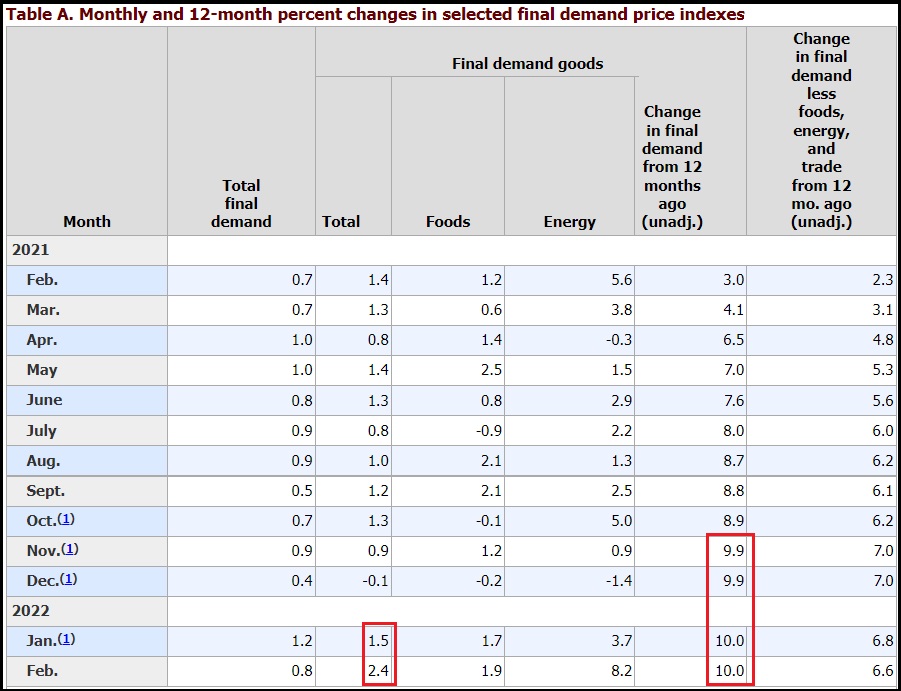

The “Producer Price Index” (PPI) is essentially the tracking of wholesale prices at three stages: Origination (commodity), Intermediate (processing), and then Final (to wholesale). Today, the Bureau of Labor and Statistics (BLS) released February price data [Available Here] showing a dramatic 10.0% increase year-over-year in Final Demand products at the wholesale level. This is the highest rate of inflation in the PPI ever recorded.

The single month increase in wholesale prices of 2.4% was driven by inflation built into the supply chain at every level that shows up in the final wholesale price. Those price increases then get passed along to consumers along with the additional costs for warehousing, transportation and delivery. I modified Table-A to take out some of the noise.

The January, December and November data was also revised significantly upward, and a sketchy footnote is included in the data. “Some of the figures … in this release may differ from those previously reported because data for October 2021 through January 2022 have been revised to reflect the availability of late reports and corrections.” Remember that temporary drop in December, yeah, that’s wiped out now.

The reason the total demand inflation number is 0.8% is only because inflation in the service sector is lower than inflation in the goods sector. Two reasons: (1) energy costs embed in goods first before services; and (2) when inflation on goods squeezes budgeted consumers, less services are demanded.

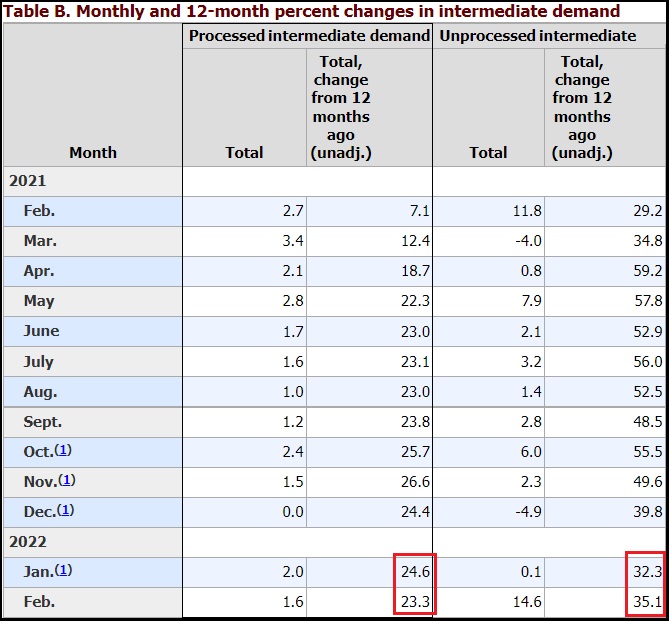

Unfortunately, there is nothing upstream in the supply chain and manufacturing pipeline to suggest that higher prices at the retail level are not coming. The price of raw materials, and the wholesale energy costs to process those materials into finished goods, are still rising. Factually, the recent massive increase in fuel and transportation cost is not included in this data.

