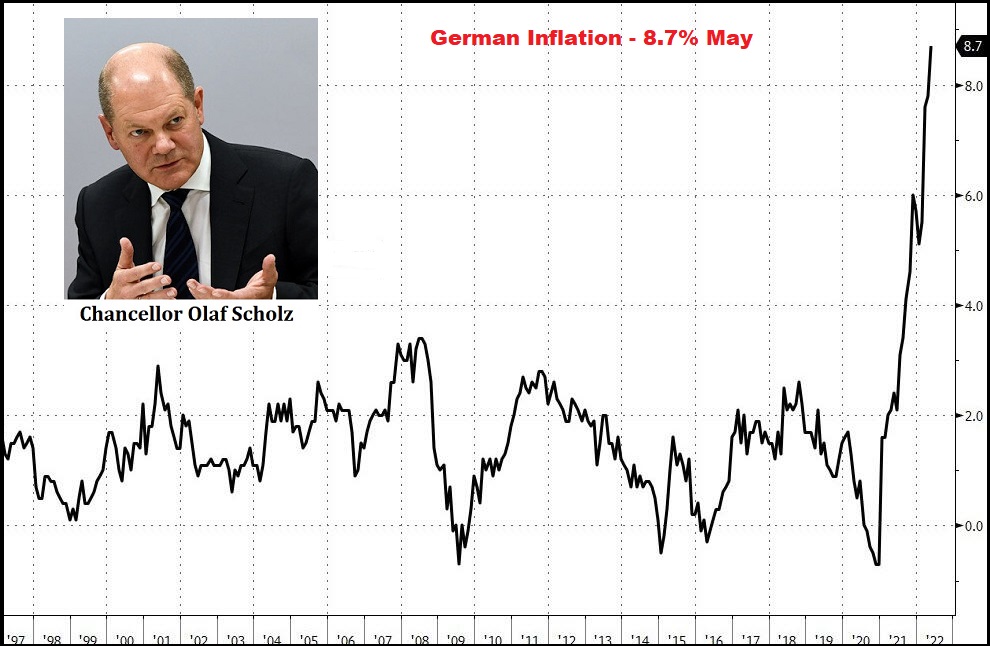

Germany is the central and largest economy within the European Union; it is also the most influential for anything related to the response from the European Central Bank and EU Central Bank President Christine Lagarde. Today, Germany is reporting a massive (unexpected) jump in overall inflation for May of 8.7%, up from the previous month’s 7.8%.

Ironically, it was a little more than a month ago when EU Central Bank President Christine Lagarde said she did not expect the EU inflation to be quite as bad as the U.S. inflation crisis due to the EU spending less on COVID relief and focusing on employment retention. This was the ECB justification for not raising interest rates until later this summer. Obviously Lagarde has joined Jerome Powell in the room filled with bad financial decisionmakers.

Germany is the largest and most influential economy inside the EU. If the German economy falters, the entire EU slips into a recession. The massive inflation now being reported by Germany, that continues climbing each month, will increase the urgency for of Lagarde to raise rates. They too are in the inflation spiral, and this issue will quickly fracture the EU response to Ukraine.

(Via Reuters) – […] German consumer prices, harmonised to make them comparable with inflation data across the European Union, increased to 8.7% from 7.8% a month earlier, well ahead of expectations for 8%, data from the Federal Statistics Office showed on Monday.

Inflation was last time this high in the winter of 1973/1974, when the first oil crisis led to a new and difficult-to-tame inflationary cycle.

Although the ECB responded to soaring prices relatively late compared to its global peers, the bank made clear last week that interest rates must go up to stop high inflation from getting entrenched.

While ECB chief Christine Lagarde and chief economist Philip Lane made the case for gradual, 25 basis point hikes in July and September in the minus 0.5% deposit rate, economist said a bigger, 50 basis point increase is very much a possibility.

“The ECB has clearly passed the stage of discussing whether and even when policy rates should be increased,” ING Economist Carsten Brzeski said. “The only discussion seems to be on whether the ECB should start with a 25bp rate hike in July or 50bp.” (read more)

Oh, what a difference a month makes. Interview April 24, 2022.

Clearly, we need to give another $40 Billion to Ukraine and get diesel up to $10 a gallon..

That should stop inflation, here and in Germany and everywhere else, dead in in its tracks.

At least another $40 billion. What will the CCP think if we don’t.

The biggest victim in the war in Ukraine is the EU. The USA is running NATO which is causing this.

