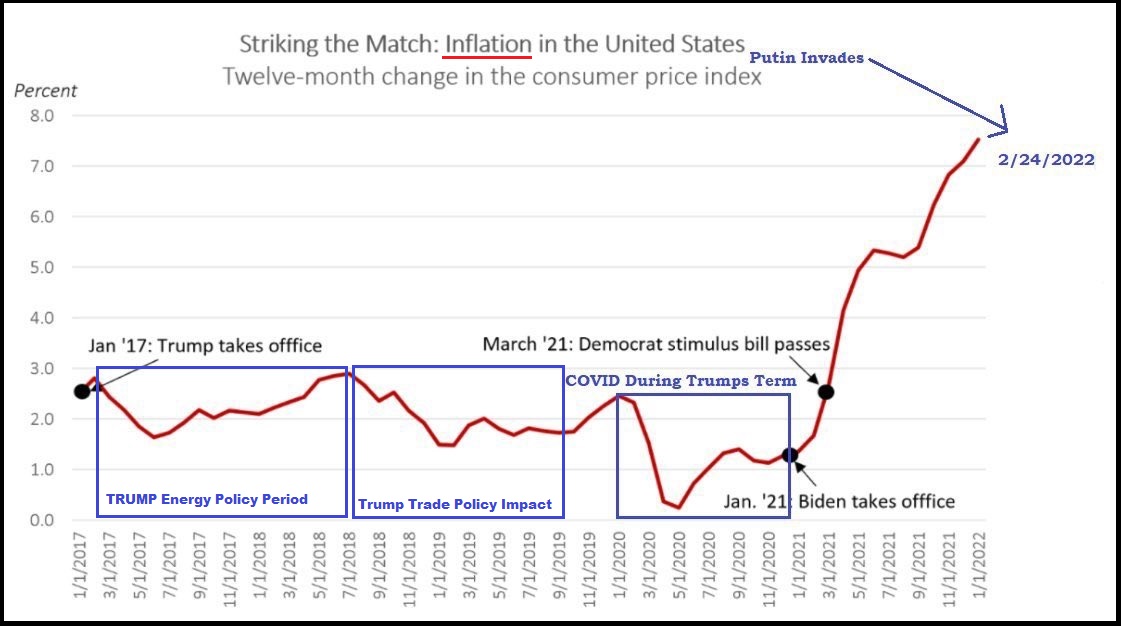

Lots of people talk about an inflation driven recession. Essentially, that’s a total economic contraction in the value of goods and services produced, sold and purchased, due to rising prices. However, as CTH has been pointing out for more than six months, if you subtract the federal COVID infusion money from the overall economy, we have been in a contracting demand economy for almost nine months.

A negative GDP outcome is quite possible, perhaps likely, when the first quarter GDP figures are released on the last Friday of this month. The most recent sales and economic data shows that U.S. consumers are prioritizing spending and high priced durable good sales are negative.

A negative GDP outcome is quite possible, perhaps likely, when the first quarter GDP figures are released on the last Friday of this month. The most recent sales and economic data shows that U.S. consumers are prioritizing spending and high priced durable good sales are negative.

Now, Fannie Mae is delivering a rather stunning shift in their economic forecast. In addition to projecting a recession for 2023, these revised home purchase figures are remarkable:

...”We have downgraded our total home sales forecast for 2022 to a decline of 7.4 percent (previously a 4.1 percent decline) followed by a decrease of 9.7 percent in 2023 (previously a 2.7 percent decline).” (link)

That is a very significant change in home sales forecast to the negative position.

We already have serious energy inflation to contend with and low wage growth. We already know a third inflation wave on highly consumable goods is coming this summer, likely around 30% or more in food prices at the grocery store.

The professional forecasts are always tilted toward the positive for this administration, so this new statement by Fannie Mae should be considered accordingly. Remember, Boy Scouts motto.

Maybe we need to “Helicopter Ben” the money swirling around in the pockets and offshore accounts held by the Washington DC Nazis we call our government? The Schumer’s, Pelosi’s, Biden’s, Obama’s, McConnell’s, and McCarthy’s have more accumulated wealth than the entire population of the US. And, every dime of it stolen. From us!

I’ve been noticing Florida homes for sale, owners are lowering their prices up to $35gs depending on the home… I’ve been following the Florida market for a while. Glad we sold our last rentals last spring, even though we took a hit in our Federal taxes, it would’ve been hard to rent them again.

We priced our properties high and still got over 10% of what our prices were. We got over a dozen contracts on each property… It’s all changing this year.

I sold my house also in 2021 and was amazed by the offers I had. Many over the asking price. Since then five other homes in the cul-de-sac have also been sold out of 11 homes. Most moved to Florida. Wonder why? Could it be because of DeSantis.

Love to see Charles Payne join Larry Kudlow in PDJT’s ‘24 economics team, call them “Cuddles and Payne”.

Seems appropriate.

Lying incompetent bass stich.

I wrote an offer this weekend, 100,000 dollars over asking price. Did we get it? NO

The offer that beat us waived all inspections.

That is very difficult for me to do for first time homebuyers not to know any hidden defects.

Just wait, and you will be glad you didn’t buy it. Prices are going to crash !!!

So here I am, been planning a house build for a while while interest rates were good. They just skyrocketed up, timing was terrible. Fortunately we haven’t built yet. Should someone building a house wait for prices to fall?