Joe Biden may be celebrating his historic achievement in reaching an inflationary milestone previously set by Jimmy Carter, but the working class is paying the price for their economic stupidity.

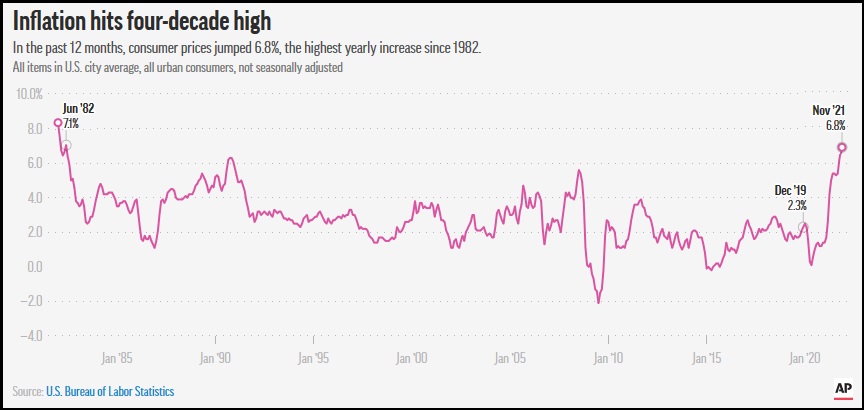

The Bureau of Labor Statistics releases the November inflation rate today [DATA HERE] showing another rise in the annualized rate of inflation of 6.8 percent. As you review the data, ask yourself this question: ‘Is there anything in the current economic landscape to indicate this is going to stop?’ The honest answer is no. Here’s why…

As the BLS accurately (albeit briefly) notes, their inflation data reflects the cumulative increases in costs of products and services at all stages in the supply chain. Raw materials cost more (extraction, regulation impact), processing costs more (energy impact), transport costs more (fuel impact), final goods assembly costs more and handling costs more. From field-to-fork or mining-to-showcase, the total cost to create stuff costs more. [AP Interactive Chart]

Yes, the inflation data is backward looking. Meaning, it is looking back toward the previous period to compare costs. However, despite the White House protestations to the contrary, that’s not a good thing, because it is going to get worse.

The contracted price for goods delivered (depending on sector) are net terms in 30, 60 or 90 days. Meaning, the purchase price on final goods wholesalers are receiving now, were agreed upon months ago. Those terms for current arriving goods are no longer valid. The new terms (purchase orders) carry higher costs, and as an outcome higher prices to consumers are still coming.

The AP chart above shows the ascending spike in inflation overall. Do you see that little plateau (mid spike)? That’s June and July of this year, when we noticed the economy overall appeared to have stalled out. As we highlighted yesterday {Go Deep}, that brief plateau corresponds with a gear change internally in the macro economy as productivity dropped by 5% very quickly in the third quarter.

Immediately following that two month plateau around 5%, the next few months of data showed that American consumers, writ large, were reacting to inflation by changing their spending habits. That’s when future contracts for new housing starts stalled out. In the next few months, up to today, all the data indicates working class U.S. consumers are hunkering down with less disposable income and prioritizing spending on essentials: housing, rent, gasoline, food. All else is less than.

In the service sector, specifically hospitality and venue employment, overall demand for services slowed, but the employment data -showing the contraction- remained hidden, because we were climbing out of the COVID lockdown hole. It appeared the service sector was gaining back jobs; but the backward to last year comparison was clouding an actual slowdown in services, because the data was comparing itself to 2020 when services were shut down. Demand for services was down, but we couldn’t really see it.

All of this inflation is being driven by policy. •[1] Energy policy (oil, gas leases nullified & pipelines cancelled) in combination with regulations targeting environmental impacts (CA ports emissions rules) is driving up energy costs. CORE inflation results from this. •[2] Fiscal policy by White House and legislature has been spending like drunken sailors, and that adds to a storm of •[3] monetary policy, with the Fed buying back the debt created by spending, and as a consequence devaluing the dollar currency.

All of this inflation is being driven by policy. •[1] Energy policy (oil, gas leases nullified & pipelines cancelled) in combination with regulations targeting environmental impacts (CA ports emissions rules) is driving up energy costs. CORE inflation results from this. •[2] Fiscal policy by White House and legislature has been spending like drunken sailors, and that adds to a storm of •[3] monetary policy, with the Fed buying back the debt created by spending, and as a consequence devaluing the dollar currency.

