There is a particular historical irony in the timing. On the same day King Charles III ascends the throne, previously Europe’s most isolated from consequence – yet loudest voice in chasing the catastrophic climate change energy policies, the British government is forced to reverse course on years of energy regulations and restrictions.

Britain’s new Prime Minister Liz Truss announced, “a new round of oil and gas licensing will come next week with more than 100 licenses issued. A moratorium on fracking will be lifted and planning permission can be sought where there is local support,” in an urgent emergency effort to lower energy costs for British citizens.

The move comes in combination with a government plan to help citizens and businesses cope with skyrocketing prices for electricity and home heating fuel. The climate change chickens have come home to roost throughout Europe and the British government is urgently trying to head-off the calamitous consequences.

Inside the media announcements of the Truss plan, the biggest concern expressed is how the financial and multinational banking sector (the ESG investment groups) will respond to the government position. After decades of ideological “green” outlooks flowing into the energy industry, the biggest concern expressed in the financial analysis is how a reversal by such a large economic system will reverberate.

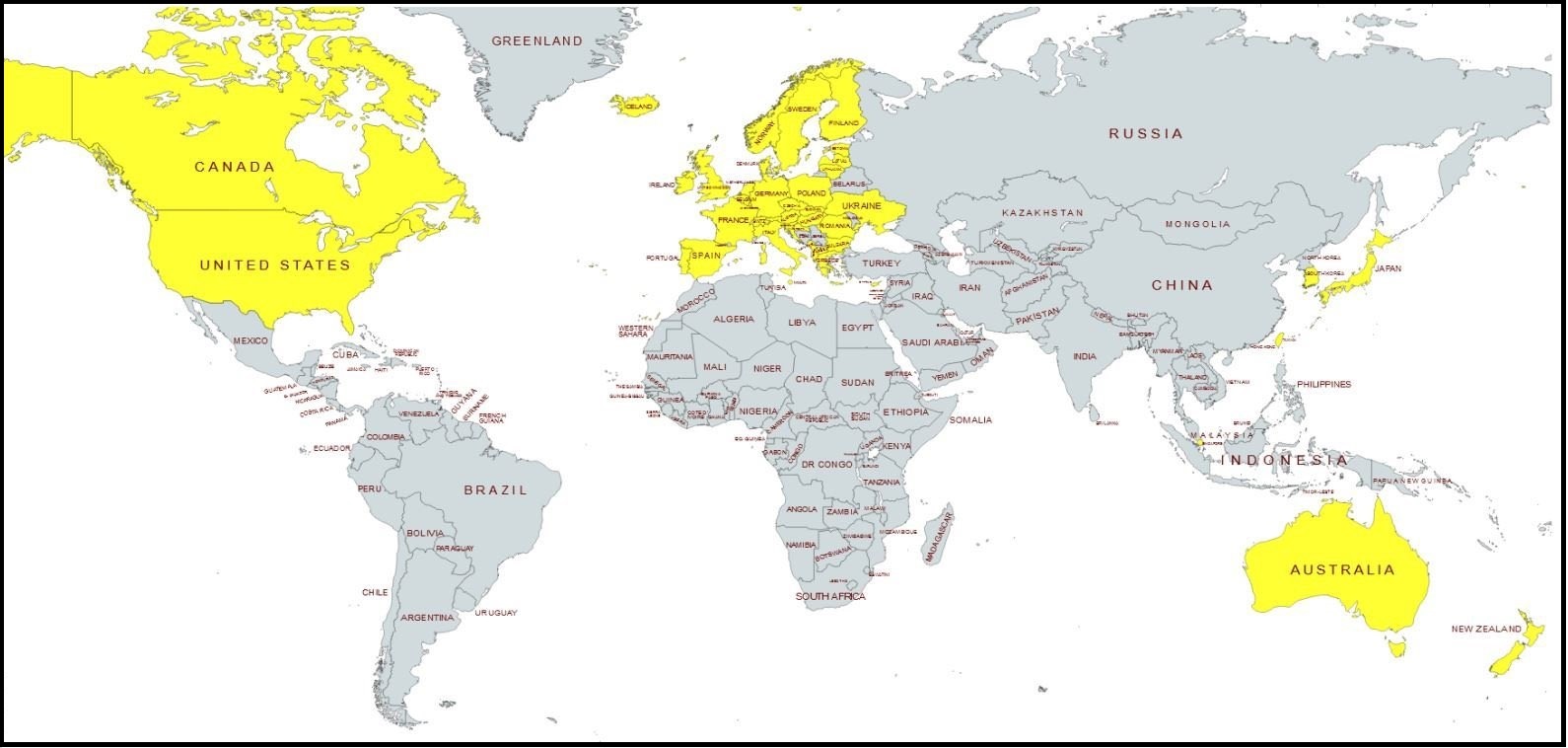

The climate change ideology has a stranglehold on the energy sector of the economy, this move by Great Britain would be the most significant push-back in decades. The minority green activists are apoplectic that they may lose control over the majority of opinion. The economics of a reversal in energy policy could reverberate throughout the western alliance, particularly in Europe. It will be interesting to see whether this shift in U.K. policy has ripple effects in the U.S.

LONDON, Sept 8 (Reuters) – Britain’s move to green-light dozens of new oil and gas fields will leave investors and banks with a tough PR job as Britain struggles to shore up its energy security whilst sticking to its climate commitments.

Starting new oil and gas projects runs counter to the world’s shift away from fossil fuels in the fight against global warming and a commitment at last November’s U.N. climate talks to phase down their use.

Yet runaway inflation amid conflict in Ukraine has forced the hand of new British prime minister Liz Truss as Russian President Putin seeks to use energy as a weapon this winter.

