The pretending from the federal reserve chairs continues. In this interview, Neel Kashkari, the head of the Federal Reserve Bank of Minneapolis, says “we keep getting surprised” by data on inflation, which continues to be “higher than we expect, across the broad range of the economy.” Yet, notice that Kashkari refuses to outline the single cause of the broad inflation is the intentional lack of energy production. [Transcript]

Kashkari continues the selling point that demand side inflation is being targeted because demand still exceeds supply. That’s essentially true, however, it is the supply of energy that is fundamentally disrupted by Joe Biden energy policy. It is not consumer demand for goods and services, it is the structural need for consumers to have consistent, affordable energy resources.

The collapse of energy production from domestic coal, oil and gas development is the problem. Everything else is ancillary to the origination problem. However, in order to support the climate agenda, the Federal Reserve must pretend not to know this. WATCH:

Kashkari notes a serious problem can arise when wage inflation starts to catch up with inflation overall. THAT just happened last month. The combination of wage inflation to match the high consumer inflation then drives an even higher cost for goods and services. This is the inflation storm that leads to hyper-inflation, structurally high inflation that cannot be controlled by any monetary measure, and unfortunately, we just entered the first outer bands of this inflation hurricane last month.

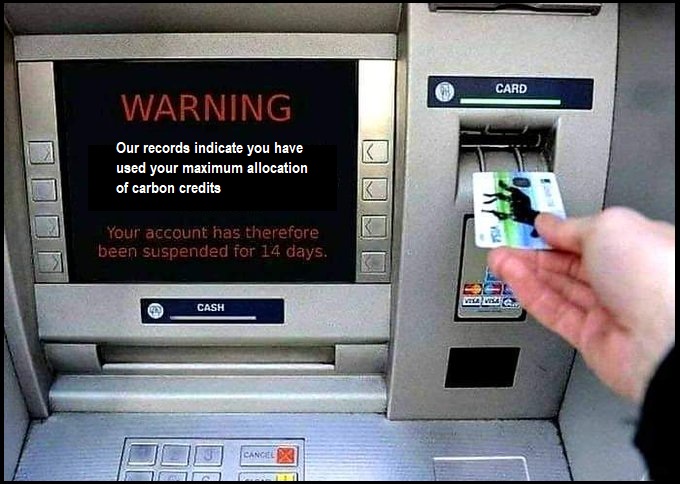

A personal sidenote: when we were going through the pandemic crisis and response in 2020/2021, CTH took heat for saying the real objective at the end of the pandemic path was the global climate change agenda. Well, here we are. At the end of this climate change path is full control over human activity using digital currency. Hunger games.

[Transcript] – JOHN DICKERSON: We turn now to the president of the Minneapolis Federal Reserve, Neel Kashkari. Good morning, Neel. Inflation–

PRESIDENT OF THE FEDERAL RESERVE BANK OF MINNEAPOLIS NEEL KASHKARI: –John, thanks for having me.

JOHN DICKERSON: Thank you for being here. Okay. Everybody wants to know inflation, still hot? What is it? What does it look like to you?

KASHKARI: It’s very concerning, you know, we keep getting inflation readings, new data that comes in, and as recently as this past week, and we keep getting surprised. It’s higher than we expect. And it’s not just a few categories. It’s spreading out more broadly, across the economy. And that’s why the Federal Reserve is acting with such urgency to get it under control and bring it back down.

JOHN DICKERSON: Wages within that, what does the wage picture look like in two different ways, we measure it, both just on its own, and then relative to inflation?

KASHKARI: For most Americans, their wages are going up, but they’re not going up as fast as inflation. So most Americans, real wages, real incomes are going down. That’s why families are finding it increasingly hard to make ends meet. When they go to the grocery store, when they buy necessities, they’re not able to buy as much because they’re getting a real wage cut, because inflation is growing so quickly. I mean, typically we think about wage driven inflation, where wages grow quickly. And then that leads to higher prices in a self fulfilling spiral. That is not yet happening. High prices and wages are now trying to catch up to those high prices. Those high prices are being driven by supply chains and the war in Ukraine, among other factors. And so we need to get the economy back into balance before this really does become a wage driven inflation story.

JOHN DICKERSON: Let me ask you about a figure that people may not know as much about, everybody knows about the consumer price index and inflation, the economic cost index came out this week. And some economists look at that as a signal for inflation. Tell me what you saw in the economic cost index this week.

KASHKARI: Well, we have a lot of different measures, for example of wages, of what’s happening to wages. And ECI, as I call it, is one measure that it’s a- it’s a robust measure of what’s happening to wages and what’s happening to benefits, and wages continue to climb. And on one level, that’s a good thing. We want Americans to be making more money. But if wages are climbing, such that the economy shows that it’s overheating, that tells me that the Federal Reserve has more work to do to bring inflation down to bring the economy into balance just at its basic level. Inflation is when demand is outstripping supply. We know supply is low because of supply chains, because of the war in Ukraine, because of COVID. We hoped that supply would come online more quickly, that hasn’t happened. So we have to get demand down into balance. Now, I hope we get some help on the supply side. But that doesn’t change the fact that the Federal Reserve has its job to do, and we are committed to doing it.