By running the war in Ukraine and toppling the EU economy, the Biden policies will look tame as to economic effect. Biden can now say “It is not just us that is experiencing this, just look at the EU and be thankful.”

The EU is going to figure out the US plan to crush the EU and the results are not going to be happy. The EU is going to have to kick the USA out of NATO or rewrite NATO altogether giving the USA a smaller voice.

Cold anger across the world against the USA is brewing mightily. The USA is going to get a punch in the face. It is coming.

Those elites listened to the Biden administration about Ukraine, or maybe were persuaded/coerced. Either way they get what they deserve. I don’t recall one of them telling Joe he is full of it.

More and more it looks like the US population will neuter its brain-dead figurehead and his congressional followers this fall. In January the world will begin to turn for the better, but only begin.

The US election is in November. The US has to keep the Russian blame game alive until then. It is not June yet. That is another 5 full months.

Democrats are going to need to show Russia has been fully resolved before the election. Russia knows the political timeline.

Therefore, Russia can get a handsome settlement because they know the USA time pressure for resolution at any cost.

The USA will claim Russia is medaling in US elections. Nope, it is just good negotiation strategy.

The USA has taken Chicago style politics to the world stage, and it is being rejected. This is all the Biden administration knows.

The world is vomiting to USA stick wielding. It is going to be like the falling of the Berlin wall.

When the world is starving, it is going to be hard to explain why the USA is converting food to alcohol to run automobiles.

You misspelled ‘obama’.

Hahaha! Good catch!

It has made the world a much uglier place.

Respectfully you are falling for BULLSHIT.

Obama was an avatar, and like other occupants of the Oval, a figurehead.

LOOK who are in “top, leadership positions” in our government.

Put aside blinders, and look objectively for,…competence.

Biden, Harris, Pelosi, Schumer, McConnell, McCarthy.Only ONE displays any competence, the rest are blithering idiots.

McConnell is the man behind the curtain, NOT Obummer who is the image being projected, the FACE saying “I am the great and terrible OZ!”

“Obama was an avatar”

Everyone of consequence is.

If you are not a puppet, you will be persecuted like Donald Trump.

Agree.

Obama is a Soros puppet who can read a teleprompter – nothing more.

braindead biden cannot read a teleprompter and is a Soros prop – nothing more.

Soros and his committee of evil globalists are running the White House.

Ditch Mitch (and his minions) and the country will be a better place.

Well deserved I should say!

TRUMP WON!!

By a landslide!

The EU has given Ukraine about 3 billion Euros so far.

The US is the only country that’s goofy enough to keep pumping billions by the score into Ukraine.

https://www.consilium.europa.eu/en/press/press-releases/2022/05/24/eu-support-to-ukraine-council-agrees-on-further-increase-of-support-under-the-european-peace-facility/

You didn’t read the bill. The $40b went mostly to the state dept, defense contractors, the pentagon, the IC and NGOs. Only a few billion to Ukraine directly, not to mention the billions to US politicians.

And who makes sure of that? It’s a $40B slush fund.

To be a victim they can’t have helped cause the problem. The EU did everything they could do to keep NATO neutered and funded solely by the US and Britain as well as doing nothing to as Russia systematically took over all the major oil and gas sources in Europe, starting with their invasion of Georgia back when “W” was the figurehead of the day. The EU owns this debacle even more than the scum currently occupying our nation’s capital. There is no EU vs US in this equation. It is NWO socialist/fascist/communist vs the free peoples of the world.

Up until around 15 months ago, the US was a net oil and gas producer

America was exporting energy….

The globalist meat marionette ended it, via slew of executive orders.

You also forget the oil and gas permitting process. That ended too courtesy of the EPA and the Interior Dept.

The only major issue facing Dimwod Senate and House members is where to park all of the corrupt kickback cash from these Ukraine “aid” packages. It’s just not that easy to launder so much cash.

That cash makes a few stops and before it’s laundered. Been going on for a long time.

The owner of Burisma was banned from the US, until JoBama helped him out. #0bamagate

It is going to get way worse in Germany when producer prices filter through….

RTTNews

May. 20, 2022, 02:45 AM

(RTTNews) – Germany’s producer price inflation accelerated further in April to set a fresh record high and soaring energy prices continued to drive prices higher amid the war in Ukraine, preliminary figures from the statistical office Destatis showed Friday. The producer price index climbed 33.5 percent year-on-year following a 30.9 percent increase in March. Economists had forecast a 31.5 percent rise. Destatis said it was the highest increase ever compared to the corresponding month of the preceding year and that these results also contain implications deriving from Russia’s attack on Ukraine.

