There’s a disconnect in the Main Street data that is perplexing from the standpoint of traditional economic and labor analysis.

There have been significant layoffs in the labor market as the result of diminished consumer spending activity. However, the Bureau of Labor and Statistics (BLS) is reporting a hotter than expected 263,000 new jobs in November [DATA HERE].

There were declines in jobs within the retail sector [-30,000 in Nov, -62,000 since August] and declines in warehousing and transportation [-15, 000 in November, -30,000 since July], which would indicate the outcome of lowered consumer spending on goods, or at least a change in consumer spending priorities.

There were declines in jobs within the retail sector [-30,000 in Nov, -62,000 since August] and declines in warehousing and transportation [-15, 000 in November, -30,000 since July], which would indicate the outcome of lowered consumer spending on goods, or at least a change in consumer spending priorities.

Simultaneously, there were significant increases in jobs for leisure and hospitality [+88,000 in Nov], with the majority of those gains in food service and drinking. However, that sector is still lower than the pre-pandemic by -980,000 jobs. Also note people are not attending events with high ticket costs, the performing arts and spectator sports segment dropped 7,000 jobs [Table B-1]

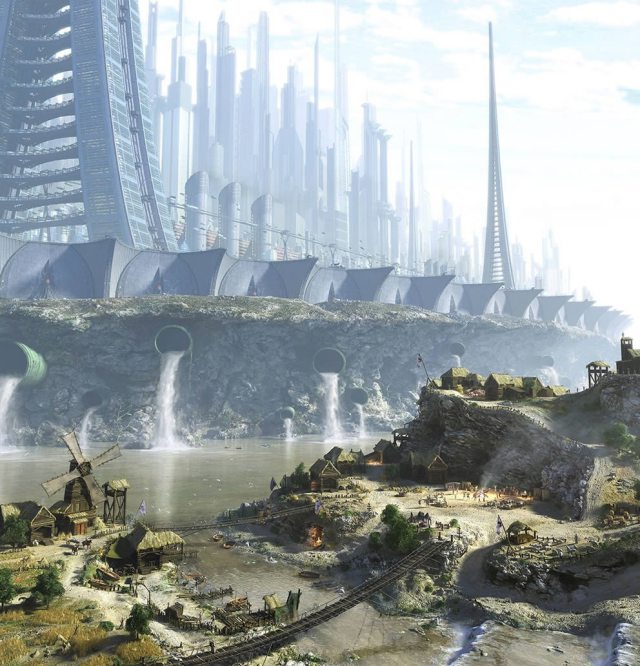

Overall, if you were to look at the macro level jobs report, anything attached to the traditional spending of durable goods (retail stores) is declining. However, the jobs related to the service or life experience are growing. Oddly, and perhaps creepily, this dynamic falls in line with the ‘you will own nothing and be happy‘ cliche’ that has been oft spoken about the new post pandemic ‘Build Back Better‘ economy as espoused by the World Economic Forum.

Job gains in the infrastructure of life such as, building and construction, as well as the labor sector associated with skilled domestic service trades like plumbing, electricians, maintenance, etc are continuing to hold stable. The major shift in the labor market surrounds the buying of durable goods which has disappeared along with the disappearance of discretionary income. Which brings us to the wage portion of the BLS report.

Wage growth was a very high 0.6% for November and brings the annual rate of wage growth to 5.1%. This outcome is almost certainly an outcome of workers demanding higher pay to cope with inflation, and employers needing to raise their wage rates in order to retain employees.

We also see an increase in the number of workers holding multiple jobs, as individuals are taking second jobs to cope with massive price increases in housing, food, fuel and energy. As noted within the BLS data:

“In November, the average workweek for all employees on private nonfarm payrolls declined by 0.1 hour to 34.4 hours. In manufacturing, the average workweek for all employees decreased by 0.2 hour to 40.2 hours, and overtime declined by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.1 hour to 33.9 hours.”

Fewer people are working, but more jobs are being worked – with lowered hours.

Higher wages are good; however, higher wages lead to higher prices for goods and services; which drives inflation higher, which creates the need for higher wages. It’s an upward pressure spiral.

The supply side pressure on inflation, almost exclusively created by the BBB energy policy, shows absolutely no sign of lessening, despite the drop in demand for domestically produced finished consumer goods which has lowered overall industrial demand for energy.

The Build Back Better energy driven policy changes are creating very weird economic outcomes.

Prices are rising. Consumers are squeezed. Jobs attached to spending on goods are declining. Jobs attached to life experience and services expanding.

Ex.1 If you are working two jobs, now you might not have time to mow your grass – so you hire a lawn service. The lawn service guys are charging more because the gasoline and business costs are higher…. which means you need to work a little longer at the second job to pay for the lawn service you don’t have time to do on your own because you need to work the second job. That’s the dynamic we are seeing in the quantification of labor and job growth.

Ex.2 If you are working two jobs, you might not be cooking as much at home. So, you grab dinner/lunch away from home. The restaurants are charging more because the business costs are higher…. which means you need to work a little longer, ask for higher wages, in order to offset the time you don’t have to eat lunch/dinner at home.