The cost of exporting products is less, because China and the Euro benefit from lower U.S. dollar values. However, more export of raw materials means higher prices domestically in what little remains of the supply/demand influence. The multinationals are making out like bandits, Wall Street is happy, and the middle class of America is once again a victim of economic policy.

First, the DC politicians delivered the “rust belt” to us as an outcome of their favoring Wall Street over Main Street, and now they are wiping out our checking accounts with massive inflation. Remember the oft repeated -and infuriating- catch phrase, “The U.S. is a service driven economy?“, said by both wings of the UniParty? Well, put another way… first they off-shored our jobs, now they off-shore our wealth. This is not an accidental outcome of flawed policy, they are doing this intentionally.

We are being gutted from the inside.

You don’t accidentally stop pipelines, cancel oil leases, shut down refining capacity, change port regulations and then act surprised by saying: ‘whoopsie’ gasoline seems to be costing more? Duh! It’s a feature not a flaw. Many of the people behind Joe Biden are stupid, but they ain’t *THAT* stupid. They know what they are doing, but they have to pretend not to know things in order to avoid the tar and feathers.

Table-1 gives us a good snapshot of how the sector specific prices are rising [data here]:

If you want to go even deeper into the categories, check out Table-2 HERE.

Final points…. This is backward looking data, and there’s nothing visible right now to give any optimism that prices will not continue rising yet again in the next few months. Exactly the opposite is true. There is visible evidence that prices will go up again in December, January and February based on the current situation.

If the Build Back Better legislation is passed, the current rate of inflation will jump even higher after February. If it doesn’t pass, we may plateau again in March and April of 2022 as we did in June/July of this year. However, prices will never drop back, because the devalued dollar status is permanent.

What will change this scenario is an actual drop on the demand side as U.S. consumers see their income values wiped out. Unfortunately, that appears to be part of the policy agenda for the White House. If they can reduce demand by making things unaffordable, they can claim victory over inflation and proclaim their economic policies a success. The downside of their achieving success is we have nothing left, we’re broke.

Sundance, it’s insulting to drunken sailors to compare their spending with the Federal Government. At least the sailors are spending their own money, which they earned, and when its gone they stop.

So I saw a commentator on Fox News (maybe on Tucker today) state that this “worst inflation since 1982 at 6.8 percent”

…. would actually be ** 13% ** currently if we were still using the version of the CPI that was being used in 1982

Read that again

… meaning that the frudulent CPI has been made even more fraudulent over time that naive one-to-one comparisons cannot be made when looking back (requires another level of analysis measuring the “grade inflation” of the CPI)

… and also meaning that current inflation is TWICE what is being currently reported on a CPI basis (let alone the far more egregious rates of inflation for gasoline, beef, home heating, etc)

If anyone has a good article or analysis of this further “grade” inflation of the CPI, please post

This aspect alone is worth a separate post by Sundance … at least as far as I reckon

Worst Inflation Since 1982 as Consumer Prices Soar 6.8 Percent

Agree!

Well said nimrodman.

I remember local barter groups in 79/80 “inspired” by Jimmy. Ours did well at first with nearly even trades of goods and services ( e.g. 2 pizzas for an oil change). A local accountant tried to keep track of small positive and negative balances for business owners but they grew large and needed inflation adjustments too and it fell apart :).

I remember interest rates at around 18% and no one was buying anything.

That is when the auto companies started making loans themselves to sell their products.

We were married for several years before we could afford to buy a house because the interest rate was so high.

Finally slowly slowly interest rates came down but I do remember those days.

Ever week that I went grocery shopping the items that I bought regularly went up so much that you could not help notincing.

Not just a few cents but sometime a dollar or more.

People were defaulting on home loans and leaving town in the middle of the night.

In some neighborhoods over 60% of the homes were under foreclosure and it was depressing and frightening.

Under Carter I had some CDs at 16.25%, and wish that I could have locked that rate in for 50 years! Now we get something like .001%, and some countries actually have a negative interest rate. What are the prospects that the good ole’ dollar will remain the reserve currency?

Those who stocked up with ammunition have had really good luck bartering for goods and services. Ammo is a currency all on it’s own.

