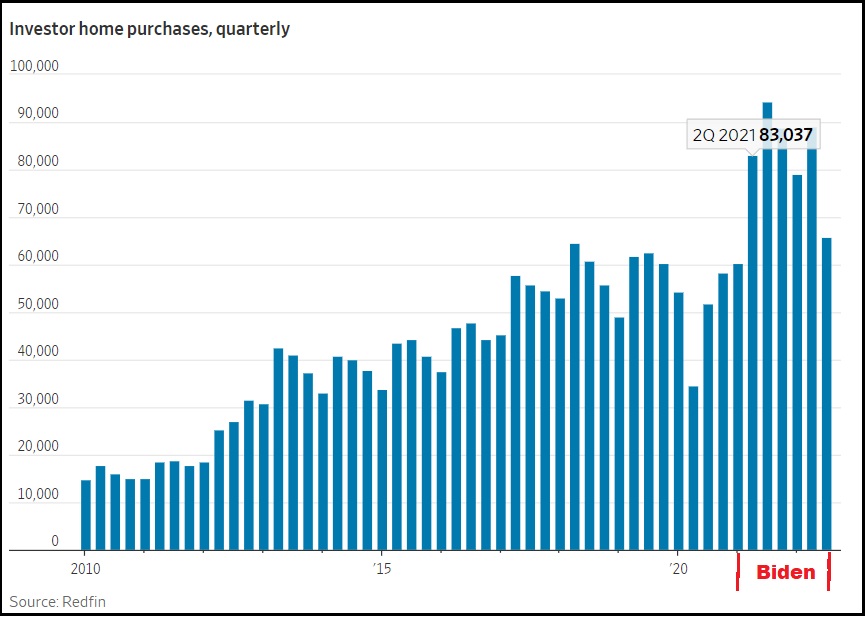

There is a significant lag in all data within the housing market. That said, the third quarter (July, Aug, Sept) data reflects a significant drop in institutional investment within the housing market.

If you look closely at the timing (keep in mind the data reporting lag) what you will notice is that financial institutions began a big surge in purchasing hard assets, specifically real estate, as soon as Joe Biden took office (Jan ’21), and the economic policy became evident. Intangible financial instruments became an immediate risk as the professional financial control groups recognized energy policy would drive inflation (supply side) and devalued money would fuel it (demand side).

As an offset to predictable inflationary policy (the insiders’ game), institutional money (Blackrock, Vanguard etc) was moved into hard assets with tangible value. This shift in asset allocation, institutional sales, helped fuel a false surge in home prices and their valuations. CTH was writing about this in 2021, and sounding alarms as it took place. 25% of all real estate purchases were being made by institutional investors.

The dynamic was predictable. The Biden administration economic policy, energy policy and monetary policy, was going to cause massive inflation. CTH was shouting about it in early 2021 and warning everyone to prepare for waves of price increases that would naturally surface first on high-turn consumable goods, and then embed into longer-term durable goods.

Despite claims to the contrary, this 2021 inflationary explosion had nothing to do with the pandemic or supply chain shortages. It is entirely self-created by western governmental policy; the collective ‘Build Back Better’ agenda. You can see now from the background moves within the financial sectors, they too knew the reality and their money shifts reflected that despite their ‘transitory’ pretending they were mitigating their own exposure.

We the People were yet again going to be victims of specifically intended monetary, regulatory, energy and economic policy.

We the People were yet again going to be victims of specifically intended monetary, regulatory, energy and economic policy.

The investment class rulers of the WEF assembly shifted assets to avoid the pain that we would feel. We “would own nothing and be happy,” and their shifts would position them to own everything and be in control.

Overall govt spending and regulatory controls drove inflation for these past two years. The ‘demand side’ was blamed, despite the lack of demand. I will be proven right when history is concluded with this. Interest rates were raised by central banks in an effort to support the policies that are driving ‘supply side’ inflation, not demand side.

Energy policy was/is crushing the consumer by driving up the cost of all goods and services. To support the overall goal of changing global energy resource and development (a false and controlled global operation), central banks raised interest rates. Various western economies, including our own, have been pushed deeper into a state of contraction by central banks crushing consumer demand, and eliminating investment via increased borrowing costs.

In short, the goal was/is to lower energy consumption by shrinking the economic activity. This, according to the BBB plan, was needed at the same time as energy development was reduced. These economic outcomes are not organic, they are all being controlled by collective western government agreement.

Within this control dynamic, there was always going to be a point where the reaction of the people to their economic reality means the financial control elements need to shift direction. They will always maximize profit and minimized risk, while knowing what the larger objective remains.

Just like every other durable good, housing demand contracts as prices and costs become unaffordable. The loss of equity within your home is damaging to your own value or ability to borrow against it. From the perspective of an institutional asset, that same equity drop is an investment loss. Thus, just as a consumer would exit the housing market, so too will institutional investment groups now control the slow dumping of the asset to remove the equity they pumped into it.

