As if carrying Homeowners insurance in California and Florida wasn’t already subject to ridiculous increases in premiums, things are about to get a lot worse.

Effective with the July 1st notification, Reinsurance rates, these are companies who insure the insurance companies, are telling their clients there will be up to a 50% increase in cost for underwriting catastrophic coverage. Perhaps claims in the past few years have been higher; however, I suspect the issue amid the reinsurers is partly connected to the issue that surrounds banks and bond rates.

Back when interest rates were near zero, banks and reinsurers likely scooped up lots of Treasuries and bonds. As the Federal Reserve hikes rates those bonds have declined in value. When interest rates rise, newly issued bonds start paying higher returns to investors, which makes the older bonds with lower rates less attractive/valuable. The result is that most banks, and I suspect big reinsurance houses, have some amount of unrealized losses on their books.

Back when interest rates were near zero, banks and reinsurers likely scooped up lots of Treasuries and bonds. As the Federal Reserve hikes rates those bonds have declined in value. When interest rates rise, newly issued bonds start paying higher returns to investors, which makes the older bonds with lower rates less attractive/valuable. The result is that most banks, and I suspect big reinsurance houses, have some amount of unrealized losses on their books.

Whatever the reason, the big reinsurance companies are now telling the insurance carriers their catastrophe rates are going up as high as 50%. Those insurance companies will then pass those rate hikes to the individual policy holders for commercial buildings, residential homes, cars, RV’s etc. Bottom line, homeowner insurance rates are about to go up again with policy renewals, especially in Florida and California.

LONDON, July 3 (Reuters) – U.S. property catastrophe reinsurance rates rose by as much as 50% at a key July 1 renewal date, broker Gallagher Re said in a report on Monday, with states such as California and Florida increasingly hit by wildfires and hurricanes.

Reinsurers insure insurance companies, and have been raising rates in recent years because of steepening losses, which industry players put down in part to the impact of climate change. Higher reinsurance rates can affect the premiums which insurers charge to their customers.

U.S. reinsurance rates for policies which previously faced claims for natural catastrophes rose 30-50%, Gallagher Re said.

Reinsurance rates for similar policies in Florida rose 30-40%, the broker added.

Some insurance firms have pulled out because of the risk of heavy losses. State Farm said in May it would stop selling new insurance policies to homeowners in California.

In Florida, “all the major carriers (insurers) left and so you ended up with this market which is populated by a large number of very small, very thinly capitalised insurers which is exactly what you don’t want,” James Vickers, chairman international, reinsurance, at Gallagher Re told Reuters. (keep reading)

In Florida specifically, homeowners insurance costs have now generally risen higher than the mortgage payment for a middle-class family. This is not sustainable.

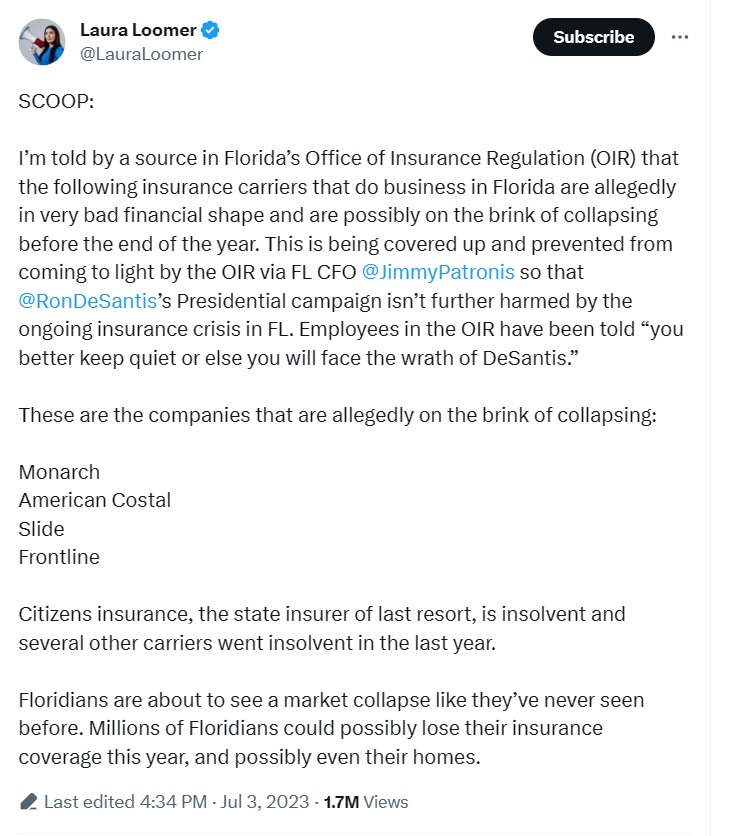

SCOOP:

