If you followed my research on banking and the reality of the Russian sanction regime, this report from Reuters today takes on an entirely new dimension.

ME: …”The same way the Patriot Act was not designed to stop terrorism but rather to create a domestic surveillance system. So too were the “Russian Sanctions” not designed to sanction Russia, but rather to create the financial control system that will lead to a USA digital currency. The Western sanctions created a financial wall around the USA (dollar-based west), not to keep Russia out, but to keep us in. The Western sanction regime, the financial mechanisms they created and authorized, created the control gate that leads to a U.S. digital currency.” (more)

REUTERS TODAY: …”The firm [SWIFT] has gone from being virtually unknown outside banking circles to a household name since 2022 when it cut most of Russia’s banks off from its network as part of the West’s sanctions for the invasion of Ukraine. (more)

[The map shows the global financial cleaving, an outcome of sanctions against Russia]

I first started to deep dive research into these CBDC datapoints when the Russian sanctions were triggered.

You see, nothing about the sanctions really made sense from the way they were structured. Never before, not with Iran, North Korea, Venezuela or Cuba was the dollar weaponized against any entity who did not conform to the sanctions. Additionally, the intensity of the drive to make the sanctions the tip of the Western spear was just too pointed; something about it didn’t make sense. That’s what took me to dig deep into the sanction impact and realize nothing said about these financial sanctions made sense when compared against their actual outcome. {Go Deep}.

So, let’s start with the latest development:

(Reuters) – Global bank messaging network SWIFT is planning a new platform in the next one to two years to connect the wave of central bank digital currencies now in development to the existing finance system, it has told Reuters.

The move, which would be one of the most significant yet for the nascent CBDC ecosystem given SWIFT’s key role in global banking, is likely to be fine-tuned to when the first major ones are launched.

Around 90% of the world’s central banks are now exploring digital versions of their currencies. Most don’t want to be left behind by bitcoin and other cryptocurrencies, but are grappling with technological complexities.

SWIFT’s head of innovation, Nick Kerigan, said its latest trial, which took 6 months and involved a 38-member group of central banks, commercial banks and settlement platforms, had been one of the largest global collaborations on CBDCs and “tokenised” assets to date.

“We are looking at a roadmap to productize (launch as a product) in the next 12-24 months,” Kerigan said in an interview. “It’s moving out of experimental stage towards something that is becoming a reality.”

Although the timeframe could still shift if major economy CBDC launches get delayed, getting out the blocks for when they do would be a major boost for maintaining SWIFT’s incumbent dominance in the bank-to-bank plumbing network.

[…] A raft of heavyweight commercial banks including HSBC, Citibank, Deutsche Bank, Societe Generale, Standard Chartered and the CLS FX settlement platform all took part too, as did at least two banks from China.

The idea is that once the interlink solution is scaled-up, banks would have one main global connection point able to handle digital asset payments, rather than thousands if they were to set up an individual one with every counterparty. (read more)

The sanction regime against Russia was always intended to generate this outcome. This is the feature of the sanctions, not a flaw.

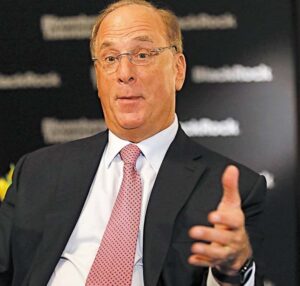

This dollar based CBDC was the intended destination of the people who constructed the Russian sanction plan (ex. BlackRock/WEF types). The Western politicians then were recruited and given instructions to support. Their cover story was “Build Back Better,” ie climate change, which was the predicate to the Russian sanctions.

I know at first blush a lot of this CBDC discussion seems esoteric, difficult to understand, and there are a lot of other issues happening simultaneously in the background. However, if you contemplate the biggest threat on this overarching power arc of Western government, you arrive to understand how serious this seemingly opaque issue really is.

2022 – NEW YORK, March 24 (Reuters) – BlackRock Inc’s (BLK.N) chief executive, Larry Fink, said on Thursday that the Russia-Ukraine war could end up accelerating digital currencies as a tool to settle international transactions, as the conflict upends the globalization drive of the last three decades.

