This shouldn’t come as a surprise. Most banks and financial institutions are being very careful right now as they prepare for the consequences of consumers running out of money. All banks are securing reserve accounts in anticipation of defaults increasing.

July 15 (Reuters) – Wells Fargo & Co said on Friday its second-quarter profit nearly halved as the bank set aside more funds to cover potential loan losses, while its mortgage lending business came under pressure from higher interest rates.

July 15 (Reuters) – Wells Fargo & Co said on Friday its second-quarter profit nearly halved as the bank set aside more funds to cover potential loan losses, while its mortgage lending business came under pressure from higher interest rates.

The fourth-largest U.S. bank reported profit of $3.1 billion, or 74 cents per share, compared with $6 billion, or $1.38 per share, a year earlier. Its total loan loss provisions were $580 million in the quarter, including a $235 million increase due to loan growth.

Under an accounting standard that took effect in 2020, banks must factor the economic outlook into loan loss reserves. Last year, the bank had released $1.6 billion from its reserves for loan losses as the economy rebounded from the pandemic.

Wells Fargo Chief Financial Officer Mike Santomassimo told reporters that retail and business customers remain strong, but the bank is prepared for a potential economic downturn. “Things will probably get worse, but that’s already included in the overall scenario analysis and the allowance level we have for the quarter,” Santomassimo said.

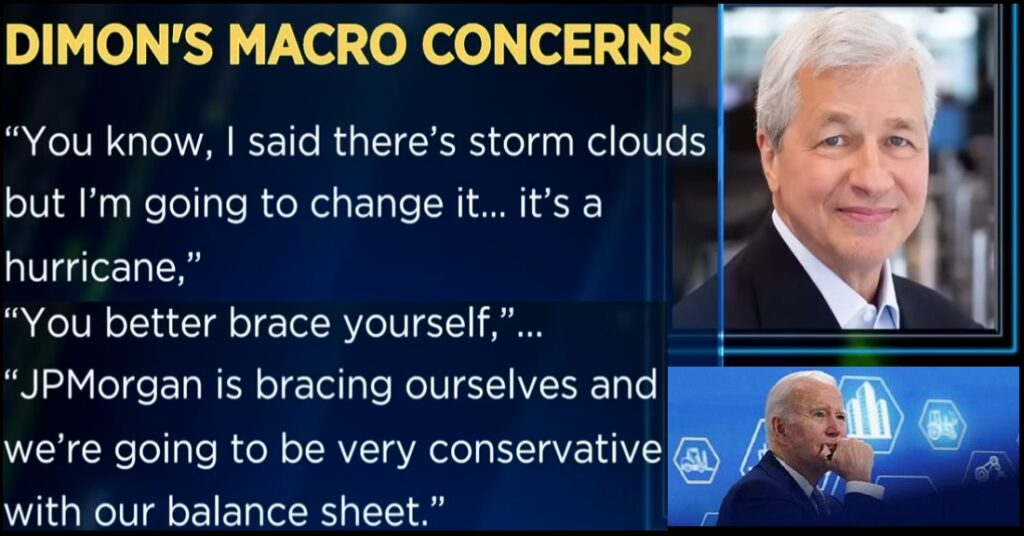

[…] Big bank executives have sounded cautious so far this earnings season, with JPMorgan Chase & Co’s Chief Executive Jamie Dimon likening the macroeconomic environment to a coming “storm.” (read more)

Get in line banks if you are thinking about another bailout. The Glorious Gay Dancing Ukrainian President is needing another 750 billion to fight off the evil Putin, and Ukraine must always come first with Congress and JoeBama

Banks don’t need bailouts anymore. Haven’t you heard of bail-ins? You better check the wording on your banks website!

If you have money in the bank, you are an “unsecured creditor”. They take your money.

https://www.investopedia.com/articles/markets-economy/090716/why-bank-bailins-will-be-new-bailouts.asp

Key part of this:

“They shift the risk to unsecured creditors, including depositors whose account balances exceed the FDIC limit of $250,000.”

If you’re under the limit ($250,000) with any single bank, you shouldn’t have to worry about this. The FDIC covers the loss. If you’re over the limit, spread your accounts to other banks, since the FDIC coverage is per bank, not per account.