I’m told by a source in Florida’s Office of Insurance Regulation (OIR) that the following insurance carriers that do business in Florida are allegedly in very bad financial shape and are possibly on the brink of collapsing before the end of the year. This is being covered…

— Laura Loomer (@LauraLoomer) July 3, 2023

“It’s the Economy Stupid!” It’s NOT that the costs of materials have gone up due to rising production, storage, or transportation expenses. It’s more akin to how far the U.S. Dollar has fallen in value. You can still to this day buy a gallon of gasoline for just a Quarter, 25 cents. A pre-1964 U.S. Quarter (90% Ag) is worth about $6.00 (depending on Spot Prices). People think it’s crazy, but they are missing the point. You could buy a gallon of gas back in 1972 for the same quarter. Thats when the United States came off the Gold Standard, and warped/morphed into the DEBT Standard, and lookie lookie, whare we are today. CHA-CHING go the Central Banks!!

This year my homeowners insurance went up $1500/yr. Car insurance on each car up $400 for 6 month term

It would seem the Insurance Companies are intent on Bud-Lite(ing) their companies … is BlackRock threatening them due to their

*ESG*DEI*CEI*CRT scores?

My condo complex has asked owners to write letters re: FL increased insurance rates to the below people. Our list included our local reps. you’ll want to include yours.

GovernorRon DeSantisOffice of Governor Ron DeSantis

State of Florida

The Capitol

400 S. Monroe St.

Tallahassee, FL 32399-0001(850) 717-9337https://www.flgov.com/email-the-governor/

Chair, Insurance

and Banking SubcommitteeRepresentative Wyman Dugan

904-381-6011

850-717-5012 (Tallahassee)

[email protected]

Chair, FL Senate Insurance and BankingSenator Jim Boyd

850-487-5020[email protected]

Vice-Chair, Insurance and Banking Subcommittee

Representative Tom Fabricio

305-364-3064[email protected]

Vice-Chair, FL Senate Insurance and BankingSenator Nick DiCeglie

850-487-5018[email protected]

Talking Points:

Condos were the goto. Not anymore, especially the older properties(40+ years oldor cheaply constructed not maintained well.

super thread.

happy 4th..

I think it’s anything 30 and up because IIRC Miami’s sunrise that collapsed was 36 yo. I knew there’d be more inspections when that happened – always assessments in old buildings. My realtor told me Aug of 2021, after I had decided to sell, she said they were discussing laws to allocate 100% reserves for things like roofs and other major maintenance. Most association fees will skyrocket because even though mine had adequate reserves compared to most complexes, none were carrying 100%.

Ron the Con doesn’t give a sh*t

He’s too busy wasting money trying to beat Trump.

Saw a poll today that he is down to 16%.

Waste of money for sure lots, of it.

No. Ron doesn’t, but FL has more retirees, condos, and just plain influx of people than any other state and WE care and any elected official damn well better care or elected someone who does.

We are worse than soldout Ron if we do nothing.

Write one letter and send it to everyone.

FRdS

Good idea. Will do. Also , like your association, we have approximately 1100 units ,with 15 different HOA’s. Condos, villas, single homes. Across the lake from us, they found structural damage on groups of condos. $300,000 condos just charged $14,000 per individual unit.

Pray and help others

Like you, we have about 36 homes on site. My 166-condo cluster had an engineering firm inspect our buildings last summer. I can’t recall what percentage of units the new law requires must be inspected, but our Board voluntarily exceeded that percentage by 15-20%. Our condo was inspected (ground, end unit). It was good to go. I haven’t heard anything re: an overall report.

Our clusters installed high-impact windows after the 2004 hurricanes that did lots of damage. Insurers are dumping so many. Maybe you can try to get your complex to write letters. We really must inidate them with letters.

Prayer is always my first avenue.

Get with your HOA board and you as a home or condo owner is entitled to the report. Also those seeking to buy…due diligence. Just like HOA minutes and financial reports and reserves.

Yes. It was discussed at our recent board meeting. We owners haven’t forgotten.

