Always keep in mind that retails sales from the Dept of Commerce [DATA HERE pdf] are always calculated in dollars. Inflation can artificially skewer retail sales if prices increase, and yet consumer purchases decline at a rate lower than the increase in price. Fewer units sold at higher prices can give the false impression of increased sales.

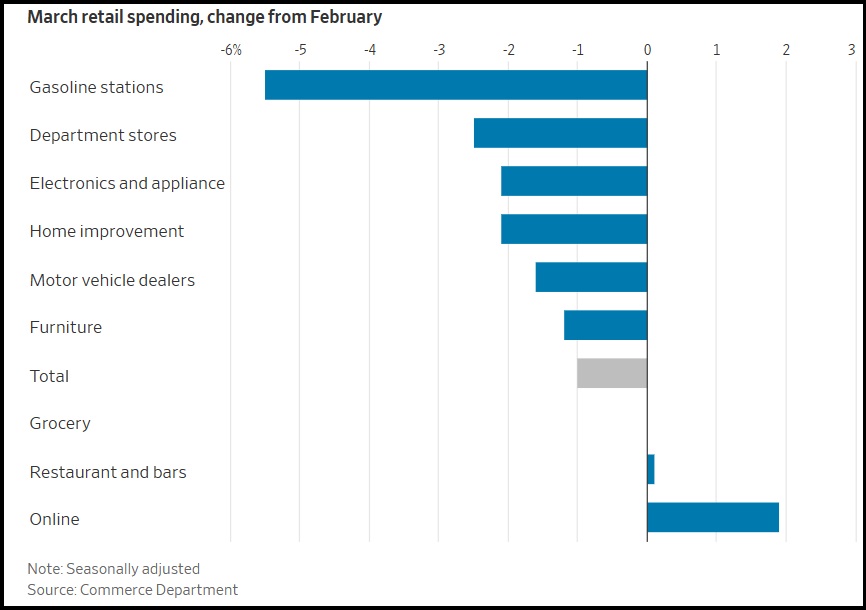

During an inflationary environment, when prices increase yet retail sales drop, there are substantially fewer units being purchased. Overall purchases at stores, restaurants and online declined a seasonally adjusted 1% in March from the prior month.

During an inflationary environment, when prices increase yet retail sales drop, there are substantially fewer units being purchased. Overall purchases at stores, restaurants and online declined a seasonally adjusted 1% in March from the prior month.

During the time measured gasoline was less expensive, so that led the drop in fuel sales; however, drops in dept stores (-2.5%), General Merchandise (-3.0%), electronics (-2.1%), and building supplies (-2.1%), shows another broad-based pullback of Main Street consumer spending. (pdf here)

These outcomes are in general alignment with what many people have shared via regional ground reports. Grocery store sales are flat despite major increases in grocery store prices (+10 to +20%). People are buying fewer grocery store units and making their food budget stretch as far as possible.

Durable goods are not considered essential, and sales of cars, electronics and department store products are much lower.

I am actually a little (pleasantly) surprised to see restaurant sales holding (+0.1%), despite the massive increase in fresh food costs. I thought people would eat out less, but the total decline in restaurant foot traffic seems to be in the single digits. I guess people can afford it more than I anticipated.

(Via Wall Street Journal) – […] The retail-sales report mainly captures spending on goods rather than most services such as travel, rent and utilities, offering only a partial picture of spending. The Commerce Department will release more complete figures later this month.

Spending on air travel was robust in March but outlays on other services like hotels declined, transaction data from Bank of America credit and debit cards showed. And the cost of shelter has increased faster than the overall rate of inflation, federal data show.

Some Americans have had to make adjustments to allow them to keep spending.

Recent data suggest many consumers are more cautious about purchases of goods they often have to borrow money to buy. In March, spending declined in big-ticket categories including vehicle sales, electronics, furniture, and at home-improvement and department stores.

