It is only one U.S. company; however, the makers of Weber Grills and products released their sales data, and the background shows a severe economic contraction that has resulted in their operating loss of $51 million in the quarter that ended March 31, 2022. NOTE THE DATE.

It is only one U.S. company; however, the makers of Weber Grills and products released their sales data, and the background shows a severe economic contraction that has resulted in their operating loss of $51 million in the quarter that ended March 31, 2022. NOTE THE DATE.

July 25 (Reuters) – Weber Inc (WEBR.N) on Monday replaced top boss Chris Scherzinger with an insider and warned that mounting inflationary and supply chain pressures could hit the grill maker’s financials and workforce, sending its shares down 20% in premarket trading.

The company withdrew its fiscal 2022 net sales and core earnings forecasts, saying higher consumer prices and geopolitical uncertainty were squeezing store traffic as well as margins.

Weber, which also suspended its quarterly cash dividend, said it was pursuing a number of initiatives, which may include job cuts, reducing expenses and tightening its inventory levels.

The company also forecast a net loss for the quarter ending June 30, citing weak store traffic and higher discounting. In the quarter ended March 31, Weber’s net sales decreased 7% and net loss came in at $51 million compared with a net income last year. (read more)

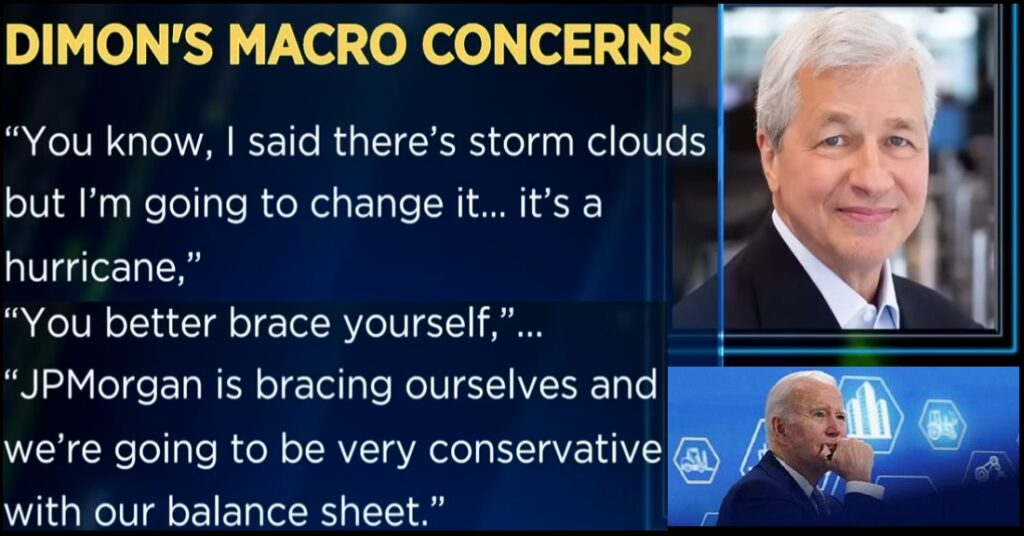

Weber is a good company with strong fundamental products. Unfortunately, the layoffs that are likely to soon surface are not going to be isolated to Weber. The contraction of economic activity is going to start surfacing in the balance sheets of multiple companies this quarter.

We can expect to see a bloodbath of employment layoffs in this quarter (July, Aug, Sept) at the same time as the federal reserve continues to raise interest rates to support the new energy “transition.”

As noted in Weber’s financials, the consumer contraction started escalating more than six months ago. Companies can only hide a severe drop in income for a short period, and then eventually cost-cutting decisions must be made.

Quick one with the dates displayed upper corner. pic.twitter.com/HhxPkz6FJa

— PoleyThePolarBear (@PoleyBear1350) July 26, 2022

Weber products are good, but are not climate friendly doncha know. And of course the Big Green Egg (I think another manufacturer) isn’t “green”. So, they ain’t on the approved list.

But a side question. The Big Green Egg. Is there a $1,000+ difference in taste for various common things cooked on it and a $50 grill?

I’ve had from $50 grill and Big Green Egg and can’t tell much difference.

The better grills have movable grates, etc that make it easier to indirect heat and control the temperature.

They are nice, but not necessary.

Nobody barbeques in the summer.

Reminds me of the movie Spinal Tap, where that rock group’s road manager tries to argue that Boston is not really a college town..

All leftists are driving hard to a hoop called a one-party State. They knocked on the door and nobody answered?

Again, I suspect Trump’s most viable path back to power is if nobody else wants it. Whatever..

I BBQ all summer long.

Same CR

I’m in N.J and I BBQ almost all year. Dec. Jan. and Feb. not so much. Unless it’s a fairly warm or not so cold day.

Heck, it rains for three quarters of the year up here. Damp, humid, cold does not make ideal grilling weather.

