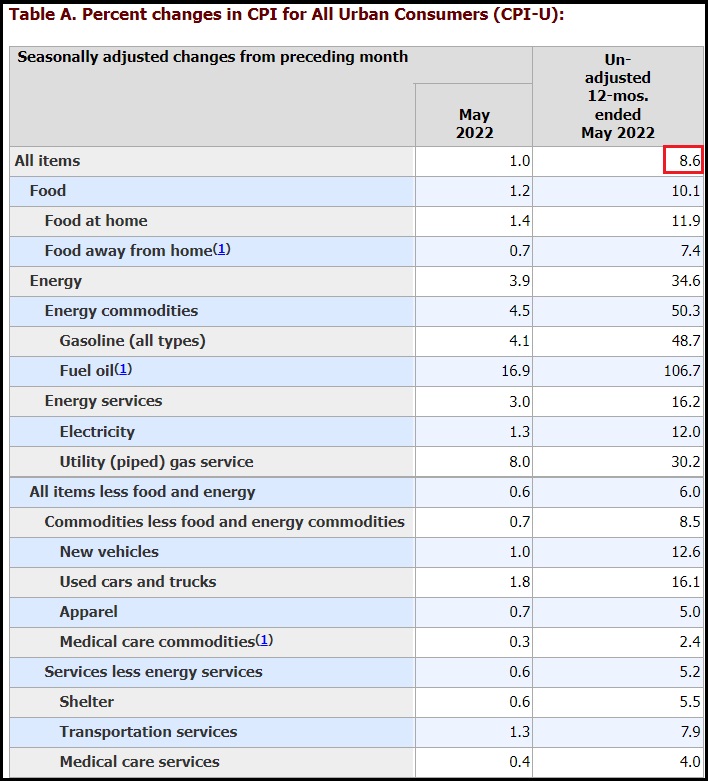

The Bureau of Labor and Statistics has released the May inflation report [DATA HERE] showing a 1.0% increase in the month of May, bringing the rate of inflation to 8.6 percent. The highest rate of inflation in over 40 years.

This month of inflation data is particularly important because it cycles through the May 2021 calendar comparison from last year when the first wave of massive inflation first triggered. The current year-over-year 8.6% rate of inflation now lands atop twelve months of massive increases in prices.

This month of inflation data is particularly important because it cycles through the May 2021 calendar comparison from last year when the first wave of massive inflation first triggered. The current year-over-year 8.6% rate of inflation now lands atop twelve months of massive increases in prices.

The data clearly shows how energy costs are the dominant factor hitting every aspect of consumer purchasing. Gasoline increased 4.1% for the month, 48.7% year-over-year. Fuel Oil increased 16.9% in May, 106.7% year over year.

The energy sector is crushing the ability of consumers to spend on anything else. Real wages declined in May 0.6% as paychecks are being eaten up by massive inflation. On an annual basis wages have declined by 4% year-over-year [BLS DATA].

Unfortunately, there is no forward optimism for any change in energy policy from the Joe Biden White House, that means energy costs will continue skyrocketing as the ideologues in control of the administration push their climate change Green New Deal policies.

Additionally, we still have the third wave of massive food price increases to look forward to later in the summer as the big increases in field costs start to reach the supermarket. Those food store increases will average around 20 to 30% more than current.

Table-2 gives you a great breakdown of the price increases in specific sectors within each of the larger categories. [SEE HERE] Eggs increased 5% in May, that’s a 60% annualized rate of inflation for eggs, which are already 32% more than last year. Chicken is exceeding 30% inflation and growing.

A CNBC media report is below, as Wall Street laments the Fed response. However, the Fed cannot do anything to stop this inflation because what’s needed is a total reversal of U.S. energy policy.

[CNBC] – ““It’s hard to look at May’s inflation data and not be disappointed,” said Morning Consult’s chief economist, John Leer. “We’re just not yet seeing any signs that we’re in the clear.”

Some of the biggest increases came in airfares (up 12.6% on the month), used cars and trucks (1.8%), and dairy products (2.9%). The vehicle costs had been considered a bellwether of the inflation surge and had been falling for the past three months, so the increase is a potentially ominous sign, as used vehicle prices are now up 16.1% over the past year. New vehicle prices rose 1% in May.

Friday’s numbers dented hopes that inflation may have peaked and adds to fears that the U.S. economy is nearing a recession.

The inflation report comes with the Federal Reserve in the early stages of a rate-hiking campaign to slow growth and bring down prices. May’s report likely solidifies the likelihood of multiple 50 basis point interest rate increases ahead.