How does Germany reverse the suicide they’ve signed up for by putting an embargo on Russian”fossil” fuels they need?

Simple!!

Rework the language, as all good little tyrants do. So now it is this…

Germany: We have to keep buying Russian oil so other countries aren’t able to buy it.

See how easy it is??

HaHa!

That is soooooo AOC.

LMAO 🤣😂

I hadn’t thought of it that way, Eagle. But you are so right! And yet that was an actual statement from the unelected in Germany. All that fine wining and dining has rotted their brains and made them soft.

Yes indeed Betsy.

Childlike suggestions and responses rule the day with these very sick minded W.E.F.-O-Crats.

They are completely controlled and beyond even the slightest modicum of grasping reality or logic. Unreachable.

They have left our solar system and exist in the interstellar vacuum of space. Gone forever.

Good God, what a fate?

They are crazier than that Betsy.

I read the Germans are cutting down the 1000 year old Hansel and Gretel forest to install 250 metre high intermittent windmills.

But never mind they will plant some new saplings to appease Gia.

Almost all of the 40 billion actually going to US and EU crooks, of course, and being spent to create more inflation…

$40 billion to US. Military industrial manufactures, lobbyists, Senators and Representatives instrumental in this huge boomerang of “aid” to Ukrainian politicians. I imagine very little to any displaced Ukrainian citizens suffering in this proxy war between the USA vs. Russia.

And reduce actual wages.

Don’t forget that!

Diesel at $10 per gallon ought to work, because few would buy it at that price.

Along with every 18 wheeler! Dead in its tracks!

Pompous Germany. Same arrogant country that shut down nuclear power plants, doubled down on ‘Green Energy’, relied on Rusdian oil and laughed at President Trump. Now they’re burning more coal and scrambling.

Side note: this is a good, simple question for Liberal know it alls. “Is Germany a rich or a poor country?” You’ll be surprised at the ignorance.

And one of the first countries to open their borders subsequently destroying the fabric of the many cities of Germany…

For a clue as to how all this open arms doctrine and their open borders works out, see Sweden which will be an Islamic State soon enough as every government entity AND their churches accept and make allowances for their replacement population., otherwise known as “culture enrichers”, per Gates of Vienna. All funded by the Swedish taxpayer to such an extent that Somalis (for example) and other antithetical culture ” immigrants” need never work again.

And no doubt the new arrivals are grateful for all the largess bestowed.

They are actually. Who wouldn’t be. Though it’s just a hop, skip, and a jump from grateful to entitled.

My question is who paid for their fares from the middle of Africa and other places into Sweden? An answer to that would be interesting…and telling.

That will only last until the ethnic Swedes retire

Did you notice that all of a sudden that everyone is starting to come around to nuke power is the only answer to carbon?

I was saying this months ago. Maybe the war on carbon was a plan just to make the people beg for nuke power because the people need to be saved from the price of carbon lol.

The people will jam nuke power down the government’s throat instead of the government jamming nuke power down the throats of the people.

Interesting observation. Wouldn’t be the first time we have been manipulated into begging for what they wanted all along.

Nothing about the war on carbon makes any sense. You then have to ask yourself what is the real reason and where is the money to be made?

People tried to answer this with carbon credits and carbon trading. But ultimately, nuke would have to raise its head in the grand scheme of things. So, I invested accordingly.

You’re lacking a basic understanding of carbon credits. Capture, carbon capture. Ponder this, Gates buys all farm acreage and grows trees. Trees capture carbon, Gates gets the profits from capture. All the while you an I pay for releasing carbon. Nuclear doesn’t release carbon dioxide. Therefore no cash game.

You are lacking basic understanding of nuke power. Nobody wants a nuke plant next to them. Wide open space is perfect for nuke plants. Like farmland.

Gates and Buffett are building next gen nuke power in Wyoming. Next gen nuke will put solar panels and windmills out of business.

Nuke is the cheapest form of power. Lot of cash game. Next gen nuke handles the peak power issues with fixed plants.

Your points of view were considered.

Spent fuel rod disposal problem; worldwide. Encapsulation & bury in Nevada scheme was a scam hoax by Sen Harry Reid that yielded him billions. Still a problem in Fukushima.

Bundle them up and send them to the sun. We could use a few good solar flares.

Musk can do it….just ask him..!

The spent fuel rod scam can be solved overnight when it needs to be.

The Dems and NWO’s have been spending their fuel rods over and over on us.