Up in Santa Ynez, California (when my mom and stepdad lived up there for about twelve years on their ranch), I think that’s where the “tri-tip” was invented – or popularized, anyway – back in the 1970’s –

Mom and Dad used their Weber grill but later had the blacksmith make a Santa Maria-style grill for them – very popular item in their neck of the woods – a friend of theirs had one of those grills made, too -and he would cook gorgeous ribeye steaks alongside beautiful swordfish steaks – and of course, on the side you had Santa Maria beans, very popular and of course great big bowls of salad, etc.

Those were the days, my friends!

Here is the real story of where the tri-tip steaks were made popular.

Butchers initially didn’t know what to do with tri-tip steak

BY MIRTLE PENA-CALDERON/UPDATED: JUNE 22, 2022 10:07 AM EDT

If you were traveling to the beautiful and sunny state of California in the 1950s, there’s a chance that you might have heard of a little something called the California cut (today known as the tri-tip steak). This cut of meat quickly became associated with California because of the boom that it experienced within the area. Active NorCal reports that it was around the 1950s that Bob Schultz, who was a butcher and meat manager at a local Safeway, decided to capitalize on this flavorful and lean cut of meat.

The tri-tip is a triangular cut that, when cooked properly, is considered to be super tender and delicious. This cut of meat, which might go by the name of Santa Maria steak, is pulled from the underside of the sirloin section that is cut out from the cow (via Active NorCal and Santa Maria Valley). The cut carries a deliciously excellent level of marbling, making tri-tip a great grilling meat but it’s also good for roasting. It is also a lot less expensive when compared to something like rib-eye.

Read More: https://www.mashed.com/289222/the-real-reason-tri-tip-steak-is-associated-with-california/?utm_campaign=clip

Don’t worry. Trudeau will still eat steak. Bugs are us little people, doncha know.

And all winter too!

I BBQ in the snow and even in the driving rain sometimes. As long as the wind won’t blow it over we are good to go.

Damn skippy.

Lulz. Summer is BBQ season here in Florida’s Big Bend. That’s why we build “cook shacks” and screen them in.

I am no idiot. I grill on a $50 hibachi using real charcoal and mesquite chips. No propane-tasting meat on my plate.

The cook shack is where I keep the Jambo Pit..

I just posted my own predilection for a weber full of mesquite and charcoal – I’m probably going to be settling in the Big Bend this year – Old Florida at a reasonable price, Suwanee basin, Crystal River, somewhere from Old Town to Blountstown. I’ll keep my nose to the wind!

May I recommend Suwanee, Fl or Perry if you can hack living in a very real, very beautiful swamp., slap full of Patriotic, America as Founded types. These places are not for folks looking for big box stores and every modern convenience.

Perry is my base of operations over there – we had a fish camp at Dekle Beach back in the 60’s growing up, I see everything is new and on stilts over there now. Thank you for the tip!

has anyone here ever heard of a “Cajun Microwave”?

a dear friend of mine from Louisiana told me that it is a popular way of cooking at the picnics/camps on the bayou . . . typically a nice heavy old front-loading washing machine reengineered for cooking purposes . . . you could even bake a cake in it!

On the MS Gulf Coast, masters at smoked whole chickens take a used tall refrigerator, cut a whole in the top and install a regulated smoke stack vent or pipe, an air vent in the bottom, then put a small bag of lit charcoal in the bottom with the racks above filled with fresh chickens, then shut the door and add one bag a day for three days,… and then take out the best smoke chicken (or smoked fresh tuna or grouper) you’ll ever feast on.

It seems like the propane grill does something to the steak – we gave some very beautiful steaks to our neighbor to cook one time (I think we had a problem with our gas stove and were waiting on the Gas Co. to come out) . . . the steaks came back over very strangely devoid of the luscious flavor we were expecting from the beautiful marbling in those steaks . . . we did not say anything but were quite perplexed by the whole affair. It was like the life had been sucked out of those steaks and replaced with cardboard.

Likely a cheap gas grill that did not get hot enough. I turn on my grill full blast to heat up to around 500-600 degrees and turn it down a bit as soon as the steaks hit the grates. Hot and fast baby.

Overcooked the fat right out of them. Makes them tough.

Propane has no taste and neither does charcoal. The flavor difference comes from temperatures/heat source and the meat dripping on either the charcoal or not, or on gas grills it can be metal or stone that heats up. The drips vaporize into steam, smoke, and other elements, all of which can flavor your food differently.

Also, depending on your type of charcoal there can be some subtle diffs. If you use charcoal and like a liquid lighter for convenience, only put enough to get a small pile going and let that migrate to the larger pile until there is full ignition of all. If you have some charcoal that hasn’t ignited when you start your food, there will be some smoke from the lumps as they get going that you don’t want.

And I grill and BBQ and smoke all year long, weather permitting. Sometimes a cold day keeps the temp lower for certain cuts you want long cooking time.