Much of the investment housing will be retained as rental housing, with the monthly rents being part of the returns on the investments. However, as this dynamic unfolds further purchases of houses stop, because the asset overall is declining in value.

(Via Wall Street Journal) – Investor buying of homes tumbled 30% in the third quarter, a sign that the rise in borrowing rates and high home prices that pushed traditional buyers to the sidelines are causing these firms to pull back, too.

Companies bought around 66,000 homes in the 40 markets tracked by real-estate brokerage Redfin during the third quarter, compared with 94,000 homes during the same quarter a year ago. The percentage decline in investor purchases was the largest in a quarter since the subprime crisis, save for the second quarter of 2020 when the pandemic shut down most home buying.

The investor pullback represents a turnaround from months ago when their purchases were still rising fast. These firms bought homes in record numbers last year and earlier this year, helping to supercharge the housing market.

Now, investors are reducing their buying activity in line with the decline in overall home sales, which have slumped with mortgage rates rising fast. (more)

At a macro level, if you bought a home in the last 18 months, or refinanced your home to pull out equity, you still have significant downside exposure. Home prices will continue dropping until they plateau on the downside at the price that existed in roughly June of 2021.

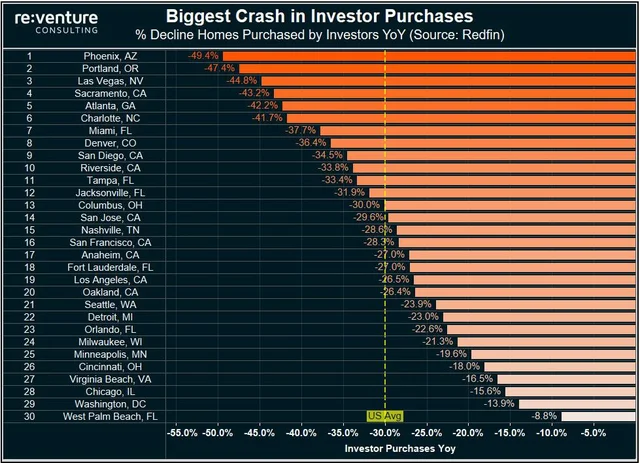

The drop in value is directly related to the regional purchases by the institutions. In areas where higher percentages of overall home sales were made by institutional investors, the subsequent drop in value will be larger (see chart above). In areas where actual people purchased homes to live in, the drop in value will be less significant.

I keep getting this buying question, so with the above in mind I will answer it in the most brutally honest way I can present…..

At a macro level, if you are going to purchase a home on this downslope, look at the historic valuation of that property (or a comparable property) in/around approximately the spring of 2021. Start there, and put your offer in that vicinity, then hold firm without any emotional attachment to it. Do not purchase another groups loss.

More wise analysis by Sundance to be thankful for.

Yup excellent data and analysis. I have not seen anything comparable anywhere.

That last paragraph in particular is very solid advice.

And we are supposed to believe that voters in the 2022 midterms like the Biden Economy?

Bullsh*t. FJB!!!

The voters didn’t, but the ballots did.

Well, we swallowed the Corporations Are People nonsense.

Next up on the narrative hit parade:

Pieces of Paper Are People.

The Chinese made ballot printers (Runbeck in AZ and the Chinese ballot Counters also Runbeck) sincerely want Joe Biden to continue.

The millennials and Gen Z’ers who voted didn’t care. They voted for dems anyway. The ones on our side didn’t vote.

This is the new story I’m hearing everywhere now. I’m always suspicious when the entire news cycle starts to put out an angle. I find it very hard to believe Democrats were motivated to vote and Conservatives were not, let alone that Democrats voted Democrat. It feels more like fraud, with the exception of Florida which was “allowed” a free election.

DeSantis worked with the legislature to put changes in place to prevent a drugged out Democrat opponent from winning against him. No ballot drop boxes, no universal mail in ballots (must be requested) and other security measures. There was still cheating, he did not get it all.

18 to 30 year olds suffer from disengagement from reality syndrome how do I know They elected Lurch in PA a stroked out brain dead creep from Addams family. It not about issues or votes its about ballots and harvesting huge mistake republicans made esp in AZ voting on election day …

Hey Lurch was way more intelligent and good looking than that Ogre Fatterman.

Notice Fetterman wears hoodies to cover up that huge lump on his neck! If you’re ever near Pittsburgh, drive through Braddock and see how run down it is. Fetterman was Mayor there!

Hey, relax, what can go wrong? After Caligula made his favorite horse a Senator, Rome lived for another 400 years, or so.

You owe Lurch an apology!

A brain damaged (stroke) Lt. Gov. (Fetterman) got more votes than a brain surgeon? That tells you all you need to know about early voting by mail. True that the Republicans won the vote but lost at the ballots. Either the GOP learns to use ballots, or eliminate the mass mail in ballots. BTW, I received 2 in the mail and I never asked for them or voted that way.

Psst. It wasn’t a mistake. IT WAS THE PLAN!!

Everything will soon be crashing down even further and used car markets are getting slammed.