You can see clearly in Table-B (again, cleaned up) the wave of inflation that took place in April through October 2021. Inflation is backward looking, so when prices have already doubled in the previous year and the compounding price goes up another 35% this year, well essentially that’s another doubling when compared to 2020. Put another way, raw materials (unprocessed intermediate goods) have tripled in price in the last two years.

In my estimation, the massive price increases the bureau quantified through January were the end of the first wave of massive inflation that CTH warned about last October.

“Do what you can do now to start preparing your weekly budget in ways you may not have thought about before. Shop sales, use coupons, look for discounts and products that can be reformulated into multiple meals or multiple uses. Shelf-stable food products that can be muti-purposed with proteins is a good start. Consider purchasing the raw materials for cleaning products and reformulate them yourself to avoid these massive increases in petroleum costs.” [October Warning]

The recent announcement of price increases we have discussed, from food producers specifically (Kraft-Heinz, Proctor and Gamble, etc.), in combination with massive fertilizer and farming costs for future yield, is the second wave that has yet to be fully quantified. The second wave of retail inflation, only just beginning to arrive now in the February results, will extend throughout the spring.

Next month, March data reported in April, the second wave of inflation data should carry the first big jumps in gas and diesel prices. For ordinary people, this next round of food inflation will be focused predominantly in the ‘Fresh Foods‘ categories. Fresh produce, vegetables and fruits have short life cycles, and rapid increases in transportation costs hit that segment fast and hard.

On the positive side, our victory gardens are going up in value, very quickly. A few backyard growing boxes can generate an easy $200 to $500/month in fresh produce as the price of ordinary row crops at the store starts to double and triple. Mature citrus trees are worth their weight in gold right now.

FJB!

Thanks a pant load Joe! Pun intended.

Eww…that could be a new name for Joe “Pant Load Joe!”

So if you have a million bucks in your retirement fund, you are going to lose because I don’t really see anything returning that 10% from here with interest rates set to rise. Looks more like how do you lose the least.

And you guys with money are buying real estate because you can’t trust the stock market — or banks — and you are driving rents up !! Invest, don’t flip. and keep your rents low if you want a clear conscience!

eventually the housing market is going to sink ala 2008…lots will be under water again

It may be true that we will have a real estate crash. One way to see if this is probable is to estimate the rent versus the mortgage on a property with 20 percent down. If the rent exceeds the mortgage, then a downturn is not likely. However, if the mortgage is a lot more than the rent, then you can expect a downturn. However, irrational markets can go on for a long time.

I thought that real estate was overpriced in 2004, and took action in 2005. Even so, the market didn’t crash until 2008.

A point of advice given to me 30 years ago is: Buy the most expensive house that you can afford. The idea is that as you have a family and grow older the value of the house will go up proportional to the original value. You will be richer when it comes time to retire. You sell your house at that time, downsize, and use the profit to fund some of your retirement.

Just an example: eleven years ago I bought a two bedroom condo ($74k) for my daughter to live in while in college. We rented out one room, and that paid for the mortgage. In other words, my daughter was almost living free while in college. After ten years, we sold the condo for $170k and had about $140k left after expenses to roll over for a vacation house on the beach. Eventually, my wife and I will sell our home, move into the beach house, and have a substantial amount of money left over. I’m sure many on this site have done even better, but that’s what we have done.

So Blackrock goes in, pumps up asset values then probably entices home equity loans which are bundled and sold.

We could easily have another disaster on our hands.

aka … “Mission Accomplished” = another taxpayer bailout = LOTS of RAT kickbacks.

Yeah, we sold our investement property in ’06.

Oh well, we did make money and got rid of a big headache.

Our own house is not considered an investment, it’s our house.

Who will buy an overpriced house when you can’t afford food, gas for the commute, insurance etc etc

Rich Chinese.

Not to sound silly, but this is different today.