The problem is the “impossible meat” burgers and the roach dogs just fall apart on the grill. Dang it!!!

My roach drumsticks kept falling between the grates! What a waste!

Weber has gotten ridiculously expensive like an elite product. Middle and working class probably wasn’t jumping on them anyway. We certainly don’t buy Weber and our grill is still going fine.

Yeah! And nobody barbeques in the summer..

Better tell that chicken I grilled out last night that. I guess I am just nobody.

Same here, just BBQ’ed steaks last Saturday!

What??????

Have I been doing it all wrong for 70 years?

Maybe that is one of those “urban myths” floating around – check Snopes? Oh, nevermind.

The Great Reset..

On one level, this stuff is comical. Barbecuing is utterly done – who doesn’t get this?

On another level, understanding this stuff is profound. Eating meat? Done.

Burning gas or coal? Done.

And the social gatherings that result from a party? Yeah, done, and that is their main goal.

That is democracy and that is the real point of all this.

What, you don’t like well done Crickets on the Q??

lol

Crickets would fall through…

That is until some Wuhan Lab engineers a cricket the size of a steak.

(Yikes, I’m giving them ideas again…)

You will need a cricket basket for the BBQ!

But they keep jumping out !

yes you are – stop that for heaven’s sake!

Yeah! Shut up! Not only are we going to have no food but with crickets like that, we aren’t going to get any sleep either.

Cricket on the Hearth –

hey!

You can’t be doing that to Jiminy Cricket!

If Walt Disney was still around . . .

Culinary tip: if it talks to you, don’t eat it.

No jello shots either? I do not drink but it sounded like fun for those who do.

PK Grills are USA made, and cook better than any Egg. The ChiCom made Webers are hot garbage. I have replaced 4 or 5 of them after they fall to pieces. The Eggs were good when they were still made here.

The best “eggs” were made in Japan. In 1977 I bought one there for $70 at the market outside Yokota Air base. Sucker weighs a ton and will last forever is you don’t get it wet.

They look good – heavy aluminum – but aren’t cheap. PK grills start at $470 and go to $1,000. …..for a charcoal grill……

Whereas the original Weber 22″ kettle-style charcoal grill is $140 at Home Depot. Webers last for decades. I had one for ~22 years and then gave it to one of my kids who used it for another 5+ years before buying a gas grill. But they have to be kept reasonably clean and out of the rain and snow. Charcoal residual chunks and ash that aren’t frequently cleaned out of the kettle will collect & hold moisture and will eventually cause rust starting where the inside coating has been scratched. Hint – buy some ceramic grill touch up paint and after cleaning, cover the scratches.

You must’ve had a Weber from the 80’s or early 90’s. Pops was a Weber man. His late 70’s early 80’s grill lasted forever. We kept buying them over the years as quality dropped and we kept replacing them until finally I said No More. I have the lower end PK. It handles everything I need, and I can load it up and take it camping and to the beach. If I am going to smoke something I will fire up the competition smoker.

I noticed the Quality difference when Weber went to plastic handles from the wood ones. The plastic gets to hot, you need gloves or tongs to lift the lid.

Yes. Bought in mid-late 70s. Handed it down to one of my adult children and bought my first gas grill in late ’90s after moving to a new house.

That first gas grill, a Walmart cheapie, didn’t last too long – 3 years before two of the cast iron (?) burners broke. Junk. Bought a better quality 3 burner gas grill from Home Depot with steel burners and it lasted 12 years before I gave it away in great condition to my lawn guy. Bought a small table top gas grill for $40 that uses the camping size bottles and that worked marvelously until my wife asked about smokeless indoor grills;. Bought her a quality Japanese-made electric indoor grill about 10 years back and she loves it and still uses it.

I have a ten year old Weber Spirit. Unlike the grills at the big box stores, the body is cast aluminum.

It doesn’t rust. I think I replaced the burners once and I grill 2-3 times a week. If the burners ever give out and I can’t buy new ones, I’ll just take ’em out and load up the grill box with charcoal. No problemo!

The taste really depends on the cook (notice I didn’t say chef). Most people don’t know how to cook on an egg and overcook their food. Those that do find their sweet spot and can make magic to the tastebuds.

For full disclosure, I do not own an egg. But, I am a professional eater.

Its the charcoal, use hardwood, and not that crappy Kingsford. Green egger here.

Every grill has it’s sweet spot as you say. Once you find it the rest is easy. Just this past week I’ve done burgers, a London Broil, Louisiana hot links and hot dogs for the grand son. Not to mention the farm fresh veggies.

I consider myself a pro eater also. LOL

Cooking on an Egg is like trying to BBQ with a kiln.

