We are in an abusive relationship with our own government. If you want a real-time example of how governmental bureaucracy fits into this statement, look no further than the footnote at the bottom of this article ¹cited from the BLS report today.

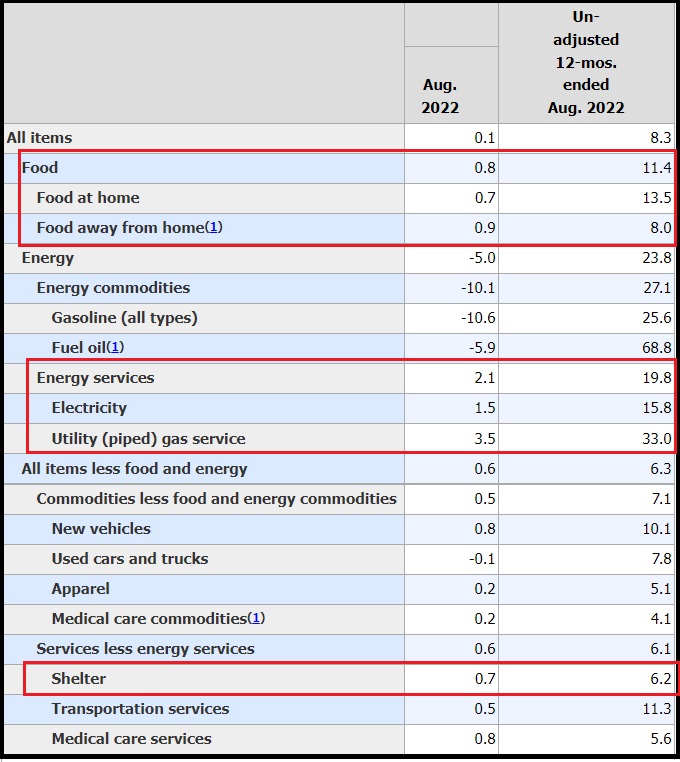

The Bureau of Labor and Statistics (BLS) has released the August inflation data today [DATA HERE] with a top line at 8.3 percent year over year. Unfortunately, things are unfolding exactly as we previously shared. [Modified Table 1 at left]

The Bureau of Labor and Statistics (BLS) has released the August inflation data today [DATA HERE] with a top line at 8.3 percent year over year. Unfortunately, things are unfolding exactly as we previously shared. [Modified Table 1 at left]

Despite the temporary drop in gasoline prices (-12%), the costs of food (+13.5%), electricity (+15.8%) and housing (+6.7%) are crushing U.S. consumers. The stock market is responding accordingly. We can only imagine the inflation data if the heavily weighted gasoline factor was not pushing overall toplines down. Estimation of inflation would be well over double digits.

Keep in mind, as you read this review the price of the current harvest (prior field costs) is only right now coming into the food supply chain.

Food inflation is running at its highest rate since 1979 (+11.4%) and it will go higher as the third wave in this sector hits.

To give you an example, margarine increased in price 7% in August alone, that’s an annualized rate of 94% [Table 2 details]. Flour is also on pace for another 22.8% increase right as the holiday baking season begins.

We cannot eat gold, silver or durable goods. Electricity, home heating (natural gas), food and housing costs are priorities right now. Main Street USA is being crushed by Joe Biden overall economic and energy policies. It’s bad now, and going to get worse – much worse, as the third wave of food inflation has only just begun.

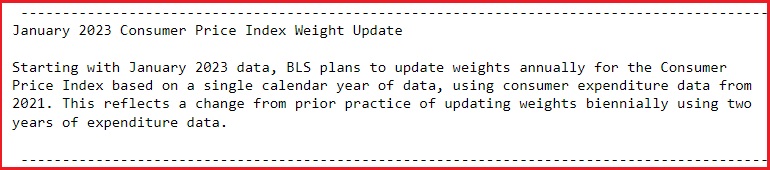

¹Before sharing a MSM perspective I want to draw your attention to the BLS notation for 2023. This innocuous footnote tells us just how manipulative the governmental bureaucracies are:

In order to give the statistical appearance of things being better than they are, the BLS is going to reset their weighting for the CPI to only compare against 2021. This is being done with purpose to give the illusion next year that things are not as bad. 2021 was when Joe Biden’s inflation policies first surfaced. By comparing consumer prices to the timing when those prices first increased, the scale of future price increases will be statistically diminished. We are in an abusive relationship with our government.

.

(CNBC) – Inflation rose more than expected in August as rising shelter and food costs offset a drop in gas prices, the Bureau of Labor Statistics reported Tuesday.

