc and lists what steps must be taken to stop this at the state level… https://www.zerohedge.com/personal-finance/tyrants-are-passing-state-laws-push-cbdcs