“The current challenges in the used auto industry are well documented,” CarMax Inc. Chief Executive Bill Nash said on a call with analysts this week, “with affordability pressured by broad inflation, climbing interest rates, tightening lending standards and prolonged low consumer confidence.” (more)

I can go to Texas Roadhouse and eat a 20 ounce ribeye steak with sides prepared for me for $28.99. The 20 ounce choice ribeye at the grocery store costs $25 alone. It is cheaper to go to Texas Roadhouse.

Yeah, Texas Roadhouse buys much more meat than a grocery store…I would think. All this talk about ribeyes makes me want to go out tonight and get one, but I don’t think I could handle a 20 ounce!

Hence, take out. Two meals for one nickel.

Probably 4-5 meals for me. One of the few benefits of the Golden Years.

I ALWAYS get the largest cut of whatever steak I’m having in a restaurant. The 12 or 16 ounce prime rib is less per ounce than the 8 ounce and the 16 ounce is at least 3 meals for me. Sides at home aren’t expensive and it’s less cooking. Win-win.

That’s the ticket; good plan! 😉

Chateaubriand for two…

My 75 yr old friend who likes to eat out has said the same thing.

I am another senior finding the same thing that a restaurant meal may be pricey but will feed me 2-3 days. I do not eat that much and start the day always with eggs which are cheap even with the price rise. Second meal is a take out now. It is cheaper than trying to buy all the spices and such at the grocery store.

With the cost of everything in the grocery store up close to 10% (or more) I find that in some cases I can eat out for about the same amount as it would cost me to prepare it at home, without having to put in the time or effort.

However, I am also noticing that restaurants are adding more filler (rice, pasta) and less actual protein (beef or chicken) than previously, so maybe it will not be quite so break even in the near future?

Yep. I go out for breakfast once a week and get a New York steak with eggs, hash browns and toast for $12.00.

I can’t even buy the steak in the stores for that.

Yes, and I can turn a 20oz into 4 days of meals so it’s even cheaper lol

ErictheDeplorable: True, but, $28.99, plus a drink and tip, is not an inexpensive meal for many people. Assuming a $6 beer (which, these days, is cheap), plus 15% tip (not calculated with the tax included, which is the latest money grab pulled by restaurants), that’s a $40.25 meal. For one person. I’ll spend that when out with other people, but never when just by myself.

So have water with your meal, and when you get home have a nightcap. By the way you are not obligated to tip, especially large amounts. I tip only when I’m treated well.

Whoa! You do know that wait staff live off tips, right? Their hourly wages are peanuts because the system assumes customer tipping. I worked in a restaurant through school and non tipping was extremely rare, and reserved for the truly rude staff, which BTW rarely happens because as I said before, tips are customary. If you do not intend to tip, buy food at the grocery and eat at home.

I haven’t eaten out for years, and my beef purchases are now stew beef, and ground beef. I buy bulk to save, and then can up chili, cottage pie, meat sauce, and make hamburgers for the freezer. My stew beef also gets canned into beef stew, beef in broth for a chunky Philly cheese sandwich, or for a beef and mushroom pot pie. 3 hours of cooking gas will give me 84 dinners, and they only take a couple of minutes to prepare when I pop a jar open. God bless the All American Canner. Its a beast!

I do the same. I also can up sloppy joes and chicken. I’ve found many ways to use all the canned meats. I call it my fast food.

Pot roast in a jar.

Open jar, drain broth into the skillet, make gravy. Dump the jar contents into pan. 3 minutes.

Eat.

Absolutely! I get 42 quarts of chicken soup from two whole roasted chickens.

Filled my freezer with mashed potatoes and homemade french fries from my potato harvest last week, and got my spinach and green beans all put up. Can’t wait for sweet potato harvest. They are a big help toward cost of dog food.

Will sow my peas and carrots in the fall, and my cabbage and collards. I have an orchard that gives me 14 different varieties of fruit. I’m positioned that I only need to find my property tax each year and monthly Internet. I eat healthy, and carry no health insurance. When its my time, its my time, and I am at peace with that. I don’t want the corporations getting my money.

