CTH has said repeatedly the road to serfdom is cemented with the catch-phrase “a service driven economy.” The June jobs report from the Bureau of Labor statistics [BLS LINK] highlights the JoeBama economic policy exactly that way.

CTH has said repeatedly the road to serfdom is cemented with the catch-phrase “a service driven economy.” The June jobs report from the Bureau of Labor statistics [BLS LINK] highlights the JoeBama economic policy exactly that way.

Approximately 850,000 jobs were gained in June; however, simultaneously the number of long-term unemployed increased by 233,000 to the current state of four million.

While we should expect to see the leisure and hospitality industries as well as education rebounding from the various COVID-19 shutdowns, and indeed they did ( +343,000 and +155,000 respectively), manufacturing was flat (+11,000), and construction was down -7,000. The details inside the data are not as great as the top-line would presume.

CTH looks at alternative data connected to the overall economy; empirical data and sector specific trends inside industry. The biggest domestic issue is inflation, stunningly large increases in prices for fast-turn consumer goods like food and fuel. Inflation is one of the primary reasons we have stated home values and home sales have peaked on a MACRO level despite the massive amount of real estate investment purchasing underway by financial institutions.

When we look at durable good production, we focus on the primary drivers of higher cost middle-class or working class products. Seeing construction jobs decline by 7,000 at the same time real-estate values are increasing only points to the problem of working class not being able to afford new home purchases. In the real estate sector this is unsustainable; it is simply a matter of math, income stability and wages.

The same issue applies within the auto-manufacturing sector. Auto jobs were down -12,000 in June. Automotive manufacturing companies operate their production forecasts on short-term (6 month) and longer term (up to 5 year) analysis. The auto industry gets immediate (in real time) feedback throughout the supply chain, distribution and sales. They modify their employment quickly.

The same issue applies within the auto-manufacturing sector. Auto jobs were down -12,000 in June. Automotive manufacturing companies operate their production forecasts on short-term (6 month) and longer term (up to 5 year) analysis. The auto industry gets immediate (in real time) feedback throughout the supply chain, distribution and sales. They modify their employment quickly.

There are now 7,000 less construction workers and 12,000 less auto workers in June than May. This directly aligns with inflation and the substantial decline in real wages.

Additional confirmation of a weak blue-collar jobs situation shows up in work hours. In June “the average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.2 hour to 34.1 hours. (See tables B-2 and B-7.) This is not a sign of a healthy, broad-based expanding economy.

25,000 day-care workers went back to work; that’s good. That reflects the service workers going back to work in leisure, hospitality, hotels, restaurants, bars, venues and other service driven sectors. However, even that gain of 25k is soft when you consider the scale of U.S. unemployment which was unmoved at 5.9%.

The top-line data looks good with 850,000 jobs created, but when you look at the “good jobs“, those jobs with higher blue-collar wage rates, the outlook is a little more concerning. Everyone is paying more for gasoline & food, and that hits the checkbook quickly. It’s not a matter of random statistics, look at the people around you, your family, friends and community…. what do you see?

We hear almost nothing about corporate investment expanding inside the U.S. economy from either foreign or domestic corporations. Wall Street earnings are being enhanced by the return to a ‘service driven economy‘, unfortunately that creates a bigger wealth gap between the working class and the investment class.

Wake up Bernie Bros,…. you’ve been conned.

Hold it down, guys–I’m trying to decide where to spend my 16 cents.

I’m going to toss mine in a fountain and make a wish.

I’d throw mine at 1600 Pennsylvania Avenue.

We should all start mailing the White House $0.16 in pennies.

We lost on the $15+ jobs and gained on the $15- jobs. Now they will scream for $15 minimum wage.

What an interesting way to call us ungrateful peasants.

And remember this?

“We feed them”

Have you fed them? We feed them,” House Speaker Nancy Pelosi (D-Calif.) told CNN’s Wolf Blitzer when he suggested Pelosi should accept a compromise on the coronavirus relief bill because “people are on the street, begging for food, begging for money.”

That was the most tone deaf exchange in the history of television. Coming from Wolf truly was a shocker.

After ruining the economy and arresting people for going to work.

