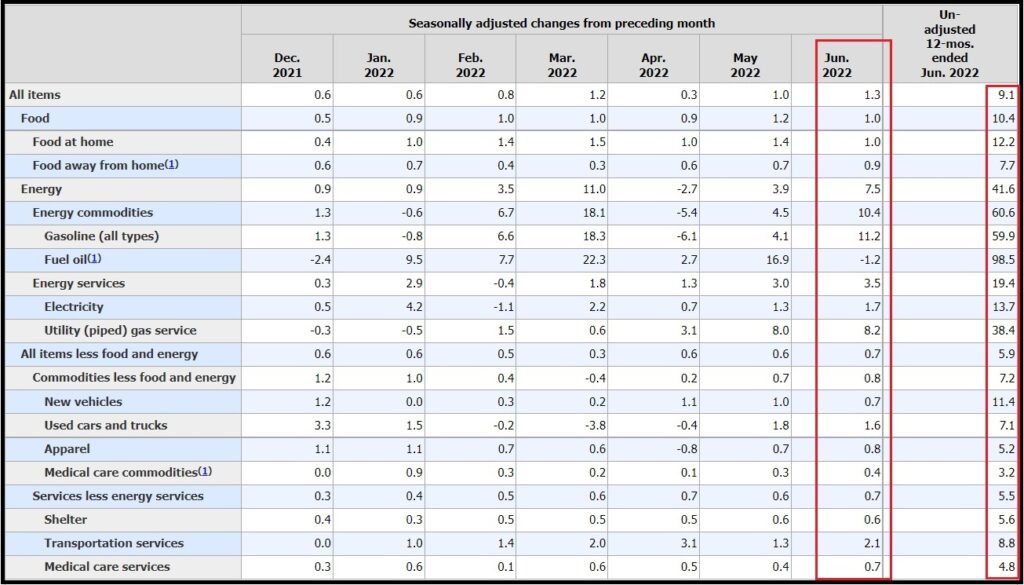

The Bureau of Labor Statistics (BLS) has released the June Consumer Price Index (CPI) [DATA HERE] showing yet another “surprising” increase in overall inflation. For the month of June overall inflation increased 1.3% bringing the annual rate of inflation to 9.1% as calculated.

Economists and financial pundits are “shocked”, “surprised” and the proverbial “unexpected” is running amok again amid the typeset. The reality of Joe Biden energy policy being the origin of our current inflation crisis is being avoided at all costs by the pretenders. The federal reserve raising interest rates can only impact the demand side, but it’s the supply side (total energy policy) creating the problem. Table-A shows the overview.

(CNBC) – […] The consumer price index, a broad measure of everyday goods and services related to the cost of living, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked the fastest pace for inflation going back to November 1981.

[…] “U.S. inflation is above 9%, but it is the breadth of the price pressures that is really concerning for the Federal Reserve.” said James Knightley, ING’s chief international economist. “With supply conditions showing little sign of improvement the onus is the on the Fed to hit the brakes via higher rates to allow demand to better match supply conditions. The recession threat is rising.” (read more)

