As we have often discussed on these pages, inflation would ultimately moderate and plateau not because prices were dropping but rather because of the calendar cycle.

As the economy cycles through a year of large price increases, the current inflation rate cycles through to the period when prices first increased. This calendar cycle means continued price increases are lower as a percentage and thus the inflation rate appears to modify despite prices continuing to rise. [BLS Report]

As the economy cycles through a year of large price increases, the current inflation rate cycles through to the period when prices first increased. This calendar cycle means continued price increases are lower as a percentage and thus the inflation rate appears to modify despite prices continuing to rise. [BLS Report]

This scenario, prices remaining high and continuing to climb – yet lower as a percentage, now provides the justification for the federal reserve to state inflation is moderating.

(Via NBC) – Amid signs that price growth in the U.S. economy is rapidly cooling, the Federal Reserve announced Wednesday it was slowing the pace of its rate-hiking program designed to tackle inflation — but that more hikes were still on the table.

The Federal Open Market Committee said it was increasing its key federal funds rate by 0.5%, after announcing four-straight 0.75% hikes at its most recent meetings. In its Wednesday statement, the Fed said it continues to target an inflation rate of 2% over the long term and would continue to increase the federal funds rate to do so.

“Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures,” the committee said.

But bringing down inflation is likely to come at the cost of higher unemployment in the short term: The Fed said it now projects the 2023 unemployment rate to average 4.6%, equating to hundreds of thousands of more jobless workers compared with the current rate of 3.7%.

The Labor Department on Tuesday reported that annual inflation clocked in at 7.1% in November — the lowest reading in more than a year. While it is still high compared to the 2% level at which the Federal Reserve typically seeks to hold down inflation, the most recent number signals that the galloping price growth earlier this year is fading. (read more)

Prices will never drop because the supply side pressure from a new energy policy remains as the driving factor.

Demand has dropped throughout 2022 as the U.S. economy, gauged in units of product sold, has contracted. Consumers are not buying non-essential goods or services as the costs of housing, fuel, heating, electricity, overall energy and food prices continue rising.

Despite the economic contraction that is lowering energy use, rapidly increasing energy costs continue to be the driving force of inflation.

This period of depressed economic activity will continue as unemployment begins to become problematic. As a nation we will remain in this economic malaise as long as Green New Deal, Build Back Better, energy policy is maintained.

On the positive side the economic shrinking is reversable with new energy policy; however, the opportunity to make that change is several years away. In the interim, the cost of living will remain the biggest challenge for the foreseeable future, and the inbound open-border migration will keep wages depressed.

Under the economic program of Joe Biden wages must be depressed in order to avoid production inflation (higher labor costs) from piling atop the energy policy inflation. Thus, the border influx will continue.

The gap between the haves and have nots is also going to explode in the next five years.

inflation like you said plateaus because of how they measure it (the year over year or month whatever).

to me, that basically means they are getting me use to a new HIGHER price and telling me its good cause inflation is lessening.

will that price ever lessen?

No.

Prices will continue to rise. The Beginning

The US dollar is strong right now because investors are fleeing the EU’s economic seppuku by parking their money in the US.

Eventually that process is going to end.

Also eventually, Team BRICS will establish an alternative system to the petro-dollar.

When that happens the Weimar Wheelbarrow will be back in vogue.

But I suspect the We(F)st is going to try and avoid such a meltdown by adopting digital central bank currencies. And if it can’t avoid such a meltdown, that meltdown will become a justification to introduce central bank currencies.

All roads lead to Rome. All routers lead to Davos.

SD tweet from yesterday – showinng China requesting purchase in their currency in Saudi Arabia.

Gold backed currency. China and Russia.

No, because that would be called deflation and we can’t have that.

…..and your life savings will buy less and less at the higher base prices.

How does the Fed measure SHRINKflation? When virtually every packaged food has incrementally shrunk? I’m paying MORE to get less and less.

That important point is being left out of the news.

Shrinkflation stops when Bath tissue becomes the size of a postage stamp.

Then they will tell us to use our hands and “wipe it like a man”.

Stone Age here we come.

Thank you Sheryl Crow …

……and your retirement nest eggs buy less and less.

And how does the Fed measure what Safeway does? It changes product prices almost daily … to the point that if you don’t shop every day … you almost BELIEVE that 3 for $5.00 is a “sale” as advertised … if you hadn’t been buying the same product at 3 for $4.00 for weeks.

I find it hard to believe that Safeway actually pays that kind of variable wholesale prices as they rotate at the retail level.