“Corona virus stimulus”

Pelosi Tells Wolf Blitzer: ‘We Feed’ the Beggars, ‘Have You Fed Them? We Feed Them’

On Tuesday’s “Situation Room,” Host Wolf Blitzer asked Speaker Pelosi why she’s refusing to accept any offers of compromise on coronavirus stimulus when Americans “need the money right now” and her fellow Democrats don’t want her to “let the perfect be the enemy of the good.”

“Have you fed them? We feed them. We feed them,” Pelosi declared.

Define “WE”. Actually the money is stolen from the people and given to the indigent so they’ll vote for those that gave them (but didn’t pay for) the food.

Most money supposedly going to feed the poor only feeds politicians.

If the “stimulus” that returned only $1200 per person back to the people (our money they stole to begin with) was divided up and ONLY used to give back to the.people it would have been approximately $50,000 per person.

That’s how she views all of us…as peasants, a nuisance, who need to be fed. Planet Earth is a civilization of sheep controlled by a small pack of wolves.

It’s ok if you like cake.

It’s a real toss up on who is more demented and out of touch, Piglosis or Joebama

Pelosi is demented, Obama knows exactly what he is doing: fundamentally transforming America to a Marxist dictatorship with him in charge.

Today it’s being reported that 72% of workers are living paycheck to paycheck. In 2019 it was 59%

https://content.schwab.com/web/retail/public/about-schwab/Charles-Schwab-2019-Modern-Wealth-Survey-findings-0519-9JBP.pdf

Oh, happy things? Okay, when are you leaving?

He meant like the way little girls cross their legs, the way their hair smells, having kids sit on his lap, and rubbing his leg hairs at the pool. You know, the usual.

LOVE^^^^^

“I want to talk about happy things, man–is Hunter back from the First National Bank of Beijing?”

He and his cabal are not going to get away with this election con. It will all fall apart well before the 2022 election. The people are on to them. Even the disengaged electorate know something doesn’t smell right.

The mainstay of any good economy is actual production in mining, agriculture, manufacturing and the likes not more menial jobs that do things people could easily do for themselves aka the service sector.

“Would ya like fries with that order?” “Table for two?” “What size were you looking for?”

Can I have a Chocolate Shake and fries with my cheeseburger?

Well, pretty soon the restaurants that survived the shutdown will shut down due to lack of customers because no one will be able to afford to go out to eat. A Big Mac from McDonald’s is now $5.99 in Ohio. $10 a person at McDonald’s is not sustainable for a fast food restaurant.

At one time back in my parents day eating out in a restaurant was a luxury. It was on birthdays, anniversaries, special occasions such as that. I see it coming back to something similar. The prices for a meal in a restaurant nowadays are unbelievable.

So true Fandog. Maybe those simpler times would be good for all of us.

That’s their plan; can’t have a stable and functional middle class with a fascist government; therefore, the Marxists do everything in their power to eliminate it.

Marx and Engels made it clear: In order to destroy capitalism, the middle class must be eliminated.

Always makes me wonder about middle-class people supporting Marxist/Communism/Democrats whose goal is to destroy their middle-class?

I wonder if they suppose without a middle-class they will now be upper-class? lol

those people are already categorized as definite kills for the Uniparty. We are the ones they are working on… because every DEM that is still one now, Will line up for the headshot when told to by Biden.

summmary – The Uniparty already knows every DEM will line up to be shot when asked, but You and US are the worry for them.

Yes, It is just as it is done when a Communist Government takes over a Country. The “Useful Idiots” are the first to go.

If you think about it, it makes all the sense in the World. No government or Country can sustain itself depending on “Useful Idiots” doing anything positive..

The quicker they are eliminated, the better off the Communist Country government……Stalin knew it and a perfect example of knowing it. Siberia the final destination for the Russian “Useful Idiots” at the time.

The vast majority voting for the libtards are ignorant. They are not stupid, they are ignorant. Some friends and relatives are like this. Some are very smart people, but they keep voting for the people that want to destroy this country.

They are ignorant because they have been indoctrinated and brainwashed by the media and the education system. I think a lot of these people are past changing their minds. When presented with evidence to the contrary, they still think the US has had over 500,000 deaths due to covid, all the vaccines are safe, and no 2020 vote fraud. I don’t bother anymore. I focus on who wants our country back, and how I can help.

How do they figure teachers (270K) got rehired in June? Teachers never got “unhired”. They worked under contract for the entire duration of the CCP flu/lockdowns via ZOOM.