The consumer price index, which tracks a broad swath of goods and services, increased 0.1% for the month and 8.3% over the past year. Excluding volatile food and energy costs, CPI rose 0.6% from July and 6.3% from the same month in 2021.

Economists had been expecting headline inflation to fall 0.1% and core to increase 0.3%, according to Dow Jones estimates. The respective year-over-year forecasts were for 8% and 6% gains.

Energy prices fell 5% for the month, led by a 10.6% slide in the gasoline index. However, those declines were offset by increases elsewhere.

The food index increased 0.8% in August and shelter costs, which make up about one-third of the weighting in the CPI, jumped 0.7% and are up 6.2% from a year ago. (read more)

For readers who do advanced preparation to offset prices. THINK BEEF right now, you will thank me four months from now. If you see a deal now, buy it and freeze it now. Anticipate retail ground beef costs be somewhere around $10 to $15/lb by spring to mid 2023 perhaps even higher. Also remember, processed foods will increase in price at twice the rate of the fresh food sector. Both fresh and processed food prices will rise, but the increased costs associated with the food processing will double the price.

Actually with the drought that was going on in the west, the fertilizer supply problem, grazing grass in the middle of the country and west is sketchy at best. Listened to a rancher saying they’re having to supplement with hay earlier than normal, some choosing to dump their cattle on the market instead of paying a higher price for hay and some have ponds drying up. It sounded like, long term, the price of beef will rise, but with so many dumping them recently it has been holding.

I bought in the mid spring, should be good for my small family until years end or hopefully next spring. As a reference my side of beef was $1300.00 on the hoof back in early May. We weren’t in a drought back then so I think that was about average.

I haven’t been able to afford beef for years…Unless it is reduced before it expires.

I buy pork butt roast when it’s 99 cents a pound and cut it up into smaller portions and vacuum bag it in the freezer.

Hubby and I are growing our own protein. We have 100 mama cows and are feeding up several yearling head to feed family and friends. We also butchered 12 turkeys a couple weeks ago I raised from chicks. They put 327lbs of processed turkey in the freezer. Our friends have hogs we purchase and process ourselves in the home butcher shop we built last year. I also have 38 laying hens and 2 roosters for eggs and another doze broilers for chicken meat that we will process next month. We will NOT be eating bugs here! People are going to have to learn to be more self sufficient. Processed food is unhealthy anyway.

I’m jealous. I wish we had enough land to have a couple of cows.

I wish there was a word that wasn’t as heavily loaded with negativity as ‘jealous’ that describes how I feel when I read what I love my freedom wrote. Tess from Philly I know you meant nothing negative in your comment at all.

So instead of saying I’m jealous of them, I have to say… It’s great! That’s wonderful! I’m happy for you and your family. I just really wish that we were in even a little bit of that position.

I don’t want them to not have it, I don’t wish them any harm, but boy would it be nice to have that also.

Understood by all, I suspect.

With those with less space or resources, research AQUAPONICS (NOT Hydroponics!)

You raise FISH, typically talapai or trout (in colder climes) pump the water from the fishtank over growbeds, which clean the H2O of fish poop, fertilising the plants and keeping the H2o healthy for the fish.

Infinetly scalable from small tabletop, to apt balcony, backyard, etc.

Fish and veggies, whats not to love? NO fertilisers, pesticides or chemicals.

Watched this system on some show a very long time ago. Struck me as ingeinous then and still does.

There are plans you can buy online at tabletop size, to which you can add modules, or backyard size. There are some great courses online, and some in person, to get you up to speed. Many people say that it’s a real time-saver.

Fish emulsion is absolute dynamite fertilizer! Anybody that hasn’t researched “BioChar” all I can say is y’all are missing the boat! Tithonia sunflower leaves are up to 20 % nitrogen and anybody that can grow bananas has a never ending supply of potassium for blooming other plants by upcycling the peels.

Jealousy does not have negativity as a requirement. It’s a basic fundamental of life that is our drive to do better and set goals for ourselves. I don’t feel any negativity admiring the accomplishments of others, when I feel they deserved it or worked hard to get it. I would love a setup like ILMF.

Best not let your GPS coordinates become public information.

I’ve posted this before but I’m into cans, cans, cans.

My kids have no idea what a can vegetable is beyond, cream corn for Sheperds pie.

But Ma sure does.

I saw the writing on the wall back in 2013 and began purchasing freeze dried food in #10 cans as I had divorced and no longer have property so can no longer grow a substantial amount to put up. Most is advertised with a 20-30 year shelf life. I feel good about that decision. However a word of warning. Moisture matters, just a tiny bit!