2022 – NEW YORK, March 24 (Reuters) – BlackRock Inc’s (BLK.N) chief executive, Larry Fink, said on Thursday that the Russia-Ukraine war could end up accelerating digital currencies as a tool to settle international transactions, as the conflict upends the globalization drive of the last three decades.

In a letter to the shareholders of the world’s largest asset manager, Fink said the war will push countries to reassess currency dependencies, and that BlackRock was studying digital currencies and stablecoins due to increased client interest.

“A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption”, he said.

[…] In the letter on Thursday, the chairman and CEO of the $10 trillion asset manager said the Russia-Ukraine crisis had put an end to the globalization forces at work over the past 30 years.

[…] “While companies’ and consumers’ balance sheets are strong today, giving them more of a cushion to weather these difficulties, a large-scale reorientation of supply chains will inherently be inflationary,” said Fink.

He said central banks were dealing with a dilemma they had not faced in decades, having to choose between living with high inflation or slowing economic activity to contain price pressures. (read more)

When the White House first started openly saying the Biden administration was reviewing how to implement CBDC’s, yes THAT Announcement ACTUALLY HAPPENED, September 2022, things from a research perspective really started to get serious. “While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC.” Whenever the U.S. govt says they’re “undecided,” pay close attention.

First things first with the Western financial sanctions- specifically the SWIFT exchange. It is true you cannot use VISA, Mastercard or any mainstream Western financial tools to conduct business in Russia; however, the number of workarounds for this issue are numerous. One of those tools is the use of a cryptocurrency like Bitcoin; and within that reality, you find something very ominous about the USA motive against crypto.

(Newsmax) – JPMorgan Chase CEO Jamie Dimon on Wednesday suggested bitcoin currency should be banned. Dimon was speaking during a Senate Banking, Housing and Urban Affairs Committee hearing on Capitol Hill.

(Newsmax) – JPMorgan Chase CEO Jamie Dimon on Wednesday suggested bitcoin currency should be banned. Dimon was speaking during a Senate Banking, Housing and Urban Affairs Committee hearing on Capitol Hill.

“I’ve always been deeply opposed to crypto, bitcoin, etc.,” Dimon said in response to a question from Sen. Elizabeth Warren, D-Mass. “The only true use case for it is criminals, drug traffickers … money laundering, tax avoidance because it is somewhat anonymous, not fully, and because you can move money instantaneously. “If I was the government, I would close it down.” (read more)

Dimon was/is positioning JPMorgan to be one of the facilitating beneficiaries of the financial control system evident within any CBDC process.

The US Treasury has set the financial system on an almost irreversible path to a U.S. Central Bank Digital Currency. As direct consequence, crypto currency alternatives are a threat to the establishment of that Western objective. This reality also pulls in the explanation around why the USA is so all-in for the banker-driven World War Reddit – the Russia-Ukraine conflict.

Conflict with Russia created the opportunity for the USA to create a sanctions regime that doesn’t truly sanction Russia; instead it controls the world of USA dollar-based finance. At the end of that control mechanism is a digital dollar, a Central Bank Digital Currency…. and by extension full control over U.S. citizen activity. The Marxist holy grail.

Take those reference points as an overlay, and now consider this little discussed 2022 announcement from the Biden administration:

[White House] – President Biden often summarizes his vision for America in one word: Possibilities. A “digital dollar” may seem far-fetched, but modern technology could make it a real possibility.

A United States central bank digital currency (CBDC) would be a digital form of the U.S. dollar. While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC. If the U.S. pursued a CBDC, there could be many possible benefits, such as facilitating efficient and low-cost transactions, fostering greater access to the financial system, boosting economic growth, and supporting the continued centrality of the U.S. within the international financial system. However, a U.S. CBDC could also introduce a variety of risks, as it might affect everything ranging from the stability of the financial system to the protection of sensitive data.

A United States central bank digital currency (CBDC) would be a digital form of the U.S. dollar. While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC. If the U.S. pursued a CBDC, there could be many possible benefits, such as facilitating efficient and low-cost transactions, fostering greater access to the financial system, boosting economic growth, and supporting the continued centrality of the U.S. within the international financial system. However, a U.S. CBDC could also introduce a variety of risks, as it might affect everything ranging from the stability of the financial system to the protection of sensitive data.