Kenji I totally agree. Kroger is king of the bait and switch. If you are not aware of the pricing complexity at the major, and now regional, food retailers a person will get taken advantage.

the price is labeled on the shelf but 25 cents more at the register

Hey W.B. the higher prices and shrinkflation will continue to increase until morale improves.

I hope we dont get to use to the beatings

W.B. you must have missed the memo.

We LOVE the beatings. (apparently, based upon the utter lack of outrage among the populace)

Once a month I buy something I need and it costs me a dollar. Next month the price increases by a dollar, a 100% price increase. Yikes! Every month I buy the same item and every month the price has increased one dollar. After 100 months of this the item costs me 100 dollars. Next month the price again increases one dollar, but that calculate to a 1% increase. Look, the slime ball politician exclaims! My sound economic policy has reduced your price! It only went up 1%! That must mean things are getting less expensive. Vote for ME! Meanwhile the cost of the thing I need has risen to the point where I have no choice but to go without. Price increase vs rate increase. Fun way to hide the costs. If I remember correctly they call it related rates.

yea- I’m noticing myself getting less and less of comfort food or quick cook food.

making a meal last a few.

not the life i expected making as much money as i do.

That is a really good example of how it works!

You think it’s bad now, just wait until the newly hired 86,000-armed IRS agents (Brownshirts) start spreading out to collect on the inevitable new taxes coming our way and on $600 purchases on Venmo.

First order of business for the new House is to defund the insane expansion of IRS Police. A promise they better make good on.

Biden: “Your exploding variable rate credit interest rates, I DID THAT!”

sure is nice how THEY got to buy homes at lower cost with 0% interest in 2020.

and now we cant buy shit.

My first mortgage was 18.5 percent but you have to start somewhere. No matter the economy as it is always changing.

All this is just moving deckchairs on the Titanic.

The simple fact is that ‘increases’ in GDP are driven by ‘increases’ in energy consumption. Yet debt (IOUs for future energy) are growing exponentially while the ‘Green New Deal’ is ‘reducing’ energy consumption, GDP down.

Also the problem is not CO2. The problem is running out of fossil energy before we can stand up a 2nd gen nuclear.

and you an I will type in the room on the titanic before it leaves the shore, knowing what is going to happen, but feeling to ALONE to stand.

We aren’t alone, even if we are outnumbered.

yep.

i believe a spontanous rising will occur from a bunch of “alone feeling” people at the same time.

We are far from outnumbered.

We just need to get our priorities back.

No, Spaul you are mistaken. The real problem is that the elite plan on living forever, and they don’t want want US using up all the things THEY will need for eternity. They don’t want us depleting the soil, burning the oil, or drinking THEIR water.

All that farmland that Gates is buying— Has anyone looked into what is BENEATH that farmland?

Why do they want to live forever? Once they kill us all off things will get pretty boring, pretty fast.

Perhaps eternal life is to put off the undesirable day of meeting their maker?

W/re Living forever: I agree with you. In my humble opinion, they’re terribly afraid of what awaits them when it’s finally time to meet their maker (and they all know, deep down, that there will be an eventual reckoning and a comeuppance.)

Personally, the thought of them facing God’s justice makes me smile. I will pray for God’s mercy because He asked me to, but mercy requires a desire for repentance and I don’t think any of them even feel they’re doing anything wrong as they wreck others’ lives for their own gain.

I believe that they are luciferians.

As such, Lucifer is the good guy, the saviour.

Jesus and the Father are bad, kept mankind in ‘darkness ‘.

In the Garden, Lucifer opened their eyes, they were enlightened.

They know that the greatest battle is coming upon the earth.

They believe that lucifer will win it.

He also promises eternal life…… lol.

Just my humble opinion, but I would venture to say it would be stunning to learn just how many of those “elites“ are already living with purchased organs “donated” involuntarily.

All this means is that they play games with numbers to make themselves look good when in reality the economy is getting worse because of their deliberate policies to make it worse. As has been said many times “Don’t pee down my leg and tell me its raining”. Unfortunately too much of the country still thinks it’s raining

Half of the country LIKES having someone pee down their leg!

Damage is done. Food and other costs have skyrocketed. They won’t be coming down. And wage growth will take years to catch up, if at all.

Jar of Hellman mayo used to be $3.50. Now $6.50.

I hate mayo. But $5.49 for 30 fl oz here.

In the 70s there were reports of the elderly eating cat food as that was the protein they could afford. Now cat food is unaffordable!

I recently had to buy a traction device for cervical degeneration. My physical therapist recommended to put dry beans in the thingy instead of water for weight.The 10 pounds of beans cost more than the traction device. Lord help us….

And the cat food tastes like shite now! Oh the good old days of quality meat by products, sigh!