Britain will launch a new round of oil and gas licensing next week with more than 100 licenses issued, part of a wider package of measures to tackle the energy crisis announced by Truss on Thursday.

And Britain’s not alone in reassessing its energy strategy. Germany, for example, has been forced to turn back to even dirtier thermal coal to help fuel its power plants and keep the lights on, hampering short-term efforts to rein in climate-damaging carbon emissions.

But for energy companies and the investors, bankers and insurers that finance them, new investment in fossil fuels also presents a challenge given many have made their own pledges to reach net-zero emissions by mid-century.

“This will absolutely hinder companies’ … ability to hit their climate targets,” said Pietro Bertazzi, global director of policy engagement and external affairs at non-profit environmental disclosure platform CDP. (read more)

This is the first crack in the western alliance and the ‘climate change’ agenda of the World Economic Forum as it relates to energy policy and ultimately control over human life within the alliance.

The war in Ukraine was being used as a justification to explain the consequences of European energy policy, particularly rapidly increasing costs for energy and food, but the war in Ukraine was not the cause. The true root cause of the exploding inflation and economic mess was the Build Back Better agenda, and the series of policies dictated from within it, that each nation willingly accepted.

The coal burning power plants put themselves out of business by whining it was too expensive to install smokestack scrubbers. That technology is still available, just do it. Internal combustion engines have made massive gains reducing emissions and are probably capable of more. Nuclear power plants are super clean but more need too be built while the engineers that have the know how are still alive. The only reason car companies are willing to switch to electric is because a vehicle with no motor that is only a shell, a drive train, a mother board and some wires is incredibly cheap to build, with massive profit margins.

Electric cars have an electric MOTOR to move it down the road. They also have disc brakes, drum brakes, suspensions, air conditioning, heaters, windshield wipers, entertainment systems, power windows, power sun roofs, power seats, power steering etc … hardly a “shell”.

And where does the power to recharge come from? Not windmills and solar.