Notably, these benefits and risks might vary significantly based on how the CBDC system is designed and deployed. That is why Executive Order 14067, Ensuring Responsible Development of Digital Assets, placed the highest urgency on research and development efforts into the potential design and deployment options of a U.S. CBDC. The Executive Order directed the Office of Science and Technology Policy (OSTP), in consultation with other Federal departments and agencies, to submit to the President a technical evaluation for a potential U.S. CBDC system.

Today, OSTP is publishing its report, Technical Evaluation for a U.S. Central Bank Digital Currency System, which lays out policy objectives for a potential U.S. CBDC system and analyzes key technical design choices for a U.S. CBDC system. The report also estimates the technical feasibility of building a CBDC minimum viable product and describes how a U.S. CBDC system might affect Federal operations. The report makes recommendations on how to prepare the Federal Government for a U.S. CBDC system. Importantly, the report does not make any assessments or recommendations about whether the U.S. should pursue a CBDC, nor does it make any decisions regarding particular design choices for a potential U.S. CBDC system. (read more)

When you read that full announcement, you realize they have already built the system.

If the system is built, and they are now making policy recommendations for implementation, the question becomes, ‘What’s the goal’?

We do not have to look far for the explanation.

Prior to the White House announcement, the World Government Summit 2022 took place on March 29 and 30 in Dubai, hosting more than 4,000 individuals from 190 countries including senior government officials, heads of international organizations, and global “experts.” The invited participants presented ideas and worldviews from within their various fields of specialty.

One presentation was from Dr. Pippa Malmgren, an American economist who served as special adviser on Economic Policy to President George W. Bush.

Her father, Harald Malmgren, served as a senior aide to US Presidents John F. Kennedy, Lyndon B. Johnson, Richard Nixon, and Gerald Ford. In this segment, Mrs. Malmgren says the quiet part out loud. Yes, they are no longer hiding the construct; indeed, as you will hear, they are saying quite openly what the future will look like. WATCH (2 minutes):

[Full Source – 6 hours (internal segment at 18:30)]

Transcript – Dr. Malmgren: “What underpins a world order is always the financial system. I was very privileged. My father was an adviser to Nixon when they came off the gold standard in 71. And so, I was brought up with a kind of inside view of how very important the financial structure is to absolutely everything else.

And what we’re seeing in the world today, I think, is we are on the brink of a dramatic change where we are about to, and I’ll say this boldly, we’re about to abandon the traditional system of money and accounting and introduce a new one. And the new one. The new accounting is what we call blockchain.

It means digital, it means having a almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on. It also raises huge dangers in terms of the balance of power between states and citizens.

In my opinion, we’re going to need a digital constitution of human rights if we’re going to have digital money. But also this new money will be sovereign in nature. Most people think that digital money is crypto, and private. But what I see our superpowers introducing digital currency, the Chinese were the first the US is on the brink, I think of moving in the same direction the Europeans have committed to that as well.

And the question is, will that new system of digital money and digital accounting accommodate the competing needs of the citizens of all these locations, so that every human being has a chance to have a better life? Because that’s the only measure of whether a world order really serves!”

The entry into a digital currency, needs a digital identity.

The end goal of a digital currency is why Western political leaders have not been worried about following the COVID-19 spending demands from the World Economic Forum. {Go Deep}

When the global trade currency does not need to be pegged, it is completely fiat. This is the current problem with global trade and transactions taking place in U.S. dollars, which arbitrarily lifts the standard of life for Americans while providing no similar benefit to other nations. That view became the underlying motive for Osama Bin Laden to target the World Trade Center, Twin Towers. That view was/is also the perspective carried by Barack Obama, that lay behind his “fundamental change” statement.

A digital currency allows ultimate control, on a global basis, by a one world government, or Western system of collective governments, that can assign value. No other mechanism will have as much control over the life of a person than a digital currency that will create a system of transactional credits and debits, perhaps also influenced by your social credit score.

Can it be stopped? I struggle with that question. I look in the mirror, think about the reality of how many people think this is an absurd conspiracy theory, and respond with…. How many people even know about the thing you are asking them to oppose?

How many people would believe the Western sanctions against Russia were really the USG building a cage to keep us in? Information, we need to start there. That’s my answer.

During remarks in New Hampshire, President Trump announced he would never allow the creation of a central bank digital currency. WATCH:

.