I had stored the cans in cardboard cases with some sitting on the basement floor. Just the tiny amount of moisture seeping through the floor, which is concrete and painted, seeped through the cardboard and corroded the bottom of many cans. ( I couldn’t have known this unless I opened one box that looked a bit off as there was no noticeable signs of moisture penetration on the others.) Thank God I reorganized and found this issue before they had corroded beyond saving.

I’m using sandpaper to remove the corrosion and Ballistol, a wonderful product useful for many things that everyone should purchase, look it up, to protect them and stabilize them, then repackaged them in new, dry boxes I picked up online. They now reside on heavy duty shelving purchased for this reason. I also picked up a dehumidifier for the basement (just as electricity prices are skyrocketing:)

I feel pretty good about my process. Those cans should be good for a number of years into the future. If I don’t need to eat them all first.

I’m glad I picked that food up when I did. There’s no way I could afford it now.

I wish prosperity to all. Keep an eye on your preps. Good luck.

http://www.mypatriotsupply.com

I hope all the morons who voted for the fake president are very happy now.

If you are prepared, then you can be happy in the knowledge that those morons had so much faith in the person they elected, that they will be the first to fail.

None of those I know who voted for him have said a word to me so far. I truly thought a couple would be man enough to admit they made a huge mistake because of their orange man bad hatred-and that’s all it was.

The ones I know who voted for Biden would rather pretend inflation isn’t real. They would never admit costs were lower when President Trump was in office. They don’t complain about the gas or food prices.

I hope their hate of him was worth it. Just the same, I know they have less disposable income now than 2 years ago. They can’t “pretend” that isn’t happening.

Pride is a powerful deceiver. Democrats are doung fine in most polls.

Oh they still go to Starbucks and sip their lattes at the park while little Eli gets groomed publicly by Miss Rosebud, the banjo playing transvestite and LGBTQ activist. It’s just another trendy Sunday morning in Brooklyn.

Someone is finally admitting to what I suspected 3 months ago. Non hiring hiring…

https://www.zerohedge.com/personal-finance/63-small-businesses-have-put-hiring-hold

Best tweet of all time

I appreciate Presidunce pointing out that every dem senator voted for the Inflation Production Act.

And every R senator, knowing their vote was meaningless to the outcome, could vote “No” to maintain the illusion of disaproving.

Kabuki theater being operated just to keep the rubes decieved, thats all Congress is.

Except for the “fly in the ointment” thos pesky MAGA in the House, who keep exposing the ruse.

People think Joe Biden and gang celebrating the Great Reset/Inflation Bill on the same day these awful numbers came out shows how stupid he is. No, it shows how Soviet he is. Or how Soviet Susan Rice/Obama are.

This is gaslighting. Since most of the world thinks logically, and think that people have shame, when they see that everything is awful but witness our leaders saying the opposite, many of them question their own reality and, predictably, defer to the official narrative.

And another good portion of them take up arms to destroy these evil SOBs.

CNN had been showing Biden’s garden party celebrating the “Inflation Reduction Act”. James Taylor kicked off the White House South Lawn bash with his 1970 hit “Fire and Rain” — a song reportedly about suicide and heroin addiction — to belatedly celebrate passage of his Inflation Reduction Act spending bill.

I’m thanking you NOW… for your warnings months ago…

I think it depends on what part of the country you are in how you are effected. I’m in PA and still getting lots of fresh veggies out of the garden and freezing or canning the extra. I’ve seen some fantastic prices for some things at farmers markets. Even though I grow green peppers, I bought more to freeze for the winter. I got a grocery bag full for $5. Last year it was $4, so really no big deal 😉 .

Because of CTH and several other places I’ve been stocking my pantry and freezer for months. I’ve always had a stocked pantry but now it’s larger and deeper. When I see a sale, I don’t just buy 3-4 to get me to the next sale, but 12-24 to get me to next year or the year after.

All I am buying is deals and stocking up when I see them. This week there weren’t any sales so got some of the cheaper fresh fruit, milk and bread. The rest of what we are eating is out of the pantry and freezer. Items that needed to be rotated.

Because of here (CTH) and other places when I saw butter at $1.39 a pound, I bought some and then went back and bought more. It’s in the freezer and because I’m not spending $4 a pound I have money to stock up on other items.

There were some beef sales over Labor Day. I skipped the steak and got the $1.99 pound London Broil. I was able to get over 12 pounds diced up and portioned out for beef stew during the winter. There was also $2.50 a pound pretty fatty ground beef and I made up a batch of meatloaves with that besides enjoying burgers a couple of nights.