Back in ’08 it was free money, with a D rating, that was being massaged into CMOs that got sold at a A rating. Why didn’t people go to jail? I guess the rich never go to jail.

Today it’s two things:

(1) No houses for sale. The people with houses are already on very low mortgages and there is no pressure to sell. Look for foreclosures and short sales… none. (*). As far as new home, in my city, we have a rather active new home tract development, it is a planned community after all. In the last two years we have seen very few homes being built. Pretty much the same in the whole county.

(2) The money coming in is cash from (a) FOB China, (b) domestic (traditional people looking for a moving up/down house) or (c) corporate. In some places, like mine, there is no corporate interest as our HOA makes it very difficult for a corporate for rent purchase. I mean, it could be done, but the fees and what not just doesn’t make as good a ROI as buying in cheaper places inland. “Cheaper” being relative, of course. The FOB money could stop, but that would mean that instead of 10 offers per house, you’d get 6. It’d make little different today.

We know a local real state agent, known him for 30 years. He’s honest. Told us NOT to sell our house unless we plan to leave the State and not come back. We could make a few tons of money but there is nothing on sale… so “down sizing” is just not in the cards, specially when the cost of selling our home is 30% of what it would cost to rent the same ( assuming we could find one ). I want to add one more room for my stereo, over the garage. If we spent $120K, it’d be worth $200! It’s nuts.

Which actually brings up a point. Most of my 401Ks are from past jobs, which means I could move the whole thing into a self directed IRA and then purchase investment land/real estate. But then, we’d have to deal with those headaches again.

By “those headaches” you mean some of the things that I have had to deal with: going to court to kick a nonpaying tenant out, dealing with tenants who vandalize your and other tenant’s property, fixing up everything when tenants move out, dealing with noisy tenants, being assaulted by a prospective tenant, having my car broken into and my tools stolen, being surrounded by 25 angry men who want the drugs they left in your apartment and have already flushed down the toilet, dealing with tenants who have government subsidies can be a pain, etc. Worst of all, a tenant set fire to my apartment and then killed himself.

No have not done that, but it’s the city or county that pushes prices taxes keep going up rent pays them, don’t like it buy a home. Not buying houses as they are going to fall as is most all else. Bills, home and cars payed off is a big help.

Similar. Paid off our mortgage in ten years way back when. Some argue to take the mortgage tax deduction. I am not cut from that cloth. Ownership is where it’s at.

Unless your property taxes are approaching the value of the real estate. I sold a farm in PA 3 years ago. My taxes after 14 years of living there had quadrupled. Yes, 4x. I couldn’t afford to pay the tax bill.

I moved to Florida, now own over 5x the land I owned in PA with a smaller, better suited house and 3 barns, and I pay one half the tax I paid in PA 17 years ago.

Don’t get locked into a bad tax situation. Your house maid be paid off but you can still lose it to taxes.

You know, here in Calimexistan we got Prop 13. Still.

If you stay put, your real estate taxes don’t go up much. Sure everything else goes up, including your blood pressure when you see the latest scam from Sacramentograd…

They tried to exempt commercial property from Prop 13 taxes but I think it failed. They tried to do end run to repeal 13.

I am in a blue state where landlords have retained few rights and been treated like deplorables for decades before Hilliary coined the term.

When I bought my first home over 30 years ago, many were advising me to buy a two-family so the rental could help pay for it.

But I could tell that being a landlord here was a losing game. The tenant would always have all the power, and if he turned out bad – nightmare.

Would never dream of it now.

I too would NOT buy back into the rental business… it was a headache even though we had excellent tenants and a house that we had fixed up (HVAC, kitchen, range, dishwasher, counters in kitchen and bathrooms, toilets, sinks, plumbing, main fuse box, roof, paint, carpets, tile, termite tenting)…. etc.. heck, I thought about moving into it and renting my own home! Yet, our renters always complained about something. Like, ants… really? I went there once with a couple of RAID cans.

Look folks, it’s SoCal.. we got ants.

However, I am thinking of buying a second home out of State. I don’t mind carrying another small mortgage on it since rates are still very cheap.

Well. we got more than that… moved most of it to a reasonable place, but for sure, it’s nowhere 10%.

I miss those heady days of Trump, we shifted our funds to Main Street companies and were doing fantastic.

Oh, I got a new job… doing science is fun but never pays well so I decided to do engineering again (R&E). Got a 25% raise… which I figure just keeps me up with inflation.

