The Commerce Department November retail sales data was release today [DATA HERE] – [DETAIL pdf HERE]. The top line issue is a shocking drop in retail sales for November in key categories that align with previous discussion of inflation spending priorities for all U.S. consumers.

Before getting to the data, one point is critical to remember. The commerce department sales figures are based on dollars spent. This point is important, because the items being purchased have inflation within them. When prices are higher due to inflation, sales figures should be higher due to higher prices. Ex. If there is an 8% increase in retail price, but only a 4% increase in retail sales, that means less stuff is being sold. [Less units sold at a higher price gives the illusion of an increase in sales.]

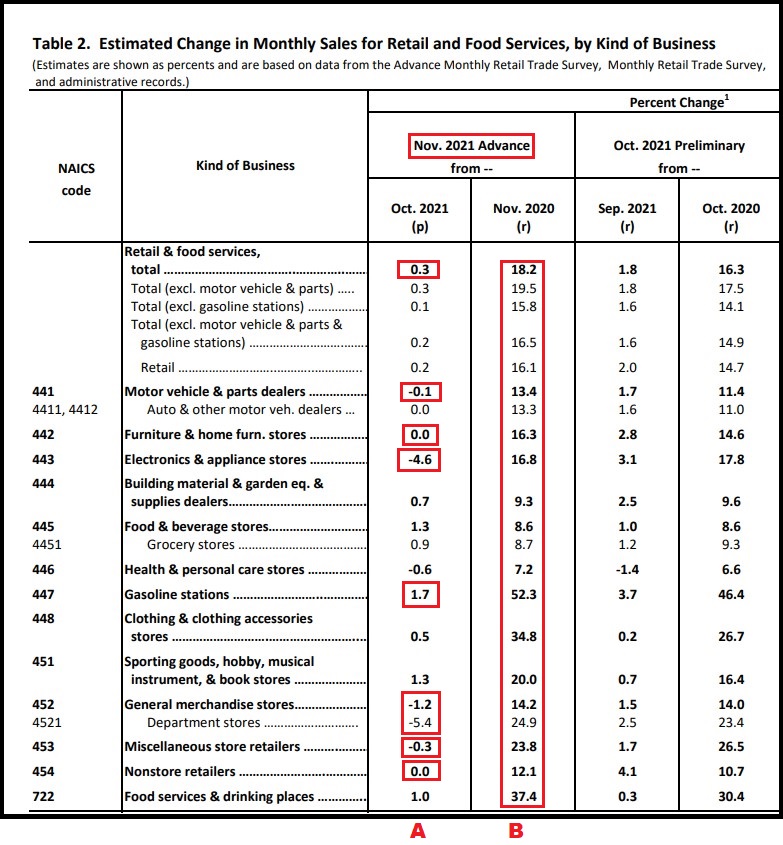

Despite the start of the traditional holiday sales and shopping period, the total sales growth in November was 0.3% over October [Column A]. Factoring in inflation during the same month to month comparison at 0.9%, you can tell that overall in November there was a drop in units sold across the total of retail sales outlets.

A drop in sales at a time when holiday shopping should be taking place is concerning. However, the sales reality aligns with the employment data last week showing a drop of 20,000 workers in the retail sector for November. Put them together, and the picture shows retailers did not need employees, because consumers are not spending.

If we look deeper into the November sales figures, we can see that a contraction in discretionary spending is the primary issue. Electronics (-4.6%), Department Stores (-5.4%) and even online sales at ZERO. We can also see a direct correlation in comparative inflation impact within the sales data for November 2021 when compared to November 2020 [Column B].

You will note that column B is an almost identical data set to the rate of inflation in those categories. Example: the November 2021 sales data is showing an increase in gasoline station sales of 52.3% over November 2020. That’s because gas prices have gone up 58.1% over the same time period. The increase in sales at gas stations is because inflation is driving sales. [Remember, these comparisons are in dollars being spent.]

A comparison to 2020 for sales dollars in 2021 is useless when you look at the rate of inflation in those categories.

However, to see electronics, department stores, general merchandise and even online sales (Nonstore retailers) showing declines in sales over October, tells us that consumer spending is being squeezed and contracting.

In the electronic sector, sales dropped 4.6 percent versus October. However, the issue is larger. With inflation within the electronics sector around 8 percent (BLS Table-2), a contraction in overall sales of items that cost more means a lot less electronic units are being sold.