There is enormous value in used rental cars. You might recall that the big boys parked thousands of cars all over the country during the COVID hoax. This is an inventory that has to be moved annually, so in times of economic downturn there is an opportunity to pick up a car with 10-12,000 fewer miles on it than would normally be the case. And if you are looking, try and find out whether a vehicle was an airport rental or in-town. The former tend to be used largely in the cities, while the latter are often used for long hauls. And, of course, never buy a used car in a state that puts down highly corrosive compounds on the roads to deal with snow and ice. Here in Minnesota, we have a long tradition of buying our used cars in North Dakota.

Very good info; thank you & Happy Thanksgiving! 🙂

Sorry, but that rental car purchasing boat sailed long ago. During the C-19 madness, I purchased my daughter’s 2019 Kia Soul with 30K miles for $13K total ($12,300 + TTL/fees). The auction price wholesale on that car had been $14.7K just 60 days prior to my purchase. The rental companies were dumping inventory.

Fast forward to 2022. The same car was retailing 90 days ago for $20K. Even with a 25% drop in price, the car is still at $15K over 2 years later. Used rental cars are now selling at a small 10% disccount to a brand new car, especially fuel efficient cars.

Until the car market returns to some sort of normal, there will be no bargains buying used rental cars.

And California may be worse yet.

The state has aggressive programs to buy old cars and scrap them. And, ironically, they get chopped up and the non ferros metal (aka zorba) shipped off to Asia… possibly to make our new cars.

Those of us with vintage cars find parts harder and harder to come by.

One might view this as deflation in this particular market i.e. a reaction to the lower demand caused by less available disposable income due to increased prices of more essential goods in other markets.

RECESSION MAYBE EVEN DEPRESSION STAGFLATION IS COMING MID 2023

There is no avoiding what is coming. I’m grateful that my Great Depression era parents did such a good job teaching me to be self sufficient.

Those of us born during the “baby boom” have only known prosperity. We will finally get to use the skills taught to us by our parents and grandparents.

I remember my grandfather holding a quarter in his index finger and thumb, while slowly moving it back and forth, telling me to put it in my piggy bank ((1950’s) I’m sure he was watching my eyes as I was dreaming of getting 5 peanut butter cups with that! At that time, I was known as “the candy kid!”

My grandfather used to give me a quarter for going to get bread with him fresh from the bakery in the morning. That was 1958-1960, I was 4 when he started.

I just put an addition to my house. A fence and a new Weber grill.

I’m good for ten more years

If boomers have waited this long to use those skills, they never had them. They may remember their parents using them though.

We “would own nothing and be happy,”

I am rereading Ayn Rand The Fountainhead (1943) and it’s stunning how well she could see the future-our present.

It’s not an easy read but will really reduce today’s events to the core.

“Atlas Shrugged” is good reading. I have personally witnessed the disappearance of the producers.

Yes another great read and not a bad movie series 🙂

The Atlas Shrugged trilogy actually seems better if you watch them now.

I’m excited to see the planned mini series now that the Daily Wire owns the rights to Atlas Shrugged.

There’s a miniseries planned?

Thanks, you just made my day. Better not be on Netflix though!

I will be surprised if it is done well, but one can hope.

You were in courtroom scene IIRC?

There really are a few “Galt’s Gulch’s” out here and they are also hidden as well as the one in the book.

Not by a force field powered by Galt’s motor but just by those who live their keeping their mouths shut and hunkering down nice and quiet.

Honest & sincere question here, seeking an explanation of the phrase: “We will own nothing and be happy”. What does this phrase actually mean? Why would we ever feel happy about owning nothing? Will our minds somehow be altered to think that way, so we won’t question the powers that be when they take everything we own?

I think you just answered your own question with your last sentence.

That is of course only what the Schwabinistas have in store.

We the people have another idea entirely.

Maybe we should start saying to them “You will lose everything and be unhappy.”

Not that we really need the last part. They are already horrendously and obviously unhappy, and they deserve to be so.

Blackrock is too busy investing in crypto exchanges via the usual vetting standards – emotions and the flip of a coin.

The bubble was obvious: what concerns me is that these bubbles keep individuals from buying houses and keeps them renting.

We were just in Columbus: two and three story apartment buildings – huge complexes – are still being thrown up, with undoubtedly shoddy quality, inside and outside the city limits.

Some McMansion cookie-cutter “neighborhoods” were also visible, e.g. $550,000, no sidewalks, very narrow streets, houses close together, with busy highways nearby (“easy access” but also constantly roaring traffic), a good 15 to 20 miles away from the downtown.

I cannot imagine such places will not need to cut prices soon, but some local bubbles linger longer than others.

Anyway, apartments dominate in Columbus, as do houses for rent from “real estate investment companies.”

Individual landlords can be awful enough: I have known very few who were not runnng properties into the ground and turning areas into slums fairly quickly.

Will companies be different?

Just wait a bit. June or July of 2023. There will be a buyer’s market.

Many layoffs have been announced, after the midterms. More will happen in Dec-Jan.