BOHICA.

I’m also concerned about security at these plants and in the surrounding areas. We are letting in thousands of potential terrorists and our Woke govt loves to hire such minorities to fill quotas. I know they design all sorts of fail safes for nuclear plants but a clever terrorist cell can potentially infiltrate and create a nuclear disaster. Or take a lesson from 9/11 and fly a plane into one.

Withthe right bribes to congress, anything can be solved.

Agree that nuke power would be the most efficient but we’re talking $$$. Very limited investment. Plant once and capture profits forever.

Exactemundo.

Who cares about carbon? Carbon dioxide is plant food, which enables plants to create oxygen. Part of the cycle of life. We do not need less carbon dioxide, we need more. And if it helps warm the earth a tad, all the better. An extended severe cold cycle is long overdue and far, far more dangerous than so called global warming.

The war on carbon is brought to us by billionaires who want to make money off of green energy, and green energy isn’t viable if fossil fuels can be used. They don’t want nukes either.

Nuke power isn’t going to help the USA at this point.

Existing plants are aging out and new one’s are not being built.

Well, assuming we can survive 2+ mores years of this incompetent bunch of morons; there is sufficient reserves of oil, natural gas and coal to power our nation and others for 500 years.

There are sufficient reserves….

So. Build, build, build. Nuke power will save us.

“HOW DARE YOU!” ReGreta was angry at coal last year. lol

“Green” Europe Looks to Coal Again

In 2000, nuclear energy from 36 plants provided almost a third of Germany’s electricity.

https://www.aier.org/article/green-europe-looks-to-coal-again/

we should tell them we will gladly ship them all the coal the need, but sorry, no gas or oil.

“You will own nothing, and be quite unhappy”

See my post above at @2-42 Mr Perot

The hochdeutsch are by nature arrogant people and need to be humiliated.

The EU, US and Japan have created and spent unimaginable amounts of currency.

It’s not the money, it’s the confidence in governments that makes or breaks them. Here is a very enlightening read. If your able, buy the book “Manipulating the world economy”, it’s pricey but you’ll have gained years of knowledge in 2 weeks time.

https://www.armstrongeconomics.com/armstrongeconomics101/basic-concepts/the-endless-propaganda-behind-the-dollar/

That would be debt, not currency. All the “rich” nations are heavily indebted.

It is something to behold.

They created money and bought their own debt. Try getting your head around that. Try creating a credit card that you use to buy whatever you want and you owe the money to yourself.

You mean, like a 401k loan?

They can talk all they want about raising interests rates and it will not stop massive defaults that we will see globally in the next several years. These idiots destroyed the global economy.

This is what Academics do best! They are brain dead and corrupt.

The economy was built on fake interest rates. If you raise rates to normal and the economy crashes, well, maybe you just crashed what was created.

Artificially low rates just hit the rot. Normal rates will expose the fake/rot.

Agree 100%. Water has to seek it’s own level.

Fake & rot = the US national debt.

Stop the Russian War and the economy will improve on its own.

Where have all the Peaceniks gone?

They are our politicians now.

Only Rand Paul, and maybe a very few others, could be called “peaceniks”.

The rest all warmongers.

The rest are all suckling the teat of the MIC.

To late, Russia is not coming back. The BRICS Nations are moving into a new system. Have been working on it for years and we should expect it nearing its finale after China takes Taiwan.

Russia and China are doing nuclear military drills and getting along well.

Sometimes Iran joins their military games.

https://www.foxnews.com/world/russia-china-military-drill-biden-japan-trip

Yep. When the BRICS hit the fan!!

China takes Taiwan August/September. Then watch the world economy crater when the mess needs to be sorted out and the chip makers have been destroyed or come under CCP “management”.

I assume Zelinsky has been calling in “favors”.

Let me guess, you are in favor of enslaving all Ukrainians to Russia, forevermore.

That is a funny comment, you actually think Russia would enslave the Ukrainians?

How about the EU enslaving them?

A lot of irony in your comment.

Lagarde is the epitome of a useless, unelected, elitist, Eurotrash bureaucrat. She’s bounced around for years, from one figurehead position to another. Her 5-star dining bill, alone, must exceed the GDP of some countries.

Manually adding 1000 thumbs up.

oh but for the pulchritude!

I think Lagarde was considered ‘hot’ by a lot of the older elitists – it helped.

This is all by design, all over the world. Governments are launching a war against their citizens.