You think it’s bad now……..will get much worse. Our US Treasuries have issued a lot of debt while masking it by lowering rates on this same debt. (1% of $20 trillion = $200 billion in interest payments/yr, 5% is $1 trillion/yr). $800 billion a year more. Year after year after year.

Then you have competing currencies and debt obligations from other countries. And the threat of other countries withdrawing their funds in Treasuries.

And now Petrodollar concerns.

US will be printing money like never before.

In other countries, with high inflation, folks don’t leave their money in cash or bonds. Buy something, real estate, cars, gold, silver, commodities, stocks in companies that really make things and money.

You can get all of in your retirement account.

His pant load from the Vatican didn’t travel well.

He doesnt even travel well from his basement to the podium to publicly mumble something incoherent.

Looking back at prior economic collapses, I wonder now how many of those were as engineered as this one clearly is.

Definitely 2008 was engineered IMO

ya right close to the election to get Obama in

I am not sure about that.

One theory is that No, it WASN’T engineered, it caught “them” totally by surprise, and the Worldwide financial system WAS on the verge of collapsing, due to stupidity, greed, unintended consequences, etc.

So, they instituted EMERGENCY! measures, as the only choice they had, to stop the collapse.

And only after they had stabilised things, did they realise they had only postponed the collapse, NOT truly addresses it.

Notice they set intetest rates to -0- in 2008, and haven’t raised them since.

The theory is this, along with other aspects of Quatitative easing, are the only things preventing a collapse of the system i.e. they can NOT ever take away these band aides, or the patient dies.

In the 14 years since, NOBODY has been able to figure out how to “cure the patient”, hence these “temporary emergency measures” remain in place.

And so, in “denial” of reality, THEY have all embraced this insane, fantasy of “Modern Monetary Theory” which posits that “because Governments create money, they can create as much as they want, without any negative consequence”, as a way to totally ignore this insoluble problem.

Totally ignoring that while governments create money, it is people who create markets, and in those markets, ‘supply and demand’ is as immutable as gravity.

So, ‘believing’ in MMT is like jumping off a high place, flapping your wings and believing you can fly.

I know, after 2008 many “ordinary joes” took the hit, while those at the top avoided negative consequences, and even profited.

So, easy to THINK it was all engineered,..but its also true that those with wealth are well positioned to use their wealth and influence to insulate themselves, whereas “ordinary joes” are not.

Anyway, I TEND to think this theory is correct; the World Financial System is a “House of Cards”,..it has been kept alive, on life support “emergency, temporary measures” that can NOT be withdrawn without it collapsing, and those most involved IN the system, are “in denial”, like family members that refuse to “pull the plug” insisting theres still life in their loved one, rather than facing the painful reality.

Damn you RUSSIA! Damn you Putin!!

… parrot the poodle media

You are very good, maybe you could be a news actor?

Should I take my Siberian Husky to the dog pound, in support of the Ukrainian people?

Brandon Did That!

One of far too many things that Brandon did and still continues to do.

Lindsey Graham doesn’t agree with you…he says that “Biden is as good a man as God ever created”.

There really is no expletive-free answer for that.

That’s the Devil speaking.

It really is. And he’s collecting a basket full of souls just like this man’s. I hope South Carolina revisits Graham’s suitability when it comes time for him to run again.

He still has Trump’s ear.

I don’t know if he does or not but I do know I still worry that he might.

I haven’t heard PDJT mention Graham at all for quite a few rally speeches.

Good to hear. Hope he understands precisely who and what Leslie is now. Thanks for sharing that.

Maybe he’s channeling his good friend John.

That means Biden has to be elevated to sainthood.

Vodka on ice please!

Thanks, all you Brandon voters. You were right – Brandon had a REALLY GREAT PLAN.

I’ll be growing in 5 gallon buckets again this season.

The rabbits and whistle pigs can be merciless on a garden.

Or cats looking for a spot.

I have “scat mats’ on my kitchen counters. Have you heard of them?

I’m gonna guess that they are a handy item to help prevent the clepto-cat from getting into the powdered donut holes.

Are those the ones with the plastic spiky things sticking up?

Or in our case racoons and skunks.

Cayenne pepper is good.

All my vehicles are pre-1990, so not a problem for me, but,..

I live in a rural area, and everyone here with newer vehicles, in which they used SOY oil, to make the insulation on the car wiring, have a major problem.