Ditto our local Longhorn. They let (senior) adults order from the kiddie menu. And those portions are big enough for anyone not interested in becoming a bumbalatty. Two meals, two glasss of wine or beer, tip: $40 tops.

Will you send me one by mail with onions and green peppers on it.?…Drool…-:)

Ribeye????

They don’t call Sirloin “SIR” for nothing!

And don’t forget the biscuits please.

Plenty of comments here to confirm what I was going to say. It’s actually cheaper, in many cases, to eat out than to cook 3 squares a day plus snacks and desserts. Although… the quality of food is the issue, for me. I want to know where my food comes from and with all the talk of injecting mRNA into food, I’m pretty done with any food that I don’t know the origin of and how it’s processed. Not to mention the GMO (genetically modifed) goods, which has become pervasive. Those famous Texas Roadhouse rolls, which are seemingly delicious, are probably chock full of crapola. Just sayin’.

Mind you… This is in present year $’s… These statistics should be indexed to the dollar at the end of October (before election date) because the figure is even worse, as goods and services have 7% to 16% inflation, and it takes that many Biden Bucks to match the Trump Buck purchasing power…

Things are bad, and getting worse by design.

An evening at the movies pushes $80. Going to a junior hockey game costs $80. Concert tickets to see a plain jane entertainment act cost $80.

I think the old ones see dining out as similar entertainment.

I think the age demographics of those dining out are aging.

That works for us.

The older the group in a restaurant, the less we have to listen to people yammering on cell phones while the rest of us are trying to enjoy a meal.

We’ve stopped eating out entirely as we are older and are feeling the severe effects of inflation.

As for entertainment?

I’d rather spend my time here on this site conversing with friends, and where on the Open Thread we lift one another up, have a laugh, share music, Scripture, memories, look out for one another’s peace, converse about anything an everything…and I can enjoy a cup of coffee whilst doing so. Friendship and fellowship and faith…no price can be put on that. Good for the heart and good for the soul.

We are content with what we have and grateful for it.

Thank you, Sundance. Your beautiful site has kept me sane.

Nice one!

🏴🏴🏴

Bless, Dekester, my friend. I do find one cannot buy the things which matter most. And for which inflation is no factor at all😉

Ain’t that the truth..at our “special place” we sat on our lawn as the waves lapped at our retaining wall.

A sea otter was chased into the ocean by a couple of crows..a seals were barking away, all the while four or five “ bald eagles” fought over a catch.

Cost..free.

Cheers! 🏴🏴🏴

Would that I could have joined you…heaven…

👍👍

Your uplifting comment brought cheer; thanks.

I am sincerely glad, Spartans.

– $80 for movie night- which is why God created $5 movie night, often on Tuesday. The frugal can even sneak in a candy bar and diet soda in a purse. Evening out $12-15 dollars for two. (Smile)

– Walking the local farmers market is free.

– Our local casino (i.e. card room) offers good meals 30-50% below market rate. Certain items great, others OK. Coffee & soda $1.

The local bingo parlor isn’t bad for cheap food, but I don’t gamble anymore so I don’t go.

I’ll take a bowl of beef stew and a good old movie any night of the week.

People, especially in small towns, are supporting their restaurant folks, their local economy.

I’d bet $$$ that fast food vendors are down as the dynamic is different (high school clerks instead of owners?)

I am finding that nearly all discretionary spending has shrunk to nothing.

What think you, treepers.

Thanks for the excellent reporting Sundance and team, timely and accurate as always.

Cheers.

Supporting the locals – yes. I seldom eat out (2-3 times a year now at most)…but when I do, my tip is never less than 25%…the waitresses I recognize and know have been hanging in there for so many months…it’s my pleasure to give them more. Even if I get takeout (like I did today as I’m splitting the last of this year’s firewood and didn’t feel like fixing my own lunch), I still give the tip.