My grandfather had an egg smoker, that smoked lots of fish when I was young, but it disappeared when he passed away. I’ve thought about purchasing one, but my classic Weber does a great job. Use a chimney, rather than lighter fluid, to light the coals. When I dump the coals I get temps of over 500F, which is plenty hot enough to get a good sear on some quality ribeyes.

Big Green Egg can do a couple things most Weber’s don’t:

One they retain heat for longer smoking and better temp control.

Two they can get very hot temps like some Steak Houses so if you’re good you can make a serious steak at home.

Now I’m not saying Weber’s are bad product. Just the opposite, I love them. But The BGE / Komodo is simply more flexible.

Worth the price diff? Up to you!

I have two BGE’s and a cheap Pit Boss knockoff.

Always start with the egg and only use the knockoff for overflow.

Occasionally use lump hardwood charcoal. But mostly use local hickory wood.

They are also my backup cooking source in the event of rolling blackouts.

I used steel pits until they would rust out about every three to four years. Then discovered BGE’s. Still have my first one …..20 years later.

I have a gas grill and a weber char grill the weber is about 10 years old andin great shape. The gas grillmis on it’s 3rd year and most likely I have only maybe a year left on it. It would last longer but they keep changing the grill insides so even if you purchase replacement parts ahead of time the grill rusts out. ‘m not spending money on an expensive grill, they really don’t last much longer than a cheaper grill. Especially if you BBQ most of the year.

and i do.i grill year round.

That’s not what this is an indicator of. You see it in upscale shopping districts as well, where there are now empty store fronts, a LOT of them, where stores that had been there for decades are now gone. These are indicators of there being little disposeable income available for luxuries and “treats.” When the downturn hits this sector, watch out, because the poeple with money to burn either no longer have it, or are holding on to it.

Either way, it’s a tell that it’s gonna be bad and the rest of us should brace for it. When the squirrels’ tails have grown thick and bushy even before Halloween, it’s gonna be a LONG and very cold winter.

Yep, the first things to get hit are the discretionary items- the things that are unnecessary, little luxuries. There are all kinds of knock-offs of Weber. People haven’t stopped grilling. It’s the middle class that feels the sting of the softening economy, the squeeze of inflation, wringing out the ability to splurge on those little extras that were within reach before. When your 401k is evaporating, you put off splurging on things like a shiny new grill. I know, I sell unnecessary items- the type of things deemed so when Covid came about.

Soak them in some Goya Mojo marinade and throw them in the crockpot.

God Bless America! = The days of summer in the old-time USA, where people are mainly concerned about Baseball, good tasting Beer, and the ~>Art of Barbequing in the backyard.

Unfortunately, the bucolic life of summer is lost, to the people concerned about the carcinogenic effects of barbeque smoke and meat. … …….. What Happened to the USA? … +If the oceans are rising, why did Obama buy a house on Martha’s Vineyard Island?

America is still here. It is the messaging in the media that has changed in order to break our spirit.

Resist!

Don’t let anyone talk you out of your old Weber grill!

Don’r repaint it either, most definitely!

I would not be surprised if there won’t be a “Kash for Klunkers” style program to get people to give up their old-style grills that are superbly heavy and you can use charcoal or wood (but of course, someone may report the smoke) –

we have Mom’s and Dad’s old grill that they used (going back to 1970, I think) -and I have a little guy that you could cook a small chicken or tri-tip in it (have done both).

The advantage of the BGE is that it is truly multipurpose. It is great for smoking. It will hold low and slow for hours. It can also be heated beyond 900 degrees. If you want a sear on your steak, there’s really no better than the BGE for getting the grill HOT. It is multi-talented.

Cooking over charcoal is cooking over charcoal it doesn’t matter what the charcoal is being held in. (IMO). We gave up on gas grills because you just can’t get the flavor you get from charcoal.

Plus they primarily used to cook meat and not bugs. A bug once accidentally landed on my grill but it immediately died and fell into the coals, so strike two. s/

Yes. There’s a huge difference because the cooking temp of the egg can exceed 700 degrees. This allows a better sear of the meat you are cooking.

good news is that you can find a near egg at lowes for under $300

NopeI own one. Its a good smoker but a pain in the ass to regulate constant temperature. Then you are assessoried to death. Just not worth it to me unless you have a huge family. Go with a pellet grill. Little less than a BGE, but make you look like a better cook.

No.

But Jen Paski said that BBQing costs went down 16 cents in key components from last year. She is an authority in stuffing hot dogs in her lying face.

I know Weber makes a propane-powered grill, and I assume they still make the charcoal version. Is charcoal still available (we use the propane canisters)? Is charcoal a product we should start buying when it gets too expensive to run our electric or gas-powered stove or propane isn’t available? Asking for a friend…

Regarding the general economy — our gasoline around here went down from $3.99 to $3.77 in the past week. I noticed when we drove to my daughter’s house (three hours away) that there were very few semi trucks on the Interstate — a very unusual sight to see. Two recent events that show the economy as it is today. People are driving less so using less gasoline. Truckers aren’t delivering products because of diesel prices and/or nothing to deliver as quickly?