I’m not expecting that to be honored.

Yeah, that’s the kicker. The FDIC usually pressures another bank to buy the failing bank, rather than pay out.

FDIC is still taxpayers money, so we all end up paying it in the end.

Actually the banks pay into a fund so the FDIC has the money to cover this most situations. Certainly in the kind of scenario Sundance lays out the FDIC would need more then what they have collected but typically that is not the case.

Relooking at that and for the 2008 time period, while I’m sure the big banks were “too big to fail”, I’m also sure the FDIC didn’t/doesn’t have nearly enough to cover the >$250,000 for millions of depositors.

It would have been one thing for bank/banks to fail, but can you imagine the tsunami that would occur if FDIC couldn’t pay off? Looking back, it was probably the FDIC that noone wanted to fail.

well put.

So, and not pinging on you, where put one’s saving account monies? I’m struggling with that decision right now.

FDIC will cover occasional bank failures but if there is a run on the banks, forget about it.

No, it’s per ownership of account. So individual, joint, trust, etc. If you structure it correctly, you could get up to 1.5 mil in coverage.

I wonder how much money the FDIC has?

And I wonder how much it is on the hook for if more than a few banks go belly up?

Recommend considering Credit Unions as part of the strategy. They have tighter rules on who and volume of loans they shoulder. In short, they are less inclined, in theory, to engage in riskier loans.

This

Not if they’re FDIC insured. Who the hell have you been listening too?

Not another “too big to fail” bailout.

Not this time.

You hear this GOP??

The banks aren’t out of money. People are.

That statement has held true since the first bank was formed in the Bronze Age.

The new narrative is that people aren’t out of money. That’s why the stock market was up so much today.

Haven’t looked at the data recently, but “plebs” own what percentage of equities? 20%? Seems to me this is more temporary bear market melt ups intended to milk clueless retail investors while teh top 1-10 percent bail.

People don’t get bailouts. Banks do. As in Wall Street. As in the “corporate” institutions behind the bank. And their boards of directors and principal stock holders.

Those $Trillions of dollars that propped up Wall Street and kept the billionaires shielded from losses did nothing to help the peasants. They took the hit in personal bankruptcy, foreclosures, or just plain old loss of savings.

If you have a saving account, it is already covered under FDIC to $250K. I’m not talking about that. Its the giant corporate bailout. And those are not “the people”.

Yes. The plebs will be left holding the bag.

Question then becomes – who is the next Ceylon?

That cheating financial institution she have been shut down for all the fraudulent activity they were caught doing.

“Wells Fargo & Co said on Friday its second-quarter profit nearly halved as the bank set aside more funds to cover potential loan losses, while its mortgage lending business came under pressure from higher interest rates.”

When the other half of WF’s profit disappears, what then WF?

Looks like they’re switching strategy at WF to WTF 🙂

This isn’t unusual, nor should it be surprising. Banks build up their loan loss allowances heading into recessions, and they run them down during good economic times. In its prior four quarters, Wells Fargo had negative loan loss provisions of $1.3 billion, $1.4 billion, $452 million, and $787 million before the Q222 loan loss provision of positive $580 million.

The real question for Wells Fargo and the rest of the big US banks is how bad are loan losses going to get in what is almost certainly already a US recession? Q222 loan losses were still very low for Wells Fargo (commercial loan chargeoffs of only 2 basis points, consumer loan chargeoffs at 33 basis points, for an all-in chargeoff rate of just 15 basis points in the quarter). In a bad recession those loan chargeoff rates are going to increase by a factor of 10x or so. It’s likely just getting started, folks.

Speaking of Wells Fargo and CA, I’ll be waving goodbye to Kommiefornia and the reign of liberal terror on July 27th. Can’t wait to see this state in my rearview mirror…

Good luck wherever you land Will! New screen name Will_NOT_in_CA?

Lol, that is certainly under consideration. Thank.s

I don’t need to know where you are headed to PROMISE you that you will look back on this decision, a few years from now, and realize it was one of the best, if not the best decision you have made in your adult life.

California is a wasteland that has no hope of returning to its former glory, at least in our lifetime.