“Obviously, nothing is good in this report,” said Julian Brigden, president of MI2 Partners, a global macroeconomic research firm. “There is nothing in there that’s going to give the Fed any cheer. … I struggle to see how the Fed can back off.”

With 75 basis points of interest rate rises already under its belt, markets widely expect the Fed to continue tightening policy through the year and possibly into 2023. The central bank’s benchmark short-term borrowing rate is currently anchored around 0.75% -1% and is expected to rise to 2.75%-3% by the end of the year, according to CME Group estimates. (read more)

We are in an abusive relationship with government…

Obama Plan

more like Globalist Plan. Printing money is taxation.

Same plan.

exactly

Oscambo is a pox on this country.

And still having a TON of influence over the illegitimate puppet in the White House. Hey, Dems, hold on to your hats…there’s a hurricane coming on Nov. 8th.

Headlines six months from now:

The pharma companies have developed yet another “miracle” vaccine that will reduce the morbidity rate from the malnutrition pandemic by 98%. Just keep getting the boosters and all will be fine. Swear.

And there will be people who believe this.

But the supplements needed to complete the treatment must be taken with dehydrated water pills.

“dehydrated water pills”. LOL

Sadly, you are probably right.

How does increasing interest rates help when most of the inflation pressures coming from gas and oil prices which soared because of Biden’s energy policy!

Increasing interest rates while still printing money ensures maximum pain for Americans, which is of course the objective.

You are correct. It wont help one bit. Federal Reserve thinks they can slow this inflation cycle down and they can’t. It’s the fuel prices that are baked in and continuing to escalate. All of this will drive inflation to unreal highs through the end of next year. Plain and simple. Fed Reserve is only going to continue to crush stocks, send real estate into a total and complete free fall, and stop any growth business trying to raise capital. This will get ugly. Jimmy Carter ugly. This will also put pressure on int rates servicing our out of control national debt, too. Good God. This will end badly. For all of us. Can you say AFTERSHOCK! As in financial aftershock.

Jimmy will be 98 this year. Having lived and worked as an adult through his administration, if I were to compare, I’d give him a hug and thank him for the memories, compared to current times and especially what I perceive to be awaiting us. Good news is he’ll likely die of natural causes. I doubt I will.

My real life example of that era was working as an apprentice carpenter and using diesel as a comparison. Back then, at the tail end of the gas shortage and high prices, I could buy 20 gallons of diesel for one hour of pre-tax labor.

Today, in the same local area of California, I’d have to make about 120-130 bucks an hour to do the same. How many young blue collar workers make that kind of coin? As comparison, when I closed my machine shop in the area in 2020, the shop rate for customers was 125/hr. Shop rate. A bit lower than some but still pretty competitive.

I think we’ll easily eclipse the violence levels of the 60’s and 70’s too once things get warmed up. No assassinations yet. Just some mercenary action by government operatives and the J6 orchestrated theater going on right now. Throwing bread and running circuses appeases the prols for only so long.

And most of it will be aimed at white and old people.

I don’t think so. It’s the ghettos and downtowns that will burn.

They don’t!

Interest rates are an incredibly blunt and cruel monetary tool.

Farmers, truckers, delivery service vehicles, manufacturers, storage facilities are all impacted by higher energy (fuel) costs. Cost of production and delivery all along all supply chains are rising. Consider farmers, truckers, manufacturers all paying off machinery and equipment upgrade loans and then they get hit with higher interest rates on those loans. Many will fold as the cost of money increases and demand for their products declines. The productive sector of the economy will take a massive hit, so expect more bankruptcies and then long lines in the unemployment queues if interest rates continue to go up. Remember what Obama said about Joe’s ability to F things up, because this time he really has.

ITS FIXABLE! Open the wells and energy. Simple. And it can be done relatively quickly.

Not so much dumb as an evil doer.

If you doing Christmas baking you might want to start buying some of the

items now. the non perishable items. Chocalate chips, candies, Vanilla

extract, Sugars (both brown and white or confectioners) everything you would

need that can be stored…

Same with Thanksgiving start buying your non perishables now. like stuffing mix,

cranberry sauce, if you make pies get your pie fillings..

Also might be a good idea to start Christmas shopping if you have ideas

of what to get..

Grateful that I have a family that likes whatever we have. Our only traditional holiday food is Bread Pudding, in honor of my late father. I am confident I will have plenty of stale bread and fresh eggs.

My grandmother invented recycling. I carry her tips and tricks with me and taught them to my children and now to their children. Being resourceful feels a lot like being wealthy, but without the money.