Liberals are like alcoholics but with endless spending. The alcoholic, at least, promises to stop and doesn’t. It reminds you of Einstein and the definition of insanity, keep doing the same thing over and over and expecting.a different result. This is insane – stop the spending. Neuter Dementia Joe and his puppeteers from doing ANYTHING simply because every single thing they have done has been WRONG!

How do so many politicians get to be multimillionaires on $176K/yr? I have a lot of knowledge of advanced math and have been unable to calculate how they become multimillionaires after just a few years. Can someone please explain that to me.

Kickbacks and graft. It’s what makes both parties tick.

Alcoholics always promise to quit – just not today. Today’s not good. Libtards are the same, we’ll get back to normal but not right now. No worries, these tax and spending increases and restrictions on liberty – for the greater good – are only temporary

I really don’t recall the song “Whipping Post” but I’m pretty sure it applies to a lot of deplorables about now.

A quizzical smart ass smirking look would be apropo.

It’s all pretty simple when you come to realize that the DNC/MSM hates our guts and wants us to suffer, and so do most establishment Republicans.

This is on purpose to destroy our quality of life. In order to achieve the same standard of living as the 1950s, you have to earn at least $150,000. They will start taxing food because the government like this is never satisfied. President Trump made it look easy because it was easy. The federal government didn’t have his back because it doesn’t have ours.

Taxing food, LOL… my state already charges 10% sales tax on it.

The Govt’ crooks are the modern Mafioso… taking their vigs everywhere they can.

This is on purpose to create the total collapse of America’s middle class. America’s economy has to be destroyed in order to usher in the one world government the WEF is striving towards

I am in business and I can assure you that SD is correct. We bought equipment on sales contracts a year ago and they added an 8% surcharge at delivery this week. “Take it or leave it” they said. Same equipment next year? Salesman said plan for 20-25% increase, maybe maybe maybe late 2022 delivery. My wife got her annual review yesterday with a 3% raise; inflation is nearly 7%. I remember Carter and this is way worse.

Some tools I was looking to buy today just went up 30% from the price shown yesterday. Now I will do without.

…30, 60 or 90 days.

Toss a war into the mix. Maybe not USA involvement, but given the worldwide economy crashes due to CV-planed lockdowns, etc., a war will put a panic into lots of aspects. What country will make the first move? Russia/Ukraine? China/Taiwan?

Thoughts?

And if Chinas economy collapses, as a result of a housing investment bubble, collapsing?

TGP has had articles on this, and Hoftvis knowledgeable, having spent years in China.

The housing investment bubble in China is FAR LARGER than the one that popped, in 2008.

You can bet all the “Big boys” Chase, Citibank etc had investments in China, so like with wu-flu, what happens in China, doesn’t STAY in China.

Stock up, move towards self-sufficiency. Get your Spiritual house in order, get your financial house in order, get yourself as self-sufficient as you are able.

Theres a BAD storm coming, with more BAD storms lined up, right behind. And the people in charge are absolutely CLUELESS.

Here in Rural NE Florida I have planted two winter gardens full of vegetables and have prepared our old unused chicken house for some new egg laying occupants. The way things are going we all need to be as self sufficient as we can.

How high’s inflation Papa?

She said it’s 6.8 and risin’

The Real inflation rate has to be 20-30% since Bidet stole the WH. Immediately upon him passing the Welfare increase most food I buy went up 30% the next couple of days. Every supply I buy to do work is up more than 30%, with some things being up 400%. Gasoline is up 70%…. local Govt’ based utilities have been jacking up the water bills and gas bills to the tune of 20%, electric has also gone up slightly. Cars on the used lot have doubled, New cars are up $10,000-20,000 if you can find one.

These communist in Bidet’s administration are nothing but a HUGE CON on the American people.

There are millions upon millions of people who never recovered their wealth, or living standards from the Prior Fiasco with this conman and his wingman Obama. The American people were crawling our way back with Trump turning the ship slowly, but look how quickly the Democrats came in and ruined this whole country once again.

Some people will never recover from this BS, that is what the Democrats love. They are Evil people across the board. It is time the American people divorce ourselves from these Crooks who are set to ruin our lives, one hook and crook at a time. We must keep these people out of our affairs and our life or things will never change for the better.