(Bloomberg) “U.S. retail sales rose by less than forecast in November, suggesting that consumers are tempering purchases against a backdrop of the fastest inflation in decades” (more)

Similarly, vehicles overall (new and used) are 20% higher in price this year {BLS DATA} and only achieved a net 13% increase in consumer sales for Nov 2021 -vs- Nov 2020. Far fewer vehicle units are selling.

This data should not be surprising to anyone who has been paying attention. Consumers overall, specifically the middle class and working class, are being squeezed hard by food, fuel, housing and energy inflation, and are cutting back their spending this Christmas. The media are blaming the soft sales on COVID and supply chains again, but that’s not really the issue.

WASHINGTON, Dec 15 (Reuters) – U.S. retail sales increased less than expected in November, likely payback after surging in the prior month as Americans started their holiday shopping early to avoid empty shelves.

[…] The modest retail sales gain did not change views that the economy was regaining steam after a slowdown in the third quarter that was triggered by the COVID-19 Delta variant and rampant shortages.

[…] Retail sales rose 0.3% last month after surging 1.8% in October. Sales have now risen for four straight months. They increased 18.2% year-on-year in November. Economists polled by Reuters had forecast retail sales rising 0.8%. Estimates ranged from as low as being unchanged to as high as a 1.5% increase.

[…] The moderation in retail sales, which are mostly goods, was in part due to shortages and higher prices. Receipts at auto dealerships dipped 0.1% after accelerating 1.7% in October. Automobiles remain scarce because of a global semiconductor shortage. Sales at electronics and appliance stores fell 4.6%.

But sales at service stations increased 1.7%, lifted by higher gasoline prices. Receipts at food and beverage stores rose 1.3%, also reflecting rising inflation.

“Food and gas are forcing hard choices for consumers in other areas this holiday season,” said Tim Quinlan, a senior economist at Wells Fargo in Charlotte, North Carolina. “Consumers are no longer the price-takers they were when they were flush with cash from stimulus checks.” (read more)

Xioe did it. FJB.

Just think of all those ships sitting offshore with cargo now heading to Overstock.com….

No they will go on dumpsters or Dollar Stores.

Pretty soon people won’t be able to afford to drive to work!

But they will be happy, BBB!

And own nothing!!

Perhaps the own nothing part is probably more of a non-negotiable in the minds of many of those hoping to be implementers compared to the happy part

Funemployment!!!

I’ve seen that before during the last financial crisis. For real.

“Pretty soon, you will own nothing, and like it.”

So says “The Great Reset” overlords.

Ammo up folks.

been there

It is often said that you use can statistics to prove anything. However, if you are honest in your use of statistics, they will tell you the truth.

In this case, the statistics are telling us a brutal truth – Joe Biden and his handlers are destroying this economy.

JB and his handlers are destroying the economy…this is by design…Socialist playbook…get more people on the g’ment dole and away from Capitalism…ultimate control is nationalization of the banks.

Yep.

Ruin the country and provide the “solution” to fix it…

MUCH more government control.

So many people will believe it. Like the “deadly pandemic”

that has people dying by the 0.00001’s.

Am in the market for a laptop. A specific brand / CPU laptop. It is on backorder. I’ll save my money.

Things are higher and don’t want to buy it. Things simply aren’t available to purchase so can’t buy it.

joe biden and the Democrat’s America.

But you can download Let’s go Brandon by Bryson Gray right now.

It’s because the rich don’t pay their fair share, but I guess Elon doesn’t agree:

I remember that false claim by the lying DemoCommies used to really trigger Rush Limbaugh. Dan Bongino has ably picked up Rush’s baton on that topic….

https://bongino.com/billionaires-pays-their-fair-share

marcus aurelius: Hey, Lizzy! Git me a beer.

Say it ain’t so, not with Joe “touchy-feely” B-B-B-Biden. Duh………….

Good Lord!

Is that why the deep state had to drop the BBB for now?

No…they have to get busy destroying state’s constitutional rights in overseeing federal elections…i.e. federalizing and cementing the corruption in our voting system so we finally achieve the title of best banana republic ever.

We better pray as never before that the Republicans understand what is going here and will do all in their legislative posts to stop it in its tracks. The Dems are in a hurry, Time’s growing short before the midterms.