Critters climb up in the cars, and eat the insulation, causeing “shorts” and major headaches as they have to go in and replace the wiring.

Many sprinkle cayenne pepper, to discourage the critters.

So glad my vehicles are “old”, only one even has a computer, and its the older type of computer.

Anyway, any of you who are making the move ‘out of the city’ might bear this in mind.

I was wondering why the mice liked to chew up the car wires in Arizona. We were told to use dryer sheets to keep them away

I tried cayenne last year, probably on your advice, but whatever critter (I have a lot of species) eats my flowers ignored it.

My mice have decided to eat all of the aloe plants that I put in the laundry room for the winter….wth?

I live in a 125 year old farmhouse….with 4 cats & 4 dogs….and still have mice!

I got cats, raccoons, possums and skunks. I don’t really know who to blame.

Are you speaking of those in your yard are the critters in DC?…;-)

Blame the Russians. These critters are all agents of Putin.

I live on salt water marsh and the deer eat everything insight, any suggestions. I could not grow grass so filled in back with coquina shells looks beautful but the little plants around the marsh the deer and marsh rabbits have gobbled up.

https://www.wayfair.com/outdoor/pdp/highland-dunes-orona-39-ft-x-19-ft-raised-garden-bed-w005059299.html?

And it is good for older folks !

The deer don’t even have to bend down LOL!

Those are very easy to make. Go to Lowe’s or HD and get the scrap lumber they have for sale really cheap. I made 10 raised bed boxes 4x12x2 using the scrap lumber and a nail gun. Had to fence them in with 8 ft. high fence to keep deer out. But deer also filled the freezer. Had plenty of land to plant on but soil was poor and dry in summer. Used soaker hoses in the raised beds. Worked great. Well water.

Deer are a real scourge here. Our German Shepherd keeps them out of our backyard, but they plague many of our neighbors’ gardens. Two of my neighbors swear that putting urine around the perimeter of a garden does a decent job of keeping the deer away.

I keep planters on our deck with heirloom tomatoes and zucchini. This year, I’m adding potatoes. We struggle with squirrels. They wouldn’t dare venture near when the dog is in the yard but when the dog’s inside, they’ll come right back. In previous years, I just figured losing 5 percent to the squirrels was the price of gardening, but I’ll give the cayenne pepper a try.

We used a 15 x 10 dog kennel as our garden last year. It kept the deer and many of the other critters away from our plants. This year, we plan a much larger garden, and will be looking for second-hand kennels to add to our current one.

https://www.gardeners.com/buy/big-bag-bed-junior/8591555.html?utm_campaign=PLA&utm_medium=googleshopping&utm_source=google&SC=GGLPLA&gclid=CjwKCAjw8sCRBhA6EiwA6_IF4buqb5jkYWkZ89su9sWEbROITToRAfGHEYi0gU01-UpU3vQ0Y90z-RoCIyQQAvD_BwE

I use these. They also have smaller sizes that are great for potato gardening.

Also this is fantastic-

https://mygardyn.com/shopping/?gclid=CjwKCAjw8sCRBhA6EiwA6_IF4ZTdV4zio7f9vE-znyl7lii_ii8_IxkmUTFUOeQGE0maSyB-qknCyRoCbIQQAvD_BwE

I have 2 and for the last 8 months I’ve had continuous salads and other greens. It isn’t cheap but it’s good for year round growing.

Also don’t forget sprouted seeds and microgreens.

And to actually address your question, you need a 7’ fence around a small garden area. For better results electrify it about a foot or 9” off the ground

Oh, 7-9 ‘ that’s good. The higher the better. Maybe we started out at 6’ and went up fr/ there, out of necessity.

Been so long ago now that I can’t remember.

I just remember it was a Real. Problem. and *eventually* we got it right. Phew!

I have a 4 foot fence, and mounted a 3 foot plastic rod (dollar store driveway reflectors on rods) vertically on each fence post. I run a cord along the tops of the rods, and tie some plastic ribbon here and there on the cord. The deer seem to think it is a solid barrier. So far they haven’t bothered the garden.

We built 6 ft. fences around our gardens in Maine.

May not need them to be as high where deer are smaller? Don’t know.

But seriously, we tried lower ones , but those deer can JUMP.

Eat venison.

.308 for the deer and buckshot for the rabbits

Might be bigger bipedal critters raiding gardens this year. 🙄

Here is FL we are already gardening all of mine is raised bed or felt buckets and potato bags. So far so good.