Look at the leadership all over the world…from Europe to Canada/America to Australia/New Zealand… it is all liberal bent on implementing their leftist agenda destroying their economies and subsequently their countries…

Slavery has become so advanced, that most do not realize they are slave.

Sorry you are describing the yellow map not the gray side.

Working as intended. You can’t “build back better” until you destroy what already exists.

Just as Klaus stated he was so proud of.

What will said governments do when the citizens can no longer pay the taxes that pay their wages and all the other monies they get? That is what is already starting to happen. Too many are no longer working, wanting to work, either one. The governments have paid them too well to fight (ha ha ha) against Covid.

Certainly. It’s obvious that the number of citizens needs to be drastically reduced “by any means necessary”.

This often happens before countries go to war with each other.

Why mar Weimar?

Never let a “created crises for Dim political purposes in order to skim money off such stimulus for a Dim created crises ” go to waste…

Just ignore the truths about a green economy! We will tell you what the truth is!

~ Authoritarian leftists

and do not pay attention to the price tags at the store, they are merely disinformtion

And “transitory”.

Or, maybe we won’t—-as usual.

Looking forward to the day when these financiers and “economists” are tried as the human rights criminals that they are.

.

I promise to not ever tire of the speedy tribunals and hangings.

.

I promise the kids and grand-kids that his economic construct of the World Economic Forum shall not come to pass in These United States of America!

Germans sat back and watched their country get overrun with illegals and did nothing. They are sitting by and watching their leaders push them into the great reset. I am afraid the United States is right on their tail. Tough times ahead. It has to start with ending the cheating. No free and fair elections…..no chance.

Exactly. Anyone who supported open borders or worse yet muslim invaders gets no sympathy. They were perfectly happy with women and children being raped and killed so they could virtue signal. Let them starve.

“unexpected.” no one saw this coming, in Germany or any other Country that is participating in the Big Reset…..

It is becoming very obvious the 40 billion is equal to bribe $ to keep all the underhanded crap that was done from 2018 to 2022 quiet. From Zelinsky,chapula, etc. that were done DJT and his administration. The bio labs, Joe and Hunters involvements, obviously D and R alike. When Biden asks for 33 billion and the senate raises it to 40. When 1 senator wanted some accountability over the $ , even that was a no no. Looks like Ukraine is the pot of gold that keeps on giving, of course funded by our tax $.

With respect, “this” has been in the works at UN since the 1990s. Please see Agenda 21. That the US citizens were to busy having fun due to the dot com economy and Billy Clinton’s lies and manipulation is the story of gee look what happened while you were sleeping your hangover.

Most prolifers knew about it and spoke about it. But people were living too well to believe it.

Not one can claim they did not know. They refused to see.

And I am referring to the the new reset as the 2.o of Agenda 21. It is Karl Marx’s dream and only the current technology could allow its perfection. At its root it is diabolic. So let us pray first, and then act with boldness.

Our economy is in free fall due to socialist/globalist/communist policies and agendas. The world goes with us.

They say… “there will be some pain”.

The reality is, that at some point, those egotistical globalists are going to hit a switch that they won’t be able to turn off. It’s going to be mayhem, which is why I’m tucked away as far as possible from big cities, with room for my family. I pray constantly for a miracle.

We need to manufacture everything we need here in this country, and kick the bums out of Washington, District of Criminals.

Globalism is a crock where all the middlemen get rich off the backs of regular folks. I don’t know what they fantasize about – some weird sick dream of half-robot half-humans servicing their needs – but at some point, the Lord will intervene, as He has done throughout history. Yes, there will be a lot of pain and it makes me sick knowing it could all have been avoided, but for greed and selfishness. History repeats.

So, moving to the unreliable green energy and killing reliable, economical thermal (including nuclear) is one of the two most visible reasons for this inflation is hitting hard. The second in my opinion is the massive creation of new money. According to the Federal Reserve website, the U.S. money supply (M2) grew by more than 36% in the last 2 years. That was before we created another $40B for Ukraine corruption.

Is this going to wake up people about the horrible green energy programs, or will it take blackouts this summer to do so? I know the libs will lie about any problems so we have to be able to educate people that when you rely on energy sources (e.g. wind) that produce as little as 5% of its installed capacity in high demand times that is what you get. I’ve actually red pilled a couple of green energy disciples by showing them the numbers.

The more I read about the people in charge, the less I’m convinced I they’re deliberately evil as just so incompetent and out-of-touch with reality that the have no idea just how harmful and unworkable their policies actually are.