And old man Biden sounded way to full of himself yesterday when he said votes don’t matter…who counts them is the key.

Now where have I heard that before.

The Republicans will do what they’ve always done…..absolutely nothing!

This is just the beginning.

Too many lootings, no profit, just major repair bill. How long does a store stays closed after mass looting?

If they counted the looted, shoplifted goods in final sales the month would look better. Maybe they’re included already.

There are shortages of electronics. I tried buying some and you have to order and it takes weeks to get here.

If you are flexible in features, there are still plenty of products available in most consumer categories. I am fairly certain that I won’t be able to say that by next Spring.

It’s the auto repair parts shortage that’s coming that will really hurt

Yes. Changing vehicle designs to being dependent on Asian (read “Chinese”) made electronics was a seriously stupid move.

Hey retail sector?

How’s that corporatism working out for ya?

… automatic!

I would submit that Printing Money causes all our problems. With a prudent Monetary Policy economic forces will regulate things and assign accountability to incompetent people.

I agree with this.

Don’t you wish we could brag “sound as a dollar” again?

As with ALL “Breaking news”, best to apply the Paul Harvey “rest of the story”, wait and see how it shakes out approach, but they are FOLDING on Brokeback mountain BBB, and will instead turn their focus to FEDERAL reforms to elections, which if enacted would insure Dems could run as Dems, instead of having to masquerade as Republicons.

On another front, the Fed will NOT be raising interest rates enough to do anything to stem the bleeding of inflation, no surprise there.

Any significant enough raise, would crash the over valued stock markets, which only got there BECAUSE of no interest rates for so long.

But, unless significant interest rates were accompanied by a reversal of Brandon energy policy, a serious reduction in regulations, etc raising rates won’t make things better, only worse.

Only one person who can get us out of this mess, even someone else instituting all his policies wouldn’t, IMHO be able to do it.

The schedenfrude is tasting bitter, as the joy at seeing the idiots in charge self emolate, is tempered by all the collateral damage they are causing.

Can we really tolerate 3 more years of this, and after 3 years, will America wise up, and will their be any pieces left, to put back together?

I wonder if California’s $950 daily shoplifting allotment is indexed for inflation. It’d be a shame if someone was arrested because of O’biden’s inflation.

Gas/food or Christmas gifts?

Go with the food. Gas or Christmas gifts will do you no good if you are not around to use/enjoy them.

I think you hit the nail on the head. Things are not as rosy as they are portrayed. This hasn’t changed views that the economy is gaining steam. Really? Whose views? Reuters I suppose doing their bit for king and party. Not all industries are equal when it comes to their effect on average pocketbooks and the petroleum industry is at the core of everything else which is a big part of current inflation as you have pointed out before. Energy costs go into everything. That is why they have been specifically targeted with the climate change charade. Destroy that and you have destroyed much that will be hard to undo. They are trying to create the perfect storm between currency devaluation inflation, energy demonization and inflation and its multiplying effect, and overall scaremongering into submission through fear for life from a new flu bug they built in Wuhan throwing people into a frenzy of lockdowns and related crap causing massive disruptions in general commerce. Unfortunately, trying to convince any of the worshippers while they are busy mouthing their public displays of virtue and party fealty is nearly impossible.

“Orange man bad. Trump’s fault!”

They want everyone either unemployed, jailed, or deceased.

This out today from Europe according to reports, unvaccinated citizens in Austria could face prison time for failing to comply with the Covid-19 vaccine mandate currently in place. Susanne Fürst of the Austrian Freedom Party (FPÖ), which voted against the amendment to an administrative law, warned that a year’s imprisonment could be introduced to punish the unvaccinated.

The amendment raises fines for failing to comply with the mandate it will also increase prison time for those who refuse to pay from four weeks up to a year. AND, the amendment even requires people who are jailed to pay for their own imprisonment.

Biden has Austria envy

Imagine a business model, where the government forces citizens to buy your product at their own expense. Did I get that right?

so backpacking Europe summer 22 is a bad idea?

Build Back Broke

Unlike the Federal Government, I balance my checkbook and only spend what is there to be spent. I have allocations for food, gasoline, rent, debt obligations, etc., so when prices go up my discretionary spending goes down. By that I mean, instead of feasting on steak, I am growing my own lettuce, turnips, carrots and beets, and I buy potatoes, dried beans and flour to make my own bread with.