Then the rent/mortgage moratorium will end. Then the strapped homeowners who needed both incomes and/or bought in the last 18 months lose an income, which leads to foreclosure, which leads to bankruptcy and divorce.

I’ve seen this cycle play out 3 times since 1980. The investors are waiting for the Fire Sale of 2023/24.

I’m sorry for all that will get hurt in this, but it was caused by the economic, fiscal, and banking policies of the Biden Admin.

Under Trump, we’d still have a booming economy, cheap and independent energy, and we’d be re-shoring jobs and industries by the cartload.

Everything you see, have seen, and will see, is a direct result of insanely stupid policies, regulations, and EOs.

Buckle up, because nobody knows how bad this will get before it gets better. I’m thinking 10 years to recover to where we were 2 years ago. This includes your retirement plans and 401k. Just being rational and objective. It all affects me, as well.

On average, Wall Street figures out a way to destroy 401k, IRA, real estate and investments every 12-14 years.

Wash rinse repeat they dont even use detergent anymore…..

Spot on as usual Sundance… thanks for your time and efforts

Kind of been wondering who can afford to buy a mid-range priced house? Mortgages are expensive and home prices, even though falling, still seem pretty high. Two income families seem pretty shaky depending on the industries those incomes are coming from. Aside from the institutional owned houses, what rate and when will the massive mortgage defaults start?

This is actually some pretty good specific advice. It closely matches what I’ve been telling my clients and is what I would do myself if I decide to pursue anything. I’d add a word of caution, though. It could get worse if things spiral out of control.

Really can’t see why a downward spiral won’t happen. Job losses force mortgage defaults. Why can’t the big institutional investors start a pull back like they are then come back in when the private mortgage defaults drive housing prices totally in the dump

Yes, prices can still fall, deflation remains a distinct possibility, which sounds better than inflation, but has its own dangers, rf. 1929.

Massive unemployment is also possible e.g. Lane Furniture suddenly shutting down 3 factories completely.

Keep in mind that the government is now spending c. 140% of the Gross Domestic Product.

When hypertrophy* has its way finally with this Leviathan called the FedGov, be prepared to defend yourselves.

* Hypertrophy is a term from Biology: it means growing too large for survival in an environment.

Hypertrophy is what killed the dinosaurs: the asteroid was only the catalyst. They were too large to adapt quickly to the loss of fast-growing plants and the cold temperatures during the aftermath.

Only smaller species could survive on the greatly reduced vegetation post-asteroid.

When the FedGov crashes like the dinosaurs’ asteroid, finally, the odds are good that only small manageable areas will survive rf. Western Europe c. 400-600 A.D.

Large urban areas – too complex and too large in population – may not do well.

Agree with the rural areas probably being far more survivable than urban or inner-city locations. Provided of course those in the rural areas are self sustaining and able to defend themselves & their property. Walked outside here just now and the sounds of target practice are echoing from every direction.

Families enjoying the holiday.

As an interesting dichotomy, since we also can shoot on our own properties, it’s gotten really quiet in the last year compared to the last seven I’ve been around. I live in the rural forest.

The only noise over the holiday was last weekend some early T-day celebrators shooting off mortars (fireworks) a few door down. Otherwise, deathly quiet. Very odd. People not visiting their vacation homes. Glad I bought the worst house in the neighborhood. Not a target and it’s paid for.

There was a little bit of a slow down in shooting out here a year or so ago, but that had more to do with shortages of ammo. The store we drive into has been well stocked with all types of ammo for the last few months. They even have sale prices on some of it. 9mm 223s and 12ga are all cheap right now, around here anyway.

So far, haven’t seen any ammo problems, though I rarely go to town for ammo since it’s quite a drive. However, my interests trend more to weapons of historical wars then modern stuff so perhaps that’s a factor. Sometimes crates of belted stuff are cheap enough it’s worthwhile to de-link it. We’re a NFA state so many have automatic weapons as well. I expect a lot of ex-military to be lurking in the forest, quietly going about their lives. I doubt the Communists will get far without a fight.

may not do well.

Turn the water and electric off for a week and it will be cannibalism in Chicago and all the other big blue state…

True. Shut off the water for a week will pretty much cause a terrible nationwide sewer and septic backup. It might stink well beyond the time the water comes back on, I am pretty sure. 🙂

The real wildcard is a digital currency. So buy PM’S and see how it shakes out or sit tight and wait???

Home I sold in Sept after the untimely death of a family member was immediately put up for lease and subsequently occupied after a full cash offer and sale. (China investor) Original asking price dropped around 100k during the time listed between the months of June and Sept. (sellers in the area began to panic when rates first started to rise forcing price reductions to stay in the game) Regardless, the property sold for much more then what the property was last sold for in 2018. If the home was put up for sale in early April (before the media began to quietly send out warning signs), it would have easily brought in another 100k and would have sold within a month.

Condolences on your loss. And I enjoy reading your post.

What State are you in, Mass?

So Cal. I was seriously going to relocate to AZ if the MAGAs took control.