That doesn’t change that they absolutely must be stopped and punished because the end results of their policies are evil… it just means they don’t actually have a genuine plan for ending up on top once the collapse happens…

They’re so delusional they don’t even see the cliff they’re driving us all over and when it finally goes over the edge they’re going to be more stunned than anyone.

I think I preferred when I thought they were supervillains. Supervillains know when it’s time to beat a retreat… idiots are just going to keep pushing until a whole bunch or people die.

Was thinking about a story that was told years ago.

Something to the effect of, ” I want to go like Grandpa went. He died peacefully, in his sleep. Doing what he enjoyed doing, driving a bus on mountainous, swtchback roads, along the coast. Not like the 50 screaming passengers as his bus was going full speed over the cliff”

Can see that happening, when the peasants have nothing more to lose.

Happy Declaration Day, Treepers, remembering those who paid the ultimate price and the ultimate sacrifice.

malignant stupidity combined with innate cruelty, a very powerful combination

I must respectfully disagree. I believe some fall into the category you described, but the majority of the People in Charge of the great reset are evil. They care not, that to achieve their goals BILLIONS must die so that they may make it higher to the peak. They’ve actually stated this publicly. I realize that “eat the rich” is classic commie propaganda, but those of us blessed to survive will have to take back what was ours to begin with.

It took forever for China’s insane ghost city/infrastructure economy to finally reach some natural limit and implode.

Europe is the same boat but with different dynamics. Remember the “PIGS” (Portugal/Italy/Greece/Spain) that were on the verge of collapse due to the monetary imbalance with Germany? Remember those NEGATIVE interest rates in Germany (you pay THEM to deposit your savings). All of the underlying economic problems were never resolved and it should have collapsed but didn’t.

Somehow, they kept the plates spinning based on sheer inertia and the power of media narrative to keep the scam going. Now some external straw has landed on the camel’s back and maybe that natural limit will finally kick in.

Debt is the ultimate killer of the economy. On a real world basis, every country with massive debt ratios are way past the point where they should have collapsed in the past. The only difference now is the massive power of the media coupled with the deliberate dumbing down of the population until the last margin of time is used up.

Yes^

But, I thought that inflation was only temporary? Was Biden lying?

/s

Joe blow said inflation in transitory and non Bidenary.

Somewhere in hell, Hitler is hopping mad.

Long after the fall of the Third Reich,

his dream of German dominance came to fruition.

Now, Germany is well on its way to Weimar status again.

I imagine Hitler is furiously scribbling his sequel to Mein Kampf,

while trying to stay cool.

She has training in talking in circles.

One day the German people will wake up and be completely broke…. only then will they realize they have socialist Commies ruling over them. Just like my Ukrainian friend, she had the perfect life, vacation all the time, multiple businesses and homes, nice family…. now she is a refugee in Spain. I sure hope America gives the Commie Democrats here…. the boot before it’s too late. Some may say it’s already too late, since they are sucking the life out of the Economy (even more so than normal!!!) I thought it was too late when food stamp recipients were eating better than working class citizens who bought their own food. That is a disgrace to any working person, yet the Democrats thrive on it. The world needs to wake up and get rid of the Commies in order to survive and maintain some standard of a decent life.

How could this possibly be “unexpected”?

Because their plans always works out well on their computer models and during lounge discussions.

Especially after a couple of bowls from the hookah pipe.

Their shocked reaction to reality is endless:

No wonder Nanzi Pelousy’s eyebrows are so high. They are in a permanent shocked expression. So her husband gets drunk and causes a vehicle accident and she’s on the east coast. Unexpected.

Excellent! 💯%

It’s all about the out of control fuel prices which affects everyone and every business across the board. Add in supply chain issues, gov interference, political hacks, and wars, and it’s the perfect storm. Nothing (rate hikes) and nobody (banks/fed reserve) can stop the baked in costs that are heading our way from farm to table or raw material to product that haven’t even hit the shelves entirely/fully. Just the tip of the iceberg so far. This will get far more ugly than it is now. Just common sense about what’s going to happen this quarter and on into next year. Raising int rates will compound all of this (killing real estate and consumer spending and capital raises for struggling businesses) until we hit a depression-like pull back across the planet. God help us all. Better be prepared and in mostly cash.

Large European corporations’ capital structures are financially “geared”, as compared to American corporations. Generally speaking, the Europeans carry a higher debt to equity ratio. They benefit from lower interest rates, and the corporations’ equity is held in fewer hands. It is easier to run the show that way.