Of course, it should be noted….. as if the entire global system didn’t already oppose Donald Trump, this position against CBDC’s just puts an exclamation point on how the multinational financial systems will hate/oppose him even more.

This 2024 election is critical for a variety of reasons. However, high atop that list is this issue of how a dollar based CBDC is a threat to every liberty we cherish.

We will win this battle and eventually this war, or I’ll die fighting it.

They are trying to move fast, because people are catching on now.

We are on the right side of every issue; we cherish liberty and individual freedom. Our opposition is built upon a foundation of fraud and lies. The politicians are corrupt, and their arguments collapse when put in the sunlight; but they are not the root of the problem – they are vessels. That’s why the multinationals like BlackRock need the rules and referees (politicians) slanted in their favor. That’s why they need censorship, deplatforming, and beyond everything else…. they must control information.

…The key battle right now is an information war.

Tell your family, friends, neighbors. At first, they may think you are crazy, don’t quit. Share the information. Use the internal citations to help you bolster your arguments. Don’t quit planting seeds of information, and then update with additional information as it surfaces. Keep driving the awakening.

Support Our Fight Here

[source]

“We will win this battle and eventually this war, or I’ll die fighting it.”

Amen.

CBDC

CORRUPT

BANK

DIGITAL

CONTROL

https://www.corruptbankdigitalcontrol.com/

I don’t know much about banking and its rules and laws…but I do understand administrations trying to push something…does anyone remember the banking fiasco of around 2008? All of the Chase commercials emphasizing how paying cash or writing a check slowed things down at the cash register (for the consumer)?

only half way thru the article but this caught my attention, WH language (and a potus ‘vision’ to make it appealing to the sheep, (aka Patriot Act):

“could be many possible benefits, such as facilitating efficient and low-cost transactions, fostering greater access to the financial system, boosting economic growth, and supporting the continued centrality of the U.S. within the international financial system”…

Yes, when they start pushing something like this in baby steps, you know another BOHICA moment is incoming.

While that PR statement glosses over the many challenges of implementing CBDC’s, as PR statements always do.

I usually focus in the concomittant biometric, universal I.D.’s, and the shortcomings inherent therein, but heres one I never hear THEM addressing; the downsides of a cashless society with all transactions tracked and traced.

There is World wide economy of illegal activity, ECONOMIC activity, drugs, stolen goods, guns, untaxed items, etc. that is massive and obviously unregulated.

Such activity has occured since the dawn of civilisation, and attempting to implement CBDC’s is NOT going to make it stop, and I submit if all such illegal economic activity stopped tomorrow,it would cause a Global economic collapse.

I suspect criminals will come up with “work-arounds” they always do.

After all, the 10’s of millions drug addicts are not suddenly going to get into 12 step programs, because CBDC’s make it impossible for them to buy their drugs, …

The old adage says that the house is so termite riddled, that if the bugs let go the structure would collapse.

DC without financial fraud would cease to exist. They will never put themselves under a microscope, that’s only for us.

Contact your state and local legislators and ask them to get behind legislation requiring physical businesses to take cash. Use the reasoning that not taking cash is discriminatory against immigrants. How can the left argue with that?

Most so-called immigrants are issued a preloaded debit card as part of the Mayorkas Welcome Kit they receive at the border.

How can digital currency be stamped with In God We Trust

Facetious Me.

Christians won’t be able to buy or sell for the 5 months (Revelation 9:5) of the first Tribulation anyway! PM’s and God’s protection will be our currency then!

Bingo!

Digital ID = the mark of the beast

Its abreviated; “666”.

Gotcha!

Governments don’t trust in God. They think they are God. The bureaucracy giveth and the bureaucracy taketh away.

Wait until you find out members of Congress and insiders will get the Unlimited Chase Crypto Cards with no spending limit and no required payback.

Spoiler Alert: They already have it

And The House makes sure their spending limit increases regularly

They wouldn’t even need to control you by claiming a credit score against you.

They would just lie (which they are addicted to) and say your account has been hacked and your funds depleted.

Don’t worry, though. The gov’t. is on it (I’m from the gov’t. and I’m here to help).

Question. What will they do when ALL the power goes out?

Not read the whole article yet, that’s a lot to digest!