I’ll continue to stock up as I see items, especially beef.

“For readers who do advanced preparation to offset prices. THINK BEEF right now, you will thank me four months from now. If you see a deal now, buy it and freeze it now. Anticipate retail ground beef costs be somewhere around $10 to $15/lb by spring to mid 2023 perhaps even higher. “

The biggest problem for me is not being able to stock up on fresh vegetables. You can keep carrots, parsnips, garlic for quite some time, but fresh green stuff has to be purchased every week. I guess frozen stuff is a replacement but how do you replace a head of romaine lettuce?

Have to grow your own, and it CAN be done on a small scale,..again Aquaponics, …

And maybe add bean sprouting, also smal scale and will give you a regular source of “greens”?

+1 on sprouts, super easy. I’ve grown them in a Nalgene bottle while backpacking.

Try growing it indoors with supplemental lighting – leaf lettuce and herbs do really well.

Spinach- quick and easy to grow. Same goes for leaf lettuce. All you need is a flower box.

Exactly! I have 20 pound of butter sitting in the freezer, and you’re right, it frees you up to buy other things

I have pantries in all of my closets now, lol. Most of what I’ve purchased lately is packaged for long term storage – hard wheat berries and dent corn were the most recent. 5-gallon mylar bags with o2 absorbers. Bought some #10 cans of powdered milk. Trying to eat the freezer down a bit as I have half a pig coming in Nov. that I ordered from the farmer in March.

My daughter is 30, she gets it. Just bought a chest freezer. Only place she has room for it (apartment) is the living room. She decorated it so it kinda sorta fits in 🙂

Definitely correct on the area of the country. Here in WI the prices haven’t risen nearly as fast as in other areas. Shop sales and use coupons.

Very smart of your daughter Smokey Jo.

When we were young newly weds decades ago we took some of our wedding present money and bought a small freezer.

The only place we had to put it in our teeny tiny apartment was the tiny living room.

Most of our friends and neighbors thought we were smart to do so as we could buy things on sale and freeze them on our tight budget and get ahead that way.

We also stacked caned goods bought on sale just about every where in that tiny apartment.

Like you we made every closet a pantry and under chairs and the couch and along the walls

That was so many decades ago I had forgotten about it, and we made it a lifestyle.

To shop sales for food, clothing and just about everything.

It can really pay off after 4 decades or so.

Smart girl your daughter!

Good deal. We have been eating down our deep freezer as well. It is time to start filling up again. I am going to buy more rice, dry beans and the like! We will survive!

You and I do basically the same thing, MfM. I have always been the grocery store shopper and probably 20 years ago I saved the sale circulars from the stores for several months to see if ‘sale’ prices had a pattern. Every staple goes on a true (25-50% off) sale every 4-8 weeks. So I buy enough when it goes on sale to last 4-8 weeks. Use coupons at the same time for a bonus. It adds up and saved us about three thousand per year for a family of four. Our credit card company provided us (still does, on request) with a yearly categorized breakdown of spending and we were amazed what could be saved with such a simple plan in one year.

That is really smart Baileysdad.

Of all my decades of sale shopping and penny pinching I have never noticed that pattern of grocery store sales but will check from now on.

Great tip!

Publix seems to be in a quarterly rotation of brands that are on sale.

I’ve noticed different brands that I’ve never heard of in my little local grocery store (Kroger owned, but small town). I’m not brand loyal so buy by price. Most noticeable in canned and frozen goods, haven’t been disappointed yet.

Pre-Covid, I had my smartphone calendar set for the sales that mattered to me.

It seems a little more randomized and intentionally confusing now, for example one of mine would be butter … they have a “pre-sale” on a brand name butter (land o lakes) @ 2.99 then they have a “new” double pack of house butter 2lbs for 6.99 (3.50/lb) + 10.00 off participating items if you buy 40.00+ (2.66/lb), then they will have a 1lb house brand butter for what used to be 1.99 for 2.49 with a 5 item limit.

I don’t have room for 12 lbs of butter storage and they run the sale on the same cycle so I get 5lbs @2.49 or less just about every time they run the sale & coupon for it. (1.99 @ holiday sales)

They used to do it for 93% ($3.97) lean beef too, stopped for a while (covid) but they are doing it again, need to stock up on beef before the crisis hits … again.

Lather, rinse repeat until more SHTF.

Kroger corp and all its heinz 57+ local names. You would know it as City Market or King Soopers if your still in CO.

Of course it is all reward card based only & digital coupon usually.

I have never had my real info on a rewards card ……ever… or a single account for that matter if I should need X2 the amount of an item.