When you find good tasting cat food let us know. Nothing like having a cat food tester in the crowd.😏

I gave up on cat food. Fresh bugs now. Nightcrawlers make a pretty tatsteless omelette BTW. 😉

It’s like eating snails; the sauce is what counts 😉

Yummy !!!!

Apparently the affordable wet stuff is made in Asia; most of what I buy comes from Thailand. The salmon and turkey & giblets pate isn’t bad.

However, the cat gets to eat some human food, nice albacore tuna and beef. Why? Cat food isn’t covered by SNAP; human food is. All depends what’s left in the tiny food budget each month. Adapt and overcome.

The average inflation across all cat food items in my pantry for 2022 is running just shy of 20%. Human food that the cat eats, better, about half that.

Unless things have changed recently, albacore tuna contains more mercury than regular tuna.

I listened to Powell. He lamented that employers are reporting to the Fed surveyors that they are hesitant to let employees go because they were caught without them recently.

Think about that. Employers are attempting to maintain the status quo for their employees, and the Fed tells them ok. Then we will add another 50bps until you fire them.

But, he did reassure everyone that they are all working to achieve price stability as they had before when the global economy saw unparalleled growth.

I don’t believe for one second that employers told Powell “we are hesitant to let people go”………..BS.

Here is the specific answer to question by Howard schneider with Routeers

CHAIRMAN POWELL: Well, I’ll tell you what the projection is. I don’t think it would qualify as a recession because you’ve got positive growth. The expectations in the SEP are basically as you said, which is we’ve got growth at a modest level which is half a percentage point. That’s positive growth. It’s slow growth. It’s well below trend. It won’t feel like a boom. It will feel like very slow growth. In that — in that condition, labor market conditions are softening a bit. Unemployment does go up a bit. I’d say many analysts believe that the natural rate of unemployment is actually elevated at this moment so it’s not clear the forecasts and inflation are above the natural rate of unemployment. We can never identify its location with great precision. But that 4.7% is still a strong labor market. If you look — you’ve got — the reports we get from the field are that companies are very reluctant to lay people off other than the tech companies which is a story unto itself. Generally companies want to hold on to the workers they have because it’s been very, very hard to hire. You have all the vacancies far in excess of the number of employed people. It doesn’t sound like a labor market where a lot of people need to be put out of work. So there are channels through which the labor market can come back into balance with relatively modest increases in unemployment, we believe. None of that is guaranteed but that’s what the forecast reflects.

https://macenews.com/transcript-feds-powell-answers-reporters-questions-after-fomc-decision/

This is the spitting image of an abusive relationship with a corrupt and totally evil government. Like all structures built upon rotten substandard materials it will collapse.

Unfortunately, right on our *%#!ing heads.

Let us not forget Powell’s statement saying his goal is to get wages down.

https://mronline.org/2022/05/26/u-s-federal-reserve-says-its-goal-is-to-get-wages-down/

So keep that border open!

“The Washington Post, which has lost 500k subscribers in the past year, has announced layoffs are coming to the paper. The meeting didn’t go well.” (Video)

I tried to feel bad for them… but we’re in this mess b/c they consistently LIED to the people. So….

It may only be single digit layoffs. However it is hard to feel sorry for the scum

I’m sorry that video ended before it caught the end of the statement that woman was making, “You seem to be disrespecting…..”

And here comes the education she obviously didn’t get but paid for at university…one way more valuable.

“Life is hard. It gives you the test first and the lesson after.”

Or as CS Lewis said…

“Experience: that most brutal of teachers. But you learn, my God do you learn.”

My Dear Young Woman, welcome to what we call “the real world.” Good luck…you’re going to need it.

The truth will set you free and keep your job in journalism and the business afloat (Disclosure; not sure we can call it journalism anymore).

This is a teachable time we are going through.

Hard times will teach people how to do many things for themselves.

That. Plus the fact that we all knew this day was coming sooner or later. We’ve lived high off the hog because of a ponzi scheme made possible by the dollar being the world’s reserve currency.

The Great Reset plan was/is to inflate the dollar, here and abroad, by printing bazzilions. That’s what the Iraq war was about, and that’s when the dollar’s decline began — and was finalized in 2008. Ubu and his Schwabian henchmen responded with more printing, known as QE, which congress forced the Fed to monetize, creating more inflation. Then Covid: lather, rinse, repeat.

The Fed raising rates is what needs to happen to slow things down and hopefully ease the economic shrinking that must take place if we are to stop living in a bubble. There is no easy way out, but Powell — who was Trump’s guy, remember, and who survived an attempt by Obamasorosbiden to get rid of him — is now, by raising rates, extricating us from control by the globalists, whose goal is to inflate the currency to oblivion, repudiate the resulting debt as a “matter of necessity” and replace the dollar with a central bank digital currency. That’s the path to slavery that we have to worry about. So, when you see the United Nations squealing about the Fed killing children by raising rates, you know we’re going in the right direction.