But, why do I get this uneasy feeling that this statement is the EXACT OPPOSITE of what likely happens

“A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption”, he said.

The key words are “,…thoughtfully designed,..”

Shall we make a list of all of the UNthoughtfully, in fact poorly designed things the experts who are pushing this have designed or implemented recently?

They do not really want to eliminate money laundering, corruption or criminal activity, because thats impossible; they just want to CONTROL it.

These are the same idiots who think if you want to extend the range of E.V.’s, just put a windmill on the roof. “As the car drives, the windmill will recharge the batteries,…yeah, that’ll work!”

Its HUBRIS, and we are seeing the Tower of Babel being rebuilt.

I have a neighbor who retired from CITI Bank a few years ago. He told me last year: “What these people have in mind once they implement digital currency would make Stalin blush.”

Did he provide details, or just keeping that information to himself?

People, you need to read the entire Book of Revelation (preferably the English Standard Version for easier understanding.)

All of this will become very clear as will the only way to win against it.

I heard a great sermon this past weekend. As Jesus entered Jerusalem on what we now call Palm Sunday, he was hailed by the people as a savior and messiah. People shouted Hosanna, which means “Save us Now.” The people had seen and heard about the miracles Jesus performed, from healing people to feeding over 5,000. What did the people want to be saved from? The tyranny of Rome. The Romans taxed everything so heavily that many people had to give up their farmland just to pay taxes. Bill O’Reilly’s excellent book “Killing Jesus” (a historical account, not a religious account) documents the horrible life the Jews suffered under Roman rule. Did Jesus save the Jews from the Romans? No. Do I think Jesus and God will save us from our government? No, sadly not. I do pray for a miracle. But just as Jesus did not save the Jews from the Nazis during WWII, I don’t think we can wait on other-worldly means.

Prophecy is cryptic until we see that we’re in the middle of it. Jesus made one thing clear: we would be hated around the world and persecuted because of him. But to be of good cheer, Christ has overcome the world.

So it’s not critical that we avoid these things, but that we remain committed and ready whilst in it. That’s a moment by moment responsibility.

We will will lose the battle of CBDC. we will win the war. Spoiler alert. God knows the outcome!

Inherent in CBDC is Universal, Biometric Identification, can’t have CBDC’s without the I.D.’S needed to access them.

SO, FIGHT it there.

There has never been an I.D. that hasn’t been counterfeitable, or a security system that hasn’t been hackable.

Any currency system requires CONFIDENCE. In order to be accepted by the masses, so that they will transfer their wealth into it, so they they will accept and use it as currency, seeing it as having stable value, they have to have CONFIDENCE in it.

We already see great reluctance with bitcoin, with maybe 1:100 to 1:1000 getting involved in transacting with an intangible token.

If access to your identity, depends on a thumbrint or retinal scan, there ARE unscrupulous miscreants that will cut off your thumb, or spoon out your eye, in order to access your wealth or property.

The people dreaming this up, have already exibited absolute ignorance or appreciation for “how the other half lives” and THEY are going to “THOUGHTFULLY DESIGN” this system?

People who leave their armed security building in their cheufer driven car to go to their armed security work, are going to design a financial transaction system for a guy going into a 7-11 on the bad side of town, at 2:00 a.m. and with miscreats hanging around outside? Yeah, right.

chauffeur

Maybe “God” could share a little about what he knows. That would be the charitable thing to do, wouldn’t it?

Will the drug cartels get special accounts?

Bribe payoffs would be labeled as…………?

The millions of transactions (large and small) that take place everyday with cash/no paper trail/no taxes (street vendors, lawn mowers, garage sales, etc.) ………?

will the Amish be exempt?

Or will the boxcars come for them first?

I believe we’ve already seen the beginnings of that, as reported here on CTH.

So as an alternate course of action, what if I decided I didn’t want to be part of this world they are constructing in the West….where would it be better to live? Brazil? Mexico? Russia? Will they be living with more prosperity and freedom ‘over there’? Just doing a mental exercise on ways around what they are pushing…..

Or conduct transactions in their currencies.

I could see a world where I pay for my mortgage for example in whatever digital currency they establish and then use an alternative currency or crypto to pay for other things. The cryptocurrency genie is already out of the bottle and I don’t see a way for a government to put it back in.