This conflicting duality is what I always called the “serfesque driven economy.” It is an outcome of erosion of the middle-class. A status of individuality where your desires for life experience determine the need for your income.

You don’t own a car, you Uber. You don’t own a house, you rent. You don’t need a kitchen, you eat out. Things seem ok, but you eventually become a serf to the people who control transportation costs, housing costs, food costs, etc. Ultimately you have no control over the time you want to spend in enjoyment, because you don’t own the mechanisms of your life and need to work in order to afford maintaining the costs. It’s a weird mental exercise.

There is a real outcome in this dynamic where the wealth gap increases.

Karl Denninger over at matket-ticker.org wrote about this today. Among other things, 2 big takeaways are that if you are working 2 jobs, you are counted as being employed twice and that can account for the increase in the number of jobs.

Second, the number of people with college degrees who are eligible for employment keeps gong down. You don’t lose education; if you have a degree, you always have a degree. Karl says the 3 options for why they are no longer eligible to be employed are incarceration, in a nursing home or dead. One and two should not account for this big decline every month.

Karl is a great writer and does a wonderful job of being unbiased by social and political norms.

It is what it is with him!!!

“I probaly shouldn’t say this, but some of the DUMBEST people I know,…have a college education.”

Kari Lake

That’s because a lot of imbecilic idiots need the goat hide to point out that they’re not the imbecilic idiots they appear to be.

Also, today’s college education can’t hold a candle to what it was 30, 50 or 60 years ago. Today, they train these kids to be drones.

Wrong. They train these kids to be victims looking for handouts, and they are doing a spectacular job with that.

“The greatest enemy of knowledge is not ignorance; it is the illusion of knowledge.” – Stephen Hawking

“Despite the favorable opinions of undergraduates and alumni, a closer look at the record…shows that colleges and universities, for all the benefits they bring, accomplish far less for their students than they should… Many cannot reason clearly or perform competently in analyzing complex, non-technical problems, even though faculties rank critical thinking as the primary goal of a college education… Most have never taken a course in quantitative reasoning or acquired the knowledge needed to be a reasonably informed citizen in a democracy.” – Derek Bok, former 20 year president of Harvard University in his book “Our Underachieving Colleges”

Far too many of our fellow citizens don’t realize that America is a republic, not a democracy.

More importantly, they don’t know why our Founders rejected democracy in favor of a republic.

“A republic, madam, if you can keep it.”

Well, I have a college education. And I resemble that remark!

“Through this and other experiences I began to discern one of the elements of an education: get as near to the supposed masters and commanders as you can and see what stuff they are really made of. As I watched famous scholars and professors flounder here and there, I also, in my career as a speaker at the Oxford Union, had a chance to meet senior ministers and parliamentarians “up close” and dine with them before as well as drink with them afterward, and be amazed once again at how ignorant and sometimes plain stupid were the people who claimed to run the country. This was an essential stage of my formation and one for which I am hugely grateful.” – Christopher Hitchens

MTG said that the thing that surprised her the most after arriving in DC was how unimpressive her colleagues were.

I share Christopher Hitchens’ experience. The awful truth of it.

Politicians around the world are the same… mostly idiots.

The top line numbers are bogus, made up, required to maintain the narrative.

In the mid day news today, LA, Channel 5, the “business guy” was breathless telling us that the economy was doing great and how inflation will require higher interest rates.

He took the top line DoL employment numbers at face value, with no analysis of what it meant.

This is how it works: create a tweaked headline number and everybody runs the propaganda with it. Make the lie big, repeat it often, enough and it becomes “truth”.

Goebbels.

“You’ll own nothing and be happy” is not a prediction, it’s an order

Yes, it IS.

and I refuse to comply, and withdraw my consent to be governed.

And if just I, and a relatively few others do, as well?

You hunt us down, lock us up and throw away the key.

And, if a BUNCH if us do, you isolate SOME of us, even if its under tank treads, and “make examples of us” to terrorise/intimidate the rest into compliance.

And, if ALL of us, in UNITY “DO” (withdraw our consent) you are screwed, because you can not kill off the governed who now refuse to be governed by you.

Then you would have nobody to govern.

“In this sense, the theory of the Communists may be summed up in the single sentence: Abolition of private property.” – The Communist Manifesto by Karl Marx and Friedrich Engels

Except, in this case, it’s only the abolition of YOUR private property.

I wonder if they counted all the lay offs of Twitter, facebook, amazon and lane furniture to mention a few.

The problem with the labor statistics is that they were designed to measure labor in an economy that no longer exists. A century ago, the vast majority of people who didn’t work went hungry or dropped into the underground economy. Today, there is an entire generation of men who choose not to work because they don’t have to. The Trust baby population is very large and growing. More importantly, the underground economy is also exploding and was huge to begin with. That is why the government is determined to have employers explain cash outlays of $600+.

That helps explain seemingly nonsensical statistical oddities like the unemployment rate going down at the same time the participation rate goes down. We need to modernize our statistical modeling so statistics are meaningful. I don’t place much importance on the employment data. It’s even worse than the oil inventories reporting.