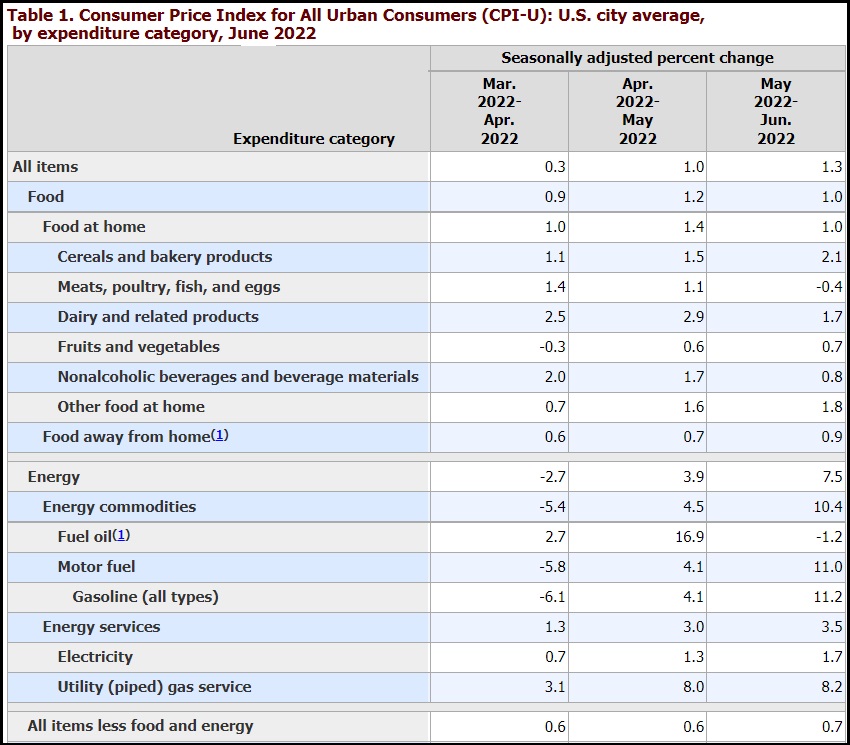

If you dig into the details, the inflation picture shows just how deep the energy policy is hitting. Everything is impacted by Joe Biden’s radical energy policy. Table-1 breaks down the data a bit more specifically. However, even this data is skewed by the BLS putting a weighting factor on the importance.

♦ The rate of annualized inflation for natural gas is now running at almost 100%. Meaning if things continue, the current price will double again by this time next year.

♦ The rate of annualized inflation for gasoline is running at 134%.

♦ The annualized rate of energy inflation overall is running at 90%.

These are the results of the people behind Joe Biden implementing the Green New Deal program by executive fiat.

Also, keep in mind the current increases in farming costs at the field have yet to reach wholesale and retail. The fertilizer, oil, diesel, packaging, transportation and energy costs at the field will not arrive to the fork until later this fall. That is when food inflation will surpass energy inflation.

Current cattlemen and ranchers are finding it more cost-effective, due to drought and high feed costs, to take their cattle to slaughter. There is a temporary drop in beef prices for the next several weeks before the supply roller coaster sets up a scenario for massive increases in beef costs this winter. Consider buying and freezing now for use later this year and into the winter. Try to buy directly from cattle ranchers.

Later this year the next wave (#3) of food inflation will surpass the last two waves. Things will get ugly because there are also predictably shortages of food coming. Higher farm costs and global food supply shortages equals much, much higher U.S. prices. Prepare.

https://youtu.be/X_gmBBZc-Jo

Thank you, Sundance for the heads up.

You also warned us about 8 mos ago, to take care of our pets. They are the absolute bottom of the grain chain.

And true to your word, after downgrading from Hill, which became impossible to find during the plandemic and switching to Beneful, the best and most available, I could get my hands on readily. Has increased steadily, but is up now $5.00 from 2 weeks ago, at the United Nations of Walmart.

Also, again, I see too much inventory in stores. No one is buying anything. We have 3 seasons worth of confusion and Fall inventory creeping in. A glut, is coming.

And while I am at it, wink, wink.

I predicted that the amount of tourist traffic on CC , between June 24 and July 10th, was so unprecedented, that it appeared to me that they were cramming in the summer vacation fun early, before they couldn’t afford it any longer.

No problem with no parking at beaches filling up now and the stores are quiet.

Because of Sundance, I connect the dots.

Someone, on Varney this morning said … LOOK OUT September! After summer EVERYONE hunkers down and goes into full PROTECT mode … and EVERYTHING … crashes

Also, people can make healthy food for their dogs. I love this blog. Here’s the link to the meatloaf recipe she makes for her dog. http://www.fiascofarm.com/herbs/Mables_Meatloaf.htm#meat

One of the ingredients, believe it or not, is pinto beans. Very high in protein and fiber. Probably good for human’s too!