When I go for take-out, it is from local family restaurant. They used to have Rush radio playing at lunch time. Good times.

Frugal Scot here, now a Canadian citizen.

Your post is accurate, we were just at our “ Special Place “ for a few days.

The town is a Pacific Oceanfront community on Canada’s west coast that is affluent and Conservative.

Every small restaurant was busy and the majority had help wanted signs up.

Now the demographic is 70% senior citizen.

At the local grocery store one can buy an 3 item “Chinese combo “ for $15.95 ( Can) approximately $12.50 ( U.S.)

The Szechuan beef and lemon chicken is superb, and prepared in front of you.

Two adults can comfortably split the meal and be satisfied.

We could not buy the ingredients for that.

IMO it is the franchise’s that are hurting most, we dropped into a McDonald’s that is located in a less affluent community ten minutes away to use the “ hot spot” and have an ice cream.

There were 4 folks in the place, two “ junkies” a homeless guy and a trucker.

A “ Big Mac “ meal cost $15.95 😟

Cheers!

Yes, There is a social aspect to eating with a group of friends on a regular basis. Lots of people have regular days where they meet a pub or restaurant for drinks and a meal. Bowling alleys serve food too.

“I guess people can afford it more than I anticipated.”

That credit card bill is just growing…IMHO…

It’s also the kids. The late teens to mid 20s segment think nothing of dropping $10 a day at Dunkin Donuts or $15 a meal at Taco Bell or a pizza place. And they wonder why their bank accounts are empty 🤷♂️

Not to mention Starbucks. One cup (excuse me, one grande) of their meh brew costs more than my average lunch.

But OTOH, when I eat lunch at home I don’t get to stare sullenly at text messages whilst awaiting the barrista.

And then there is Costco if you are into that.

The food court requires no membership and the hot dog plus 20 oz soda is still $1.50 + tax.

I make my own hot dogs at home on the grill, or on my roller or toaster oven if it’s too cold on the patio. a side of chips with salsa and a small drink of soda, juice or chocolate milk and I’m good till dinner.

Beside Biden gas prices & inflation … the other huge contributing factor

to retail numbers … CRIME … Soros DA insanity – RAT-run, out-of-control city crime !!!

We’ve curtailed our shopping to sunlight hours only … no malls, high walking-traffic areas or high usual-suspect shopping areas.

IF a female drives a big or nice car – she is a carjacking candidate 24/7 … be VERY careful at gas stations.

A lot of people don’t know how to cook. That is why restaurant sales are fairly steady.

That’s what I think, too.

Those renting rooms or staying in motels (far more people than you know) might not have anywhere to cook.

I’ve always thought that people who tell me that they don’t know how to cook are just simply lazy.

It’s amazing that there are people walking around who practically boast that they “can’t boil water” and they wear this as though it’s a badge of honor and something to be proud of.

Yeah people will be eating out more when gas stoves are banned in the usual suspect states. A perfectly good gas stove is sitting there but you cant use it and cant afford to replace it with an electric one- so you’ll be forced to eat out. Next up: banning propane grills.

We have them beat so far, at our special place we cut off our natural gas service, and did away with the furnace and have a terrific wood stove.

We also took out the electric stove and have now a propane stove.

We have a regular tag hooked up just outside the house by kitchen wall.

Great too for the occasional power outside, never mind minimizing government fee and tax grabs.

Never let the bass turds win.

Cheers!

IDK if the restaurant thing can last. They appear to be resisting raising prices by cutting back on wait staff, staff in the kitchen, and raising prices or charging for things that used to be free or nominal cost. The meal may cost the same, but you might be paying $3.50 for an ice tea and get no bread.

My wife and I like to go out once a week, and we can afford it, but the quality of service is taking its toll. Sometimes waiting a long time for tables when there are clearly empty tables but not enough staff to wait on them. We are also more often getting food that is cold or even nearly raw which shows the lack of staff in the kitchen. We really aren’t terribly picky — it’s got to be really bad for us to complain. We had moldy bread in one high end chain restaurant.