I have drainage issues in my yard when we get heavy rains as in Lake Mari for a day or two. We get these rains 2 or 3 times from spring to fall so I grow in planters and pots on the back deck of the screen porch. No critters have bothered them yet, maybe because the 3 cats spend a lot of time on the screen porch. I added blueberry plants in pots this year and will be using bird netting to protect the berries when they start to ripen in a few weeks.

Any fruit and veggies I’m not growing will be bought at the farmers market when it owns the first weekend in April

Whoda thunk it Bungles Biden and his gang bumbling idiots are ruining our economy.

I’ve discovered how to freeze oranges! Just peel and quarter. I’m also dehydrating all sorts of things just to see what happens. Asparagus, green onions , apple chips and pears, even kale and spinach.

You should be able to dehydrate most any edibles.

I saw a Facebook post on making flour from dehydrated zucchini to supplement ever more costly wheat flour in baking.

Carrot slices (thin), sliced mushrooms, coarsely chopped leeks, sliced or grated par-cooked potatoes (they don’t go brown), sliced tomatoes (or cherry tomato halves), sliced strawberries, zucchini slices and coarsely chopped cabbage are all regulars in my dehydrator. I’ve even got some thin sliced dehydrated lemons (got a HUGE bag from a friend).

I found tomatoes dry really well. You don’t even have to peel them, just slice thin with a mandolin, and when you use them, clip them into small pieces and add to chili, etc., or blend them for puree..

Even low info people on fixed incomes will be looking around for information outside of the approved narrative. They will still be drowned in the media drumbeat of Putinflation but they are going to be aroused enough to listen to real information that matches what they have been experiencing in their personal lives.

For the rest of us, whatever you have been saving up for your whole life, it is being wiped out in front of your eyes. The left has wanted to confiscate private savings and retirement funds and inflation is a backdoor way of doing just that.

I wonder how many of those with “free phones only get approved narratives and thus real news is still not accessible.

I should have replaced that back door when I had the money.

Government will send uniforms to confiscate your stored food too. It has happened in history many times. It will be to feed the hungry, and that is ok, but much of it will corruptly be taken by the “more equal” folks.

Food can be buried. Vacuum sealed food like beans and rice, placed in heavy duty plastic buckets, placed within metal trash cans, and then buried should store pretty well.

Might be worthwhile to rent a storage unit close to where you live to put stored food, surrounded by the typical “junk” found in most storage units.

Some folks do “guerilla” gardening, planting food crops in the wild or even on scrubby empty lots.

Don’t forget to plant sunflowers. Most people don’t think of them as food 🙂 great source of fat and protein

Thanks Sundance. Please keep us and the media further informed like you did on the fact that the Nov, Dec and January months were adjusted upward .

Brace for impact.

And if the Saudis drop the petrodollar, invest in lead.

All intentional. Hell is not hot enough for those responsible.

For their afterlife, Hell is cranking up the heat.

Saudi’s and India both working on paths to buy/sell outside the petrodollar. The USD is on the path to relegation… pretty far along the path by the looks of it.

Invest in lead, anyway!

Name me anything else which is as appropriate, as an investment right now?

Gold, HAH! Gold is good to preserve your wealth THRU “Bad times” and TO “the other side”, but is nearly worthless DURING the bad times.

And during the bad times, “He who has the lead, will get the gold!”

Stock tip? Carbon Fiber, holds up better than wood, lol.

My neighbor is a sheriffs deputy. I count his ammo as part of my self defense 😂

Don’t have the means to grow much in my own land but purchased a share in a farm co-op for produce meat and cheese. Many people locally sell eggs. Thank goodness we live in the boondocks

Same here. We live close to farms so local eggs, meat and poultry are readily available.

We even have a neighbor who bikes a mile or so to get eggs from someone who raises chickens and then delivers the eggs to her small list of interested parties.

For those who can, a backyard garden for growing produce should be seriously considered.

we’ll be planting our starts this weekend – PNW

spring is here now. the window for planting is now

Likewise in Southern Oregon, getting the prep work done for Spring planting.

Ammo to the left of me, chickens to the right; I love my neighbors!!

Nothing like a well armed militia.