Very similar experience selling my Mom’s rowhouse in OR. We had to fix a few things and during the time off market had to lower the price them accept an 80k less offer. Still got more than we originally expected by the market really just died and we thought we were gonna have to eat even more.

Sorry for your loss but good job 👍

Does that mean I will no longer be getting post cards and letters every week, stating that they want to buy my house? The pitch the buy as is, they claim to pay cash. In the last couple of yrs. My neighbors and I have received hundreds of offers. All the houses they have been able to buy have become rentals.

A friend of mine who does house inspections in Bell County TX said someone was buying whole subdivisions of new homes and turning them into high priced rentals.

Gee what could go wrong if the economy tanks?

Haven’t had one for a while

Got 2 yesterday. They go into the circular file.

I never get them for my home. Got them about once a month for the rental property I sold.

Yep, same here. Rural agricultural properties with shops aren’t exactly easily flipped or rented. I owned rental properties in town during the last crash but the renters lived in them so no idea what offers they received in the mail.

Good analysis, and thank you. From keeping a somewhat uneducated but willing-to-learn eye on the real estate market and trends (especially regarding mass migration to Florida from other states recently) I feel that the value downturn will not hit as hard in Florida. Do you agree?

I live in Florida. Post -2008, Florida had huge numbers of foreclosures – every city, every block.

This time, it won’t get quite that bad because more purchases were cash. 2 of my 7 offers on my condo were cash.

I was outbid by cash offers on several homes I bid on.

Yes, the influx of people from blue states had a big impact on the home prices. I expect that to go in reverse a little bit after the next hurricane hits the state. The devastation of Ian was a shocker to hurricane veterans.

It’s also good to remember that raising the price of oil and all its derivatives allows the state and federal government a larger revenue stream of taxes. The federal and state governments are never going to let go of that regardless of BBB and all the other BS they are spewing out as they have nothing to replace it with. What are you going to replace it with? It becomes like that perennial question at the supermarket “Paper or plastic?”

You’re lucky you still get that question at all. My sliding-into-wokeness blueMA town virtue-signalled away the useful plastic and started killing trees several years ago.

If you look at this list carefully, you will note that Texas isn’t on it. Take a look at the housing market in Austin, and then start expanding outwards to the full reach of the commuter zone. For example, go west on TX 7 and look at pricing in the lake district southwest of Kingland on Realtor, Zillow, or any other tool of your choice. How much has remote work extended the reach of urban markets? Should we be looking at prices inside Austin, or outside? The point is that Redfin is using traditional analytic platforms that may no longer be all that relevant.

Before putting in an offer anywhere, I would urge anyone looking at present to study trend lines across many different properties to get a handle on when the rampant speculation that fueled this market began, again keeping in mind that there was wholesale flight at the beginning of the COVID hoax from urban to suburban and exurban markets. I use December of 2019 (pre-COVID, pre-George Floyd) and April/May of 2021 (one quarter into Biden energy policy) as general yardsticks, and then refine the data in quarterly increments for the markets which interest me.

Thank you–very interesting . . . .

It appears that most, if not all, cities listed in the chart are predominantly Dumbocrat cities. No surprise there.

I am honestly waiting for it. Not in any malicious way, but I knew something had to give once people started buying $150,000 homes for $900,000 (in Canada rural Ontario). Was absolutely mindboggling and makes me sad I will likely never be able to afford to purchase a house in my lifetime (39).

Take heart, keep looking and keep praying. Real estate goes in cycles — I have seen several of them in my lifetime (67) and am hoping for prices to come back down, so I can get a good deal here in NE Ohio on a cheap little house by Lake Erie. It only takes one.

FWIW, I am seeing the market slowing, with houses sitting longer, prices reluctantly cut, and even one or two bank owned foreclosures popping up. A friend who does foreclosures for a living said that there are a lot in the pipeline right now — he is so busy he is turning down business. I do not wish for anyone to lose their home, but I wouldn’t mind seeing Blackrock having some fire sales of all the houses they scarfed up greedily and kept from middle class buyers.

Also, it sounds like in Canada, Pierre Poilievre is campaigning hard about that very issue — he wants to see houses become more affordable for young families and others. If he could replace Justin, it sounds like he has a great anti-WEF vision for energy independence and economic turnaround for Canada. I hope things improve for you, and that your house dreams come true.

Since we are in an era of stagflation, I look to the 70s/80s stagflation period for guidance. What does that decade of stagflation show us in regards to home prices? It shows that home prices, despite the pitiful economic conditions, actually kept pace with the rate of inflation and increased about 160% over the stagflation decade. Those elevated prices did not decline once stagflation was controlled.

Any decline in real estate prices will be modest and short lived.

After 2008 in Florida, it was neither modest nor short lived. But banks did not make available all their foreclosed inventory. They trickled them out to maintain values.

Blackrock will trickle them out. Banks let people squat for as many as 3 years in Florida after 2008 because they were unwilling to sell their holdings.

Consider the east coast of Vancouver Island. If work and family allow.

.