I don’t care a wit what the numbers show, all I know is that each week I spend more and walk out of the grocery store with less.

FJB!

Sent my son to pick up groceries for me. He came in with 4 plastic bags. 2-3 items in each bag. I thought he had left some in the car. Nope. 102.00. I had the Vapors !!!

The year over year rate is on top of the 7% in December 2021.

Maybe without energy the printers can stop printing money, the paper money that is printed will be as valuable as the price recycled paper. Looks like we are on the road to being North Venezuela.

So very sick and tired of the LIES!

Here’s one for you: Gas goes up $2.00 then it goes down 25¢ and Joe Biden brags about bringing down the cost of gas!

The trick is to leave out any context, and to simply throw meaningless numbers. That’s the game these days.

As they old saying goes, ‘They always lie, even when the truth would do as well.” Being a pathological liar must be a prerequisite for a career in politics.

All part of the plan. As Sundance has pointed out many times, the WEF and NWO have been installing their trained apes into positions of power all over the world since the George Bush 1 era. They have their hands on the levers of power around the world. Police, Judges, Governorships, Mayors, Election Officials, Media, and Military’s. Its the reverse of previous fundamental revolutions in the past, where the people would storm The Bastille or the Palace of the rulers, behead them, and then look around and say, OK, so what do we do now, and who’s the boss? They are playing the long game, and they are having success as long as the majority of people choose to snooze.

They have planned long and hard wonder if we can even stop them at this point. All I can do is not play and hope for the best.

“History may distort truth, and will distort it for a time, by the superior efforts at justification of those who are conscious of needing it most.”

–Thomas Jefferson to William Johnson, 1823

Jaysus, Mother and Joseph!

Lies, damn lies, and statistics.

One other factor to slowing price increases is that retailers are still trying to clear off inventory that is still on the Distribution Center Shelves and other storage areas.

My kids living in Arkansas have major rolls in Walmart Corporate Supply Chain and they indicated during our recent visit that Walmart is still trying to clear stuff delivered LAST YEAR and earlier this year.

There has to be an impact of major sales to clear that inventory in places than Walmart. Of course that is non-perishables. Cost of perishables continues to climb at at more steady, higher rate.

i’ve noticed Canned fish prices are not changing.

Anyone with credit card debt….well, no one has to bring up how much this is hurting us. The idea of raising rates over and over “to curb inflation” — and yeah, don’t bother with theory, the fact is, as we all know, it only means our adjustable rate debt, which means all cc’s, just keep hitting us harder and harder — and do we see one mention of that in the corporate press — or really, anywhere? Naw….

Remember all those stories they specialized in, decades back when the anecdotal leads would always begin with something like:

“Maria and her children paid $5,000 for the three of them to get from Honduras to the US/Mexico border. Now they wait in a processing center, eating cheap, processed, American “burritos,” and already missing their home.

‘If I had known this is what it would be like,’ she frets, pulling off a bite to feed to her toddler…”

Gee, wouldn’t it be great to see one of those now? The family gathered around the ubiquitous kitchen table, “scrawling figures on the back of an envelope, trying to figure how to make the numbers add up…”

But regular ol’ working-class Americans aren’t fashionable anymore, are we? Well, maybe if it was:

“Tom and Peter sit at the kitchen table, their toddler, Freddy smashing Cheerios with his fist in the high-chair beside them…”

My company announced hiring freezes today. One of my neighbors just went through round one of layoffs. I just saw the WaPo layoff story. Stellantis in IL… It’s going to roll over the whole economy in a wave.

Trying to kill the goose that laid the golden egg. The morons at the FED strike again.

How about instead we drill baby drill, install more pipelines, issue permits to expand and build new refineries where they are really needed in the good old USA.

Ahem, that was the LAST President, the one who cared about WE THE PEOPLE.

This is all simply acceleration of the largest transfer of wealth in human history.

Why the hell do you think the fed is doing anything to benefit US? They’re not now, never have, and NEVER will.

I await the final report of the bankruptcy of the Federal Reserve. Everything reported till then is smoke and mirrors.

And I will still earn only .0001% on my bank savings.

Deja Vu all over again

It always amazes me how the same people vote these same bums in over and over and over.

That, to me, is an ominous and flawed aspect of the human race which produce these horrendously destructive episodes.