These are odd things to see in this country. I fear it’s going to get worse very quickly. May the good Lord help us through these wicked days.

I grill on charcoal exclusively. I do not use propane. I add dampened mesquite chips to the charcoal prior to putting the meat on the griddles. We’ve grilled this way in my family since I was a kid. 50 years and counting.

Just drove 400 from northern Michigan to Chicongo. Lightest truck traffic on I94 I’ve ever seen. Usually a nightmare of commerce.

Biden thinks or lies that it’s him causing the prices to drop .50 ! He’s full of it. Just as you’ve pointed out I see a much smaller volume of traffic when I decide to go anywhere. It’s the old supplu and demand trick. When it gets too expensive you either drive less, or you make your trips economical. You don’t go out for every little thing, you make a round trip. Even then I spent over $160. last month for gas and I don’t really go anywhere special.

i said this to my wife last week,the interstates sure looked bare compared to normal.

Did you notice that diesel prices didn’t go down but a couple of pennies? Yeah…

Climate Queen Gore needs all that sweet, sweet, aviation fuel. His Yachts don’t run on apple juice either.

Charcoal has gotten stupid pricewise, especially the designer brands. Fallen hardwood tree branches make perfect fuel for a charcoal grill – free, no additives, burns hotter, less ash and everything tastes better from the real hardwood smoke. I did add a second coal grate crosswise on top of the first one, like this (#), to keep the smaller pieces from falling through. Burn coals on one half of the grate (a 2 zone fire) for searing first over the hot half, then finishing over the cooler half.

Made myself hungry for a burger at 8am.

Making your own charcoal is easy. Get a 55 gal metal drum, and a 35 gal drum. Shoot holes in the 55 gallon drum, load the 35 gallon drum with the wood of your choice, I use oak and orange tree wood. lay the 35 gal drum on its side, slide it into the 55 gallon drum and stand both upright, so that the 35 gallon drum with the wood is upside down inside the larger barrel. Pack sticks and leaves in the void between the outside of the 35 gal drum and the inside of the 55 gal drum, then light it on fire,the leaves and sticks will burn and the wood on the inside of the 35 gallon drum will char in a low oxygen environment. That is also how I make BioChar for the garden.

Good tip. Thanks.

That’s a great idea, CR. Thank you. I like my ‘campfire’ in a grill method for it’s rustic simplicity. I have a Weber Performer that has a tilt out plastic can underneath to store the wood in and keep it dry. I fill it with 3-4″ cut or broken up pieces that light quickly in a charcoal chimney. I’m talking about sticks that are 1/2″ to 1″ in diameter, I don’t think there would be much left if I tried to make charcoal out of them. Anything larger than that goes into a trash can for kindling for starting the winter fires.

those chimneys are great – no more “lighter fluid”!

It’s amazing when someone like CR follows the site rules for posting and actually posts something of value in place of just common Blog posts, that it stands out and actually makes reading this segment worthwhile. It seems like most everyone has got caught up in gabbing off topic which is the economic impact of low consumer buying resulting in business collapse and, a growing recession.

Thanks, SCD. I am a “habitual line stepper” (ala the late Charlie Murphy) when it comes to the House Rules, but I am making a conscious effort to improve my behavior.

I tried to wade through the tips for saving money and it was 1000 comments mostly favorite recipes and yukking it up with one liners…I’m sure there must have been some good commentary, but I gave up after the 4th page…..Mods are great here, but the commenters who commandeer topics with worthless chit chat are a major detriment….that said…

On topic…I heard a stock analyst on this morning discussing Weber, and he pointed out that grills have been sold to the tune of 70%, much of which occurred during our last incarnation of RE bubble…so look out below when the bubble deflates…large home appliances (and outdoor grills) are cyclical, not a business I would want to be in right now

Great idea. Thanks for sharing that.

Anytime.

Yes!

And you could make coffee to go with that!

So Weber can’t sell barbeques in the summer..

How is Baskin-Robbins doing selling ice cream?

No matter how enormous and pervasive the media conspiracy now being constructed, the depression will bury them all, and most of us.

If thousands of talking heads are repeating the same nonsense, then who needs thousands of talking heads? Why not have the same talking heads all day? The news channel in Canada is already doing this..

The changes coming, like a tidal wave, will shock so many of the fools who vote Democrat, along with the goofy RINOs. Frankly, not all are victims – thousands of oil field workers voted Democrat in 2020 on the logic that Biden didn’t mean what he said. (And our taxpayers now support these imbeciles)..

This right here. I agree and all these companies had it great under POTUS

the economy was blazing and they were all making money.. But he

said mean things..so they voted Dem ..well so now oh well..how

many of them supported POTUS reelection? I guess their hurt feelings

were more important than making money..