Thank you, appreciate it.

Good luck! Don’t forget to vote intelligently wherever you land. I lived in CA for 3 different stints. Relative had an ‘amond’ farm in NAPA. Wonderful climate in the state. Wondrous natural beauty.

Too crazy and expensive. Much like Hawaii, it also seems like the infrastructure (including housing) simply has a too pervasive 60s look to it (i.e., past its replacement date).

Congrats on your move. And on your way out, PLEASE tell Gavin Nuisance to stay the duck away from the White House.

Thanks. I would say Hair Gel Hitler has no chance in 2024 but I expect the Dhimmies will cheat like there’s no tomorrow, again. It’s the only way they can win.

We left last month after 40 years. What a royal mess. This is what happens to a state that run by one party.

Congratulations! Hope it works out well for you.

Left 6 1/2. years ago and never going back for any reason. Ex 5th generation Californian.

You’re one among many ex-Californians I am sure.

Good luck! I left MD in 2018 after nearly 30 worth most of the previous 14 in Northern Virginia when it was still sane. You won’t regret leaving.

Thank you, I appreciate the sentiment.

I escaped four years ago to Las Vegas where it is only hot outside. I haven’t looked back.

Isn’t the county that Las Vegas is in just as woke / Dem as California?

Clark County is definitely blue, but not really woke. Vegas has a tolerant live and let live populace. If there are Karens about, they know better than to act out.

This!

And, one might add, the federal gov’t as well. At some point, the bond market loses its customers. No amount of money printing (inflation) and FOMC interest rate suppression can stop yields from going up (i.e., real market factors taking hold; bond prices cratering).

For years, Warren Buffett said how upright and honest the management of that bank was and what a great company it was. Then scandal after scandal of fraud that was outright criminal and should have resulted in some high ups going to jail for larceny. He’s giving all his money to the Gates Foundation, which is funding the current war on the middle class and working class around the world. He’s got this aw shucks uncorrupt public image which I doubt. Anyone funding this war against us is the enemy. So I’m glad to see he lost money on this investment.

Oh, wonderful. Buffett’s billions added to those of Billy-Boy. That ka-ching you hear in the background? Every future election being sold to the highest bidder.

Tanker cars on the railroad versus pipelines. Good Old Warren. .

Perhaps leading one day to freight cars going to concentration camps.

Everything in America is depressing now, just like Leftist Democrats.

Leftists only happy when everyone is as miserable as they are.

I posit that they have an insatiable drive to cause misery as they can never be satisfied in life from being so estranged from nature’s creator.

Talked to my real estate brother in a 30,000-population town in central California. He said housing sales have come to a complete halt and have been this way the past month.

I can believe it.

There are always people with cash to buy or need a house. They know it will be a buyers market when the SHTF.

I’d be waiting for the bubble to pop if I needed a home. Rent until the foreclosures snowball like in 2009.

With an overwhelming amount of homeless, the government will buy them and rent them out. You’re forgetting BlackRock is in the house!

Didn’t you mean illegal aliens?

What’s your opinion of the stock market rally today? Yesterday morning it looked liked things were going to get really ugly, but in the back of my mind I knew something was going to happen to temporarily reverse sentiment.

As you know the Stock Market is highly manipulated by the Federal Reserve, US Treasury and the big three investment bankers. What they have in common they are all controlled by democrats.

The early drop yesterday was the World markets before the US market opened. It was a drastic drop and poised to drop much further. The US manipulators had the power to reverse this potential horrendous downslide. and the prop carried on for Friday. They don’t want the public to see a down market on Friday and over the weekend. Plus, they need to psychologically keep the market above 30,000.

I see this manipulation good for those wanting to get out of the Stock market. It gives them the opportunity to get out at higher prices than would be otherwise. We have been in an overall Bear Market since January 3rd. However there have been four bear market rallies since January 3rd. I see the bear market rallies as giving people another chance to avoid a wipe-out later on.

Once the Stock Market drops below 30,ooo support I don’t see the next major support until 28,500. I have said this before, “I don’t see how people rely on “fundamentals”. To me Stock Market “fundamentals” are just lies no different than the media propaganda lies which are concocted.