Unfortunately due diligence was likely not done by prospective buyers and maintenance was not adequate. It’s sad but the special assessments are necessary when condos jointly perform work and maintenance. People have to budget for this. All part of the equation. Sad but true.

paradise has it downsides – the state cannot insist an insurer write a money losing risk pool -might as well ask the govt for a backstop or bailout; I rent 1 mo/yr on the gulf coast there and expect the rent to escalate to where we won’t pay it any more; in 20 yrs I expect Sanibel/Captiva to be a group of massive hotel/resort developments where the condos used to be; condo and most homeowners will be gone; those who remain will be able to self insure

I foresee that all beach property (or close to beach) will be owned by firms like Blackrock or the very wealthy who will own individual properties. This could be just the initial push.

Replacement costs have gone up. It’s far more expensive now for insurers to rebuild/replace whatever is destroyed.

You know I have never understood the financial reasoning behind the panic among bean counters to sell low interest bonds in a rising interest rate market at a loss. All they have to do is hang on to the bond till it matures and then cash it for full value. Yes it is correct they are not earning as much interest as the current market but the interest income should be sufficient to cover their our current requirements and provide a profit. If not the CFO has not done their job properly. What they are doing is turning a paper loss into a real loss then trying to get others to make up their losses. Yes I have studied PHD level financial theory and am still was not convinced they are right. I believe the problem is the limitations of the accounting system we use.

Certainly, each case has different details, but I thought these low-rate bonds are also longer term. It’s not like these financial institutions bought 1 year CDs. I believe these are 10-year Treasury bonds. That’s a long time to wait for maturity.

Well then, they shouldn’t have bought them in the first place, should they?

Which I think is a valid, different way to what Anon II is saying.

Play a stupid game, lose your stupid *ss.

I agree. They spent the money they should have been saving from premiums for other things.

The other thing they lie about is that it all due to replacing coastal properties and that the interior rates should be lower, well 2004, we had 4 blow through Central Florida, some went E to W and some went W to E. It was a wild year, usually they follow the E or the W coast S to N, but not that year.

I was surprised when I learned that LTCM’s strategy hinged to a great extent on buying “off the run” treasury paper. Apparently the older prints were available at discounts beyond the theoretical coupons clipped.

That was back when there was a normal yield curve. The fund could pick up treasuries that paid the higher longer term rates but with shorter remaining durations and at a discount. They were picking up discounted 30-year bonds with 29 years to run.

Maybe new paper was preferred for international trade. I don’t know.

Just got a Citizens policy this year as rated were like 6k for HOI. Home is paid off so if it goes nuts will just cancel and pray.

may have to drop my wind rider, had to use it, am looking for the insurance to go up

For the 25 years here in fl. , with wind and homeowners , have always gone for the highest deductibles. Saves 10 to 15% of total. Luckily ,we have not had a claim. And we were on a barrier island for most of those years.

The only item on the list of “Not Good” that I can see DeSantis having a potential effect on is property taxes. Considering all the other items pressuring the finances of his residents, DeSantis should be working hard to get legislation passed that will lower Florida State property taxes.

Save our home is the best tax saving you can get but you must buy to get it. My taxes cannot go up more than 3% a year no matter what. They are high to to all the new homes and infrastructure for all the new moving to Fl. New cities pop up about every 2 years now.

Unfortunately the new development drives school taxes and other infrastructure well beyond the 3% likely. I live in an area if still rapid development and city leaders REFUSE to listen to taxpayers.

That is interesting. Is it a private insurance against property taxes? Do you have to pay a premium every year? What do you mean you have to buy it? I do not live in Florida and my property taxes went up 18% this year, after they had gone up already 15% last year. Property taxes are insidious. Older people on fixed income who own their homes can be priced right out of their homes by usurious property taxes.

No. In fl. ,if the residence is your MAIN residence, you apply for a homestead exemption. ( normally $50,000) off of appraised value) and starting at year you purchase house, annual property taxes can only be raised a maximum of 3% in any year. I think that was passed many years ago and called ” save our homes” . Example. Anna maria home purchased 20 years ago at 350,000. Taxes were 3000. Sold house for 850,000. Taxes were 4200. Pray and help others

Plus if you buy and sell in the state of Florida, you can hang on to the rate you were being taxed at for the residence you sold. Your taxes will rise, if you buy higher priced property, but, it won’t rise much if you buy even or lower priced.

Also, you can grandfather RE taxes on a new purchase from a former Florida residence, which helps a lot. So, just moving across state does not mean a huge RE tax hike. You have to do it within the same year to have continuity like I did, otherwise you pay full up for a year, then, your former rate kicks in. This meant my RE taxes went down with my move into a smaller home in a less expensive area.

State property taxes seem to go mainly to the schools.