Regardless, this is a dire issue that needs to be confronted directly to prevent it from happening in the first place before we even consider the inevitable work arounds to not participate.

Gubmint, and banksters will just break the bottle and spit in the genie’s eye! …

I think they will outlaw the use of any other digital currency….they will somehow lockdown your ability to make transactions using other sources….fences built around the internet in some way.

I don’t know all the terminology but believe there are things like ‘cold’ wallets that don’t depend on the internet, rather in-person interaction.

We use a version of that in barter, but it’s much less convenient negotiating what for what.

A neighbor gave me a quarter yesterday to print a UPS return label; I saved her a 40 mile round trip to town. It’s the first ‘money’ I’ve earned this year. 🙂 Tossed it in the coin bag that I’m rebuilding since the thieves stole it last November at my CA place. Normally she pays me in eggs but the chickens have just started up now that the weather is warming.

Anyway, I’ll find a way to fight the government. I’ve been doing it for decades. This is nothing new.

“That view became the underlying motive for Osama Bin Laden to target the World Trade Center, Twin Towers”

There is a lot of evidence to suggest that, perhaps, in that statement “Osama Bin Laden” should be replaced with “Osama Bin Laden and/or CIA”

which actually increases the veracity of the narrative above.

Digital Currency would be every bit as reliable as CheatWare Voting Machines.

We’ve seen how you people count. No, thanks.

I have been contacting my local officials, politicians, et al for decades about issues. I have pounded the keyboards and heated up the phone lines this last few years…I live in a red state. Rather MAGA. My county is heavy MAGA. The politicians are owned. We came close to cleaning out some rinos (and did in a few districts) but I still have a 50% rino in the house rep, although he did face a tight challenger. Doesn’t matter. He rarely votes in favor of USA. So when your neighbors keep voting for a jerk rino you have little room for hope. We are being pushed into corners and that will not end well. Denying a freedom-loving people peaceful means of resolving their differences is unwise. Radicals need to calm their hatreds, realize the idiocy of cornering an animal that has the means to destroy them, with no other path to freedom.

Sundance, Been gone for a week or so. Waiting for approval messages now? Why?

If CTH cookies get cleared out, it’s possible that could have play. However, I tested that using a Brave private window where I had to enter all the forum information and cookies are shut off and it still worked. IDK, glitch?

Welcome back! 🙂

This is big… do or die!

I never cease to be amazed at what my parents knew. With little education, no tv, no telephone and a good understanding of bible scripture, they could talk about the things we are seeing and talk about today. That includes the Bilderberg’s and other “secret societies.”

As for the money, the bible says the people will cast their money into the streets.

Money at some point will be worthless.

yes, its all in The Book.

Fiat money is stealing your wealth. CBDCs will steal your wealth and freedom. The off ramp exists and is growing daily. Bitcoin is freedom money. Study it. Wall Street has woken up to it. You are not too late.

Ok– you studied Bitcoin… tell me… how many transactions per second can it handle? What are the current transaction fees? (i.e. how much would it cost you to buy a $5 hamburger from me?) How much energy does it use (this is tided to it’s ability to scale).

Beta Test Coin is a distraction– and the evidence is in the NSA libraries they used in it’s construction (SHA256).

They don’t want you anywhere near what they will use.

Yes, a practical example…. my neighbor gave me a quarter yesterday to ‘buy’ a UPS label she needed printed out to save a trip into town. I was chewing on my tax return (grrr!) and had the printer up so accommodated her.

Say she was ‘buying’ some paper to write on during a power outage, maybe a long one, and my printer wasn’t working hence the need to write, could she ‘buy’ it with bitcoin? How would she ‘pay’ me?

As is, that archaic quarter ended up in my coin bag with all the others. Because people, for now, still trust it, I can ‘buy’ things with it, just like we have for centuries. How does bitcoin/crypto fit into that milieu?

How about we start at the root cause of all of this BS! Eliminate the FED RES and all those who own it. (((They))) are the bane of humanities existence, but everyone is afraid to say it!! Look at history and what (((they))) have done to every country resulting in their removal and exile…..

It means digital, it means having a almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on.

And the ability to tax it. Spend 10 credits at the local yard sale; additional credits to the federal and state revenuers.