It Will Lower The Increases On Social Security A Yearly Increases In Cost Of Living And Or None At All

Social Security To Have The Largest Cost-Of-Living Increase In 2023

The Social Security Cost-Of-Living Adjustment For 2023 Could Be 8.7%, According To A New Estimate From The Senior Citizens League.

An Increase That High Would Be The Biggest Cost-Of-Living Adjustment In Four Decades, Surpassing This Year’s 5.9% Cost-Of-Living Adjustment.

There Is Still One More Month Before The Official Adjustment Is Announced. Here Are Three Factors That Could Affect Next Year’s Increase.

Klaus Vedfelt | Getty Images

An 8.7% Social Security Cost-Of-Living Adjustment Could Be Possible In 2023, Based On Government Inflation Data Released Tuesday.

The Estimate Comes From The Senior Citizens League, A Nonpartisan Senior Group, Which Found That Increase Would Boost The $1,656 Average Monthly Retirement Benefit By $144.10.

Such An Annual Increase In Benefits Would Be The Highest Cola Ever Received By Most Of Social Security’s Current Beneficiaries, According To The Senior Citizens League.

But they go up on your medicare premiums. Don’t count those chickens yet.

Yes, new Medicare premium will be $170.10.

I received a mailer just today offering to see if I qualify for Medicaid.

If you do qualify for Medicaid and/or meet the requirements, some states have assistance for payment of Medicare part B premiums as well. Income limits apply. Sample from my state, OR…. (Link to .pdf brochure)

I believe the program also pays Medicare co-pays and deductibles but would have to check. The programs may also assist with part A premiums for those with less than 40 quarters of work credits.

Funny, how it is always the amount you gained.

Tempted to ask “How can they deny inflation, while at the same time announcing this COST OF LIVING increase, which puts the lie to their narrative, ….

But hey, its EASY.

They don’t have to worry about making sense, or truth,..they just spout nonsense.

They can deny or assert anything they want because their volunteer audience doesn’t have the will or ability to THINK anything through and identify what is true vs. what is false.

Those whose hold on power depends on deception will always be able to find an audience willing to be deceived.

Always.

Engineered Democrat Greatest Depression will kill many millions and devastate hundreds of millions IN THE USA, more world-wide! Prepare for gasoline rebound; https://citizenfreepress.com/breaking/biden-drains-strategic-oil-reserve/

Get that “Democrat” word OUT of there!

Its UNIPARTY!

Bidens Mainstream Republicans are TOTALLY on board, actually driving the train, while Biden takes the blame.

You are so right Dutchman.

There is widespread complaining about the power the msm has over the Democrats but we have the same thing with so many of our Republicans.

They will blame Biden Biden Biden and the Democrats Democrats Democrats and not give the sleazy Republicans the credit they deserve for the pickle we are in.

Too many of the registered Republican voters have the same brain dead focus on blaming the Democrats that the Democrats have on blaming the Orange Man Bad.

Until We The People can see who is really doing the dirty work, the Uniparty, we will never solve this.

And Biden et al celebrating today at WH??

We have a looney bin and it’s the WH under Biden.

And those that voted for this buffoon will remain silent on everything he has fxcked up! I know my entire liberal family even though they see the inflation when they purchase food and gas, they would still vote for this idiot……because Orange man bad. They also all rolled their sleeves for an EUA vaccine for a flu that has a 99.97% survivability rate!

The power that the media has over these people is mind boggling!

‘BLS plans to update weights annually based on a single calendar year of data.’ – CPI release

What changed dramatically, after the Spring 2020 lockdowns, was a drastic increase in working from home. This in turn changed how people spend their income: less on commuting, business clothing and dry cleaning, more on food at home, streaming subscriptions and home improvements.

While we are entitled to be skeptical of motives when the “Biden” regime lies so often, statistically BLS is justified in excluding the anomalous transition year of 2020, when urban downtowns emptied in March 2020 and never fully recovered. Whether it will done honestly is a different subject.

I have canned more meat this year than any other, and the freezer is also full. Meat can remain up to two years in the freezer if temps are kept well. You can then take from the freezer and can it. If you have canned goods now, and a full freezer, you should be able to eat meat for the next 5 years. I have canned around 600 meat products, soups and stews. I have even canned ground breakfast sausage, and wrapped and canned bacon. If anyone is looking for a good cheap soup. Sam’s club rotisserie chicken for $4.99 will make the equivalent of 20 pints of soup. Pick the meat, boil the bones and skin for the broth. Add you carrot, celery and onion. Season when you eat it, and don’t forget to bag up egg noodles while you can using mylar, or a foodsaver.