Where I live, property taxes are county taxes. They are used to support schools. I am not exactly certain what percentage of the assessed property tax goes to schools. I believe it is somewhere between 35 and 50%. When the housing market is strong and valuations are high, it becomes a boondoggle for the schools, as they rake in way more money than they budgeted for. Of course, they always find a way to spend it and come back asking for more.

The Federal Government is already the 100% reinsurer of the Flood Program.

For other catastrophic losses, Reinsurance Companies spread their loss to Retrocessional Insurance. These companies share the premium and loss from the Reinsuers.

House insurance has gone up a little here in Northern Minnesota. Car insurance is down and my less than 25 year old son is on the policy. If insurance rates double, or triple then my retirement will be early and ill be traveling in a uninsured RV.

Snowmaze, I’m along the north shore, in the socialist arrowhead.

Where are you?

Rubbish….Isn’t your shift over..

Sorry,this was directed at someone who disappeared from my phone screen. Gremlins working overtime…😔

I’m in the insurance business and what is said here is true. However, writing the governor, or blaming him is wrong. It’s not his fault. It’s a market problem. And asking him or the government to fix it will only make it worse. Charlie Crist tried that in 2009 and it was a disaster. I don’t know what the solution is, but it’s certainly not more government interference.

A lifestyle, built on false premise, stacked on top of false premise, up 1/2 way to the sky, and then can’t understand “what to do” when its obvioys the whole structure is inherently unstable, and bound to collapse.

Living in “Hurricane alley” and not building to take that into account, building and living in areas “right on the icean, cause we love the view” and not taking into account those areas will take the brunt of the storm surge, and then just expecting “Insurance” to address that,…short sightedness.?

I saw a story on a guy built a “hurricane proof” house and it worked.

Saw another, built a forest fire proof house, and it worked.

Yes, such construction may cost a little more, but done right, insurance premiums should be a lot lower, if not unnesesary.

But then, why do building codes REQUIRE sprinkler systems (for fire) in Commercial buildings, but not in residential?

MOST who die in fires, are asleep.

Exactly this, Dutchman. I work for a very large global reinsurer. Reinsurance is essentially the business of resilience, and the risk modeling for natural catastrophe events is highly impressive to the point where inputs would include building-by-building metrics especially in high risk areas. A good reinsurer will have a large team of risk engineers that are the boots on the ground experts who work directly with businesses to reduce their risk exposure prior to an event occurring.

Interesting topic,

We are at our oceanfront cottage on Vancouver Island at the minute…

It is an original and is approximately 110 years old built of old growth fir a wood that along with cedar is native to the island.

We recently redid the the roof a roof a roof that done with hand split cedar shake shingles.

It was moss laden twenty odd years

ago when we bought the place.

At extremely high tides and if the wind direction is from the N/E ( usually ever 2or 3 years)spray and sea weed may reach the structure.

I write this because all these years ago most folks “ did it right”

Back on the mainland folks are having nightmares with “ leaky condos” many are only around twenty years old.

It is not unusual for folks unable to pay the “ special “assessments and sell cheap.

Here in Greater Vancouver some folks call such housing units CONdos.

Cheers, and have a pleasant July 24

“Cheers, and have a pleasant July Two Four”! LOL! Dekester you’re a real Canadian card & someone should deal with you!

When you say “oceanfront”, this to me means that your cottage is located on the Pacific Ocean side of Vancouver Island OR is it located on the Mainland Side!

If a Nor’ Easter blows “shit under your shingles”, then it makes sense for it to be on the Mainland Side.

Sorry, but I was just trying to get the “lay of the land”, without sounding too much like a Newfie! LOL!

Happy Belated Canada Day!

Again wanting something that others will pay for and not enjoy or benefit directly from. Builders being allowed to short end construction and in hurricane alley cbs, concret block stucco is essential but lots of existing homes are not that. These alone should have extreme insurance rates. Look at fort meyers when Ian almost wiped off the map but for a few concrete block and the like structures.

There are a lot of trailer parks and manufactured homes in Florida. Those blow away in a direct hit, if they are on the coast.

ALL of Florida is hurricane alley. 2004 proved it when 4 hurricanes crisscrossed the state back to back. Michael (more recent) not only crossed Florida, but blew through parts of Alabama and Georgia.

The dude that built the hurricane proof house, built a round house on the equivalent of stilts with a porch that could blow away. It was not just a little more expensive, it was 2X or 3X more expensive. Plus, there is no guarantee it would survive a cat 4 or a cat 5. Camille took a block length of I10 and turned it vertically into the water. There was a building in Miami one year with a convertible stuck into its side several floors up.