Somehow I see an underground barter and trade system popping up outside the digital currency as a go around to taxing your local yard sale.

Found in the bin…. 🙁

It’s (underground barter and trade) been around for decades if not centuries. However, most of us are indoctrinated into ‘the system’ so become inured to it. We associate with people who are likewise inured to it so trust each other and the medium of commerce the system has arranged for us.

We can make different choices. I look in the mirror. I was indoctrinated. Had my first bank account at ten, had one of those early ‘BankAmeriCards’. Bought into an Exxon DRIP back in the 70’s when working the oilfields. Bought Apple at 11 bucks a share. Bla, bla.

Now I see with different eyes, kinda like in that movie ‘The Matrix’.

It is, simply, economic slavery. But, after all isn’t all slavery?

CBDC intends to make it ubiquitous – inescapable.

FYI, just tried to post a comment about bartering but my computer keeps on reloading this webpage. We must be over the target. 😉

Use the Brave browser. All others reload page constantly

If there were a digital currency today, they would have taken or frozen ALL of Trumps money instantly.

He’d be in a digital prison.

Yes, they can freeze money in their system but they have to claim dirt by, ultimately, threat of or actual force of violence hence why we historically have wars to occupy dirt. One can’t merely throw a switch and claim it. I mention that because of PDJT’s claim to fame is in the acquisition and development of dirt.

This isn’t really about digital currency. We already have that. Almost everyone gets their money electronically now and pays their bills electronically and buys their goods with a plastic card.

What they really mean is a digital ID to control each individual. Just like in China when the Covid lockdown was enforced with smartphone and they scanned every person’s cellphone. Green response and you could pass and red sent you to an isolation camp.

That is what the goal is and it will be used to control where we go in our electric cars and mass transit and what you will be allowed to purchase (good luck with that new Glock) and what movies you will be allowed to watch on your smart devices.

Administrator @ Sundance I wish to ask a person with a platform to share this article content via video/podcast social media. I cannot locate your writing of encouragement regarding sharing CTH and crediting content, including on CTH ABOUT page. May you provide me a link about sharing CTH content, please?

Banks!

Anyone remember how hard it was to get Americans to store money in banks. Common sense.

Yes, since my parents lived through the stark poverty of the Depression, it was quite a task to re-indoctrinate them and their generation into ‘the system’. WW2 and the roaring 50’s did a great job of it though. By the time the 60’s hit, they were indoctrinating me into the system but I was always a bit of a rebel, even as a child. Still, to a large degree, I ‘believed’.

When my uncle died in the early 1980’s, his daughter found nearly 100 grand in cash in his bed. Looking at him, driving an old pickup and diving in dumpsters, one might have thought him a hobo. Nope, apparently he died a millionaire. Frugal to the very end.

She also said in the same session: “We’re already in World War 3. We are already in conflict that extends so far beyond Ukraine, actually, even within the context of Western Europe but we’ve clearly been pretty much at war in space, uh below the surface of the oceans, submarine warfare between super powers, uh, I’d even say this has been happening for at least four years, [since 2019] and it’s spilled over into public view on the ground, uh, but we don’t “frame” it that way.” ~ Philippa “Pippa” Malmgren (Economist, Former U.S. Presidential Advisor) statement at the 2022 World Government Summit in Dubai. Now changed to the ‘World Governments Summit’.

Anyone, please explain to me when a government, any government, provided any service that was more expedient and efficient and productive for the people. I’ll wait.

Oh, and we can’t have ID’s presented for voting, but you will have to have a digital ID to access your own money. SMFH !

Simply don’t use the digital currency. Stop accepting it as legal tender, only accept things like bitcoin etc. Basically I will buy Yen before I use a digital USD

“Can it be stopped?”

No, of course not. That’s like sitting at your typewriter listening to a vinyl record asking if digitization can be stopped. It’s the next step in banking technology and it’s coming whether we like it or not.

Dr. Malmgren is right. We are going to need a “digital constitution of human rights.” Or, as I would describe it, a constitutional amendment that spells out our digital rights and also makes clear that what’s left of the constitutional protections of our analog rights applies to digital transactions and processes as well.