It’s a bear trap by the market makers. Market was very oversold. This week was also opex so will chop the market to have most options end up out of the money.

I don’t think much of it today. Volumes were generally very low. Also, most of the “bigs” are out until after Labor Day. Offices are being handled by middle manager groups right now. They tend to not make any real moves until the big boss comes back.

However, repetitive negative news can cut the Hampton’s vacay a little short

They come back from the Hampton’s early and then what?

A realtor in Las Vegas said the same thing, mostly due to interest rates.

Yep my neighbors are both lawyers and he told me that he remembers obviously a few months ago people were closing on homes with 2-3% interest rates now he’s seeing 6%!

It’s the same in N.J. for Sales

Rentals is a different story sky high and in high demand

FWIW, Wells Fargo is actively soliciting new suckers – er, I meant, takers – for its credit cards. My credit “score” is high and stable; I’ve gotten three such mailings from Wells Fargo in the past four months. Odd behavior, looking to give credit to someone with a track record of carrying zero balances, who thus generates zero interest income for the issuing bank.

Hey 47Y, The Temptations , It’s a Ball of Confusion .

“Vote for me and I’ll set you free”.

Even if you don’t pay interest, they make money off the interchange and processing fees charged on purchases. I still like to pay cash.

I too like cash and we have a bit lying around.

However we do like the cards.

We only buy what we need, and seldom make an impulse buy and have never paid a stick of interest.

The “cash back”ones are handy and the “ cash back” goes into the “ fun fund”

The vendors are paying through the nose though in excess of 3% in many cases.

They still get income from the fees they charge the sellers. I haven’t carried a cc balance in over 20 years and still get solicitations.

F Wells Fargo.

Once got a advert with fine print stating “we know you opted out of receiving mailers, however this offer is so good we had to send it to you”.

Got emails as well and my reply was…”I would rather be doused with Napalm, shot out of a cannon, through a burning stream of oil suffering fire sucking oxygen out of my lungs, while falling in 10,000 foot gorge before being deposited into a lava flow than do any business with Wells Fargo”

Then I got something from a sweet young lady introducing herself and responded with what I thought of Wells Fargo, ripping their customers off finishing with something about her heritage and how miserable it is working for a corrupt organization.

And the mailers kept coming, then the final straw was some local rep texting me…I lost it. I responded to the text that if he contacted me again, I know where his office is and I would personally meet and do things to him that started with the shape of his lungs.

Then more advert came (though not from him). Finally I got a hold of Wells Fargo and said some things in a way that (it was recorded) that I’ve attempted to remove myself from their adverts in numerous ways and their refusal to do so, I would make use of materials which has the capacity to reach out in particulars ways and that the responsibility would rest with them.

Finally they stopped, and haven’t had anything from them in years.

Sounds like your subtle approach worked.

Haha…

Get ready for some of the same things from 2008 happening again – I remember getting contacted by every credit card company where they stated they were lowering credit limits.

The US fiat currency system is bankrupt and imploding. This is NOT a repeat of 2008.

This is “uncharted waters” for those of us who were born here and have lived in this system all of our lives.

When the government tries to force its authoritarian-controlled digital currency system on us, it must be rejected.

Well said. Everything going on right now is connected insofar as it is happening inside the same system. That system being our society.

Several indisputable facts exist, we shut man y businesses down for 2 years, many closed their doors, money buys less and housing and food are at maximums.

Even if what we’re seeing today is purely passing fallout from the events of 20-21, it would stand to my reason that it wouldn’t be over in 1 years time. No, even if the fallout takes two years to fix (it won’t) the worst is still in front of us. How many people can kick their credit down the road for another year? How many people live pay check to pay check.

Even if the financial system isn’t collapsing totally, for many people, their way of life is ending. For the people who sat on their ass on the governments dime…that’s ending. For people underwater, that too will bite them. For those of us who have done all we could to stave off the worst, even we aren’t immune and humanity has a breaking point where the costs of providing for our families is greater than the cost of losing our lives to ensure their’s.

No one is thinking about their 401k retirement rate of return when their brakes go out on their car. For many people, they’re speeding down the highway right now not realizing that they’ve already used their brakes for the last time.