What happens when power is diminished or even cut, as EU is already facing?

Not enough solar hours many places in the winter and generators need power and batteries.

I have a 2 month supply of gas for my generator. I would also be using it to can my freezer goods

Honestly we can each only do so much.

It things get bad, real bad then who knows what can happen.

There will be roving gangs of thugs trying desperately to take what you have and one of your most important areas of focus will be not only to feed and clothe and shelter your family but to try to keep hold of what you own.

It will be hard times, very hard times.

All plans with fuel and food and shelter will depend of defense and who knows what.

If you live in a populated area you need to think about a whole lot of things that those in rural areas might not.

We just need to hope things do not get that bad, where we need generators and solar and things like that.

The world will change so fast we will not recognize it.

We do have some precedent to access, the generations of oppression and poverty in the Soviet Union. I saw a lot of it being there after Communism fell in the early-mid 90’s. Sobering.

It’s pretty difficult to mount an offensive when everyone is fragmented and focused on surviving. However, we patriots might find international friends in interesting places. Keep the faith.

Hah! I have used rotiserie cooked chickens to make chicken soup, works great!

I use a crock pot, but last 2 months smiths hasn’t had any rotierie chickens.

I have heard Powell state these things:

He is committed to a 2%inflation at the cost of losing value on stocks and real estate. He will continue to raise rates until this is reached.

He stated clearly the FED is learning about inflation??

(Question marks mine)

He, for the first time ever in my memory, stated the FED DOES NOT have control over inflation itself. In other words if Congress and Treasury continue to raise debt, that causes inflation too.

Lastly, the dollar losing some ground as a reserve causes issues as well.

Increasing rates does nothing unless the interest rate is higher than the inflation rate.

Here is the Updated List of US-Based Food Manufacturing Plants Destroyed Under Biden Regime — You Can Now Participate and Add More Incidents on the Interactive Map

https://www.thegatewaypundit.com/2022/09/updated-list-us-based-food-manufacturing-plants-destroyed-biden-regime-can-now-participate-add-incidents-interactive-map/

And these are all seriously understated.

Inflation up, unexpectedly.

The Biden WH is suggesting a new food group for those who are having trouble with the high price of food – Bacon fat on white toast.

Meanwhile, in the Imperial Capitol there is no concern for inflation or deficit spending. More largess for Ukraine!

With the price of eggs, the regime needs to save roosters for layers.

tomorrow’s Kroger ad – 18 lg eggs $1.49 – Louisville area

Freeze them!

Liming.

They will keep for months!

Unfortunately you cannot use the liming method on store bought eggs or any eggs that have been washed.

Clean, freshly laid eggs only can be done this way.

Unwashed clean eggs have a natural protective coating on them. If you want to do this and do not have your our chickens find a farmer who collects their eggs promptly so they are clean and buy from them.

Eggs are up 40%.

People here in Bel Air, MD (suburb 30 minutes outside of Balt) are still eating out like crazy. I guess they got money to burn or are illiterate in the kitchen.

Restaurants are crowded in Baltimore County too.

Money printer go brrrrrr ….

Print, baby, print.

Keep printing money and add it to the debt. Slap it on the credit card.

All this how does your garden grow is great if it is what you chose to do and not what you have to do. It is music to the “Bad Guys” ears. All this surrendering, complying, accepting, accommodating reminds me of the masks and vaccines. It is another symbol and evidence of power and control over the People.

Yes, this aspect seems grossly under-emphasized. I would also expect attacks on those of us who choose to fight not only by the enemy but by those hunkered down. War is hell. Humans are a fickle bunch. Decades of indoctrination and brainwashing will need to be modified to succeed. However, if our founders did it, so can we.

You make an interesting point Fangdog.

We can only cut back so far and I am pretty sure the “Bad Guys” will not stop in putting the pressure on us.

We will need to fight back one way or the other, they will not stop taking and taking and taking and taking from us.

They will grind us and the country down for ever unless we finally say no more.

Cutting back on food and fuel is fine for a short time but we will soon have to some how tell them NO MORE.

They will never stop what they are doing to us, we will need to take the power and control from them.

This is awful to say but I want our economy’s problems to remain front and center until Nov for this election. Congress has got to be flipped. I hate the GOPe but a change has got to take place.

Why is it awful to say? We are in a War to get our Nation back. You think saying and doing only nice things is going to get our Nation back from the Evil?

Some people’s path is diplomacy and peace. That’s a valid path and I respect it. Get the vote out. Get involved in the social fabric. Leave dealing with the zealots to others.