They can’t continue to allow quality of experience to suffer in an attempt to resist raising prices.

The ‘new normal’?

At my favorite Chinese food restaurant they have been cutting back on portion size. What used to be 2 meals is now barely one.

The cleanest restaurants are dirty. I’m eating out very little and when I do it is usually a locally owned place that I trust.

Good points, Charles. Eventually, the restauranteurs will have to give in and significantly raise prices.

I think most people are into convenience and do not cook most of their meals. Look at the ridiculous prices people pay for coffee at Starbucks, or other specialty drinks nowadays. They aren’t the type to make a bag of beans last a few meals to save money.

people have to have some recreation. Dining out is the clear top choice.

We could see these numbers change after the summer months are finished. People will have backyard bbq with family/friends who will potluck.

The old fashioned American fellowship will return.

Susan Rice’s plan working as intended.

I go out to lunch every Wednesday with people I met on Nextdoor. It’s a core group of 7, all retired, with additional people some days. We try to eat at locally-owned (although the Ruby Tuesday salad bar at $6.99 on Wednesdays is a draw.) Eighteen months ago I budgeted $20 per meal, tax and tip included. Some weeks were more, some less, but it worked out to average that for the month. Now I budget $25 and have to be careful in what I choose. I continue to go because I enjoy the company and I give a good tip because they earn it but it is getting more expensive.

“I am actually a little (pleasantly) surprised to see restaurant sales holding (+0.1%), despite the massive increase in fresh food costs. I thought people would eat out less, but the total decline in restaurant foot traffic seems to be in the single digits. I guess people can afford it more than I anticipated.”

Or… in some cases the meal purchased is cheaper than buying the ingredients and making it yourself.

In SW Missouri, I am seeing home and apartment building still flourishing. The Lowes is usually packed, and people around here seem to be eating in the upscale eateries more than the corporate fast food joints.

I think restaurant visits will eventually decline .

The prices are being talked about from family to friends.

I’d bet money on that !

“I thought people would eat out less, but the total decline in restaurant foot traffic seems to be in the single digits. I guess people can afford it more than I anticipated.”

My thoughts:

(1) More people than ever simply do not know how to cook.

(2) Many people have the habit of eating out and will go into debt, for awhile at least, to continue with their established habits. Only when the debt sting begins to hit will they take the time to think and consider what to do.

It is far easier to not buy a new car or new computer than to give up the small cost of a Sunday dinner out or Thursday breakfast with your buddies or the Friday after work Fish Fry and beer with family or pals.

Here’s another: After covid, everyone wants to go out, and are willing to pay more just so they don’t have to stay home.

Here’s another: with warm weather the BBQ will return with guests doing the potluck thingy.

Ultimately, their WAR on Oil, will lead to the destruction of the auto industry, there is simply no other way it can end, if they are successful in killing off oil.

Electric cars are a chimera, an illusion and I won’t rehash all the reasons why.

As for restaurants, not all are actually feeling the bite of inflation, yet.

Those that were living right on the edge, “paycheck to paycheck, and pay the monthly minimum payment on the credit cards” ARE hurting.

But, there are those at the next level of income; they notice the increase in prices, but it isn’t enough to adversely effect their “discretionary spending” (YET!).

Thats SOME of the restaurant goers, as well.

As someone had stated….

People’s wallets are losing weight faster than they are.

On another topic slightly related to weight…

I have never seen in my life so many people that are fat, obese, and morbidly obese in stores riding the electric scooters.

Also, I have never in my entire life seen so many people in cars that have “Handicap License Plates or Handicap Hangers on

their review mirror.

A very large segment of society of all ages are very, very overweight. So sad.

You can bet on it that those individuals are collecting disability benefits that we the hard working Americans pay for.

Were they wearing military uniforms?