Yep, as an ex union member I could see that. The reps would come in and lie about the policies of the dem candidates and the people would trust them! Not all like me a too many for sure. What’s the phrase “you get the government you deserve.

Any blue collar worker that voted Biden, deserves to starve and be homeless. No sympathy from me. Donald Trump did more for them than any president in over 50 years and they didn’t appreciate it.

Stupid should hurt.

The bug guy came for the annual $95 inspection, to make sure the termites hadn’t come back and the carpenter ants were under control.

He told me that he had a dozen customers cancel on him in the past week.

I made a joke recently to hubby that we are being told we have to start eating bugs, so we should cancel our exterminator contract. Our termite inspection is 180/year for them to find nothing to treat.

Who still buy’s Webber grilles ?

It’s not the economy that has killed that company it’s they never diversified and have always charged way to much for the standard that never existed in their products.

I have heard through private sources, maybe it’s been reported, that, Walmart general merchandise sales is expected to be down 12%. Although the dollar value of food is up considerably, grocery items have a much thinner margin. Walmart has historically demanded at least 4% increases every year from its vendors and the Joe Biden/WEF economy is impoverishing the Walmart customer – in particular.

Not to mention (apparently) enormous piles of summer clothing both prominently displayed on the sales floor and still in the backrooms – all clearanced, and not selling.

Ironically it was just yesterday that we pronounced my grill DOA on arrival and I started trying to research online on a replacement.

I considered the Weber but it has about a $150 price differential for no reason that I can see.

I couldn’t even find information about which grills are manufactured by the ChiComms.

A little update. Turns out that Weber does still manufacture their high-end grills in the USA, but the least expensive in those product lines is $3000.

Everything below that is now made by the ChiComms.

I still have not located a decent quality 2-burner grill made in the USA. Suggestions still welcome before I settle for a CharBroil (also made by the ChiComms but without the $150 Weber bump in price).

PK Grills. Made in the USA. Do it.

Here in SE Georgia, a most strange thing happened yesterday.

I went to my local Goodwill and everything was 75% off ….it is closing down due to lack of business!

Never in all my decades of Goodwill shopping have I seen a store go out of business….never.

When people can’t afford thrift stores, never mind a Weber grill, you know there’s a problem!!!

Wow, that is a shocker..

I read that as they aren’t donating because they need to hold on to their stuff.

Hmmm, interesting thought! This didn’t occur to me, but it could certainly be a factor!

I have a female friend who goes to Goodwill a lot, she said prices had went up on many items… by a magnitude of 2-3x.

If your Goodwill is anything like the ones here, I say “Good riddance!” A few months ago I tried shopping at a Goodwill to find soapmaking supplies. Their tattered, worn merchandise was twice as high as that at the dollar stores. Ummm . . . no thanks!

Goodwill (at least around here) is obviously run by the stupid and greedy.

Totally agree on the crazy prices!

I’m so cheap, I shop at the “by the pound” Goodwill🤣 in Savannah. It’s the only one in the region, even the Dominicans come up from Orlando to send large quantities back to the DR.

I just love thrifting and the thrill of the hunt!

I used to frequent the Goodwill in Winter Park, Fl, a “fancy” neighborhood in Orlando. Many times I would find designer clothes with the tags still on them!

I stopped donating to Goodwill about 15 years ago when I found out their CEO makes a couple million a year and everything that is sold is pure profit, except for overhead. There are local places for thrift donations and shopping.

Yep, they’re horrible opportunists. I never donate to them or Salvation Army! And no, I don’t round up my change to “help the mission”!

Goodwill started raising prices a few years back. Many items doubled and tripled in price, which explains why many people won’t buy their items anymore.

Some quick research – there probably is more to this. Poison pill?

People cook meat on grills, not crickets and soy. Weber has about 25% share of a global market. That means it is subject to globalist-controlled capital, trade policies, market share deals, distribution and supplier relationships. Given its customer base and open market history, all-American Weber was likely a target.

Back when I was still working in tech, I noticed a shift in our company and our customers’ companies to what I called “globalist CEOs”. Cookie cutter pretty heads from the outside who were not aggressive competitors. First it was the social agendas, then green/sustainable, then BigData, then….

Perusing their website, Weber does not seem to have been pressured into that woke nonsense, but it sure looks like Weber had had its well poisoned by BigTech and global capital.

I noticed something out of place for Weber’s history. In 2021 they bought out a San Francisco start-up (June Life) which makes a “high tech” $1000 toaster oven. Although it is something you’d see on QVC, the thing has all the markings a silicon valley con job.

https://www.weber.com/US/en/blog/behind-the-grill/weber-acquires-june/weber-2118732.html

June Life was funded by a silicon valley Vulture Capital company (Eclipse).

https://eclipse.vc/team/

BigTech heavyweights making a toaster oven? Basically, June Life makes smartphone app that talks to a Chinese toaster oven. But….look at the background of June Life’s “founders”.