I believe the election was our last chance to pump the brakes of free speech to stop this. Now a more intrusive fix is demanded. And since we have yet to find that, as a society, the car is still picking up speed on the downhill towards the stone wall at the bottom.

As long as people, in general, have the mindset of profiting or capitalizing on the government and industry-backed and caused suffering of others under color of law, society as a whole will fail. Crime will skyrocket and peaceful relations will become a vestige of the past. Expect it.

The financial weapon is the last relatively peaceful weapon. Use it on each other instead of the enemy and the enemy wins. I expect humans to respond to their base nature as they historically have and have prepared appropriately and decoupled any vestiges of care for humanity existing prior. Not an easy task for a lifelong peaceful, law abiding, God-fearing person. It is what it is. So much for the iconic Wells Fargo stagecoach.

I pray you are wrong about the last election being our last chance.

Try a local community bank that helps your area and has higher standards about where the money goes.

I do business with a very small local bank. The president told me he spends most of his time defending his bank from the bank auditors.

Example: why does he loan money to me, a middle-aged white guy, for commercial real estate deals, but he didn’t lend to Shaniqua, a 24-year old single mother, money for her first home. Forget debt-equity ratios, credit scores and payment history, this is now about “social justice”.

Sorry, but my worst experiences ever with a bank (s) has been in North Carolina. I will never go anywhere near a local bank as a result. Totally unprofessional and harmful to me. And ditto credit unions..had one in Missouri, really disrespectul to me…they only require you to write on a slip of paper what you want for a withdrawal…are you kidding me? In another century. I prefer to be an anonymous person with a large national bank…no problems with anything.

Though times have changed and become depersonalized, there was a time when we’d call in a customer to meet with the loan committee to discuss derogatories on their credit report and, pursuant to that discussion we’d sometimes overrule the loan officer who was following ‘policy’ and make a loan not otherwise made.

That’s what can happen when members (depositors) own the institution and members (depositors) are elected to leadership roles. When I joined back in 1970 it was a small state employee credit union. No longer. I enjoyed the days of small and local.

Now, banks and financial institutions in general are off-limits. I’m into the alternative economy now. A new age anonymity in old age.

Fed just finished their stress testing. I doubt Wells Fargo CEO (Charlie Schaefer) just cut profit for giggles.

Consider Jamie Dimon on the testing results for JP Morgan:

“We don’t agree with the stress test,” Dimon said. “It’s inconsistent. It’s not transparent. It’s too volatile. It’s basically capricious, arbitrary.”

https://www.cnbc.com/2022/07/14/jamie-dimon-rips-fed-stress-test-as-terrible-way-to-run-financial-system-.html

Oddly leveraged bank ETF BNKU soared 14%+ today.

The market ending the week on a sharp rise as well is very suspicious.

Call me crazy but it can and is juked when desired.

It is “juked” primarily by the Federal Reserve, US Treasury, Investment Bankers such as; Black Rock, Vanguard, State Street, etc. What they all have in common; they are all Globalist democrats.

Agree on the dramatic cast. Disagree on the political police lineup. The Republicans are equally complicit. Who, after all, tubed the gold standard?

We have to change the definition of “Money”.

We cannot continue to agree with their definition of “Money”.

Yup.

They are going to take all of our wealth.

We worked for years…like idiots…stashing away dollars…for what?

They are destroying the value of the dollar by printing excess money.

They own our 401 Ks, IRAs, Pension Funds, Annuities, Bonds, Mortgages, Debt, College Loans, Car Loans, Refinance Loans, and, if we cannot pay our local excise taxes, they own our land.

That is what they are doing and nobody cares.

The Dopes keep trading in the thief “Money”…instead of changing the definition of “Money”.

THIS

We have to stop using their money.

Alternative economy and defensible assets. They can try to take them but I keep a dull chain saw for those who fail. That’s what war is. Nasty. Most folks haven’t figured out we’re at war yet. Those living in ignorance are going to get a wake up call of all wake up calls. There will be who lives and who dies. Expect it. Heck they’ve already been killing off scores of us and we’re just sitting here like sheep taking the casualties. Payback is a b*tch.