Don’t you?

You make bread with potatoes and dried beans?

I think the Oxford comma is dying a slow death.

Up with the Oxford comma.

Sprouted grains in Ezekiel bread lol

“Theres a bad moon on the rise”

love CCR – famous misheard lyrics – “there’s a bathroom on the right”

I still sing it!! Bathroom on the right!!

The constantly lying government says inflation is at 6%.

Here is simple example of why that number is a complete lie.

Last year, a chili I make cost $35 for a large pot.

I just made it again…$72. Double.

Want one more?

I just filled up my gas tank. Well over $100 (Suburban)

This time last year about $60.

FJB, and all dems.

Real inflation is at 15%… Rudy Guliani put it best today in an interview. We r in a fascist state, no longer a Republic thx to the empty suits in congress and the weaponization of all branches of govt, incl fbi now = ss. The devil’s army never rests…

It would not have happened had the R party been responsible to their own president and stood up for the principles they ran on. 2/3 are outright frauds. They must be sidestepped and we start over with a true party that loves to anger the left and the republicants. We would be in the minority, but we really are anyway.

Stagflation here we come.

Wait until the December consumer spending data out. It will shock everyone. I and everyone I know, are planning to spend half of last year. I don’t plan to spend anything this year. All my kids will have silver coins as presents which I bought several months ago. It is not that I short on money, just don’t feel the joy. My best spent Christmas was 2016. I felt so good after election and really open wallet to share the joy. Not any more.

Joe and the Ho’ could F/U a wet dream, but right now they’re still working on our country.

Auto dealers up this way ( Southern British Columbia)are having their best year in decades.

Essentially zero on lot inventory, all units coming off the transporters are pre sold at over suggested MSRP.

Doc fees and delivery fees are inflated 😏

Profits are huge, premium used are sold to the U.S. ( a 10 min drive from several major dealers) especially the Ford 150s trucks.

Dealers put 5000 kilometres on a new, and can sell it in the U.S. as a used.

As always, the uninitiated and or average consumer ( gets it in the throat)

I “ curb” the odd vehicle for a hobby…the last four I contacted the seller on were already sold.

None had been on the internet more than two hours.

Just this afternoon.

A two pack of average looking sirloin steaks were $55.00 (Can)

I scrambled eggs in pan fried potatoes for a main course😉

Steak truly is a delicacy.

Cheers!

we are kindred spirits – I’ve been curbing cars, trucks, boats, zero turn mowers for nearly 50 years. It is a fast game right now. I’m tight with a couple used car lots and live in a good location to sell. but most of my action comes from Craigslist and my good pictures. Not buying much but am making walking around money. Boats, bikes and convertibles right now. 2011-12 era Toyota sedans get 3.5L front wheel drive. Find a well maintained Avalon or Lexus ES350 w/under 100k miles and you’re set with a fine driver for a long time. They go 300k routinely with basic care.

Great stuff!

I owned an Avalon..terrific vehicle.

Craigslist up here is very hot.

Mostly junk on there at the minute.

As you know you can pay a small fee to Craigslist and get a notice before it hits the general pages.

Honda Fits with the J at the start of the V.I.N. are gold. Likely 35 mpg.

I bought a 2009 new in 09, ( I know the dealer.) for $16,500 (Can)three family members have used it over the years.

Including a trip from Vancouver B.C. to Palm Springs.

120,000 miles on it now, and touch wood, brakes, tires, and fluids are all that we have done.

No accidents on it and would be an easy sell at $5,500 ( Can)

Happy hunting!

I recently priced a marked down “Manager’s Special “ rib-eye steak. It weighed 14 oz. and cost $15.99.

I cannot afford to pay $1/oz. for my meat.

Amazing..

If you’re anywhere near open farm country, get a chest freezer and buy beef direct from those who raise cattle. There are still small processing houses around, call them to help you source it. You’ll have to buy in bulk, but the quality and cost savings is outstanding…shortens that pesky supply chain, too.

Yeah but unemployment is the lowest it’s ever been for ever it is, it’s the best economy ever and ever, so says Cramer.

As I said a couple days ago, the commute to work and back has not shown any real signs of increased traffic, something that would be expected with a booming economy.

Brandon is getting no wins!!