We own rental a cottage there..many Ontarians have already made it home.

We occasionally rent to Easterner’s in the winter months.

Real Estate Investing 101 – – – this should be a college level course.

Excellent analysis as usual by Sundance.

“To support the overall goal of changing global energy resource and development (a false and controlled global operation), central banks raised interest rates. Various western economies, including our own, have been pushed deeper into a state of contraction by central banks crushing consumer demand, and eliminating investment via increased borrowing costs.”

(Reuters) Demand for coal is growing against the background of the energy crisis in Europe, coal prices are rising again, but Western coal producers cannot normally expand production because Western banks with their ESG principles means that corporate strategy focuses on the three pillars of the environment, social, and governance. This means taking measures to lower pollution, CO2 output, and reduce waste) principles limit lending to the sector.

On a sorta-related topic, Brandon suddenly *likes* oil fuels. Maybe someone is blowing truth in his ear (or up his butt):

https://www.theepochtimes.com/biden-admin-quietly-greenlights-plan-to-build-huge-gulf-oil-terminal_4883351.html

This is not a production increase.

This is giving what we have to the Chicoms.

That is why the Chicoms will do anything to keep Biden and his crime family from facing any sort of Justice. Chicoms must have bought every Judge and Justice one way or another.

That’s just storage we need a refinery.

deleted

Oh just wait. They are about to crash railroads next.

Excellent analysis. However, I believe your 2021 ‘pricing’ guidance will prove in the end, to be overly optimistic (for sellers). Over nearly 230 years, since records first began to be kept and analyzed, the P/I ratio nearly always reverts to the mean. If history is any guide, prices must return to 2012 levels (in real terms) to bring the P/I ration in line with historical norms. In nominal terms, this means pre pandemic pricing in the 2018-2019 range. Not 2021. It could be ‘different’ this time. But I’m betting it won’t be.

Interesting analysis. The long bond market doesn’t think interest rates will rise much higher or stay high for very long. That may be a factor in why that ratio is out of whack.

Retired Magistrate here: Our house is 65 years old and not updated; however, everything works and thank GOD it is paid for.

People were always telling us “oh you should update your bathrooms and kitchen”, etc. but we declined. The house is well built and in good condition so we left it “as is” except for replacing carpet in the kitchen and bathrooms. A really bad idea from the 70’s; can’t keep carpet clean in those areas.

Our neighbors overpaid for their house 3 years ago and have had to put a lot of money into it to fix hidden problems. Right now they are probably upside down along with several other new neighbors who just bought in the last year.

If you are in the market for a house don’t just look at the cosmetics. Check out the roof, septic system and well (if in the country), any cracks or settling in the basement, how many electrical outlets are in each room, does the house have enough electrical capacity for your needs, are the walls solid, are the floors solid, etc.

Some of the new homes are so poorly built that if you lean against a wall, you are going to put a dent in the wall. Not good. I expect to see a lot of homes going into foreclosure this Spring and Summer. So, now is the time to choose the area you would like to purchase a house in a keep your eye on the market. Nothing is moving now to due to the holidays but houses usually start to go on the market, at least here in Central, Ohio, the first part of March.

To be clear, in my market, that is still a 30-40% drop from where we were at the peak in my market. It has already come down 15-20%.

Bullwhip Effect.

Massive Cancellations Make Mess of Already Low New-House Sales. Inventory Glut at Deep Housing Bust 1 Level. Buyer Traffic Plunges

by Wolf Richter • Nov 23, 2022

https://wolfstreet.com/2022/11/23/massive-cancellations-make-mess-of-already-low-new-house-sales-inventory-glut-at-deep-housing-bust-1-level-buyer-traffic-plunges/

Homebuilders reported plunging traffic of prospective buyers of new single-family houses, according to the National Association of Home Builders last week. Its index of Traffic of Prospective Buyers has plunged for eight months in a row and in November fell below the May 2020 level.

Beyond the lockdown-low of April 2020, it was the lowest since 2012, during Housing Bust 1. But this time, the descent has been far faster than during Housing Bust 1

Ocean Shipping Costs Decline 84%, Truckers On Verge Of Losing Money

24 Oct 2022

https://www.zerohedge.com/economics/ocean-shipping-costs-decline-84-truckers-verge-losing-money

Which is what Burry’s prediction is all about.

Overstocking for a huge but transient spike in demand, labor shortages from same leading to higher wages which are “sticky” and do not decrease after the demand surge is over, that leading to cost increases due to higher wages paid. When the demand surge ends, employment will plunge in everything related to supplying the demand surge.

Michael Burry (The Big Short) Is Now Predicting Another Huge Crash (Here’s Why)

The economic activity is not false, but both the motivation behind some transactions and the money in the US is.

I like how at the end SD gives advice on how to take advantage. It won’t work just yet but at least it gives one opinion of a data point to watch for in picking the coming bottom. I caught it 2012 in a depressed area and made a 300% return in 5 years (and sold too early). People tend to focus on and be paralyzed by the crash. I focus on what happens after the crash and when. The crash is old news, everyone agrees where the market is headed for now.

