Some economic data released by the land of the rising sun points to a larger global weakness in manufacturing demand. Within the data year-over-year exports from Japan fell in July by 0.3%, which is the first time since 2021 the contraction was noted.

Digging a little deeper, the weakness in Japanese exports is driven primarily by a decline in exports to China of 14.3% in July, which follows a 10.9% decline in June. Japan is a component supplier to China, which would indicate the demand for Chinese products globally is substantially less than Beijing has previously admitted.

Digging a little deeper, the weakness in Japanese exports is driven primarily by a decline in exports to China of 14.3% in July, which follows a 10.9% decline in June. Japan is a component supplier to China, which would indicate the demand for Chinese products globally is substantially less than Beijing has previously admitted.

That said, Japan’s direct export of finished goods to the U.S. actually increased 13.5%, mostly driven by the export of electric vehicles.

However, 13.5% is identical to the overall decrease in Japanese imports.

Essentially, component parts to China are down, but completed finished goods to the U.S. are up. Overall, the results from Japan point to a soft overall global economic status, the result of continued contraction of Western economic activity.

TOKYO, Aug 17 (Reuters) – Japan’s exports fell in July for the first time in nearly 2-1/2 years, dragged down by faltering demand for light oil and chip-making equipment, underlining concerns about a global recession as demand in key markets such as China weaken.

Japanese exports fell 0.3% in July year-on-year, Ministry of Finance (MOF) data showed on Thursday, compared with a 0.8% decrease expected by economists in a Reuters poll. It followed a 1.5% rise in the previous month.

[…] Japanese policymakers are counting on exports to shore up the world’s No. 3 economy and pick up the slack in private consumption that has suffered due to rising prices.

However, the spectre of a sharper global slowdown and faltering growth in Japan’s major market China have raised concerns about the outlook.

The World Bank has warned that higher interest rates and tighter credit will take a bigger toll on global growth in 2024. (read more)

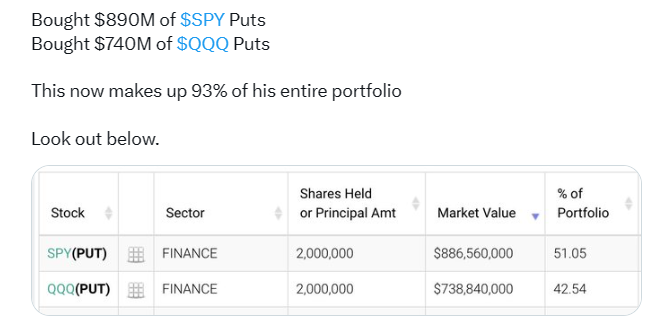

Meanwhile, I would not bet against Michael Burry.

Burry is betting against the S&P 500 and Nasdaq 100 this week, according to his fund’s latest releases. Securities and Exchange Commission filings. The filing shows that he is now holding options against the S&P 500, hedging $886.6 million against the index.

The filing also revealed that Burry sold his shares in Capitol One, First Republic, PacWest Bancorp, Wells Fargo and Western Alliance after betting on them earlier this year in Trying to make money from the regional banking crisis. Burry also sold his stakes in Chinese e-commerce giants Alibaba and JD.com.

In addition, he bought $738.8 million in put options against the Invesco QQQ Trust ETF – a fund made up of popular high-tech Nasdaq companies, such as big tech companies Apple and Microsoft as well as Nvidia, Tesla and PepsiCo.

Burry has pulled money out of China investments and U.S. banks and is hedging against tech and the S&P. He took these positions before the data from Japanese exports to China was released.

Why would you take advice from a guy who sells newsletters for a living? If he was correct in prognostications, he would be a muti billionaire.

Are you referring to Michael Burry? He’s not a billionaire but I believe he made at least $100 million during the sub prime collapse. I don’t believe he sells newsletters but I could be wrong. He ran, and continues to run anew Scion Capital.

He is a multi-millionaire and doesn’t sell newsletters, so that information is false.

He became well know from the book/movie The Big Short based on his ultra-leveraged bet against the housing market during the Great Financial Crisis (GFC). He’s very smart, he’s usually ahead of the curve, and the investment industry respects his views … while not always right.

One of the greatest movies of all time. Every child should be forced to watch it

Sounds good, nobody’s always right.

A guy like him can be right 20% of the time and still be, very, very far ahead financially.

Not many ever talk about this. It’s all about positioning, be able to take a loss and let the big ones run.

Reminds me of the comments on Stocktwits. No stopping, NVDA to the moon baby. p/e is only 223. There is a cognitive dissonance going on in the stock market kind of like masks and the pandemic. Don’t say anything different or you’ll be shamed. Bidenomics my ass.🙄

The challenge for using Michael Burry as a proxy for the market is that he is always EARLY! Being early is also synonymous with being wrong, as he admitted earlier this year.

https://www.kitco.com/news/2023-03-31/Michael-Burry-I-was-wrong-to-say-sell.html

I totally respect his viewpoints, but you can’t underestimate the amount of market manipulation that is taking place right now, both economic release manipulation (overstating jobs and understating inflation) and potential equity market manipulation (supporting just the top 5 stocks prevents the major indices form crashing).