.

Before going to Weber in 2018, Outgoing CEO Chris Scherzinger was CEO of Jarden Brands and Newell, massive globalist conglomerates that ate up many US brands. Scherzinger is the polar opposite of what built iconic Weber. His work at Weber was done.

thank you

Green New Deal: Market for the JuneLife Oven

—————

Free Market Economy: Market for Weber Grill

Toaster ovens generally seem to be not what they used to be, either!

And crock pots are totally useless too, if you buy one with a vent hole in the top or even if the lid does not have a vent hole, it does not seal well and thus the moisture is lost . . .

speaking of Goodwill, Mom and I were moving a few years ago and took lots of stuff to the Goodwill . . . unfortunately, we took our good old crock pot there as we had bought a new one or someone had given it to us – we had not used yet . . . bad idea, really bad . . . the new one had that vent hole!

But, thankfully, the Biden-brain-dead Treasury Department redefined “recession.” Therefore, we can ignore our lying eyes when we pump gas or buy food or otherwise try to exist in this idiot’s wrecked nation.

There is no finer way to cook MEAT than on a Weber kettle with a full load of mesquite charcoal. I have owned probably a dozen Weber grills over my lifetime, and I’m due for another one.

Watch out. I was told there’d be hell to pay the day Six Pack Joe can’t brag on the neighbor over who has the shiniest grill.

Nothing screams depression like the collapse of a BBQ maker

Yep, even during the recessions in the 60’s and 70’s we still BBQ’d on the weekend, not on a Weber but rather a cheap roundie; that was a ‘treat’ instead of going out to eat, a rarity.

I just checked on what I paid for the brand new Weber I have stored in the SHTF prepper building; in 2013 it cost 49.99. Similar units have been all over the country on camping trips making memories. Solid performers. Simple, portable.

Twenty years ago I started hearing from corporate customers that ‘we can get it cheaper in China’. That’s when I saw the writing on the wall and became a niche repairer and manufacturer. In the coming depression I’ll be the village blacksmith and that venerable Weber will give many years of dependable service like its predecessors did.

I bought a top of the line Weber five years ago, it has a smoker, electric rottisori, grilling station etc. I love it and it’s got a ten year warranty.

Are Weber grills still made in the U.S. A.?

Their own website says “Shop Grills Made Right Here In The USA with U.S. and globally sourced components.”

So it probably varies from model to model as to what parts are made here versus somewhere else (China etc.)

As for the Xiden clip, who buys a box of food? We used to a very long time ago. Today, for every three dollars of anything, it’s one bag. We’re now overrun with plastic bags, that we recycle into littler trash pouches to get rid of them. They will go away when these fossil fools have their way, at least, 70% of what we wear and use.

All real Business Leaders should have been front and center supporters of President Trump and his MAGA agenda.

Those who did not support him. Those that sat on the sidelines and did nothing. Those that fornicated with the leftists. This is the result…..Massive recession.

then there is this:

Sorrow in Choco Taco town after summer treat is discontinued (msn.com)

SD, I did note the date. Much news today about companies just now reacting to the FIRST QUARTER of 2022. What generationally successful business makes current decisions on history from 2 quarters ago. Can’t wait to see the numbers for April, May, June. Honestly, if you are running a company now, and you cannot SEE what the future looks like today, you need to be gone.

Yes, history is important; but management is supposed to use that historical data to predict FUTURE sales, buying, and manufacturing decisions. How can those decisions be made when woke management is more concerned with social justice road apples, and academic doublespeak. (Communist Euro-Economists, what a bunch-a-Clowns)

This comment spoke to me as well, “July 25 (Reuters) – Weber Inc (WEBR.N) on Monday replaced top boss Chris Scherzinger with an insider…………….“.

I believe the businesses that survive the coming business-geddon, will, out of necessity, return to successful business practices. Solid business ideals that were around long before Hippie academics infiltrated every facet of our education and then financial system.

Promotion from within, instead of all these whiz kid consultants/CEO’s, who have nothing but academic theory instead of nuts and bolts knowledge of the very business they are trying to run. My brother calls them the “Khaki Brigade”.

Then again, they can proceed to let said whiz kids run themselves, the company, and their stockholders, into the sand bar. What the hell, it’s only peoples retirement funds they are smoking through. No big deal, right? It is soooooo much more important to signal their virtue. So what if it is with your money.

Don’t mind me. I am just crabby today.

I am a truck driver, an owner operator with 30+ years out here.