I agree, my Jack Russell gets cubed chicken thigh meat, added into his food daily. I stretch his container into 3 portions.

My Vet told me that he lacked the calories and vitamins from just straight chicken and carrots and peas.

My 2 large dogs food has been near impossible to find for the past few months. I finally pulled trigger on a new flavor.

“Pets” are going to be the least of people’s worries down the road. When I was a kid “pets” would eventually be our dinner.

yup. okay. proud and grateful ‘to be an American Girl’.

all that’s missing here now, is abigailstraight. but then I didn’t comment on trump.

i have more faith than to eat my dog.

In the Valley of the Dems, otherwise known as The Swamp, D.C., I notice that the cost for three bags of food at the grocery store today was $190. Last year the same three bagger cost me $100 and the year before that about $75. I guivered at $75! I think I will grill my hot dogs over used Washington Posts that say the economy is booming!

LOL. I was in the very heart of the beast a couple of week ago to have lunch with my friend – Chevy Chase DC. Let me just say this – every yard – had its virtue signal flags flying – love is love – BLM – ukraine flags. What a bunch of drones.

More quivering coming. That 1.3 % monthly jump annualizes to just over 15% inflation and the talking heads are stone cold silent.

The BLS figures are damn lies. Inflation is way north of 20% and rising.

ya that dark roast canned Kirkland (Costco) coffee I like was $9.99 a few months ago, it’s now $15.99

That price was constantly $9.99 for a three pound can for the longest of time (multiple years).

$330 pesos in Mexico

People have no idea what’s coming, at least the ones I encounter.

I live on the East Coast and in the last few weeks have friends, family, and coworkers who have taken the following vacations:

1 month in the Florida Keys

1 week in Los Angeles

1 week at Disney World

2 weeks in OBX

A trip to Rome and a Mediterranean cruise

A trip to the Bahamas

1 week in AZ

10 days in Hawaii

1 week Ocean City, MD

10 days in Ireland

1 week in Spain

1 week in Myrtle Beach

I am sure I am missing some as it is Summer.

tell me about it. My friend who is very close to retirement has spent so much money this year I have to shake my head. She spent $4500 at Disneyland in March, $7000 to relandscape her yard. $2000 to have her garage floor epoxied, and various other big gas burning trips, and its only July..She should be saving, and we are in California so retiring here is dicey and she plans on buying a new car as well, and no shes not wealthy..She wants her and I to rent a car next April and drive to the Grand Canyon and Sedona for a week trip, we both have never been. Even though I have the money to do that I am finding it hard to justify the cost..high inflation, prices, gas the highest its ever been..

She NEEDS a drive to Sedona … to get her shakras realigned … or her aura read … or something New Age-y.

One thing to add to the mix and I’m as guilty as anyone. Filling your freezers with beef, pork, chicken, etc., is a disaster if they’re going to take away your electricity. Buy a pressure canner (cheap brand is Presto, expensive brand is All American – either will work). Pressure can all the meat in your freezers so it becomes shelf stable. Follow the guide so you don’t make yourself sick. (https://www.healthycanning.com/). At this point, food is an investment, so treat it like one.

Absolutely correct. Any power outage, manmade or natural causes, will take out your stockpile in 24 to 48 hours without electricity to keep it frozen.

Well … I suppose you can get me to eat canned beef … BEFORE … I’ll ever start eating crickets

I have smoked chuck roast and grilled London broil canned up that we love. Ground beef also canned up for tacos, chili, etc. for about $2 a pound. The real beauty is it all just needs to be heated up, it’s already cooked.

When hurricane Ike blew through Ohio, I spent a day and a half on the phone. I finally found someone with both power and an empty freezer, saving 200 pounds of beef.

I see comments here that we need to get our real President back in office to cure this inflation.

I don’t disagree that we should have and are entitled to our truly elected President (among other stolen offices).

But the Left/Uniparty has created a Frankenstein like monster in that this is so far out of control even reversing all of the stupid and evil O’Biden policies would not get us out of the inflation/recession headed to a depression cycle. Events have taken on a life of their own.