Most democrats appear to be either communists like Obama or career criminals like Biden. There are also complete ideological idiots who actually believe in a total wealth redistribution as a formula for everyone being happy. We would be negligent of course not to include the millions of parasites who’s only wish is to live off government handouts in return for their votes for the democrats party.

From a macroeconomic standpoint, four things are happening simultaneously, causing inflation and negligible change in real GDP:

1. Increased Aggregate Demand due to increased government spending,

2. Reduced Aggregate Supply due to threatened tax increases, increased business regulation and mandates, and other actions that raise business costs.

3. Increased imports due to increased foreign mercantilism as foreign governments manipulate the dollar’s exchange rate in hopes that we will buy their exports and pull them out of the recessions.

4. Greatly increased money supply due to Fed Chairman Jerome Powell keeping not raising interest rates for much too long so that he would get renominated to another 4-year term.

The Fed can’t raise interest rates now without sending the economy into a recession, but it will try by raising the interest rates a bit whenever the stock market is high and lowering them back when the stock market is starting to crash. By doing this, the Fed will prevent the stock market from going higher than it is now. In the meantime, inflation will get more and more momentum. The Fed will eventually be forced by the high inflation to raise interest rates, and doing so will cause a recession.

If you try want to preserve your money put it into something whose value will rise with inflation but not crash when the worldwide recession happens. Meanwhile donate to campaigns to insure that a second term President Trump can solve the problem by cutting taxes, cutting regulations and mandates, raising tariffs and cutting spending.

Any good suggestions, Howard?

Historically, the price of gold has kept up with inflation and gold mining stocks have kept their value during recessions.

Physical gold is far, far safer than gold stocks. Buy it and hide it.

Money is a medium of exchange, for time and energy.

For me to produce something, I must expend TIME and ENERGY.

When you buy that something, you are giving me $ which compensates me for that time and energy.

If you learn to view it that way, you view things differently, and your decisions change.

Anything other than Time and Energy that we unconsciously evaluate, that increases our perception of value, falls away.

For example, we unconsciously put a lot of extra value, based on “status”; the “keep up with the Joneses” purchasing.

What is the basic function of a purchase? Anything beyond that function, is probably “added percieved value” due to STATUS.

A used car, well maintained will transport you from point A to point B, as safely, efficiently and economically as a NEW car.

And yet many have justifications for why they must have a new car; reality is, because they WANT one, for the status.

They like the status, the image they are projecting.

As I foreswore credit 20 years ago, I see someone with a new car, I know its highly unlikely they bought it outright.

They are enslaved, making payments each month, and paying for the required full coverage insurance, and probably haven’t a penny of income, that isn’t going right back out again, to pay bills.

I drive well maintained, 20+ y.o. vehicles, paid for cash. Carry state required minimum insurance.

I drive sanely, and that combined with the type of vehicles I have purchased, make it highly unlikely I will ever get in a wreck, highly unlikely that if I do I or my passengers will be injured, highly unlikely the accident will be my fault, and highly unlikely my vehicles will be damaged to the point of being undrivable.

I actually have $, “left over” every month, to save or spend how I choose.

I LIKE my “status”, I like the lack of stress in my life,..and respectfully to all, feel sorry for those suckered into working for the finance companies, enslaving themselves, for a percieved “status”.

We buy new to avoid lemons then drive them for decades.

“Circle Back Bitch Psaki Claims the Only Americans Who Look at Economic Data “Work in New York and Other Places”

https://www.thegatewaypundit.com/2021/12/psaki-claims-americans-look-economic-data-work-new-york-places-video/

“Inflation meals are higher, now? I mean, I didn’t even know they HAD in-flight meals anymore, wow! They usually just give peanuts on AirForce umm… AirForce… you know, the thing!”

Haven’t seen peanuts for years on in-flight snacks.

Something about peanut allergies, passengers going into shock.