Some of the largest investment funds in the world, such as the Norway Wealth Fund and the Swiss National Bank own more than 10% of the world’s equities. Can you guess their top holdings? Apple, Microsoft, Nvidia, Amazon and Google. By buying these stocks, they keep the US equity indices from crashing.

Just as we know the 2020 election was rigged, we have to suspect that the current financial markets will be rigged until the 2024 election. Democrats can’t let the markets crash, as that will be the death of them going into an election year.

I do believe the market is close to having a ‘correction’, but they will likely save the ‘crash’ until late 2024/early 2025 (although I hope that I am wrong).

Spot on. I wouldn’t be surprised if the crash/correction/fall isn’t later than 2025. Recall that all the signs were beginning to manifest themselves in the housing market in 2005ish. That’s when people in the know started feeling like something might be amiss. The music didn’t stop until summer/early Fall 2007.

The data we’re seeing now reminds me of those early days albeit, we’re likely far more in tune with what’s happening due to experiencing other financial calamities.

It’s not specifically and solely housing this time but the writing is on the wall. It feels bigger than just housing and we know how that turned out. When the music stops this time, all I know is that things are going down. How you’re positioned before that will certainly matter. Trying to determine the bottom will matter too.

A wildcard this time is if TPTB try to lever that ‘crisis’ and change how everything works going forward.

Lots to consider this time around…

I suspect you will be proven correct.

Early? The Clinton Administration experts would have known the likely outcome of their policy….

“Fannie Mae, the nation’s biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people.” (New York Times 30 Sep 1999)

The old cliché was: “markets can stay irrational longer than you can remain solvent.” I think it should be updated to now say: “markets WILL stay RIGGED longer than you can remain solvent.”

I am anticipating they will crash the economy around or just after the election, bigger than 2009, and regardless who is in the WH, their intention is to use the created crises, to force the adoption of CBDC’s and Universal biometric I.D.’s, insisting they MUST have these new “tools” to get control of the crashing economy.

I think thats their PLAN, but their plans are far from 100 percent successful.

As for China, their vulnerability has always been if the World economy contracts, cause their economy is a ponzi scam, and only s consistent market for their crap, keeps their whole system working.

Interesting times,…

I used to play this game also. It was called monopoly!

Yup!

That’s because it’s backed and (en)FORCED by government.

You can see real time socialism in action as you see the response for failing to remove the treason and corruption from our houses.

“The utopian schemes of leveling and a community of goods, are as visionary and impractical as those which vest all property in the crown. These ideas are arbitrary, despotic, and, in our government unconstitutional.” – Samuel Adams

“I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending on object of benevolence, the money of their constituents.” – James Madison – Annals of Congress, House of Representatives, 3rd Congress, 1st Session, page 170

You crack me up Patrick and I dont mean like Hunter Biden

If memory serves, a global financial crisis was the underlying condition from which emerges the anti-christ to lead a one world government according to Hal Linsey in his book the Late Great Planet Earth from the 80s. Who knows?

If that’s the case, then it has already happened. Out of the great financial crisis of 2008-2009, came a two-term U.S. President named Barrack Obama. Some say that his 3rd term as President is in place now. You can’t see him, but he is just behind the curtain pulling the strings.

Although it has been nearly 50 years since I read that book, the other thing worth mentioning is Lindsey’s paying particular attention to Revelations saying the anti-Christ would be heralded as a “bringer of peace.” The Bamster got the Nobel prize after he had barely been in office a year.

Disco will make a comeback, I am betting on it. Further, there will be–shortly, a horse whose performances will surpass that of Secretariat. I sense a trembling in Prince Harry’s marriage. Beyonce knows she is being eclipsed by Taylor Swift and will modify her performances by introducing more whore like behaviors. Madonna may not make it through her next major plastic procedure by her new doctor in Chile.

And a great white shark will be discovered lingering just off the shore of Obama’s island home in Hawaii. I am not sure when Hell is going to freeze over, but my senses tell me it could happen.

Yes, I have a crystal ball and, of course, a giant disco ball…where is Donna Summer when you really need her?

There is a serious reason spiders wait on the edge of their webs…vibrations trigger a response and this article suggests one should pay attention even to soft and distant vibrations.

We have a fiat currency. It’s not worth anything. All the numbers are cooked. We’re in for a great recession. Not a correction and it’ll probably begin happening this year.

Yep! They are seriously holding down the gold/silver price, and the only people that benefit are the BRICS nations buying it up!

This morning I decided that I will not buy any shoes (ouch), clothes, make-up or other items that are not absolutely necessary for the rest of this year. No store-bought Christmas gifts. No dinners out. NOTHING. Already don’t have television. They want to break us. Let’s break them!!!

Absolutely what every American citizen needs to do.

At least, those of us who are wide awake.

Michael Burry not “Berry”. And… beyond the big short which took several years to work in his favor with a period of huge losses, he has not been as consistently insightful as some would have you believe.