I wouldn’t worry about it. I heard a clip today on the radio. biden said he’s going to make it his priority ! So I guess we’re all set and it was just a minor blip because he was focused on so many other things that are making life better. Like Ukraine, Jan6th, and much more

I wonder what’s been his priority up until now?

Oh yeah, causing this mess.

I forgot.

These numbers are under reported grossly and do not include many of the items we purchase that have doubled in price. We know for example that gasoline has doubled in price under Biden, and now “Shrinkflation” is biting us as we are paying the same price for less quantity as products are being sold in smaller weight and volume packages.

Joe Biden’s inflation. This big spending and more borrowing must come to a screeching halt.

Gasoline prices are UP 48.7%

Used Cars prices are UP 16.1%

Meat/Fish/Egg prices are UP 14.2%

New Car prices are UP 12.6%

Electricity prices are UP 12.0%

Food at home prices are UP 11.9%

Food away from home prices are UP 7.4%

Transportation prices are UP 7.9%

Are these numbers last month or this week?

Yes. They do not factor in the shrinking quantity of the items we purchase. It now costs more money to buy a smaller size of a product.

Hey SD, trusting God is with you and you are protected, well on the road to restored health.

As for your post, nothing to say that hasn’t already been said. Of course I think of one thing: seems the most certain route to armed revolt is hunger. If armed revolt, OGUS (h/t Micael Yon, occupying govt of US) pulls out the military to squash it and a forever state of martial law is implemented. We’ve already seen the Constitution doesn’t matter to them. Nothing to stop this.

We’ve been mighty blessed to have lived such comfortable lives in much of the country for so many decades. Our ancestors survived terrible terrible times, so can we, especially with receptivity to God’s grace. May all beings everywhere know the roots of happiness.

Remember what the government did to the Bonus Army in 1932. That was unarmed war veterans.

Difference between then and now is we can literally shoot holes in their propaganda. We know. They know we know. We know they know. There won’t be any BOTD or compassion when things go down. None. Zip. They made their choices. Big difference from incompetence or events beyond human control. They chose. Choices have consequences. God will sort it out.

Maybe that’s why MacArthur got sent to wage war in Asia in WWII. He practiced on his own vets.

Wasn’t it a few days ago that the junta said Americans are better off than ever before????

Larry Summers Says Fed Forecasts Look Ridiculous, Warns on Rate Delay

https://www.google.com/amp/s/news.yahoo.com/amphtml/larry-summers-says-fed-forecasts-173126927.html

The little elfin who is (trumpets) “the first openly gay female person of color to be a White House press secretary” is going to get massacred when the data comes out and people realize they have lost more than that 16-cents for the 4th of July BBQ.

Heads up… Time magazine has an article on feminine personal product supply trending in Twitter today. Wouldn’t Incontinence products be in same boat?

https://nbc-2.com/news/national-world/2022/06/10/tampon-shortage-hits-u-s-as-supply-chain-issues-persist/

the graphs show year-over-year increases (i.e. comparing May, 2021 with May, 2022). What about comparing May 22 with December 2020 (last full month of Trump economic data)?

Biden can blame , Russia, China or Timbuktu. Those high gas prices at the pump is the Green New Deal in action. Thank Obama for signing the Paris Accord in December of 2015. Bidens presidency is Obama’s 3rd term, Make America Last

Does the idiot currently occupying the WH really think we are going to believe his continued lying about the reason for high gas prices? Please! Time for impeachment!

He stopped thinking some time back.

Many who survived Covid-19, will not survive the economy.

Potatus solution to his energy/food crisis is increasing handouts to his parasite class and illegal alien super citizens, which will cause even more inflation. Torches and pitchforks coming soon when people can’t afford to drive and can’t feed their kids. Gee, I can’t think of any gov in history that was overthrown when people went hungry. (sarc)

Hence why they are desperate to disarm law abiding citizens.

Have we yet mentioned who owns all the farmland that produces the corn that makes the ethanol?

Increasingly, those owners are Bill Gates and, in Texas anyway iirc, China.

So those who own the land will control the corn production and will increasingly control the cost and supply of gasoline and the feed lot supply for beef, pork, etc., let alone use for our own food staples.

Isn’t corn a main staple in the diets of all those South Americans they’re importing? Care for a food riot with your Tortilla?

Heck, that farmland would be better used for solar panels from China, yes? (yes, /s)

You will eat bugs, and you will like it.

I was in a relationship in the past where I was abused.

I left.

My life got MUCH better.

Maybe the conservative states should consider it?