In 2020, Germany exported $26+ Billion in goods to Russia. In return, Russia exported $14+ Billion in goods to Germany. Germany “had” a nice trade surplus with Russia. Oil/Gas comprised 45% of Russia’s exports. Again, a good deal for Germany.

That is all gone… or is it?

https://oec.world/en/profile/bilateral-country/deu/partner/rus

Fannie Mae is forecasting inflation dropping to 2.3% in 2023.

https://www.fanniemae.com/media/43566/display

https://www.fanniemae.com/research-and-insights/forecast/housing-feels-stress-rising-mortgage-rates-inflation-weighs-consumer-spending

Not unless President Trump is reinstated into his second term.

If you want to see what passes for sober economic “thought”, look no further than these three articles from Voxeu.org.

It seems the academics think a tariff is the answer to Europe’s problems with Russian energy. Also, the academics feel a cartel should be created to dictate terms to Russia. As is to be expected, no academic thought has been given to the relevance of the German exports to Russia, or any reactions from Russia.

https://voxeu.org/article/what-if-germany-cut-russian-energy

https://voxeu.org/article/how-solve-europe-s-russian-gas-conundrum-tariff

https://voxeu.org/article/eu-gas-purchasing-cartel-framework

Here is a link to academic expectations of a Russian embargo of Europe. Their modelling work leaves much to be desired.

https://voxeu.org/article/effects-embargo-russian-gas

EU Central Bank President Christine Lagarde is getting a fat salary despite giving bad advice.

Gas in Germany is well over $8/gallon.

Yeah, 3.785 liters to a gallon, Current exchange rate 1.07 dollars per euro. At 2 Euro per liter it is $8.10 per gallon. Price is higher than 2 euros, 2.25 to 2.5 Euros per liter, so $9.11 – $10.12 per gallon.

Not to much traveling, next weekend is a major holiday, Pentecost.

Historically, the Germans have always responded well to hyper-inflation.

(Sarcasm off).

“…EU Central Bank President Christine Lagarde said she did not expect the EU inflation to be quite as bad as the U.S. inflation crisis…”

Perhaps she was being truthful.

Maybe OURS is much higher than we’re being told?

Von der Leyen is still pushing hard for an oil embargo by the EU which will destroy European industry. She is a complete idiot. Italy seems to be getting concerned.

This news from Germany is not going to help her get her 6th sanction package met. But she is confident that an oil embargo on Russia would help to push through her most extreme green agenda and allow it to be pushed on all EU member countries.

wondering how all of the “new Germans” will react. No history of food riots in muzziestans, are there

Usually, they raid the non believers for their supplies.

Ain’t National Socialism great? Coming to a Country near you soon, oh wait.

By September, watch for the Fed to signal that it has inflation under control, regardless of what the numbers are. It will come up with some new measure if it has to. It will want the markets to increase prior to the midterms. It will back off taking proper measures to get things under control and in the long run will make it worse. Next year could be really bad.

The REAL main issue are that the Green energy solutions are illusions for the future. Solar, wind, electric cars might be good ideas as additions to oil and gas for the future but are more expensive and not adequate as needed to replace oil and gas. All this shutting down of pipelines and exploration with no immediate replacements. The intentional destruction of oil and gas industries unless halted will make 5 or 6 $ gallon gas seem cheap and can only lead to a much less quality and more expensive living of life. Pray and pray more

As sundance has pointed out, the goal of Team Obama is to gaslight until late summer. At that point the year-over-year inflation numbers will look better because the current inflation rates will be compared to themselves.

We can keep saying that but if the price at the pump keeps going up more people will start to disbelieve what the Dims are peddling. Do you care about a % or the actual amount coming out of your bank account…

The stolen election of 2020 was a global operation. The ramifications are global as well.

Recently I’ve seen people getting pretty verbal about how disgusted they are with inflation. They aren’t stupid either, they know why it’s sky high.

I live outside of Chicago in an area with a “mixed” electorate—it’s not often that you hear people openly discuss politics, or at least denounce Democrats, in public areas like a store.

People are waking up to the failures of the occupant of the White House, and they aren’t real happy about it.

If only those ignorant Democrat voters would have listened when we warned them.

They are know it alls though, you can’t tell them anything!

Did Creepy Uncle Brandon actually get 81 million votes?

There weren’t as many ignorant Democrat voters as the numbers show.

There are millions of them amongst us, voting for the Commies without thinking twice.

Or even once.

They will still vote Dem..because Oprah’s told them to.

Not all of them, not even 80% of them.