Judging by the numbers I guess all that IRS hiring is complete.

Supposedly the Biden administration is quietly demanding they count undocumented workers in these tallies…which has only been done before in the run-up to Obama’s second election. That’s why the numbers aren’t jiving with economic reality anymore.

So it’s a government agency fully captured like every other government agency these days. One has to admire how Obama’s team did what they set out to accomplish – thoroughly take control of every organ in the Federal government and leveraging said control for retaining power.

I do not now nor will I EVER admire what obummer’s team did and is doing. You must be joking!! Next you’ll be calling him brilliant; the one who is the devious son of satan.

We’re transiting to a servitude economy.

Corruption and dishonesty have become the hallmarks of much of what the government says and does.

The glide-path of our decline was set from the days of LBJ but Obama altered the trajectory into a much steeper dive. Everywhere you look carefully you see the his fingerprints and minions, and the consistent way the choices government makes benefits China uniformly cannot be coincidental.

Well, it started with Wilson, not LBJ.

And, in order to GET LBJ in there, they had to first eliminate two who would not have gone along with their plan for Viet Nam, the way LBJ did, as a useful stooge.

So, CIA got rid of one (B. Goldwater) by political assasination, and the other (JFK) by literal assasination.

If you look, you will see the Uniparty fingerprints all over that, with RNC, DNC, MSM and I/C collusion and conspiracy and a “silent coup”.

Once you open your eyes, its not that hard to SEE.

5.1% annualized wage growth is still 2%-3% lower than inflation, meaning reduced real wages. And, in keeping with what Sundance says about folks having multipl McJobs, labor force participation is still about 1.2% below what is was Feb 1, 2020. So even if you believe these numbers, they are still pretty beak.

bleak… lol

I believe the spike in the service “experiences” sector is a temporary one. Coming out of the lockdowns and normalizing people want some kind of a release. Wage growth is below inflation. I think whatvee re seeing is the calm in the hurricane before the back end hits.

Also CA payments part of ‘wage increase’ and some other one time pmts.

Juiced # for the Potato talking point.

Cooked books.

Let me get this straight.

We’re supposed to trust their #’s, that make no sense, on jobs when they can’t even accurately and transparently count marks on a ballot?

Riiiiiiggght!

Simple explanation. Every business is hard up for help. There are help wanted signs everywhere. Businesses have closed on certain days not due to a lack of activity but due to having no help at all. The crash in employment is always the last segment of the economy to collapse and it will still happen but just not yet.

They probably would have all the help they need if they paid better and did not require stellar resumes.

A bit of an incorrect ‘angle’, if I may say so. These last couple of generations, the principle is not “we will save until we are ABLE to pay for what we want/need, WITHOUT CREDIT”… it is “I want/need it NOW, so let’s buy it even if we don’t have the money in hand”. Many folks who were born in the 30’s and 40’s, believed in ‘purchasing’ only once they had the money ‘in hand’… and, disdained CREDIT. Many of those same folks (I am one) took any job, worked hard and honestly, and APPRECIATED whatever wage was offered. “paid better” be damned.

Kudos, Sturmudgeon! You grabbed mike by the nose and kicked him in the a**!

Significant increase in low-paying jobs. Loss of higher-paying jobs. Dem utopia, gutting the middle class. Good job, Brandon!

It occurred to me as I read this that the 20-30 somethings aren’t interested in the actual cost of things, just in whether they can handle the monthly payments. About the time the item is paid for its unserviceable (like cell phones) and they start over. Sounds like owning nothing to me. I don’t think they’re very happy for the most part though.

I experienced the inflationary wage growth a few days ago having Les Schwab change take off summer tires and put on my winter tires whic is mostly labor with some administrative costs included.Last winter cost $79. This winter cost $99.

I like Trump’s version of wage growth with low energy, low unemployment and strong GDP growth.

Those are now the good ole days. People forget how good we had it under Trump prior to the Covid coup.

The coronacoup and twittergate destroyed our republic.

Please read the zerohedge.com article out today on the cooking of the BLS books: 2.5M unaccounted for jobs. This administration lies about EVERYTHING.

What about the traditional extra hiring this time of year for the holiday season? Most of those jobs are temp jobs, not full time henceforth. I think a more realistic look at the job market will be had in January or February, not November or December.

“more realistic” does not appear in this administration’s dictionary. Believe NOTHING coming out of that hole.

Zerohedge had a good take on this, the numbers are fabricated.

https://www.zerohedge.com/markets/something-rigged-unexplained-record-27-million-jobs-gap-emerges-broken-payrolls-report

Its totally possible to spend more than your income on eating-out, entertainment, gadgets and lifestyle.

Even if you are making good money, the busier you get, the more likely you will eat out 3 times a day. Easily 100$ a day. Thats 700$ a week. 2800$ a month. If the entire family of 4 lives like that, that’s 14000 a month just on freaking food.

Ad, Uber, and online subscriptions. There goes your income.

Its the SUBSCRIPTION Economy