Fox News conducted a poll last week [Data Here] asking about views on the economy overall. As would be expected the majority of Americans see the economy as the #1 issue right now.

When asked for their view on how long the issue of rising prices are likely to remain a problem, 65% of the respondants said a year or more, while 29% had a more short-term view.

It is very hard to see a short-term end to inflation, accepting the status of energy prices and the looming issue of much higher food prices later this summer and fall. In both the energy sector and the food sector the upward pressure on prices remains incredibly strong; perhaps the strongest ever predictable scenario for much higher prices yet to follow.

Fox News – […] Three-quarters say recent price increases pose a financial hardship for their family. And increasing numbers say they are a “serious” hardship. Higher grocery prices are a serious problem for 44%, up from 36% in February. Same story on gas prices: 44% serious hardship, up from 35%. (more)

♦ Where are we now? There are two sub-sets:

• Inflation on durable goods should now be nearing the apex. The durable goods price flatlines right now as all production costs are embedded in the cost of the product. The prices of finished goods are now set; inflation has caught up to production; the prices of on-shelf and inbound deliveries are higher, but stable.

Now, we enter the phase where consumer demand becomes the dominant factor in price. Simultaneously, demand is contracting because the higher rate of inflation in highly consumable goods (energy, utility costs, housing, gasoline, food) is now a spending priority for consumers and eating a larger portion of wages. As a result, the price of durable goods is now dependent on the ability of the consumer to pay for them.

Sellers of durable goods are going to be chasing a smaller customer base who can afford them. Durable goods prices will remain static, and now durable goods prices will likely become part of the competitive equation. The businesses within the durable goods sector are going to have to find customers in order to stay in business. Incentives will show up this spring/summer as businesses need customers. If you are a wise, careful and smart shopper for durable goods you will find deals

• Inflation on consumable goods is not yet at the apex. It’s likely close to production parity, but prices pressures are still volatile in the upward direction. The price of gasoline and transportation overall will be a big factor in current prices of highly consumable goods. We should see oil, gas and energy prices stabilize first.

Rents will likely increase for another three to six months, then stabilize (and, in my opinion start to fall late summer).

Housing overall is far more challenging as mortgage rates are climbing. Refinancing as a method to bridge the income gap between wages and expenses is a big problem now in this phase. There is going to be a period of massive fluctuations and instability in the housing market depending on region and employment stability as the recession phase of the total economy is going to bite hard.

For most regions with mixed blend underlying economies (products and services) macro housing prices have peaked in the last 15 days. For ordinary housing purchases, not institutional investments, we should start to see price decreases again as the customer base for high prices shrinks. Obviously, this is driven by inventory and regional specifics; however, I am talking in the aggregate within the macro housing situation.

Food prices still have some upward pressures through Memorial day. Then a period of stability will settle, before the third wave of food inflation hits later in the summer/fall of this year; that’s when the increases in farming costs will reach the fork.

Late summer and fall food prices will likely be 15 to 20 percent higher than current prices at the supermarket. The fresh foods will be on the upper side of the future price wave, and the processed foods on the lower end; however, both will increase.

The last factors in the food price are far more challenging to predict…. Supply? Any problems within the food production cycle that impacts supply will drive prices, beyond what we already expect. If there are major shortages, the prices will go even higher.

This food environment is unfortunately the best time for Big Agriculture, the Wall Street multinationals, to make the most profit. The Big Ag multinationals will exploit every possible angle within inventory, supply and harvest controls to maximize their profit equation. There are a great deal of unknown global variables right now that could impact U.S. food prices later this year. The only certainty is that prices will further increase.

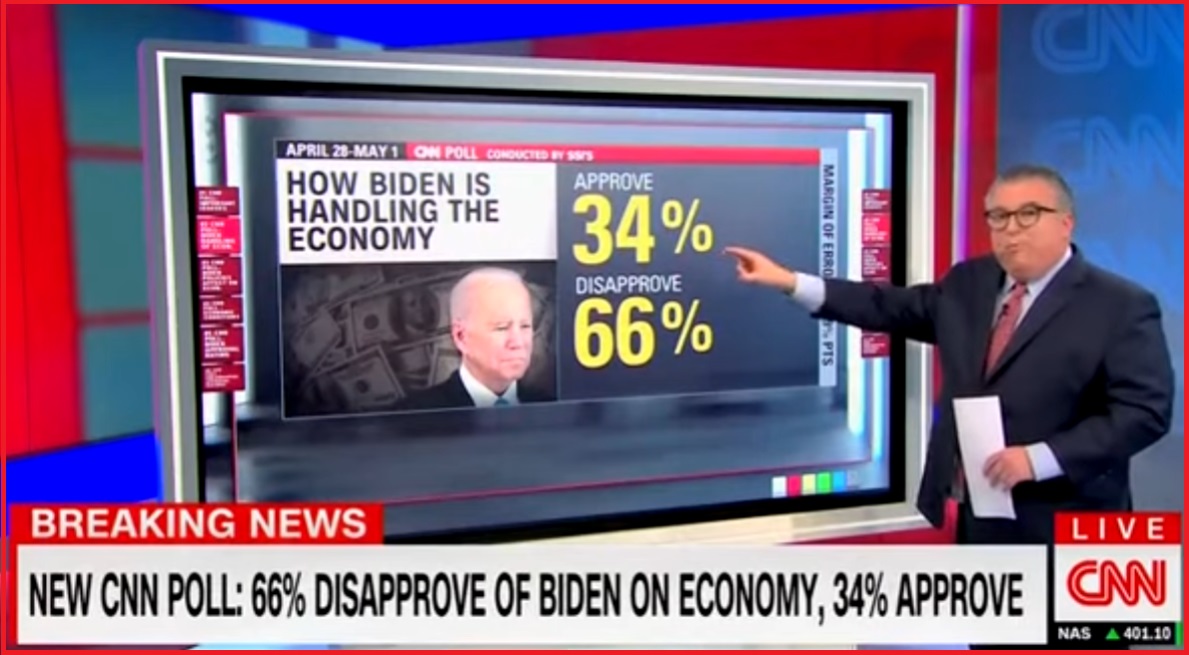

Joe Biden sucks.

As CNN painfully noted: “Even within the Democratic Party, just 7 in 10 approve of Biden on the economy (71%) and helping the middle class (71%), considerably lower than the 86% of Democrats who approve of his performance overall. Fewer than half of Democrats say Biden has improved the nation’s economic standing (45%), down from 58% in December.” (article link)

Remember, and emphasize as much as needed for importance, the U.S. government (Biden administration) needs inflation in order to sustain debt.

That’s why we are seeing a Ukraine spending package ($33 billion), the next round of COVID spending ($22 billion), and now a demand for a college loan bailout ($900 billion). Combined the three massive spending packages generate another $1 trillion in artificial money, designed to keep inflation high.

The Fed (monetary policy) and White House (fiscal policy) are working together to try and manipulate the economy. You can identify their intent by noticing both actions, raising interest rates -&- massive spending, work to counteract each other.

Right now, our U.S. economy is a game of musical chairs, and they are trying to keep the music playing. However, the record is slowing (economy is contracting), and the music sounds weird. Inside the economy the activity is slow to non-existent. Consumer spending is only high because ordinary stuff costs more; the overall U.S. economy is not generating any additional value.

If this isn’t “stagflation” I have no idea what it would be.

FUBAR

Just one of my vendors has had SEVEN price increases since the beginning of 2021.

Prices are never coming back down.

They are creating the crisis , so they can step in and do what all communists do :

” Seize the means of production “………. that way , we can be sure everything is distributed “” Fairly “”