No they were not. Vets in my neighborhood generally wear their Veterans Hats.

I give all Veterans of Wars the deserved respect in a brief conversation.

My father was a medic during WWII.

Years ago when I was a kid it was extremely rare to see a morbidly obese person or even someone who weighed 275 or more pounds and those who did really stood out.

These days they’re a dime a dozen.

The difference in cost between eating out and buying from the supermarket has shrunk.

In the last 2 years $ has lost much of its value. It’s taken a while to get used to all these higher prices and I have accepted it but certain

things I will do without. Wife and I go to carrabba’s maybe once a month and rarely were disappointed. Last time I ordered their ribeye(30.99) and it might have weighed 16 ounces but cut was very thin and it just didn’t have that special taste. Will have to try other places now. Here in Naples there are 100’s of restaurants and many are pricy. I also did enjoy Texas roadhouse so will go back there. Where I work security (outdoor upscale mall ) ribeye with 2 sides is $85 and haven’t been offered an employee discount so have not had 1 yet. Remember ,things can always be worse. Live your best life,pray and help other and do the right thing. Best to all on these branches.

Marc Kotlovker: Hmm. I’ll pass on the $85 ribeye, and the $30.99 one, too. When I’m on my own, I scrounge and graze, relying on whatever is in my kitchen. It’s amazing how many meals I can make with the remainders from previous shopping trips. It’s like found money.

You are fortunate. I would do many things differently if I was on my OWN. Sadly ,when I got married many moons ago I was fine with my wife not cooking. Now ,not so much,so I went back to work.

I work 2 jobs. In case 1 job disappeared I have a backup.

It keeps me busy and I try to stay out of trouble : )

For many, many years I worked two jobs and sold Avon on the side. Then I ended up disabled, and it was VERY hard to get used to the loss of discretionary spending. Any time I get a little extra money I set that aside for visiting the grandkids. Last week I broke a tooth, and that sure set me back!

$85 ribeye meal at an upscale outdoor mall in Naples, FL? That steak wouldn’t happen to be served at Shula’s?

The restaurants here in southern AZ have been doing great business for a couple of months…People seem to want to get out, and the snowbirds haven’t left yet….

It’s been a cold snowy/wet winter that seems to be lingering….

The Royal Bank of Canada has stepped up to the plate…

New Report: Canadian Bank RBC the #1 Financier of Fossil fuels, World’s Biggest Banks Continued to Pour Billions into Fossil Fuel Expansion

https://www.ran.org/press-releases/new-report-canadian-bank-rbc-the-1-financier-of-fossil-fuels-worlds-biggest-banks-continued-to-pour-billions-into-fossil-fuel-expansion/

Sundance, people are stressed in juggling work and family sometimes carryout is a good luxury.

I think also for some people, such as those who don’t know how to cook, take-out (Chinese food, pizza, and such) is their comfort food.

These days people need comforting.

Meanwhile the debt clock for our corrupt nation is $246,868 per taxpayer. Per citizen it’s much lower. Our congress approves this.

Consider: Restaurant revenue is holding steady because people are eating out in their hometowns … since thay cannot afford to vacation out of state or out of country. Those restaurant sales dollars are in effect repatriated dollars.

Many people probably dine out because they’re bored or lonely too.

Car registration in our State, (Vt) went up this year by 50% thanks to a Democrat super-majority is the state house. Just got my auto insurance renewal from Geico, up 40% from the last bill, because, as they told me over the phone, Vermont state govt….I read in a local paper where the State also wants to up school and property taxes 20%…My wife and I are seniors on fixed incomes like a lot of folks and quite frankly if we were younger and more mobile, we’d move down south…I guess the bottom line is, Democrats are destroying this country. Most of the increased taxes are no doubt going towards ludicrous woke policy, i.e. Climate change, trans blah blah blah…I’m F…ing fed up!

We’re feeding and buying apartments, insurance and cars for the illegals too, don’t forget.