The coastlines do suffer the most damage, but people can lose their homes many miles inland depending on geography and homes can be damaged 50 miles or more from the shore.

Unfortunately it’s true risk and benefit payouts from claims. And stopping the HAARP and like machines. Everyone can’t eat the losses, those that live in those zones gotta.

Thumb up for the HAARP comment….I DO wonder, and often….

If Sundances speculation is correct, I suspect other Insurance companies, like auto insurance are also experiencing losses, based on investments in U.S. Treasuries, and so also will be raising their rates?

And, if Insurance “conglomerates” are also involved in life/health insurance, the effects of Covid vax would also be felt, across the Industry.

If you eliminate the Insurance industry entirely, people are more dependant on the Govt, and all that $ currently in the Insurance industry coffers, probably ends up in Govt corrupt pocket?

Auto is also experiencing losses, but more limited, and the insurers are usually pretty adept at investing (and land motor vehicles depreciate rapidly, and are easier to adjust). Have worked that realm and glad I’m out (hubby has a few years yet…). The insurers, in general, decided to go with fewer and younger adjusters and rely instead on “technology” and they have had a lot of turnover accordingly. A small part of the problem in California is that the same people looting stores at night go home, photo their loot, create receipts, and report a break-in. Maybe a dozen times or more, but nothing law enforcement has an interest in. They also have a lot of public adjusters, many of whom pad claims to cover their costs.

Insurance companies are regulated to limit the percentage of profit, and wages play a part in the calculation. It also depends if it is a mutual or stock company. I suspect California would prefer to have the state be the only insurer for everything.

I know his company’s affiliated life branch did have agents directly talk to survivors about actual cause of death (not listed on the death certificates) and based on the results employees were neither required nor encouraged to be vaxxed.

I thought of my auto insurance immediately. Went up 25%. No accidents, no tickets, no anything.

I think the “sage of Omaha” is supposed to be the re-insurance kingpin? Meanwhile for our sf house in west Pasco, the big hit has been sinkhole coverage which we will probably drop . I guess Fla law requires coverage in the basic policy for total loss due to sinkhole, but any damage/partial loss is not covered without the rider.

As someone who is related to a LOT of insurance adjusters, many of whom started right out of high school, I can tell you that every piece of the insurance “business” is getting a lot more of your money than seems even close to reasonable.

Most of these people make six figure incomes.

I can see the hardship side of the job, but it is nothing more than what many other professionals do who make a lot less.

Ha…doesn’t take a mind reader to know this part was coming…not even that far into that pull quote, either:

which industry players put down in part to the impact of climate change.

It’ll be used for every little change that benefits the elites, and of course, that includes the continuing transfer of $$$ from ordinary people to the corporate crowd.

Not good is too nice to describe what we are facing in Florida.

You should put:

COMPLETE FAILURE TO ACT BY RON DESANTIS

My recently widowed sister lives on the west side of A1A, East side of the Intercostal. Old home, tin roof, wood frame, open foundation…never flooded, never made a claim. Insurance premium DOUBLED ! $$$ is tight already, she freaked! Hubby and I stepped in, paid off the mortgage for her and we ALL told the bank and the insurance company to “*uck” off! Calculate what this is doing to ‘retiree’s’ !!!! Banks are gonna foreclose, folks are gonna be hurt, families are gonna suffer! Buckle up Floridians, or most likely, just bend over ‘cause we are ALL gonna get screwed 🤬

Part of “their” plan to steal homes from hard working Americans.

is she opting for no insurance?

i may go that route. not in a flood area. no claim history.

i calculated that i would be out of pocket 10k before insurance kicked in. and risk is lower for my area so roll the dice.

Wait. Insurance companies need insurance?! It’s just a never ending buttf* k for the consumers, isn’t it?

It’s part of a risk reduction plan and any P & C insurance company worth it’s salt will do it to help mitigate catastrophic losses. I work for a mid-sized P & C insurance company located in the Midwest (over 20 years now). We would probably have been insolvent without our reinsurance programs over the years. A large storm that starts in Nebraska and rolls through Southern Minnesota/Wisconsin and Northern Iowa/Illinois and peters out in Michigan over a 2 – 3 day period dropping hail, high straight-line winds and a tornado or two can cost 10’s of millions of dollars. That’s over and above any “normal” losses that are part of life in the P & C business. You don’t get charged “extra” because an insurance company buys reinsurance. The truth of the matter is the reinsurance companies have lost money like 8 of the last 10 years (something like that – its a ball park) and they basically said to us “if you want reinsurance – you are going to pay a lot more than you have in the past”.