I understand your feelings soap lady.

You hate to see people suffer but at the same time know that they must wake up to the seriousness of our countries political situation and in order for this to happen they must not have the economic stress relieved before the election.

I do not think we will solve this problem for quite a while even if we flip Congress in November.

We have a long road to go down before this is over and it will take more than one MAGA winning election to get things back on track.

The Vegetable-In-Chief, POTATUS Biden, said today that the month’s inflation was 0%. WTH?

He means it hasn’t gone up since last month’s incredibly high number. Which is also a lie.

Has that guy ever told the Truth on purpose?

“Despite Temporarily Lower Gasoline Prices, August Inflation Skyrockets

with Biggest Jump in Food Prices Since 1979”

…AND ALL DONE ON PURPOSE AND BY DESIGN.

Can’t be stressed enough, really.

Having been a working adult in 1979 I can safely opine today is nothing like that period, socially, economically, politically, whatever, even if the inflation numbers mirror that era. It’s nuts today. FUBAR.

I can’t state with confidence that the 70’s weren’t on purpose and by design but would agree today’s mess certainly appears to be such. I was already a skeptic by the time Carter got in so I definitely had no rose colored glasses during the era. Being a rebel had/has its costs. I don’t recommend it.

Funny how the Brandon regime plays with words…It’s not the Inflation Reduction Act. It’s really the Income Redistribution Act.

September 13, 2022

5:29 PM EDT

Last Updated an hour ago

U.S. railways to halt grain shipments ahead of potential shutdown -agriculture sources

https://www.reuters.com/world/us/us-railways-halt-grain-shipments-ahead-potential-shutdown-agriculture-sources-2022-09-13/

What can be done about using the National Strategic Petroleum Reserve to prop up supply statistics for oil? We might be paying less for gasoline this month and next month but, before the end of the year, the Strategic Reserve will hold less than the minimum allowable amount. When do the Republicans point this out to the voters? I can’t believe we will lose our next proxy war because our energy supplies are depleted. I say proxy war because we haven’t fought anything but proxy wars for the last 70+ years.

Gas prices in California are on their way up again; $4.99/gallon last week, $5.09/gallon this week. Never mind that our Strategic Petroleum Reserve is being sucked dry as Biden seeks to offset his stupidity… What could POSSIBLY go wrong here???

…Thanks again, Traitor Joe…

Sundance gives a great tutorial. Yet, do not discount that the folks actually running the show in DC are actually pretty smart and also already have this exact same view and knowledge…Plus they even have reams of supporting data to dump into super computers.

They know as well as understand,exactly, the concepts of delayed impact on COST of products, point of creation to shelf, for critical components and resources. It can actually be modeled with a degree of accuracy that is close enough to predict the magnitude of damage that will be done or undone, point of creation to shelf.

The capability to align planned damage and repairs with events like say …. elections …. news cycles … market performance is now the norm.

This is the “planned” economy on steroids.

Resident Joebama has emptied 1/3 of the Strategic Petroleum Reserve and still we have high inflation. I’m sure it was worth it for him, since he bought many votes with the low info voter.

I’ve never canned meat but grew up eating it. My mom was born in Germany in 1935, she taught me well.

I have a pressure canner and cases of jars, a freezer full of meat, and a pantry full of dry goods.

My husband and I went fishing on Lake Michigan on Saturday, came home and smoked pounds of salmon and trout. We also hunt. Bring it, so tired of these bastards.

I’ll share with friends, neighbors, and family, we’ve been doing that for years. Time to get with the like-minded in your circle.

True about the circle of friends Smokey Jo.

We might get to the point where we will need a good strong community of like minded friends.

For many many reasons.

I just don’t get it. I know they are doing this to us on purpose but what exactly is their final objective?

We are the carbon they want to reduce.

There has to be more to it than that.

Not really. They don’t think long term, i.e. who’s going to keep the lights on. History has an uncanny way of repeating itself.

Oh they’ll make slaves out of many, to do the menial labor. Maybe that’s why immigration has gone viral worldwide. Replace citizens with immigrant serfs.

Much of it is not menial labor, rather quite technical and learned. It will bite them in the arse.

Yes, they’ll need some skilled servants to manage the AI. We see this matrix in the oil countries where extremes of wealth and poverty exist.

Combination of AI (technology), servants and menial prols that are brainwashed/drugged. Kinda like today, absent rebels and patriots. We’re the depopulation target.

Kinda off-topic but we could examine the social fabric of the OPEC countries for examples.

The problem with their idea is that the illegal immigrants they are importing here are nothing like the poor of the middle east.