A lot of state/county teachers actually initiate a contract every year (behind the scenes). You sign it at the beginning of each year after summer; sometimes people are told they won’t get a contract renewal at the end of the year. They rig all of this to coincide with the fiscal year and encumber going forward. For too too many, it’s just “come in and sign your contract.”

What is amazing to me is the so called Republicans in Congress.

They all went to College and can read more than the headline. How is it that McConnell, Graham and the rest of this RINO crowd can’t see or better yet won’t see or speak about what Sundance so easily and eloquently stated.

Again, it is just another example of the true type of people we have in Congress. Imagine either being so afraid or so complicit with the left that you can’t even put out a rebuttal to this jobs report, telling the American people the truth behind the numbers.

This is why NOT ONE DIME IMO must be given to the GOP or RNC! IMO only money should be given to PT, Gov DeSantis and anyone who PT personally recommends in public.

This is the FoxNews Gambit. Remove the only president worth a damn in three decades and replace with Reagan-Faker Decepticons.

They knew Biden would wreck the country but assisted the Election Fraud Coup anyway. Now they’re going to “save” us from the total disaster they helped sponsor.

They’re worse than Biden.

#HeyMitch:HurryUpAndRetireToSpendMoreTimeWithYourHandlerAndYourMostFavoredNation,Asshoe

the RNC believes that the answer is a Pence/Haley ticket…

Those two could never do a rally as the boos would be loud and endless.

Ha ha ha ha. Pence/Haley, that was a good one.

Judas and Jezebel. Awesome..

Sad but true

Haley is a no-go for me! As Governor of SC, she made a lot of enemies, even though she did a good job with the economy. However, when she put down Trump, she lost me.

How is it that McConnell, Graham and the rest of this RINO crowd can’t see or better yet won’t see or speak about what Sundance so easily and eloquently stated.

Because they are lawyers. Las time I did a search, only about 15% of Congress have accounting degrees. But it doesn’t really matter since they’re all on the globalist bandwagon.

Telling that Nikki Haley does have an accounting degree, and worked in the private sector as an accountant, but she never gets into the weeds of these numbers either.

<…Telling that Nikki Haley does have an accounting degree>

Figures 🙂

She kept the books for her parents’ shop.

Which means do NOT GIVE TO ANYONE THAT USES WINRED! Including P. Trump.

The RNC takes in MILLIONS in commissions, and uses it to fund RINOs.

If you have a candidate that uses Winred, call the office and tell him to also open an account with http://www.right.us, OR Anedot.com. It charges the same commission, but it doesn’t go to the RNC.

And it means that you will have to donate directly through http://www.right.us, and not use the “donate” button on the candidates website. But it’s worth it.

I keep saying this is the

millionbillion $$$ question… How did sooooo many Americans become this??!!We learned so little from the 2008-2009 recession. The subprime mortgage debacle was driven by poor people buying houses they couldn’t possibly afford, but the US economy has become dependent on new home sales. Manufacturing jobs have largely left the country, and the Left intends to choke off the automobile industry.

The vassal class of our neo-feudalist culture are the government bureaucrats. Their salaries grow, whatever the economic climate. That, ultimately, will be our downfall, but the Democrats are locked into that spiral.

The welfare state has be addressed, while growing the welfare state is in the best interest of those same government employees. Cloward and Piven have their secret agents.

Obama was a splendid subversive. He gave out raises to government employees during a recession. Now the federal bureaucracy is a branch of the Democrat Party, and subverting Donald Trump for extremely obscure reasons was labelled “The Resistance” by those same bureaucrats. And Trump, a man who grew to maturity in the Cold War era and just assumed the patriotism of others, couldn’t see the banality of the evil.

Anyone who calls obama a “splendid ” anything is obviously one of his admirers. UGH!

He clearly wrote,

“splendid subversive” and gave examples of obama’s subversion…….get your dictionary out and use it before being rude.

The recession that started in 2008 was the result of the derivatives industry. We did not start to come out of that recession until 2017. Yes, our VSGPDJT got us out.

Depending on what data you look at, derivatives is a $5 to $20 TRILLION business in the US alone. Put a 5% tax on that and the US debt would be paid off in less than 5 years.

Unfortunately a 5% tax on 20 Trillion would only equal 5 Trillion in 5 years. Our US debt will probably be 29T-30T by end of year.