One only needs to keep an eye on the transportation and logistics industry to see what is coming. We are slowing down considerably at my little brokerage, that I contract myself and my truck to. The freight is drying up, contracts are cancelling, businesses are closing. I believe this will be much much worse than 2008-2010. But there is another issue, that is spoken of, but not in the terms I am going to lay down…

I’m going to go out on a limb here, but I believe that the vaccines are also playing a roll in what is happening in regards to truck drivers, and employment in general, at least here in Michigan. We are honestly short on drivers in the Detroit area. Detroit shares a lot with Canada in regards to freight of all kinds. You need to be jabbed to go to Canada, many drivers did go to Canada…

Here is the thing, I have never seen it like this. Wages are up, as there are no drivers to fill the seats, companies are actively stealing drivers from other outfits. It is so bad some companies are making drivers sign non compete forms, I have never seen that before, not in these numbers. This is not normal in the least. The last time we went through this with Obama, a recession, the truck drivers did not simply up and disappear like they have today.

I went through this as an owner operator, I parked my truck and went and worked for someone else until things got better. I’ve done that a few times over the years when the government fubar’d the economy. I don’t see these drivers doing that, because these drivers are not here.

In 30+ years I have not seen it like this, there has never been a real driver shortage, there has always been a pay shortage, now the pay is up and yet many drivers are no longer available. I have lost over a dozen friends, truck drivers, to the jab, all healthy and all in the first round. All were dead either the day of or within two weeks of the first shot. Something to think about as we spin down the drain.

But what was the literal reason the CEO resigned?

Refused layoffs?

Refused paycut?

Wanted more woke?

Wanted less woke?

Got blamed for Bidenomics?

I don’t think Weber Manufacturing has anything at all to worry about. I just read where the Biden administration announced, through Treasury Secretary Janet Yellen, that they are changing the definition

of a recession. The old standard of two quarters of negative GDP growth is no longer valid. It means nothing. The new definition, whatever exactly that is, allows for more flexibility in deciding these matters. Quit worrying.

Well, there you have it. I really hope someone tells Weber, WalMart, big tech, etc. and the American consumer that they now have nothing to be concerned about. Dementia Joe and Grandma Yellen have declared it so.

And, also, Joe demands you don’t forget to get your Covid jabs and boosters. We have a new variant heading our way just in time for the fall elections. It’s expected to render you too weak to vote. Mail in ballots will suffice nicely. Good Luck.

I love Weber products and have purchased many for my use and as gifts.

I’ve tried propane and infrared, but much prefer charcoal and wood.

I grill outside year round, perhaps 150 days a year.

Weber has excellent warranty support and quite often ships replacement parts well after the warranty has expired. Unfortunately, that discretion by support personnel will probably end.

We have been in a stagflation depression since Old Joe got into office!

Keynesian economics and Communist theories go together. I remember the 70’s it was high inflation and high unemployment and that is when they created the word recession concerning the economy. They never wanted the word depression used again.

Old Joe and his masters are blaming the Fed; not Old Joe’s policies that caused this ( we know the policies and the Fed. caused this).

So lets just say, Stagflation Depression the likes that no one has ever seen! Good by DemonRats and lets hope the Rinocrats with them.

On a related note, I glanced at the local paper and saw a story about the DOJ going after poultry producing corporations for alleged mishandling of employee data to depress wages or something. Now they very well may be guilty of that but its funny how everything these a-holes do seeks to exacerbate these major problems and goals of the globalist gang while they’re uninterested in actual justice.

BBQing involves non-green energy and meat. You deplorables should be frying insects under a solar cooker (magnifying glass).

Hence Liawatha’s OpEd. They know that a recession that hits hard close to the election will mean they can’t overcome the election bloodbath with the usual mail in voting fraud.

Expect Democrats to increasingly panic heading into September.

I’m not sure what they’re so afraid of since the eGOP will work to protect them…

What I found out about my Weber grill is most all, if not all, the parts are plug and play. If a burner or igniter goes out, order another one and replace it. Want iron or steel grates – order it. All the parts are available and upgrades, as well. Also, now people make knock off parts. Weber grill cover $$$. Some other brand $.

See? Joe Biden delivers! In the video he said it’s outrageous for hungry Americans to wait in line for hours just to get food; and he solved the problem by having the food bank run out of food in just 90 minutes! Hurrah! No waiting in line for hours!

The nice thing about living in rural AZ—-free mesquite wood!!! And it lies around long enough it is ready to pick up and use.

You can always tell the “townies” at the store with their bags of charcoal.

Quick update from Ed Dowd incl supply chain issues:

https://gettr.com/streaming/p1j2iqk32f8

I do not know this 100% but the sister company “Weber Restaurants” is a huge boondoggle. The pre planning for the locations, and the concept in general was a mess. I think this part of Weber is dragging the rest down. Nobody wants to admit they made a stupid mistake.

Darn. And here I was just thinking about what kind of cooking alternatives I should get for when my electric stove is useless.

Beans are the best nutrition alternative when cost and scarcity are problems, but you definitely have to do some serious cooking.

I’ve had many grills. Weber is the best. Made to last and they do. 5 years later the ignition works perfectly and I use it often.