It might be, at best, a stop digging effect.

Orange man bad … mean tweets upset suburban mommies. The same mommies who hand out PARTICIPANT trophies to every little fat, awkward, kid who ever waddled across a soccer field. Now … we’re all getting the PARTICIPANT trophies some mumbling old basement hermit promised we’d get. And we’re getting those trophies shoved right up our … nevermind. I got carried away.

“But the Left/Uniparty has created a Frankenstein like monster in that this is so far out of control even reversing all of the stupid and evil O’Biden policies would not get us out of the inflation/recession headed to a depression cycle. Events have taken on a life of their own.”

I disagree. So much of inflation is bound up in the EXPECTATION that prices will continue to go up. Like the futures market for oil, for instance.

Just Trump being re-elected, raising hopes of his energy policy being reinstated, will have an immediate positive effect on the economy.

You watch. It will happen that way!

Actual inflation is much higher. The government took gas, food and rents off the CPI years ago as to volatile . In other words to true of indicators.

And they also injected the improvement factor – basically Moores law – you get more computer today with a buck than yesterday.

I splurged today and went to Costco. I purchased approximately 9lbs of organic, boneless, skinless, chicken thighs. It was $5.99/lb (outrageous). Since I don’t eat much, it will last me a really long time. But, if I had Littles right now, it would take some work to feed them high quality foods in quantity, and I could never afford this luxury.

I’ve gone back to whole chickens. ONLY NON-organic. Gotta break em down … but that’s worth the savings.

Try $8.99/lb Albertson’s not organic, not free range, skinless only in CA.

Yiiikes! I sound like my grandmother (who survived the Depression) when I say … “I remember when chicken was $0.99/lb … all day long”

Just had my second stand up freezer delivered for my garage.

I am heeding your warnings and have from the beginning.

Get a propane generator and a tank.

Well mostly a Mike Lindell commercial but Hold on…

https://usamagazinestudio.com/president-trump-hold-on-im-coming/

Wow! We’re facing an economic tsunami to the downside. Sadly, this is just starting. The third and fourth quarters of this year portend a coming economic disaster. Sadly, most of this is by product of horrible Democrat policies agumented by Republican entrenched politicians. It’s 100% self inflicted!

The Biden administrati0n is falsely accusing Putin of causing this mess. I wouldn’t put it past them to start some sort of deflection in the form of a conflict with Russia. It’s back to the old ‘Wag The Dog’ scenario. Sooner or later people of the world, our allies, will grow tired of these politically created conflicts.

This political and economic insanity has to be brought under control. When it does, like every time in the past, there will be a renaissance. For those who kept their powder dry opportunity will abound.

My wife and I have around 150 head of cattle. Fortunately we have some good hay suppliers who maintained their price per bale for us this year. Since we purchase so much and I pay them immediately, they appreciate are doing all they can to keep us as a customer. Obviously, the cost of beef doesn’t concern me, but I’m spending a lot of money on remote cameras and other things to keep them from walking off in the middle of the night.

Wonder if we prostrate ourselves to Lord Biden and promise never to vote Trump again will he restore the energy sector former glory of being the largest producer in the world.

The answer is no. Biden and his kind are never satisfied.

The past several weeks Bear market rally gave a good opportunity to get out of the Stock Market for those who want out.

Interest rates need to go way up to break this high inflation. Interest rates were about 18% in 1980. Which means the Prime rate would have to triple. And in 1980 we had Paul Volcker as the Fed Chairman. His strict monetarist policy was in contrast with the Keynesian policy of Arthur burns in the 1970s. Interestingly the prime rate went up during Trump because the Feds were trying to suppress the Trump economy.

They can’t do that now. It would stop inflation, but we were a different country then. We weren’t a debtor nation like now. The interest on the debt is already more then the entire defense budget. So we will have stagflation, high interest rates and inflation for years to come.