Besides, anything “extra” (plus a lot more) will just be immediately spent by Congress–That’s how we got to 28T debt in the 1st place.

In liberal minds they think to convince you their plan is for you they always have a catchy name to market it. The “affordable care act” was actually highly unaffordable. The “patriot act” is being used against our true patriots. The “for the people act” was intended to screw the people. And JoeBama’s campaign slogan build back better, is the total destruction of the American way of life and complete control of the people by a Marxist government.

Irony is like Bidet’s mining sector.

I suspect consultants get paid hundreds of thousands to sell those stupid phrases to the rats who then are all too happy to repeat them to us in the hopes that the useful idiots fall for them yet again.. But if the election stealing stands they won’t even have to do that anymore.

The big picture is the world reserve status of the US dollar and worldwide net energy production that drives the economy , everything else is a sideshow.

In short the US dollar Ponzi scheme enables the global Ponzi scheme of ‘all’ other fiat currencies, in which, at the margins, all real wealth is priced and can still be exchanged at these artificial valuations. But after the reset you won’t even be able to buy toilet paper of equal weight with physical currency in any nation.

Mankind has faced the ultimate collapse of a ‘national’ fiat currency fueled Ponzi scheme thousands of times before. What we are building up to though is at a scale no one living or dead has every gone through. The Black Horse rides.

What makes this different this time is both its global scope and how interconnected the global supply, production and distribution chain is in now. For example during the Great Depression, 80% of the Americans still lived on self-sufficient family farms. Now it is less than 10%, if that.

Just about everything you find on the store shelves right now requires all manner of globally sourced natural resources, labor, capital and distribution systems. All powered largely by fossil fuels.

Without an effective ‘global’ medium of exchange it all shuts down immediately.

At which point everything you can count on to survive goes from global to local in a hurry.

Now PDJT understood all the above, which is why he was attempting to reverse globalization so that at least the United States of America could progressively become more self-sufficient in more things than we are now.

Further he wanted to destroy the various globalist cartels that act as parasites, controlling the price of nearly everything.

Thus forcing consumers to over pay even while also driving down wages, both globally and locally, as compared to the value that labor produces. Absolute no different than the business model of a slave plantation.

Do tell, ours our full; and yours will be as well, prior to the reset. Price in the end solves all temporary scarcity problems in both the existing and reset system to come.

You must have no idea though of how little excess capacity real time production/delivery has generated? Just one item panic purchased at rate 5% higher than ‘predicted’ is enough to clear the shelves of it.

But I’m not talking about that. Eventually the panic goes away and the shelves are restocked. Real capitalisms would not have it any other way.

The issue is when all ‘methods’ of payment of stops, the production and flow of goods/services ‘also’ stop.

Don’t confuse what I’m saying with your run of mill all bottled water is gone because a Hurricane is coming problem. Its much worse and something you obviously don’t understand about currency, let alone money.

Fortunately, the powers that be, do understand.

Which is why those families, that go back hundreds of years, ‘already’ have solutions in place.

And don’t confuse them with their paid for useful idiot low level crooks in DC and around the globe. Most of which will never live to see the purchasing power of all those electrons stored on computers that they willing sold their souls for in order to sell out their nation. Yet their eternal sham will remain. So biblical BTW.

Speaking of which, there are many passages in the Bible the talk about all the above, including money, maybe you should read it sometime?

10 points if you know what the solution is to ‘removing’ global unpayable fiat debt while ‘also’ maintaining global commerce?

Its so easily even a caveman could do it. In fact, come to think of it, they probable figured it out in the first place.

Hint, the solution is actually older than the wheel.

A jubilee year?

The tone of your comments is incredibly patronizing. Doesn’t matter how well-reasoned. When you talk down to others, well, some of us tend to just pass you on by on future posts.

Go ahead. Its called free speech. You either benefit from it or suffer, depending upon what only you can decide to do. Such is the will of God.

Store shelves are not full….period.

Your arrogantly made point is moot when you acknowledge the truth.

Meanwhile almost 1/2 the wealth created since 2008 has gone to the richest 1%

Yes, but what is wealth? Electrons on computer? No. Only useful idiots of Satan value those, and I would add that both are not redeemable in Heaven or Hell.