The illegals coming here are expecting a nice, cushy life style of non-work and comfort.

The poor and lower class of the middle east countries ( at least the ones I have been to) are trained from birth for many generations to expect to be low level servants to the upper class wealthy and do no fuss about their lot in life.

When the cranky, some what angry illegals who come here find out they are not going to get a hand out or a nice easy life they will be very un happy and hard to handle.

Our leaders who think they can replace us middle classers so easily might find themselves with a bunch of rebellious, nasty, third world people who riot all the time and loot and steal and get no work done at all.

If the middle class is gone America will be filled with lazy idiot “elites” who do not know how to do anything and lazy idiot illegal immigrants who do not know how to do anything.

I had a really hard time understanding it. Then read some history on the Bolsheviks, Communists, etc. We’re dealing with the same, right down to what’s going on with the farmers. Same play, different decade.

Same viciousness, too.

Yep, my family were farmers in the south of Russia when the Reds came for them. They escaped and left their farm behind and paid a high price to make it to Ellis Island.

Money and power. These aren’t deep thinkers we’re dealing with. They just want more of what they already have. Don’t try to do a deep dive, just accept it for what it is and carry on.

My daughter is a liberal who’s not exactly speaking to me.

Yet she sent me $150 worth of bulk food. Nice to know she’s aware and cares.

Tho I’ve been prepared since last year.

I even grew veggies in containers. Leafy kale has been the best producer. We’ve had fresh greens all summer from the same few plants.

Late in the season I bought up clearance seeds for next year’s attempt to supplement food.

Kale is surprisingly robust. I’ve had a few volunteers show up in my bucket garden and they are good producers. My neighbor is the farmer though; she has the sunny side of the canyon. I’m relegated to a greenhouse or windowsill garden or inside growing. Too much shade in the forest.

We all have a skill to offer. My husband is a roofer, exchanged for exterior painting. I’m good with computers, exchanged for home canned goods. Start thinking outside the box.

Yep, I’m the village blacksmith; machine shop owner in my prior life. One aspect I’m always mindful of having a widespread skillset is human’s natural inclination to take advantage of others. I expect it to get worse as things deteriorate. Those of us with skills and raw materials will become targets. I’m seeing it already. Those who are used to having others serve them tend to be the worst.

Food is getting crazy high. Items I bought for say 9.99 a year ago are now 15.99 at BJs. Costco is the same. There’s items at Costco that have been virtually the same price for years – not anymore, not even close.

Then there’s basic like canned goods that have gone up to 1.50 from 1.00 – that’s insane inflation.

Everybody at Costco is shocked.

House brand can corn 4 pack pre-covid 1.99 or less on sale, last weeks sale price was 3.29 for the same 4 pack: 65.3% inflated price.

Tortilla chips pre-covid 1.09 or less on sale, last time I looked at buying them (didn’t) 1.69: 55.09% inflated.

They used to have sales on brand name canned veggies for .50 / can which equaled the house brand price. Have not seen that one in years now.

$0.8225 / each for a multi-pack of cans now for house branded.

I thoughtI’m told inflation was significantly less than 50%+Glad I stocked up on can corn @ 2.29, unfortunately down to my last 4 pack.

Definitely will not get cheaper after this years harvest. SMH

If you voted for Biden…

Soylent Green for you;

No car, take the bus;

Move to an urban center, no house, no condo, about 50 sq feet per person, one bathroom for every 10 people.

You don’t get to vote anymore.

@tonyE, the FEW individuals that DID vote for Biden are cultists. If you gave them actual Soylent Green (the kind from the movie with Charlton Heston) they’d gladly gulp it down if the package said it would “save the environment”. That’s how far they are from reality.

The closest thing we had to an Intervention/Deprogramming attempt was the election of Donald Trump in 2016, had the Great Cheat not succeeded, they’d be mentally broken and have to face reality… that THEY WERE THE “BADDIES”.

Just put in my order for quarter of mixed beef from the local butcher. Should be around $6-7/lb cut weight vacuum sealed. Ill get a bit over 100lbs. The meat, especially the ground beef, is out of this world. I loved the ground beef so much, I increased it to 50% of my order from the butcher.

Nice breakdown, but the math is wrong. Inflation gets compounded, just like interest.

If margarine increases in price by 0.073 per month, annualized that is

——not——

12 x 0.073 = 0.876, meaning 87% over a year

but rather

1.073 ^ 12 = 2.329…. , meaning 132% increase per year.

I have a hard time believing that food is up only 13.5%. The food in my stores are up nearly 50% if not more. Even everything at the Dollar Tree went up 25%.