Awesome, just doing the preliminary research and waiting for the bottom now. The opportunities will be very good.

If you’re in Texas, particularly central TX, I would do a look back to at least 2018-2019.

Houses were selling for way over asking starting in 2020 up until now.

I am seeing lots of price drops and houses staying on the market a lot longer, currently. Some good deals will be had in 1-2 years

Institutional investors. Foreigners and banks. Chyna. America for sell, but not to Americans.

Thank you for the regular R.E. analysis…

Here in red hot Graeter Vancouver B.C.

Our overheated market has already dropped maybe 10% and inventory is increasing.

18 months ago or so, mortgage money was available at 1.5% or so for five year terms, today it is north of 5%.

We are are small time investors, and wouldn’t touch local Real Estate.

Especially when a significant number of our high quality dividend paying stocks are paying north of 5% and can be “sheltered “ and may be tax deferred.

In our tax bracket.

Taxes on dividends on said stocks are 27% income from R.E. is taxed at nearer 40%

Me thinks a further 10% drop in our homes are likely.

As an aside, we just renewed our insurance on the rental properties.

Last year they were approx 4K the cost is now 5K.😟

Cheers!

It’ll be interesting to see the job cuts after xmas

Understand: the amount of SFR homes institutionally owned has grown exponentially over the past 15 years. And with Institutions fawning over ESG, a nationalization or an outright sale from Blackrock / Vanguard of their residential portfolio to the Federal US Government should not be discounted. Larry Fink? ESG? WEF (“you will own nothing and be happy”) Think! I am more prepared for a nationalization of an oil/gas/fossil fuel company before 2024 election.

IMO, people should stop looking at this from the standpoint of profiting on the suffering of others but rather how we can use economic tools to destroy the enemy who’s, with malice and aforethought, perpetrated this attack on our Republic and all citizens. I know what I’ll do to any bottom feeders that come my way. We’ll go to God together. Promise. I’ve had enough of the greed, avarice and mendacity of humans in this country. Enough. If that sounds harsh it’s meant to. Selfishness may be human but it’s also quite unGod-like.

Yeah. It doesn’t make sense that these big guys would have bought high knowing a recession was coming and higher interest rates. They aren’t going to sell low. They are going to turn their investments into Sec 8 housing for all our new 3rd world replacements

well, you know where some of the 4 trillion went that congress counterfeited. wall street uses it to buy up the land.

the fed is counterfeiting so that wall street can take the country and land out from under us. this is what every spending binge is about. incremental usurpation.

This sentence doesn’t make sense to me, at least not in the context of hedge funds:

Investor buying of homes tumbled 30% in the third quarter, a sign that the rise in borrowing rates and high home prices that pushed traditional buyers to the sidelines are causing these firms to pull back, too.

Yes, for small investor buyers who need mortgages this applies. But a hedge fund doesn’t take mortgages on houses; that would be like taking a loan for the coffee and pastries for the board meeting. Hedge funds have been distorting the rental market precisely because they don’t have debt service. In fact they likely don’t have insurance either; with more money in cash parked looking for a use why would they bother to insure investments that are so small they have to be aggregated to have a spot on the books?

That aspect of this analysis is absent in this post. The hedge funds haven’t just been snapping up properties (until recently) but have been cutting the legs out from under traditional onesie-twosie investors trying to build a little equity. If they (hedge funds) choose to start dumping it’s NOT because of debt service.

Just a gut reaction. No charts or hypothesis. But it seems to me we will have inflation and deflation.

The things we buy continually and out of pocket, such as food energy and clothing, will soar. The things bought on credit, cars, homes, etc will crash because of the interest cost and unavailability of financing.

Many interesting dynamics are playing out. The fiscal mess of the US govt, a clear and present danger, will increase the severity in unpredictable and unprecedented ways.

What would the inflation rate be if the credit cost incurred by so many households were included in the CPI?

Wait for the avalanche …downslopes are for the beginners.

Great advice, Sundance.

Everything thats old is new

Soon as they printed the first stimulus check , I knew inflation was coming . Inflation is a tax on the people. Lesson learned from Ron Paul 2 decades ago.

Printing money brings inflation, it’s as simple as that .😉

I see no cities in Texas on the graph. Hmm.

While I didn’t have the resources to buy more real estate, we did cut back 401K contributions from 20% of salary down to 5% (plus 3% company match) and began making double mortgage payments. Seems similar to what the big guys did. Also continued by decades long strategy of purchasing the three precious metals, silver, gold and lead…

I would say just do what it takes to pay off any mortgaged property. Mortgages are a ticket to hell in an inflationary economy. I lived through the inflation of the late 70s and early 80s and mortgage interest rates were much higher than we see right now. People were spending money today because they knew their money wouldn’t buy as much tomorrow. It was a self defeating spiral, but most people just took the attitude that you can’t squeeze blood from a turnip anyway. We haven’t even gotten very far with the current inflation/recession cycle yet. If the Globalist/Demcommies are trying to destroy our economy, we will have another depression on the scale that Roosevelt presided over for basically his entire Presidency. The Country will panic and vote in the biggest purveyor of the collectivist clap trap that runs in every election nationwide. Demcommies will be ecstatic and our Constitutional Republic will end up completely dismantled.