The real issue is what of those that have utilized via various forms of fraud and corruption vs hard work and innovation have both acquired real wealth, on this Earth.

Yes both have wealth, one group stole it and the other earned it. To the eyes of Man there is no difference, but to God? All the difference in the world. But more importantly to God and Satan as well; what did you do with this wealth?

Real wealth on Earth ‘always’ exists in a physical or near physical form, whether if its in the ownership of the ‘source’ of natural resources or the ability to produce things of value to others from the same.

I will give you one example. Let’s say you figured out how to cure most cancers; after the consumption of many physical resources, I might add? Is that not knowledge not wealth? And yet you just produce value to untold number of people, well beyond what it took to produce.

You ‘may’ also acquire physical wealth of this Earth for such an amazing achievement, but that at all times any form of wealth on this Earth is always fleeting, at least to those the acquire it. Even atheists agree on this point.

For example, even Nancy won’t be able eat all the high end ice cream in her high end freezers, praise be. BTW Nancy ice cream of any quality, doesn’t last long in Hell, just saying.

No, the real wealth you acquired by eliminating the suffering of so many, is wealth stored in Heaven itself. That is ‘real’ wealth in the purest form.

A form of real wealth that never goes away.

Amen ?

Absolutely, well said!

I’m on fixed income from 3 small sources which allow me to survive. Reduction or loss of any of them would be devastation. I had to retire early due to health problems. An old hard hat with a worn out body and even if I was healthy I don’t speak Spanish. I’m wondering how to increase my income with the inflation thunderclouds within sight. Gasoline a leading indicator of what is to come.

Sigh.

If you have a bit of money to invest and are worried about inflation, buy an I-bond. I put my old CDs paying .03% and got 2.5%. the rate is calculated by a fixed amount + twice inflation. so if inflation goes to 10% you get the fixed + 20% interest.

The fixed amount is now .0% but it is currently paying 3.54%. The rates are changed twice a year. You can only put in $10,000 a calendar year and there are penalties if you withdraw it before 5 years.

The bad news is the children currently in the White House report the inflation rate.

Good call on the I-bonds.

i can honestly say that my family’s economic present and future outlook is worse under the illegal administration.

the best thing that has happened is our retirement portfolio has continued to grow, along with our homes value.

And those are no sure things. The bottom can and will fall out again, leaving us back where we were at in 2014.

But id bet 75% of Americans dont even have access to .those illusory benefits.

And many would say my family is slurping from the trough of white privilege.

inflation is outpacing earnings, thats the canary.

My family enjoyed the financial breather provided by President Trump, but it’s slipping away fast—pretty much due to the increase in food prices, and of course rising fuel costs (rural life). The paycheck can only stretch so far. Life’s getting obamaesque again, sadly.

We are hiring and our governor has ended the free federal money.

Without competition from the government wages are already settling in our area as supply now outweighs demand. At the same time inflation is skyrocketing. Workers are in shock at how quickly their real wages have dissipated since the election.

I live in Trump county and this is just fuel on the fire. I gotta believe people across the country are waking up to this economic disaster.

The ‘service driven economy’ strategy is nothing more than outsourcing every job Americans need and want to cheap labor outside the country so that the “Elites” can capitalize (take advantage of and get filthy rich) on the situation they created. I’m incredibly disgusted with our government.

Here in the Democratic People’s Republic of NY Crazy, here is what’s happening since the Junta and their drooling idiot took over:

Cost of everything especially food and fuels is WAY up, 20-30% in many cases depending on what you’re buying. Gasoline, heating oil, propane gas are all going up with no end in sight. Nothing is coming down.

Real estate prices here in the NYC suburbs are insane. I have never seen houses being sold for such crazy high prices. There is no inventory to speak of. As soon as some shack goes on the market there’s a bidding war. And I do mean in many cases a veritable shack that was once a summer bungalow.

Mortgage rates are extremely low. We just refinanced our home and easily got a 2.75% mortgage. I can’t believe it can go any lower but who knows?

The small contractors we know and work with, including plumbers and electricians, are all booked solid. Cost of ALL materials has skyrocketed, especially lumber and metals like copper. Never seen scrap prices so high.

All the local restaurants and eateries in Westchester/ Putnam/Dutchess are looking for help – desperately. People are going out to eat now that the mask regs have been relaxed although I can’t believe how many idiots I still see walking around Main Street fully masked in 90 degree weather!