Sounds like my neck of the woods! We also have access to fishing and crabbing and a small crappy Jon boat lol

Even container gardening on a patio can help. Potatoes can be raised in grow bags, which are easy and cheap to make yourself by using burlap sacks. Line your driveway with them. Lots of calories and nutrition in the common spud! And they are easy to store. Check out YouTube for lots of gardening on the cheap videos.

A sunny window sill where you can raise micro greens, or better yet, inexpensive led grow lights suspended from metal shelves, can raise a lot of food, not just micro greens.

Order bulk grains and beans from some place like Azure Standard and bake your own bread and cook from scratch. Home made bread is healthier and cheaper than store bought. YouTube has lots of videos on no-knead bread making. Really easy!

It’s possible to survive this mess, but start NOW.

Inflation helps the government with debt. I believe the FED wants inflation running hot, maybe not this hot but after facilitating the government huge spending binge they want inflation. In any event they’ve caused it. Horrible to have been a saver, spending power of savings going down compounded double digits.

Please explain how inflation helps the gov’t. w/debt.

The only thing the gov’t. pays on debt. is the interest. Inflation has nothing to do with interest unless interest rates are raised to curb inflation (which is going to happen tomorrow). When the interest rates are zero, the debt, is basically zero. The debt. will never be paid off. Only interest payments will be paid. Thus if interest rates are raised to lower inflation, then inflation actually hurts the govt. with debt.

The government borrowed say $ 1000 from you and pays you 2%. At the end of 10 years you get paid back $ 1000. What’s that $ 1000 worth 10 years from now. Next to nothing. In the meantime taxes go up because nominal wages and GDP goes up. So the government has built in revenue increases but they still will only ever owe you the $ 1000. Magnify by 30 trillion same process.

And the government does pay the debt even if it’s a new $ 1000 bond to retire the old $ 1000 bond.

Thanks.

People get inflated into higher tax brackets that do not reflect greater wealth. It helps with debt, just a bit. The interest on the debt is another matter. If it moves up, it can make the erase the gains quickly.

Thanks.

Social Security paid out $2,086 BILLION, in 2021.

“Gave” highest COLA ever, of 5.9 percent, starting in 2022, and I don’t see how they can “give” less than 10 percent next year.

Without even calculating additional recipients signing up, and seniors permanently signing out (except for voting, of coarse) thats a 16 percent increase in the payout of 2,086 BILLION, in just two years.

No wonder they worked hard, to kill as many in nursing homes as possible!

Good point. Maybe that was another reason for the timing of covid. Get us old folks killed off, which reduces the Social Security obligations, then inflate the currency.

Not just timing but what was released and how treatment and quarantine protocols were designed. Yes, seniors were targeted. Not sure where the tally stands now but somewhere north of 70% of all deaths in Ameristan have been in the retirement age sweet spot of 65 plus years of age.

Simple, debt is fixed in dollar terms, if that dollar shrinks you owe less. Tax money flows in in nominal dollars, meaning without growth tax revenues go up in dollar terms, so more dollars to pay a fixed obligation. Interest is another story.

But their obligations are cheaper, like pension payouts.

Thanks.

So, if the petro dollar is toast inevitably, who wants it before the midterm elections. Even though it would be probably GOPrick RINOs that get elected, I don’t want any tangential Republican tagged with loss of the petrodollar.

No relief in sight is the objective.

No relief until about late October miracle. Bull sh!t News BSN touts the victory over inflation which miraculously returns mid/late November.

Won’t work. Too many are awakened.

TAKE THAT, JIMMY CARTER!!! Biden is like a Carter tribute band, all the old hits (high inflation, high unemployment, the Cold War, high gas prices, malaise) but not as good as the original.

Carter was the warmup band for the Biden Sh*t show. It will not be complete without a hostage crisis. Never mind those left in Afghanistan.

The feature of the Biden hostage crisis is those who reside on US soil. When Biden says he is going to finish the wall, that will be the sign.

Don’t forget that Obama ran this same playbook he just didn’t have time to finish us off, Joe does and Obama going to make sure that fundamental transformation happens just the way he thought.

We still have some of the Covid Horror Show left to reveal. You know they will have saved the best for the last chapter.

Hmm – pretty hard to virtue-signal about hostages in crisis when the gummint doesn’t give a fig for their lives, and everyone knows it.

Afghanistan proved that.

What was highest inflation under with Carter? What is the number to beat even at current phoney inflation calculations?

Bannon often mentions a figure of 15% from the Carter era.

He also says that, if today’s percentage weren’t faked in various ways, we would have already reached that now.