The rents will keep going up and up and up. And they keep bailing out the EU and Ukraine. Shipping all our LNG to Europe and starving our supply of gas for the winter. You can thank the RINOs.

I look at ‘new subdivisions’ going in on former hay fields, cornfields, potato fields, and the signs say “starting at $400.000.”

How many families can there possibly be that need a $400.000 home and where do people Work that can afford such a home?

Open the books website seems to indicate these jobs are in GOVERNMENT and for ever expanding bureaucracies where a secretary for the local Social Security Office enjoys a salary over $120,000/year. Or the local Community College secretary for each head of a Department makes the same amount with benefits and pensions and those rungs of the ladder that start with a G- number and go up to eventually massive salaries and benefits depending upon how long you can hang in there, not on what you produce.

Proving, yet again, that everything that goes up will also go down. The net result is zero unless you want to benefit from lower housing prices. In which case, we will have to wait until the prices get back in line with pre-inflation, home buying values, which will include much lower mortgage rates for all of us losers who must buy real property that way. Don’t worry, as long as the institutional invester class believes they will eventually be landlords to all of us, these buy/sell cycles will continue to happen at even shorter intervals until the mortgage loan industry is eventually transformed into the mortgage bankers holding the assets they now merely control.

Public housing cannot be any different in the USA than what it has always been in Socialist controlled countries. Most people will be renters until the Government takes over the entire real estate industry. Does anyone else see the pattern, yet? Our has all of the Collectivist clap trap already produced a mass mind meld?

Institutional investing has targeted real property as their hedge against the declining value of their monetary assets. The ups and downs of the housing market because of inflation and higher mortgage rates, means that they will continue to pursue their long term strategy of becoming owners in the real property markets. The best marker to observe is whether the investor class own increasing percentages of the overall real estate assets.

It is not how much the property costs, but how much of the property is held by the investor class, the mortgage lending industry, Government, or individual home owners. Our Federal Government continues to be the largest landowner in the USA. This will eventually determine who gets to control the means of production. I am not betting against the Government right now, because they are the only entity with the power to take away my own tiny amount of real estate without spending a dime for it, Our Constitution be damned, of course.

I was shocked a decade or so ago to see that the US Government owns vast areas of the West. VAST.

Yes, in my state the Fed owns over half the state, not far behind their biggest holding, Alaska, and at a rate of nearly twice the national average. No wonder they destroyed the lumber industry.

Ballotpedia has a list

We’re seeing price cuts here in Northern California, properties taking longer to sell.

Out here, it’s common for newer buyers to rent out a bedroom or bedrooms, if single. Especially when a bedroom can rent for between $700 to $1,700, or more. Plus, they pay a portion of utilities.

One friend recently bought a second investment property, a condo, likely $600,000 – $700,000 cash. Early inheritance money.

Nicer areas typically have an influx of East Indian and Asian buyers. (Hi tech.) Oftentimes, the parents then come to stay for six months, or longer. We’re importing the wealthy from India.

I also wonder what % are playing the system to sign up for SSI or such. I know a few decades ago an American academic who spoke fluent Mandarin said there were tons of ads in Chinese newspapers advertising, offering elders advice on how to gain Social Security, Medicare, etc … though most have never paid into the system.

Margaret and I are both full time Realtors, 17 years for her, 25 for me. This is one of the most important features you have written, and your readers REALLY need to wrap their heads around this.

“Much of the investment housing will be retained as rental housing, with the monthly rents being part the returns on the investments.”

We own a handful of mortgage free single family rental homes. It slowed down about 5 months ago, but we would receive a minimum of 3 calls per week asking us to sell one of our various properties.

Black Rock and Vanguard have so much cash, they don’t have anywhere else to put it. Their intention is to buy up every single-family home in the country and turn all of us into tenants. It is very important that your readers understand that they must own their own real estate, and if they can, buy investment properties, even if they are small and cheap. If you have to, buy condos that allow the units to be rented, and the exterior maintenance is taken care of by the association. Put everything on a 10, 15 or 20-year mortgage, the shortest you can. Make sure that the mortgage payment is covered by the rent, although I did have one property to which I had to contribute $100 a month towards the mortgage payment, but to me I was contributing $100 a month towards my retirement. Never borrow against your real estate unless it is to buy more real estate. Acquire the real estate, and time takes care of the rest. If you get a tenant that pays on time and takes good care of the property, don’t raise the rent for a few years. By the time the rent is raised in order to keep up with taxes, insurances, etc, there will be no place the tenant can go, and get what they have, for what they are paying. Most importantly, if you choose to purchase multi-family dwellings, you now have to manage a community of people, as well as the property.

I no longer have the chart, but over any given 20 year period, real estate will ALWAYS out perform the stock market.