Feels like a bubble or a perfect storm.

Upstate NY: many newly built houses on acreage in the countryside around us, all very nice. Cities continue to be abandoned and maybe some suburbs too? Houses and property for sale at inflated prices.

I’m surprised at the net loss in construction jobs when this is construction season in the north. Materials cost might be the critical factor. Coming to the time where folks just throw a walmart tarp over the leaky roof and duct tape the broken window back together.

The Demo Commies from NYC just LOVE beautiful upstate New York.

Construction losses will continue to mount. In our industry, commercial roofing, if anyone places an order today, they can expect it to be delivered in 2022. Yes, 2022. This is nationwide. Steel decking, screws, 55 gallon drums, adhesive, insulation all on allocation. It is a giant shit show out there and no one is talking about it. New commercial building construction is poised to screech to a halt. Watch construction numbers in coming months. The Texas freeze is apparently part of the problem along with trucking.

So for what it is worth, I have been a member of the manufacturing community for 40 years. I’ve worked for and with many companies that you all know well, and others that you have almost certainly never heard of. I am in and out of manufacturing plants all around the south-eastern United States everyday and I can tell you with absolute certainty that the reason job growth at these companies has been slow is because no one wants to work anymore. All, and I mean ALL of my clients are trying to hire more workers. No amount of enticement or incentive they offer is working. These companies have more orders than they can fill and the biggest thing holding them back is lack of people who are willing to work, and can also pass a drug screen.

“drug screen”

I’m sure drug screens will become a thing of the past as Democommunists want drugs decriminalized. After they get that and are running out of ideas for freebies…free gubmint drugs !

Where I live, many companies are not doing a drug screen on hiring. They wait until the employee has excessive tardiness or absences and then check them. Every reportable safety violation or injury gets one as well. Failure of the drug screen is automatic termination. It is a system that seems to work pretty good. Only the problem employees get checked.

Same here. I am an industrial consultant. My customers are looking for people and can find none. Employees are maxing out OT.

I lived in CA when they incrementally passed drug legalization. First it was a ticket if caught with a small amount. Next it was waived for medical use. A lot of my druggie friends IMMEDIATELY found a doctor to write up a prescription for “back pain.” Nowadays, the police don’t even bother with the homeless shooting up on the street in front of the police station.

My sister does the hiring of administrative staff for a large company that provides management services for about two dozen hospitals and healthcare facilities.

She said that it’s almost impossible to get educated and experienced Millenials.

She said the average age of applicants is about 55.

Taxes are too high to be an employee… I do my own stuff and get to determine my pay. Working for these manufacturing wages is an insult when I can make 10X what some company wants to pay, by doing work myself.

My son’s company in Charlotte, NC is still having that same problem. Great jobs with great benefits… no takers.

This is the Buffet/ Munger economy with a healthy sprinkling of CCP bio poison dosed out by Chocolate Syrup For Brains in the Oval Office. Now take your 16 cents and get back to your service sector job and be thankful your not taxed on it. Hey wait- you owe the IRS $.8 cents.

The entire Joebama economy, Parts 1 & 2, is built on minimum wage jobs that leave people unable to move into the middle class. And that is a design feature not a flaw!

Keep them dumb and keep them dependent… Come on man!

Manufacturing jobs evaporating and service industry jobs spike.. just like during the Obama tenure. During that time wages stagnated and corporations got richer. The wealth gap widened. Wages grew during Trumps tenure and the trade deficit with China shrunk. Mercifully I believe the Amerucan people know how much better things were with Trump and now with more states tightening voting rules I believe Biden and Harris wont be in office after 2024. I hope we get there relatively unscathed.

You will not get there relatively unscathed.

The Country’s heading into its second only era of economic Stagflation, a Democratic specialty. This is going to be rough but like all hardships in life it’s also going to be a blessing in disguise. It’s going to paralyze the Democrats ability to print money and coopt countries, organizations, and people. We’re not a little banana republic – China’s not going to be able to come along and subsidize their operations.

See, you can’t Print your way out of Stagflation, that’s the source of the problem. Biden thinks he can (and all the dumbass bureaucrats) but they can’t (gone to the well to many times). Like I said it’s going to be rough, he’s going to give us a Crash we can’t get out of utilizing Monetary Policy. Another President might be able to utilize some sort of Productivity oriented Work-Fare but mostly it’s going to have to work itself out naturally according to all the Laws of Economics.