Oh-fer infinity

Greatest loser on the planet

As the polls numbers dive all over. They’re probably 8-10 pts lower across the board than what the dismal view is now

Resign

The economy and inflation is so bad I can’t even afford a bad attitude……………..

Guess the Globalist broke good ole St Nick.

I’ve spent quite a lot of money, mostly earlier this year. Loaded up my credit cards several times ….. prepping.

Now I’m eating off that stash where the price was baked in at lower inflation rates. It’s a little late to start but I don’t see a ceiling on prices any time soon.

Santa not happy with the globalist either….

We are probably only a year or so away from the old Soviet system when you see a line you get in it. You don’t even ask what you are in line for because if you can get whatever it is you are in line for you are lucky.

We haven’t been spending hardly anything for the last year due to biden/democrats in place.

This Christmas is very tight for us. I sold things on a site called Mercari just to fund my kids Christmas this year. Very little came from our bank account.

Oh, but Powell says consumer demand is driving inflation. SMH.

I would ask Mr. Powell if he thinks printing several trillions dollar out of thin air resulting in inflation?

I don’t know,…but it seems to me these evil people are not SMART, and not nearly as smart as they THINK they are, and the American people are not nearly as DUMB as the elites think they are.

Seems to me, they don’t really have a WORKABLE, DOABLE plan, for how to get, where they want to go.

And, I DON’T think they have a “plan B”.

They are trying to create a narrative, that gives them a SKAPEGOAT, as thats essential.

All of the misery THEY are creating, they NEED to pursuade the American people, is THEIR fault, the OTHER is to blame.

And the OTHER (strawman) they have been desperately trying to construct, is US; Deplorable White Supremacists who douse people with bleach and put nooses around their necks, cause they are POC’s and Gay.

These SAME Deplorables tried to overthrow the Gov with an Insurrection on J6.

Same people who are fighting the Vaxs, which is (according to them) the reason the economy is tanking.

If these damn Deplorables would just take the jab, everything would get back to normal,..rising priced, falling demand, its all THEIR fault.

It just ain’t working,…witness brokeback better collapsing.

Witness MANY who took the first jab, refusing to stay on the train, and regretting it.

If they can’t succesfully blame a scapegoat, the blame rests on THEM.

And with a whole group of candidates lining up, who like MTG are openly challenging and publically critisising REPUBLICAN leadership in Congress, the thing which has always been their “ace in the hole”, and that has enabled them to make so much progress, is being exposed and unraveling (the illusion of the Uniparty).

Without that, they NEVER could have taken the Republic this far left, and without it, any more movement in that direction isn’t possible.

I think they are screwed,..

This is obviously a multi-part plan for economic collapse and takeover that is working so far like the proverbial dose of salts. The illegitimate criminal traitor regime and their Chicom bosses know that Americans will never tolerate a Chinese takeover and the globalists realize that we will not accept the communist-fascist Great Reset unless people are starving and frightened. That is precisely what they mean to achieve in 2022, along with continuing plandemic panic so that lockdowns and mail-in voting (with democrat ballots already loaded on the trucks and packed in the suitcases) can be used again. Millions of Americans now hate The Dotard and The Round-heeled Mongrel, and brave citizens are beginning to boo Brandon to his drooling face; we must fix it so that, like de la Rua in the Argentine economic apocalypse of 20 years ago, the authors of our economic misery will not even be able to show their faces in public.

Must say, “talk is cheap”. Everybody is complaining about Joey and his entire cabal of communists pushing the great RESET for the planet, which will set up every person in the middle and lower class for DIGITAL SLAVERY, including our children and grandchildren. But where are the discussions about putting a stop to the “F’ing RESET”? At some point we have to send the message that WE ARE DONE with this stupidity. It is going to take a mass display of unity toward ending the MANDATES, EQUITY BS, DIVISIVENESS and LAWLESSNESS! To accomplish that, it will probably require public displays of OUR FRUSTRATION at every “WOKE” government facility in the country on ONE DAY that we the PEOPLE SELECT to tell the “officials” we are done, the BS STOPS NOW! This TYRANY will continue until we have the courage to PUT AN END TO IT! What we need is LEADERS, where are they? Would love to be one, but approaching 80, with the big C, just not in the cards for me…..but I will do what I can…..but, surely OUR FREEDOMS are running out of time!