Good luck with that, when hundreds of DOJ contractors can pour over our emails, text messages, and telephone calls (they are all digital) with no warrant. So much for the Fourth Amendment. What the good doctor describes is something we already need. When Trudeau de-banked everyone who supported the farmers uprising, his globalist overlords immediately made him reverse it because he gave the whole game away. So, yeah, good luck with getting any constitutional protections of your digital life.

It’s what’s for dinner. Express an unapproved thought on the Treehouse, and suddenly your “transaction card” is cancelled. No food for you.

There is one, and ONLY one, way out of this nightmare:

Trump 2024

Oh, and while I am at it, watch out for the perfect storm in regional banking coming just about election time as commercial real estate collapses under its own post-covid weight:

https://brownstone.org/articles/the-meltdown-of-commercial-real-estate/

Need Governors that will say…that aint gonna happen. Stay on US dollar

The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.

Lord Acton

Will candidates for office be on the record for their position on this? That’s probably our most important responsibility right now, forcing their response.

If we’re told the “I’m uncommitted but support ongoing study on the subject,” that’s a yes.

Of course the system has already been built. It’s called ISO20022… and was fully implemented last year across banks in the system. SWIFT’s role today is a messaging system to banking transactions between nations– and IT SUCKS. Takes days to settle and costs a lot of money in fees (and doesn’t even guarantee it will be successful). There are TRILLIONS locked in NOSTRO/VOSTRO accounts between nations used for this settlement. Crypto (ISO20022 compliant Crypto– hint, it’s not BitCoin or Etherium) can greatly reduce this friction in money movement and free up those trillions (which is going to be needed as Japan’s YEN will cause a cascading global credit event soon).

The collapse of the the western financial system has been in the works for decades– this is why they do not care about debt spending. Be ready– get some gold (and maybe some ISO20022 compliant crypto).

For the life of me I can’t remember anyone here posting about this but maybe I missed it. It was released in Oct and I stumbled across it in mid Dec. I waited til beginning of March before I decided to share as I was waiting on an “expert” to pop their head up and refute what Mr. Webb is saying. Now I don’t agree they will “seize everything” but when it comes to title and law I haven’t heard one “expert” counter what he says here. The psycopaths in the WEF/Davos crowd have been chirpin The Great Reset, 4th Industrial Revolution yada yada yada. for the last few years with one of the many themes being “you will own nothing and be happy”. I would read or hear this and for the life of me couldn’t figure out how they planned to take all my stuff. I’m no expert on this type of thing so I’m hoping someone can enlighten the masses here but if what he is saying is true, it’s all codified in law and perfectly legal(thanks to their backdoor schemes). He lays out in The Great Taking in an easy to understand way. Webb agrees the end game is a digital ID. The question I have is how they get there. They need a catalyst. Look, reading the comments on this, it’s clear there are many who will not willingly concede to the “ID” so it must be something catastrophic that has the plebes begging for the govt “DO SOMETHING! ANYTHING!”

My money is on some sort of cyber attack on the grid, internet etc…this collapses the financial system, banks go bust(which also wipes out their debts), we blame Iran or some other nation and we are off to martial law. You’ve heard the phrase “There are only 9 meals between anarchy and mankind”. No power for a few weeks or months gets us there reeeeeal quick. Then they ask “Can I interest you in a digital ID so you may eat?”

The Great Taking vid-

He has a book as well. Not long ~160pgs

I may not understand all the details, I may not even remember the sequence of letters in the scronym, but I know with certainty that a govt controlled digital currency spells D E A T H to F R E E D O M.

And that is very similar to others I have spoken to and with.

Especially anyone who has continued to use cash whenever possible as a matter of principle.

Real currency is right behind freedom of speech and the 2A when it comes to personal sovereignty.

FDR issued Executive Order 6102 April 5, 1933 to order all Americans to turn in their gold to a Federal Reserve bank branch in exchange for paper money at the official rate of $35/oz.

Biden’s longstanding goal is to make himself into “another FDR.” But this time he would be ordering all Americans to turn in their cash in return for CBDC.

Interesting analysis, but keep in mind, Larry Fink and Jamie Dimon are not deep state bureaucrats, they are merely smart, hard working, risk taking businessmen. No CIA here.

The key in the information war is misinformation. Miseducate your colleagues and let then do the work of your opponents. It is shame that there is so much misinformation surrounding CBDCs.