That’s where he’s taking the democratic party, Oblivion. And after Stealing the Election, it’s tough to describe how despised that Entire Generation is going to be.

The complete opposite of their parents. Pure Scum.

Racerx,read this,she just updated the article July 1,isn’t that convenient,

https://www.thebalance.com/what-is-stagflation-3305964

BY KIMBERLY AMADEO REVIEWED BY ERIC ESTEVEZ Updated July 01, 2021

Could Stagflation Reoccur?In 2011, people became concerned about stagflation again. They worried that the Fed’s expansive monetary policies, used to rescue the economy from the 2008 financial crisis, would cause inflation.18

At the same time, Congress approved an expansive fiscal policy. It included the economic stimulus package and record levels of deficit spending.19 Meanwhile, the economy was only growing 1% to 2%.2 People warned of the risk of stagflation if inflation worsened and the economy didn’t improve.

This massive increase in global liquidity prevented deflation, a far greater risk. The Fed won’t allow inflation to go beyond its of 2% for the core inflation rate.20 If inflation rose above that target, the Fed would reverse course and institute constrictive monetary policy.

The unusual conditions that created stagflation in the 1970s are unlikely to reoccur.

First, the Fed no longer practices stop-go monetary policies. Instead, it commits to a consistent direction. Second, the removal of the dollar from the gold standard was a once-in-a-lifetime event. Third, the wage-price controls that constrained supply wouldn’t even be considered today.

I’m curious about the comments regarding auto jobs being lost.. Is SD aware that some manufacturers have such narrow supply chains that the computer chip shortage has shut factories down? If you drive by a dealership in many places they have virtually no inventory.

It isn’t just auto jobs…my >two year old induction cooktop just suddenly stopped working and the repairman finally made it out today. Said it is the motherboard and if he couldn’t find one in the US it could be 5-6 MONTHS before one arrives from China! Thankfully, there is evidently one in Cali and we “may” have a working stove by the middle to end of July, depending on when it arrives and when he can get back out here to install it. They had 10 technicians Pre-Covid and now have three! Two retired, one is on family medical leave, and the rest don’t want to come back because they get more money sitting at home on unemployment!

Our fridge is 31 years old and he told me not to replace it unless it completely dies and cannot be fixed! Said it should last forever if we keep it maintained – the new ones cost $3K+ and people are lucky if they get seven years out of them!!

the chips are also used in gaming consoles (which can’t be found at all.)

The Toyota dealership here in Southern California has no cars!

Same here in Kentucky. Our sales person will sell cars the moment they get the notice that a delivery is leaving the factory. They are getting $2K or more over sticker.

Chip shortage is a scam, nobody can afford the vehicles which is why the plants are really slowing.

More hamburger flippers! Just like Obama did for eight years. It’s a feature not a flaw and millions of American idiots voted for it. Amazing!

2022 we elect more republicans

oh joy

It would be interesting to determine how many auto workers voted for the Senile Demented Vegetable. To those auto workers who did, congratulations. UAW apparently now stands for

U Aint Working. The Senile Demented Vegetable “administration” is an unmitigated disaster.

I don’t think it mattered one iota how anyone voted. It was a rigged, stolen, fraudulent election. The outcome of this election was determined by a coup without firing a shot.

I see that professional services rebounded too. So the minimum earning service folks and the well to do professionals do better while the group in the middle is left out. I can relate. I work in an engineering firm and the engineers are well off enough that the cost of living increase doesn’t matter to them and they by enlarge bask in the esteem of liberal political sensibilities. While an employee there I am a technician and in a single income household, so I have the perspective of the blue collar earners. Its interesting to see the difference.

Yes, but remember when they told us the US was going to become a ‘service’ economy when

they shipped all the good paying manufacturing jobs overseas?

Looks like we’re back on the globalist track…..

We live in a Bizzaro world nothing has meaning it just grows on trees except in this case it computer dollars out of thin air. The whole world is living on a credit card soon the party comes to an end.

Satan sons and daughters believe in the re-set where the one world government come into play. I have a news flash the great reset ushers in the one world government ruled by Satan for 7 years then Jesus comes back and Rules the earth for One Thousand years.