“Interest rates need to go way up to break this high inflation”

No – I don’t think you understand

(if I do, correctly)

Raising interest rates may help cool demand ** a bit ** by raising costs to the point people will stop paying; but that’ll only affect ** discretionary ** spending, which is becoming more and more slender a portion of the family household budget.

And in the near future I think discretionary will become much less important – to the point of irrelevance – as it trends to zero for many households (all but the light-cigars-with-hundreds fat cats).

But Sundance has pointed out that much (or most) of the inflation we’re seeing is SUPPLY-SIDE inflation, not demand-driven inflation

They’re increasing energy costs by insisting that only green / renewable options can be used — and that coal, petroleum, and natural gas MUST be phased out

Resultant increases in energy costs ricochet thru every level of the producer and transport and distribution elements that bring goods to your table

Raising interest rates will cool things most directly in segments of the economy that are governed by interest rates (home mortgages, for example)

But rising interest rates will not cool the producer-transport-distribution-retail inflation that we’re experiencing

In fact, higher rates will increase those costs even further, by making it more expensive to do business at every business level

And here’s the killer: those price increases will hit every family HARD — in that they’ll affect non-discretionary spending

[you still have to buy food — you still need to heat your home in winter — you still have to gas up your car to get to work — you still need to buy a new car if yours conks out]

— these are all things whose costs are rising as a result of supply-side inflation

That’s the way I understand what Sundance has been telling us and specifically why he’s using that very phrase, “supply-side-inflation”

The entire point of this article that Sundance has written is that they’re pretending

They’re pretending that it’s the kind of inflation that’s curable by raising interest rates

It’s not

They’ll raise interest rates and deepen the developing recession and we’ll still have the inflation

I believe that’s referred to as “stagflation”

I’m open to correction if I’m wrong

Anybody just tell me where, please

(would appreciate a word from Sundance if he’s scanning the thread)

Just bought a side of beef from my ‘cattle rancher on retainer’ in KY. A little less $6/lb. when all was said and done. About a 20% increase from last year. Infinitely better product than any beef found in a grocery store.

we just got a whole ordered and locked in fully cut and wrapped for a little less. much better quality and much cheaper than the store.

F.J.B.!!!!!!!!!

This is scary – Jimmy Carter wasn’t near this bad. Something is going to break.

We had what appeared to be a Bear Market rally which should have taken the Stock market to a retracement of 32,500. It has come up 1,000 points short. This means extreme weakness. The resumption of the Bear Market commencing January 3rd looks poised to resume to a 28,500-support level.

They are going to try with all they have to keep the Stock Market above 30,000. Despite the Federal Reserve, US Treasury and Investment Bankers with all their Trillions I don’t think they will eventually prevail. At some point massive capitulation begins to take place on a Worldwide basis. I am not confident 28,500 will eventually hold and the next major support not until 21,000.

Don’t forget the railroad strike coming 18 Jul. That will just ratchet it up another couple degrees.

what rr strike?

My rule of thumb is that REAL inflation is twice the official number.

http://www.shadowstats.com/alternate_data/inflation-charts

For me real inflation is what I need to buy is too high a price I can buy it.

every time one of these reports come out I just wish they would publish real numbers.. food is up 100 percent and energy a lot more. I don’t get it.

https://nypost.com/tag/inflation/ ; (07/13/2022, 5:50 PM.)

The Green Hell Agenda, aka Build Back Better, aka The Green New Deal are an evil political correct/cultural marxist SELF INFLICTED ENERGY CRISIS.

FJB/LGB

I just love this turn of phrase:

…the proverbial “unexpected” is running amok again amid the typeset

Remember also, this rate of June inflation is compounded on top of June 2021’s rate of 5.4%. So in one year, we have an increase of 14.5% when compounded.

And next month? Look for another gain of over 1% because once all their lying about the numbers catch up with them it will be like a dam breaking and the REAL numbers are going to come out. We are heading for the Carter years where I borrowed money at 18% with a 1.5% PMI…..get ready there is nothing I see that is going to be any different this time around when our energy was choked off!

Remember the White House and the admin has told us, repeatedly, best economic situation ever 😜