I personally know people that would not vote for a Republican, or any other party than Demonrat even with a gun to their heads. Sickening

You have to ask them if they’re ok with the crime, homelessness, and gas/food prices.

A 20 yo friend on a limited budget told me over the weekend that she and everyone she knows is disgusted and fed up with this admin. They’re not Trump supporters …yet…but they see what’s going on and are paying attention.

Energy is a required input for nearly all goods and services to one degree or another.

What Satan’s stooges are doing to the supply and thus price of energy is deliberate.

Apparently the Putin Price Hike began hitting Germany two years before the Ukraine conflict.

Classic precognatory inflation.

UNEXPECTEDLY!!! Hat tip Prof. Reynolds…

I despise this haughty freak and her eminence front. She is the very symbol of the mind and behaviour of the WEF.

Liar-Liar, pantsuit on fire.

🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥

The Duran had a good discussion about this topic today. They contend that the irrational approach toward the violence in Ukraine is geared to break the EU away from hydrocarbons. It is the Greens in Germany that are driving this train. They really don’t care about Ukraine’s territorial sovereignty, but use it as an excuse. Rather compelling.

When will Europe have a headline such as Sri Lanka… MMT should solve the problem.

https://www.hirunews.lk/english/305250/need-to-print-one-trillion-rupees-inflation-could-hit-40-prime-minister

The former German Bundesbank Presidents must be shocked if living, and rolling in their graves if dead.

Their specific interest above all else, after previous German currency disasters, was preserving the spending power of the Deutsche Mark.

Before going on TV, Ms. Legrande really should wipe that egg off her face, very distracting.

Couldn’t happen to a nicer group of people, further demonstrating the incompetence of un-elected experts, for those who missed the clear “lesson learned” from the Covid responce.

Shouldn’t trust any of these people with a houseplant to water, while your on vaca, let alone anything, you know,….IMPORTANT.

One would think that those who are advocating governance by unelected experts would try to consistently demonstrate how such governance is BETTER than other forms of governance.

One would be mistaken; by their actions, and seeing the results of their actions, they are consistently making the case that their governance is HORRIBLE.

“TRUST US, because we have been so consistently WRONG in the past!” seems to be what they are selling.

Rush pointed this out frequently.

“The (fill in the blank) report produced unexpected numbers….”

“Analysts were surprised….”

etc.

Doesn’t imbue any confidence in those economists who seem to be continually caught off guard in their own area of (alleged) expertise.

Surely with German’s history they will stop what they are doing and do a 180? There has to be some type of institutional subjective memory of what happened last time their economy went this haywire? Perhaps that’s why other news stories are starting to come out that it’s time for Ukraine to get to the negotiating table, time to end the Russian boycotts before the entire western economic system collapses?

Nope. Those people are all dead now. That was in the 1920s, so anyone still alive who was at least a teenager would be well over 100. No institutional memory left.

Regarding nuclear power plants, I read just a few years back that the latest designs do not produce waste that cannot be easily disposed of.

Now, they are capable of taking the waste and reusing it as fuel, thus they become self-sustaining.

The engineered oil and gas shocks in America and the EU have now undermined the easy money and printing presses of globalism. Traditional Germans (not sure how many are left since Merkel tried to turn the country into a mongrel state) who came out of WW2 are massive savers and property investors – they can’t be pleased with this nonsense at all.

The EU & US are in deep, deep financial crappola and the current imbeciles at the helm of both are trying their damndest to deflect attention away from their collective ineptitude (Ukraine) before being booted from office.

Vote like your life depends on it, because it does.

https://www.breitbart.com/europe/2022/05/31/european-union-agrees-to-russian-oil-embargo-of-90-per-cent-by-years-end/

C’mon man, the GERMAN GLOBALIST NAZI COMMUNIST Klaus Schwab will make everything right. This megalomaniac is sure to fix all of Germany’s and the EU’s problems. IT’s CALLED SLAVERY! Globalism, naziism, communism, socialism, fascism, islam, et all are all forms of TYRANNICAL GOVERNMENT to ENSLAVE POPULATIONS and America is on the menu.

Inflation anywhere is not 7-8%, it’s 20%. Fact One.

These “smart finance” people have so managed finances that there is no wiggle room left. Raising rates .25 of a point now inverts bond yield curves. Fact Two.

The only thing left is to print more money. Fact 3.

See Venezuela. Fact 4.

You want to know why they want to limit legal citizens gun rights? Fact 5.

You want to know why they limit speech? Fact 6.

Meanwhile career politicians get richer. Fact 7.