Deja vu allover again>

“Economy

Biden Commerce Secretary: ‘A Lot Of’ Jobs Lost in Retail, Service Industries ‘Might Not Be Coming Back’

By Jack Phillips

July 2, 2021 Updated: July 2, 2021″

Unless things have changed since I was out there people working temporarily can get food stamps, medical assistance, and yes even some of their rent is paid. Not only that, their children get free vouchers for school clothes, etc. In other words, its still better than a forty hour week to people who really don’t want to work.

The job numbers are truly great … for the Bimbo from the Bronx. With the booming hospitality employment picture, Ms. AOC is assured of a job when she gets canned either by the voters or the redrawing of congressional district lines … she can then go back to doing what she does best, making nonsensical statements that no one pays any attention to as she keeps pouring the booze down her customers throats.

The whole “reported” employment picture smells like a dead rat in closed steam room.

We know the revisions are coming that will make the numbers go to the bad by 20-50%, depending on the size of the lie told. It has for the past 6 months.

How can any numbers of growth be believed with a Government reported a demo-fascist MSM endorsed message of a record level quit rate by workers and no new employment is being sought??

All that before one considers attrition due to retirement and other causes.

Plus, this jobs added but how many were actually filled. I hate to knit pick wording but lately it is critical call attention to all the little verbal nuances in any report thanks to all the obfuscation, quibbling, lies by omission and double talk.

They’ve gone back to the Barak form of reporting economic numbers: Tell the rosy whopper and revise later or use their favorite word UNEXPECTEDLY to explain away the bad news.

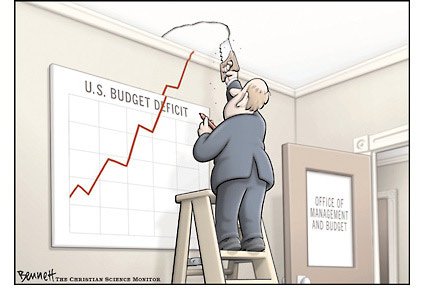

Worry not about that hole in the ceiling.

Up next is the inflation chart…

The biden economy, sucks as much as he does.

There are now 7,000 less construction workers and 12,000 less auto workers in June than May.

‘FEWER!’ NOT ‘LESS’.

Good grief.

But, bahama said he created 3 million jobs.

As someone who owned a blue-collar industry shop for decades and lived in industry for life, well, I’ve nothing to add that conforms to forum guidelines so will just say ‘yup’. Have a pleasant holiday weekend.

Good news for the service sector and bad news for manufacturing and construction? This is by design. Democrats don’t want us making anything! They only want low-paying white collar service jobs for all the pajama boys and Julia’s out there.

Pajama Boy:

Julia:

https://i.insider.com/4fa2b6afecad04990e00001e?width=600&format=jpeg&auto=webp

The term “service economy” always sounded dubious to me. How could we survive trading services with each other while all the physical products were being purchased overseas. To my mind it has always seemed that that would drain away the wealth of the country. I think that a lot of people are waking up to the fact that a lot of the “experts” that should have, and probably did, know better had had an agenda to obfuscate the truth.

It’s globalism aligning with environmentalism.

All the mining, logging, manufacturing etc .. is moved offshore to countries without EPA or OSHA/MSHA regulations. USA becomes a green economy with white color jobs and enough farming to keep people fed and maybe some assembly plants.

It means selling phones at T-Mobile for $17 an hour.

And exempt the TSP so government employees reap the rewards.

Everyone that lives around me in my neighborhood either works in government, (firefighter/EMS, school teacher), pastor, retired, and/or grocery store assistant manager. When I tell people I work for a form/fab/assembly machine shop they jump back in amazement. I only told 2 neighbors but now half the neighborhood knows what type of work I do.

Carl Sagan was our Nostradamus

And yet, just wait for the affects of the slave-labor coming across the southern boarder as it will wreak havoc amongst the working poor putting many of those Americans on the real minimum wage of $00.00 per hour and adding them to the 4 million Sundance mentioned.

Why isn’t the debt limit in the News? Before the end of the month, Congress has to raise the debt limit or we default on our loans. No one will buy these bonds. The American people will be handed the new debt amount. We need to have a spending freeze and off setting spending reductions. This will be the biggest scam on the American people this year.