The Eurodollar system tells you that China is low on dollars, and so is India for that matter, and face de-valuing their currency. Which would cause a massive deflationary wave across the global economy. The western media pinned their hopes on a big Chinese economic recovery to provide a soft landing. Now they preach the opposite. Re-opening had no impact on China’s economic downturn.

Other countries are happily divesting themselves of the dollar!

They still have lots of dollar denominated debt to pay off. That in turn makes the dollar rise, making it harder for countries to pay off their debt, that are owed to not just the US, but every other country as well. This is the trap of the system. You can’t divest from the dollar without hurting yourself and everyone else. It’s by design. Once you know this, you realize how much else is as well. Defaulting on debt is going to lead to massive conflict.

I requested a quote from China last night for a common item that I ordered 18 months ago. The new cost came back 17% lower ~ FOB: USA.

Then I just see “China’s Economy is Weakest in 4 Decades”. Hum,,,

Please before you flame me: The same item made in USA cost is: 73% higher.

What is the item?

Plastic letter opener

50,000 units

Something I found amusing, is people were bitching about China buying all the grains. Now China has decided they don’t want anymore, and will use BRICS nations instead. Now people are bitching China is putting farmers out of business by not buying! Nikki Haley came out with some real horse sh*t about it.

I am think the word Mr. Berry is looking for in his hedged bet is…

Unsustainable

I have never seen a group of people with less understanding of Bidenomics and the improvements it has brought into their lives.

You spelled ‘deteriorations’ wrong. Unless you ment to say ‘deprivations, in which case, you also missed by a bit.

The trillions of covid and other money has left a wave of inflation and interest on the debt funded by more debt. The printing press eventually won’t work any more. We will have nothing and be happy. That’s their plan.

All’s I know is that at the end of the month my accounts receivable need to exceed expenditures. My equipment is paid for and outlays include fuel,insurance,maintenance, base plates,tolls, and permits. Anyone that dosnt operate similar to this is a friggen crook- even if the government allows them to.

I am focused on quietly restocking my baby wipe hoard as well as curing salt and water purification tablets for the launch of the BRICS gold backed digital currency. I ordered 2 new pairs of New Balance trail running shoes with rush delivery, hopefully they get here soon.

Not in touch with…well anything.

From the Potato’s cheerleaders.

NBC’s Tur: ‘It’s Not Bad News’ that Inflation Keeps Rising

Tur added that unemployment is low, there hasn’t been a recession, and the inflation rate has dropped, “it’s still expensive at the grocery store, it still can be expensive, at times, for fuel, it’s kind of fluctuating.

But the idea out there is that things are bad, how do you combat that idea when everything does seem to be going in the right direction, yet, people still don’t feel like it’s going in the right direction?”

How do you cure people feeling alright paying so much more for things than under Trump ? It’s like mass Stockholm Syndrome.

How do you cure people from thinking that accepting a decaying city filled with feces, drug zombies, empty offices and crashing property values is better than ….GASP….voting Republican? They seem to think the worst thing they can possibly do to piss off their illustrious peers would be to vote Republican. Actually look at Dershowitz – shunned on Martha’s Vineyard for standing up for the Constitution. These people who largely would be regarded as quite intelligent can actually be incredibly stupid and bigoted.

But if these economic conditions persist I bet even China would be on the bandwagon for Trump 2024! The ones who must be very pleased with all this are the nazis at WEF…rubbing their hands together anticipating how they will own and control it all.

The list of investments he’s betting against is essentially every consumer item made. You may as well say he’s betting on a general recession or a depression. It looks like he thinks the worldwide consumer – the US, the EU, Japan and China – is tapped out.

I wouldn’t say he’s wrong.

Gold is back under $2,000/oz with over spot. Keep your purchases under $10k per. Just saying. Think ahead.

Joseph Robinette Biden used the following aliases:

Robert L Peters

Robin Ware

JRB Ware

JUST IN – Crisis-hit Chinese property giant Evergrande files for Chapter 15 bankruptcy in New York.

Did my part to help out our Japanese friends last month. Bought a Toto Washlet bidet seat for my bathroom throne.

Call me a prepper, I’ll never have to worry about toilet paper shortages again.

🙂

Also in today’s news China is selling massive amounts of US Dollars and buying Yuan in the foreign exchange markets to try to stave off a currency collapse. Another huge property company, even bigger than EverGrande, is about to go bust.

I pulled all of my investments out of the stock market couple weeks ago when the S&P broke 4500 and put it all in fixed positions of 5.5%, gold & silver

Feel like investing genius ever since…. Its gonna get really ugly really fast…

Do you purposefully buy China made products as much before? Neither do I.

There is your collapse.

If I am Micheal Burry I check my car very carefully every time I get in to drive because my guess is he is on both an FBI and CIA hit list!!! 🤔

And he can sell those just as fast as he bought them after any pullback in the market and make a lot of money quickly. Publicizing the purchase will probably actually help cause said pullback and is a form of market manipulation all by itself in my opinion.

Sometimes you ‘short’ then spread FUD, other times you ‘short’ expecting others to spread FUD. But everyone’s being warning about an impending official “official recession,” including Musk, for awhile. Will be interesting to watch.