N.W. OKC –

New home building is strong. New neighborhoods platted left and right. Starter homes $250K +.

Waiting lines at peak times in restaurants.

Gas prices rising.

And…doggy day care $30/day.

How are these young families pulling it off?

Hey did you guys see this…18k cattle just got blown to hell in Castro Texas? My buddy just told me and was surprised no one has covered this unless I just missed it. Search “Castro County TX Cattle”…..Whiskey Tango Foxtrot!

You missed it, SD did not cover it with a thread tho, mentioned in OT & Pres.

https://theconservativetreehouse.Com/blog/2023/04/12/wednesday-april-12th-open-thread-2/#comments

https://theconservativetreehouse.Com/blog/2023/04/12/april-12th-2023-presidential-politics-resistance-day-813/comment-page-2/#comments

We know one thing for sure and Americans love to dine out. That will be the last thing to go..

Perhaps the relatively small increase in restaurant sales compared with retail food prices is due to retail food’s precipitous rise.

Food service is an incredibly competitive sector…restaurants are probably paying the same 10-20% more for their foodstock, but are less willing to raise consumer prices on pace with grocery stores out of fear that their consumers will simply take their business elsewhere. We’re still alarmed by the sharp increases in restaurant prices, or somewhat comparable prices but with smaller portion sizes or menus dropping more expensive items.

If any of what I’m guessing is close to accurate, food service is under great pressure to operate on thinner and thinner margins. That’s trouble waiting to boil over. So many great places have just disappeared where I live.

They will continue to disappear too, raising prices does not necessarily cover increases for natural gas and electricity (both of mine doubled)(unless massive increases), not to mention the food costs increasing.

It saves more money to decrease personnel, for me here, I saw problem in advance with the 5$ an hour increase in minimum wage passage, converted to carry out / delivery only (just me working) from dine in services, good thing I did, would have never made it thru COVID.

As it was, someone took the opportunity to install another pizza chain due to forced covid demand for delivery.

We had not had a chain store in town for 5 years.

Severely reduced my volume, thus major price increase for me, others had created local businesses to replace the chain store volume leaving. (chain store sucking up volume just to stay in business)

The chain franchises have an easier time of bumping prices on items by .30-.50 cents/item to get where they need to be and do it again next quarter. My burger alone @ sonic has went from a little over 5 bucks to 7.90 now (was 7.10) … 8.22 for my Subway one that was 7.90 in January.

Its only a matter of time, someone has to close, there is not enough available volume for everyone.

I am looking at converting to something else, I will know based on summer tourism which direction to go.

I keep a full pantry and freezers, garden and dry or freeze, brother gardens and cans, nephew hunts, so we swap around

I was at The Container Store this morning and two clerks, one Container Store and one from another store in the shopping center, were talking about how slow business is these days.

Anecdotal but interesting they are openly discussing it.

Many of us eat out and fly airlines for work. Once employment in these areas takes a hit this will fall off the cliff as well.

I wonder how much the work travel meals at much higher prices is offsetting the drop in local dining. In general, it is two different markets.

Depends on who pays for it, corporate has a meal price limit for day. (price varies by corporation)

If corporate cap for the day has been hit due to price increases, so will the dining in locally for cheaper carryout to stay under/at cap.

Some may add their own cash to what the daily cap is to get what they want.

I can point to both examples for my customers that call when they are in town (weekly, monthly and quarterly)

They can’t really afford it. They just can’t or won’t cook.

Funny thing, this generation who watches youtube for everything cannot watch the professional chefs teach them how to cook?

The Left Wants You to Starve to Death

The left wants you to sit at the bottom of a freezing, muddy hole and eat fish heads until you gloss over.

Seriously.

