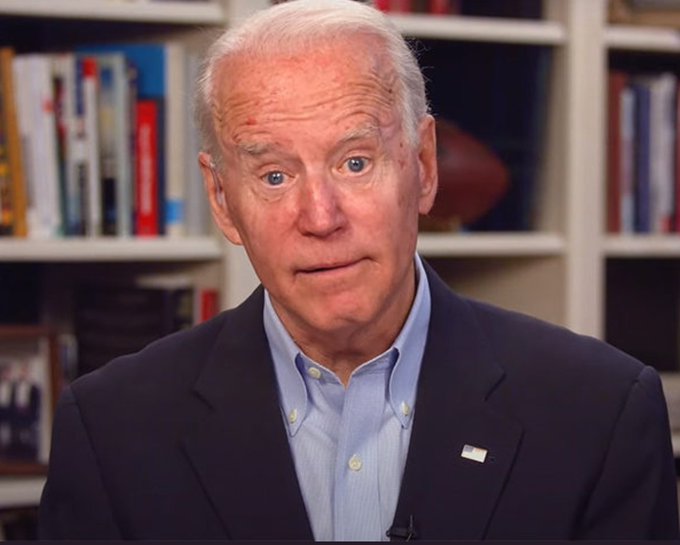

Think about the logical insanity of this position for a moment…. According to the Biden administration the economy is in trouble, people are struggling, and congress needs to spend trillions to bail out state, local and federal governments along with sending income subsidies to all Americans as the economic crisis around COVID continues.

Due to policies on energy, regulation and the COVID virus, simultaneously food prices are going higher, fuel prices are up 30 percent, overall energy prices are rising, transportation costs increasing and the inflationary impact on the middle-class is eating up their limited paychecks.

Due to policies on energy, regulation and the COVID virus, simultaneously food prices are going higher, fuel prices are up 30 percent, overall energy prices are rising, transportation costs increasing and the inflationary impact on the middle-class is eating up their limited paychecks.

AT THIS EXACT MOMENT the same administration is now proposing a tax increase.

THINK ABOUT THE LACK OF LOGIC HERE.

(VIA AXIOS) […] The biggest-ticket item would raise the corporate rate from 21% to 28%. That’s worth $730 billion over 10 years, according to the Tax Policy Center. The other three would:

- Impose a global minimum tax on profits from foreign subsidiaries: $550 billion.

- Tax capital gains as regular income for the wealthy and tax unrealized capital gains at death: $370 billion.

- Return the top individual rate for those making more than $400,000 to the pre-Trump rate of 39.6%: $110 billion.

[..] Democrats close to the White House don’t expect Biden to fight as hard for other expected proposals, including one that could raise some $740 billion by imposing new Social Security taxes on the wealthy.

-

- His campaign plan to impose a 28% minimum rate on the wealthy, which would raise $220 billion, is unlikely to cross the finish line.

- And making it harder for small businesses to claim deductions, which would bring in $140 billion, will likely encounter serious roadblocks.

- Changing the ways estates are taxed, which would raise $220 billion, may not make it into the final legislation. (read more)

Freakin’ fools! They’d bankrupt a free lemonade stand!

Of course massive tax increases don’t raise revenue at all. Just the opposite.

People/businesses adjust their behavior, growth slows and ultimately tax revenue declines.

This is all intentional on the part of the get rich quick schemers in DC.

What’s amazing is how many times a great number of Americans watch it happen over and over, experience this destructive behavior, yet can’t seem to grasp who the recycled bad guys are.

Massive tax increases don’t necessarily lower revenues. As a rule they never generate as MUCH revenue as the static projections used to calculate them project, but that isn’t quite the same thing.

That isn’t to say that some tax increases don’t crater both tax revenues AND the industry taxed; the prime example there being the now non-existent luxury boat industry that use to feed a fair bit of the northeast. The extent to which it either doesn’t meet projections depends on the elasticity of the demand curve and the ability of consumers to avoid the tax. The more elastic the curve the less revenue generated (or more tax revenue lost in those cases where it does go negative).

Now applying that to Dementia Joe’s plan, the areas of the economy he CLAIMS he is targeting are precisely those bits of the economy with the highest elasticity and most ability to avoid. If you don’t want to be taxed at those rates on your profitable corporation it is fairly easy to stop: Sell/shutdown the plant and invest in stocks, bonds, and or tax-exempt vehicles. So yes in this instance Dementia Joe is far more likely to damage the economy than help it.

Why not tax sales of marijuana at 100%, Starbucks coffee at 200%, electric vehicles at 300%, and property taxes in Loudon County, Virginia at 500%?

Want your country to self implode? Put democrats in charge! “Nobody does it better”!

Danger Will Robinson!