Gas crisis: Germans rush to stock up on coal for winter warmth

Fearing a total cut-off of Russian gas over the winter in retaliation for European Union sanctions over its invasion of Ukraine, some German individuals are now stocking up on coal.

In capital Berlin, the fossil fuel has now become a rare commodity.

In Berlin, 5,000 to 6,000 households still heat with coal, a tiny fraction of the roughly 1.9 million homes, the city says. These are often elderly people, sometimes entirely dependent on this fuel and living in old houses that have never been renovated, or lovers of the heavy heat emanating from old stoves.

But this year, new customers have arrived “in droves”, Frithjof Engelke, whose small business has also diversified into wood pellets and fuel oil, stressed.

“This Is Beyond Imagination”: Polish Homeowners Line Up For Days To Buy Coal Ahead Of Winter

… with Poland still basking in the late summer heat, hundreds of cars and trucks have already lined up at the Lubelski Wegiel Bogdanka coal mine, as householders fearful of winter shortages wait for days and nights to stock up on heating fuel ahead of the coming cold winter in queues reminiscent of communist times.

Artur, 57, a pensioner, drove up from Swidnik, some 30 km (18 miles) from the mine in eastern Poland on Tuesday, hoping to buy several tonnes of coal for himself and his family.

“Toilets were put up today, but there’s no running water,” he said, after three nights of sleeping in his small red hatchback in a crawling queue of trucks, tractors towing trailers and private cars.

“This is beyond imagination, people are sleeping in their cars. I remember the communist times but it didn’t cross my mind that we could return to something even worse.”

She has started in the right direction of a true Brexit via energy independence of a sort.

Let’s see if she can rein in the Foreign Office and MoD from there idiotic support of the Ukraine War. Advocating for “neutral” stance by England would be interesting within the NATO construct, as a means to encourage talks to end the conflict.

Part of reining in the MoD would include having the Royal Navy actually OPERATE for REAL in the Channel to stop the illegal immigration by benefit shoppers.

And she previously met with the Queen what, a week before her death? I would like to think the Queen whispered in her ear.

A little bit of me is hoping the Queen left her a little bit of fairy dust. Good start, however, they are batshit crazy over there and will fight energy independence. Charles himself has been an avid climate change activist for many years.

The Winter of 2022-23 will pit the environmental Luddites against reality. Green nonsense can do well in a decadent society where the wealthy virtue signal about climate from their private jets. It also does well as a cocktail party’s ‘wouldn’t be nice if’ mentality. However facts tend to not care about Liberal ideals such as electric cars:

1) NCSL Sep 22, 2021 “70% of the US grid’s transmission lines and power transformers are over 25 years old. There’s also insufficient transmission capacity, especially transmission that facilitates transfer of power across regions. $1.5 trillion to $2 trillion will need to be spent by 2030 to modernize the grid just to maintain reliability.

2) As to alternative energy: New York Times: “In the NREL study called Western Wind and Solar Integration, you will find that if you go as high as 35% wind and solar you have to have conventional backup equal to the total capacity of the wind and solar systems.”

3) SEPT 6, 2022 “California’s grid manager warns of rolling blackouts tonight” About California’s Rolling Blackouts Stephen Berberich, president of the California Independent System Operator [CAISO], which runs the state grid said: “if the wind hadn’t run out on us, we would have been okay.”

Bottom line: Democrats want to shift away from what works to something which does not yet have the same ability and ‘see what happens’. An alternative, like alternative energy, has to be up and running at least as well as what it purports to replace or it is not a viable alternative at all.

Reality is quite an event even in England and on the continent. The entire climate hoax has caused this problem. Windmills and solar are pipe dreams that inevitably led to this mess. Winter will make its point and Jimmy Carter sweaters won’t cut it.

Liz is even dumber than Boris. No small feat, that.

Are we beginning to see reality set in? Is the Green New Deal going to have to face actual production or stand by for fossil fuels to return?

subsidies, like apt. rent will be subsidized to give wall street a steady income.