Unfortunately, as long as the human race reproduces, we can expect a continuation of the cycles we’ve seen throughout history until the species goes extinct. We’ve shown no sign of evolving, yet, that I can discern.

It’s no accident that we keep regressing to the Master-Serf mean. No matter how much any society moves toward individual freedom, the psychopaths among us rise up to crush everyone else.

Fake Ballots Great Again

The FED is is using a new formula for nirvana. Exactly same formula that got us here. 31 trillion in debt. Debt to GDP we rank number 12 in world.

That doesn’t include un-funded liabilities like social security, medicaid, etc. Its much worse than 31 Trillion

The rate hike is not to tame inflation but to accerlerate the wealth transfer from the middle ( and what’s left of the lower class) the the wealthy. Notice I used the word “wealthy”. 1/2 of the “upper class” is living paycheck to paycheck and are just a slip away from joining the unwashed masses. Expect anarchy to begin in the next 18 to 24 months.

This has never been about inflation. Inflation is a pretext. This is rather about forever removing QE from the central bank toolkit, ending the “Fed Put” as it were, and breaking the back of the offshore Eurodollar market. In other words, defending the sovereignty and integrity of the US dollar from certain collapse. And the Fed (more specifically its Wall Street owners) is/are prepared to wreck the national and global economy to do so, if necessary.

I don’t doubt it Sundance .

When do you think they’ll force the digital dollar ?

All this build back better stupidity is not going to end well for anyone, and I predict will lead to violence from desperate people who have nothing to lose. People can only be financially stressed so far.

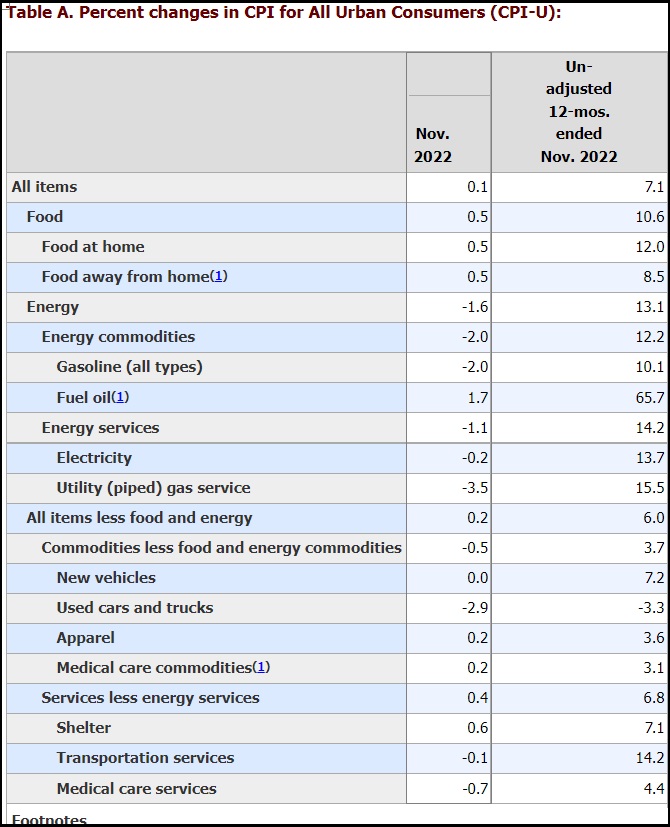

The CPI table leading this thread does not have anything to do with fed interest rates.

The fed uses only one thing to determine whether or not to raise interest rates.

That one thing is an index called the Personal Consumption Index (PCE).

The PCE they use does not include food or energy effects. Which is why your food and gas costs have nothing to do with the fed setting interest rates. IOW the fed could care less what you pay for food or gas.

The reason the fed is lowering the rate now is because the latest PCE they use has dropped from about 4.7% (6/30/22) to 4.6% (11/30/2022)

The fed target rate is 2%. That is, when the PCE is at 2%, the fed will stop raising interest rates. So you see, they have a long way to go.

https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA

Keep pushing interest rates until the real estate market breaks and then I will rid myself of this useless paper.

don’t see cattle feed on that list but a bale of alfalfa is now $36! one bale

What can I say?

1/2 gallon of organic milk was $3.49. Now it is $4.49.

Eggs – organic eggs – the prices are so disparate that I don’t even look any more . I just buy extra large eggs figuring that at least I’ll get a big egg for my money.

The big worry I have is that they might try to take away our cash. Do Not Give Up Cash. It is the only thing we have that is not traceable. Or trackable. They track us wherever we go through out cell phones. So far they have not been able to know what we buy when we are where they know we are. It is really nobody’s business but our own what we spend our hard earned cash on and I hope others feel the same way.