Now with the clot shot, what will be the response when passengers drop dead, go into shock etc🤔🤔🤔🤔

A glimpse of what is coming may be found here. This is a touristy area, the economy driven by NYC summer people. But that’s seasonal, real people need year-round employment. The area was de-industrialized in the mid 80’s as the major employer, GE, morphed into a “global entity”. 15-20 K jobs were eliminated and never replaced except with low end retail and hamburger flipping. The population here is graying, they worked hard, saved their pennies, bought homes, and they are now relatively comfortable, but dying off. Young people bailed out. The ones remaining have no prospects so they turned to opioids. Everyone and their mother is on heroin or fentanyl. Then they get in trouble with the law, go through detox/”recovery” programs, get assigned case workers and are referred for “medication-assisted therapy”, meaning suboxone or methadone. The “clinics” popped up here like mushrooms. It’s common to see young “single moms” with multi-hued kids in tow lining up for their free dope from the state. The clinics have play areas for the kiddies like McDonalds. It is nothing less than state-sponsored addiction. Others go to mental health clinics and get “dual diagnoses”, drug abuse plus “generalized anxiety” and they get scripts for benzos. All of this makes it’s way to the street and benzos and “subs” are the de facto currency. Nobody works, they don’t need to, their rent and food and even their dope is subsidized. The underprivileged eaters all seem to have thousand dollar smart phones. The Pandemic didn’t touch them, it affected mainly the productive members of society. But they are owned by the state like cattle, completely dependent, and will be culled when the time is right. The state will make the kill shot a requirement for all their free stuff. That’s the MA version of the new economy and it may be a template as MassHealth was the template for HusseinCare. The bidens want to make it nationwide. As he said “we’re making progress”.

Well in my lifetime, Carter was the undisputed Worst POTUS in history but then O happened along and took that title and a few short years later Pedodent Biden has lowered the standard so low that both Carter and O actually look less worse….. I know I murdered the grammar there.

Biden is a record breaking POTUS, thats for sure.

Approval rating that, despite constant “good press” is worse than LBJ at its lowest ebb, or Nixon just before he resigned, stagflation thats going to make Carters look good by comparison,..an unprecedentedly high #of people who chant they want to have sex with him,..and we’re only one year in.

So, what other records will he break?

The idiots in charge don’t read here, exceptvthe rolcons intent on causing trouble.

TIIC, are stuck in a closed loop, a bubble in which the “economic experts” all really believe what they are spewing.

The “sticker shock” when the consequences of their failed policies TRULY become apperent, is going to be awsome schedenfrude, even as it is going to be terrifying to behold.

They really, I believe have ABSOLUTELY no idea, whats coming.

I have experienced people “in denial” first hand. Its not pretty, as they go thru the 5 stages, bouncing back and forth before eventually settling on “acceptance”.

And, since “acceptance” necesitates admitting, to themselves and everyone else, that they were WRONG, and since a basic, foundational article of faith in “true believers” is that THEY are RIGHT, and therefore everything they do is RIGHTEOUS, which lays the foundation for their “by any means necesary” approach,…

we are approaching a VERY dangerous time, is all I’m sayin,..

The sad fact is it appears there is no way out.

I’m no expert, but …

Precious metal prices are manipulated and have not gone up while inflation rages on.

Single Family Housing prices still strong but weakening and not really the best creator of wealth unless you have a bunch of them (even then dangerous to over extend when the market turns)..

Possible sooner or later the Stock Market has a reckoning, as does Housing and the USD.

And if the dollar doesn’t crash we’re stuck with negative growth. If it does, we’re wiped out.

https://en.wikipedia.org/wiki/United_States_Consumer_Price_Index

It could be far worse.

Don’t worry. Senile Sock Puppet Biden and Kameltoe Harris are working on it.

And Brandon did it in record time!

Get the hook!

Excellent work.

Inflation in pictures…(more charts)

https://www.jsmineset.com/2021/11/26/jims-mailbox-2750/

Misery Index Time…

How to add to inflation without being blamed: Manchin votes against eliminating the filibuster, but several of the RINOs vote in favor, rule changed. Manchin votes against the BBB, but several RINOs vote in favor, bill passed. Pre negotiated for Murky, Collins, and/or Mittens to take his place and get this through.

He reached Carter’s record and he did it in under one year? That’s quite an accomplishment! Heck, by the end of his term he will have had time to totally destroy our economy and our lives!

That’s their idea. Don’t think for a moment that the current inflation and destruction of the country has not been very well planned. All of what has happened in the last few years including covid-19 was planned to happen.

Jobama will never Best Jimmy’s starting the Department of Education. No other group has done more to cripple the United States than the Department of Education.

I remember paying 16% on the mortgage back then!

It means higher the inflation the higher the taxes and In turn higher income for themselves!!!!