Setting aside reserves for non performing assets saves on income tax.

Yep, been to this rodeo; ’07 – ’08. ‘The Big Short’ and ‘Margin Call’ give us nice rearview looks at a monumental historic slow motion economic train wreck. Wiping out $Trillion$. Oh how predictable guberment policies repeat! Taxpayers will again have to pony up the bailouts. 2022 – 2023 is different however. This one will be exponentially worse. Planet earth is drowning in massive I.O.U.’s. There is no where to hide. #1. Find a deep relationship with Jesus. #2. Throttle back on all excess spending. Hunker down. Be smart. Prepare thy heart and house.

I am a mortgage loan officer. I have worked for two very big banks but not Wells. Given that Wells, like other big banks,sells off the vast majority of their funded loans to the secondary market, I’m thinking they are expecting losses on the small number of Jumbo loans that have not sold off in addition to anticipated losses from credit card and auto loan losses. Interestingly, about a year ago Wells stopped doing Home Equity Lines of Credit (HELOCS) altogether. It might be a good time to get in the REPO business.

I agree there will be a tremendous opportunity in the REPO business. This is will be a perfect time for the “little guy” to make hay.

I remember during the last crash some lady traipsing (and trespassing) around my property yelling at me on the tractor that she was going to ‘take my house’. I was more peaceful back then and it was the neighbor’s place that was being foreclosed on. I think I was the only place to survive among adjacent properties during that time.

Now I’m not so peaceful and keep a dull chainsaw for such cocksuckers.. Profit from the pain of others at your own risk.

I’m in the process of dumping Wells Fargo after 22 years. They do NOT value us as customers. I should have dumped them when after 18 years they wouldn’t finance my mortgage but less than 90 days after closing they purchased my mortgage from the company that did finance me. Go on their website and it’s all woke dogma. I’m done.

The idea is this:

step one: crash the economy and bankrupt homeowners.

Step two: Foreclose on the properties.

Step three: Make a fortune by reselling the properties at a later date or by controlling them.

Its an open secret that WF is controlled and utilized extensively by the CCP and PLA. Keep that in mind before repaying any debt to a communist criminal enterprise

Some of us bought homes in 1979 era of 19% interest.

Surely the seditious bunch in DC think we are mushrooms. They try to keep us in the dark and feed us BS all day.

The powers that be are trapped. The top 1% are cashing in, buying farmland, fortifying their private islands. Faith is all but evaporated in key societal institutions (e.g., judiciary, MSM). And what are we (Main Street) being offered? More spending, more Federal debt, more repressed interest rates (watch, my belief is the Fed will back off QT/FOMC pressures as the incipient recession worsens). It’s a huge Ponzi scheme and we have been the suckers.

This isn’t just hopelessly mediocre Progressive Democrats feathering their beds at everyone else’s expense. Both parties are complicit. Buckle up. The rampant conspiratorial WEF tales forget one key – it never, ever plays out as planned.

I have read derivative collapse warnings for over 30-years.

Like MBS? Fed gov’t had to step in and bail these Ponzi artists out (TBTF, etc.). This appears to be your profession so I defer to you – with the caveat that my readings of various financial analysts is that global derivatives packages are in the mega-trillions (i.e., incredible multiples of global aggregate GDP) and that the tranches in these things are increasingly built on high risk junk/low grade debt instruments. Are yields eventually going to have to increase in bond markets? I.e., There aint nothin the Fed Reserve/gov’t can do to prevent this at some point (seen as arriving sooner than later by many).

Either way. I am learning from your posts. Trying to figure out the best strategy for protecting my family as the storm approaches.

Banks make money by lending it. Interest differentials are their cash flow. They get these monies from only two sources: depositors or the the Federal Reserve if they are members. If you refer to the current national statistical abstract you will find that those citizens with assets in cash of 1.5 million or greater are a very very small number compared to the nations current population estimate. So … where do banks get most of the money they use as working capital? From the Federal Reserve. Why is this important? Because their lending policies are crafted from a central source. They could careless what depositors think about their banking practices or solvency.

Which is doublespeak for “We just won’t pay our dividends no matter what.”