You will either comply and quietly coexist in their toxic, life-rotting “corporate America,” in which they call all the shots and name all the tunes, or you can starve to death. The incentive for your corporate masters is that your serfdom provides tax revenues, and not in some form of altruism that allows you to make just enough to get by and live as far beyond 65 as your portfolio will take you.

more…

https://skeshel.substack.com/p/the-left-wants-you-to-starve-to-death

I think one thing contributing to people eating out is a chance to socialize. After being isolated for 2 years I am craving more than just a well-prepared meal. I want to be around people, I like to see people out and about, I like to see restaurants – especially small business owned – doing well.

It still isn’t doing as well as before the China virus, but that’s because Biden has been busy destroying as much of this country as he can as fast as he can.

Very soon he will meet his maker and pay the price for his sins.

Unexpectedly.

Is that skewered, skewed or jest screwed ?

How can this be?

Are they finally admitting that the governments intentional rise in food costs combined with the same governments intentional rise in fuel/energy costs making everything that travels more expensive can no longer be artificially countered by the same governments unlimited and unlawful subsidies being distributed to illegal invaders, ILLEGALLY at our border by the same government leadership that we are told that we “elected” and who later sworn an oath to protect and defend the constitution from all enemies foreign and domestic?

when the reality is that it’s the constitution that needs protecting from them!

Don’t worry, now you can up your credit score just by paying your rent.

What they aren’t mentioning about the building supplies is the massive theft places like Lowe’s is experiencing. Why buy it when you can just walk out the door with thousands of dollars in materials and tools? My neighbor manages a Lowe’s and in one month they have lost nearly $200,000 in merchandise due to our relocated southern neighbors.

I’m seeing lot more poor families eating at InNOut with kids.

Cheaper than buying meat and potatoes at the grocery store, here in SoCal.

Better quality too.

It seems to me that if more people are working extra jobs in order to make ends meet (clearly they are) then they could be eating one or two meals more (per week) outside the home. It could be the simple logistics of working a second job (for millions of Americans) that are keeping restaurant sales from tanking along with most everything else. Don’t have any empirical data to back that up but grabbing something “to go” while going from one job to the next could be part of it.

Sales at my own restaurant (Orcas Island, WA) have increased over last year but not by a significant amount. I raised my prices across the board (15-20%) on 1 January of 2022 because I could see the carnage coming. As it turns out I was correct and have held steady since. That could all change in the second half of 2023. Fuel prices are heading back up and most of this year’s crops are still in the ground.

My spouse and I have been intermittent fasting and eating low carb for a year. Two meals a day and simple meals of meat, vegetable and a fruit keep costs down even when we eat an grass fed ribeye. We don’t buy the expensive packaged stuff much anymore, so we can afford better quality basics.

Saves money and we’ve both lost 20 and 30 lbs. Plus less time shopping, preparing, and cleaning up from meals.

When traveling to a vacation in Florida and while there, we ate one meal a day. Mainly at Golden Corral for $15.99/pp around 2 pm. Ate all the salad, vegetables and meat we wanted. Bought a large tray of freshly picked FLorida Strawberries at a road stand on the way down to snack on. Big cup of Joe in the morning with organic heavy cream and we were a happy couple.

People are hurting. They have lost assets if they have any and their incomes are not keeping with even the fake inflationary numbers our government provides.

Meanwhile borrowing costs for houses and cars has gone up.

In 50 years, the dollar has lost 98% of its purchasing power. And this will only accelerate going forward.

Start acting like those in high inflation countries because US is now one too.

Own assets, not dollars.

Oatmeal with frozen blueberries and ground flaxseed for breakfast. Blended can of diced tomato and a can of beans for lunch. Vegan healthy and cheap.

The surcharge restaurants are now charging can add up!

We’ve noticed a similar pattern on the South Island, lines at drive through take-out joints and busy restaurants.

Mind you we live in one of the most desirable locations to move to on the west coast of Canukistan so there is a lot of disposable income floating around and no end in sight for new development even with rates rising.

That graph appears to be full of apples, oranges, and doughnut holes. I don’t think it supports Sundance’s thesis, but more actual data could easily prove it to be more enlightening.