JOHN DICKERSON: We have 30 seconds left. Help on the supply side, what does that mean?

KASHKARI: Well, I talked to a lot of global businesses who are trying to get their supply chain sorted out so that they can meet their customers’ needs and make sure that there are products on the shelves. They’re making some progress. There’s some signs, it’s getting better, but it’s taking a lot longer than they thought and that I thought and so that means we cannot wait till supply fully heals. We have to do our part with monetary policy.

JOHN DICKERSON: We’re gonna take a commercial, we’ll be back to continue this conversation with Neel Kashkari. Stick with us.

JOHN DICKERSON: Welcome back to Face The Nation. We continue our conversation with Minneapolis Federal Reserve’s Neel Kashkari. Neel, let’s pick up where you left off on this question of supply. When I was talking with two senators earlier there was this debate about whether taxation on companies that don’t pay a minimum level of taxation will have their supply hurt. So in other words, you tax- tax them supply goes down, that hurts with inflation. What’s your assessment of that?

KASHKARI: You know, long over the long term, that’s probably true. On the margin, people say that about raising interest rates, why raise interest rates, that’s going to make it more expensive for firms to invest. And that’s going to not help with the supply side. That’s true over the long-term. But over the short-term, the demand side effects totally swamped the supply side effects. And so when I look at a bill that’s being considered that your two senators talked about, my guess is over the next couple of years, it’s not going to have much of an impact on inflation. It’s not going to affect how I analyze inflation. Over the next few years, I think long term, it may have some effect. But over the near term, we have an acute mismatch between demand and supply. And it’s really up to the Federal Reserve to be able to bring that demand down, and we’re committed to doing what we need to do.

JOHN DICKERSON: Neel, help me understand recessions. There is a debate in Washington that’s full of political gamesmanship. So take us inside why it matters if America is in a recession, and what the component parts are, that are a part of that and how that helps us understand the health of the economy.

KASHKARI: Well, it really matters when Americans feel it, when Americans are, especially in the job market. That’s the most important part of the economy, so to speak, for Americans is their job. Do they have a decent place to work and earning decent wages? And typically, recessions are, they demonstrate why job loss is high unemployment, those are terrible for American families. And we’re not seeing anything like that. The labor market so far, is very strong, we are seeing some sectors like the tech sector start to shed workers or start to cool down in hiring. But fundamentally, the labor market appears to be very strong. While GDP, that the amount the economy is producing, appears to be shrinking. So we’re getting mixed signals out of the economy. From my perspective, in terms of getting inflation in check, whether we are technically in a recession or not, doesn’t change my analysis. I’m focused on the inflation data. I’m focused on the wage data. And so far, inflation continues to surprise us to the upside, wages continue to grow. So far, the labor market is very, very strong. And that means whether we are technically in a recession or not, doesn’t change the fact that the Federal Reserve has its own work to do. And we are committed to doing it.

JOHN DICKERSON: Last 20 seconds, Neel, on GDP when it goes down, isn’t that kind of what the Feds trying to do? Slow down growth? So is that a good number?

KASHKARI: Well, we definitely want to see some slowing. We don’t want to see the economy overheating. We would love it if we can transition to a sustainable economy without tipping the economy into recession. There’s not a great record of doing that. Typically when the economy slows down, it slows down by quite a bit, especially if it’s the central bank that is inducing the slowdown. So we’re going to do everything we can to try to avoid a recession. But we are committed to bringing inflation down and we’re going to do what we need to do. And we’re a long way away from achieving an economy that is back at 2% inflation and that’s where we need to get to.

JOHN DICKERSON: All right, Neel Kashkari. Thanks so much for being with us. And we’ll be back in a moment. (read more)

How come no one asks these Fed Members about the decline of US dollar as a reserve currency?

And what impact sanctions and Swift actions against Russia mean to other countries?

And why they may be more inclined to diversify their reserves?

And it’s impact on US dollar?

Fed cannot manage inflation with a Congress that far outspends its budgets.

But maybe they could be concerned about dollar reserve and devaluation?

Let’s keep them focused and critical of overspending Congress.

Probably have to submit a list of the questions that will be ask or no deal.

Love the “long term” argument. We all know that over the long term we’re all dead, so I guess that reduces the demand side pressure.

How can these lying scum bags stand to look in the mirror while knowing the suffering they’re causing in the name of climate change fear mongering? Hell is too good for Joe Biden and his cabinet of soulless liars.

Let’s have Fed talk about currency value.

You know, their purpose.

If Bald Dunce wants to get back to 2% inflation, he’s gonna need to vote differently. Trump 2024