Yes, they changed the metrics to exclude the most volatile elements. Like food, and energy. Because nobody needs food and energy, those are just “nice to have.”

Just buy an EV.

Tesla raises prices across entire range, with its cheapest car now starting at $46,990.

Yeah…….I can just see the future EV version of the 70s gas lines as EV owners line up at power stations when it their designated day to charge……while the power lasts.

There’s got to be some very good memes possible from our artist friends; Tesla’s plugged into a frozen over solar panel; plugged into a broken blade windmill; Deplorables cooking outside in winter over a dung fire, driver-less trucks out of gas along an empty interstate, etc

Yet during the Plandemic all the manufacturers dropped their lowest cost economy cars, apparently based on the premise that we would soon be motivated to purchase EVs in their stead.

Ain’t gonna happen with these prices, and those Unicorn Cars haven’t appeared in any case.

This morning a chicken got out of the chicken house. Suddenly, it was much more valuable than it was last summer/fall. I worked extra hard to get it back.

Also reduces the relative proportion of Student Loan debt as wages rise. Only problem is that wage rises lag significantly and relative worth of savings are decimated.

Except for their wages which received a 21% increase??? Not sure if that’s even true, it seems outrageous.

We’re gonna need a bigger asteroid.

That is a total fantasy. Inflation at this level will force up interest rates. On the other hand if they do not force up interest rates, that will force all debt onto the Fed balance sheet and since excess interest is paid back to the Treasury, you could have a point. However when that happens, the value of the dollar will drop making everything more expensive.

The debt will not disappear unless the mint stamps out Trillion dollar coins and the Fed agrees to accept them.

I find it ironic that the Turtle is holding onto his wallet while talking to that group of thieves whom he leads.

By the look on Chuck & Nancy’s face, he may be digging for his wallet to PROVE to them, he’s already a Central Member of the CCP.

Sometime in the near future Brandon and his henchmen in Congress will come out with the 1.5 trillion dollar Putin Inflation Rescue Bill. It will be a retread of the BBB bill. The when things get really bad they will introduce the New Civilian Climate Conservation Corps and millions will be employed installing EV charging stations. I am shocked Brandon still has 37% approval.

Biden has managed to do what few Presidents have ever done. Create a domestic disaster and a foreign disaster. And put us on the verge of WW111 and a 1929 style depression. And he has done it with help from the uniparty.

In just over a year.

Obama loves that everyone cites Biden when criticizing his destruction.

And with help from the unimedia, now that Faux has joined the virtue-signal chorus.

How I hate virtue-signaling. I used to play gigs with somebody who did it nonstop. Dumped that particular duo shortly after the CCPBioweapon. Couldn’t imagine watching her attempt to wear 6 masks on stage, and I suspect she might have tried…

Bought seeds a while ago. Our basement has been transformed into a nursery with starter pots everywhere. Our soil isn’t warm enough to plant yet here in Wisconsin, but we hope to have established plants when the time comes. An observation. The seeds have already been picked over (unless more stock is delivered). If you find seeds, you may want to grab them before that is no longer an option.

Throw your excess seeds in the freezer!

We are sharing our extras with our children and friends. Who ever dreamed that seeds would be so coveted? Thank you for your suggeston.

If you’re like me and never throw ANYTHING away (a messy habit until times like these arrive) remember that many vegetable seeds remain viable for years. I always grow a lot of beets (largely for the greens, which can be picked judiciously without harming the beet crop and eaten all summer) and beet seeds remain viable for several years. So if you have seeds left over from last year or even the year before, they might still be good. Here is a website that lists their viability:

https://www.gardeningchannel.com/seed-life-chart-how-long-will-seeds-last/

You can also save the seeds from certain plants (generally, self- and open-pollinated) and plant them. Tomatoes and beans will work. Note that melons and squash may be bee-pollinated and the resulting plants from those seeds may not be good even though the fruit that year (the year of cross-pollination) will be fine. Here is a brief overview:

https://extension.umn.edu/planting-and-growing-guides/saving-vegetable-seeds

Thank you so much for your advice. Treehouse has very knowledgeable people who selflessly share their expertise with others. The tips are appreciated, and will no doubt be needed in the upcoming hard times. Thank you to everyone sharing their personal experiences and contributions to make life a bit easier.

Our whole little garden came from 2009 seeds from the freezer the last time the world nearly blew up. Continued to buy seeds every year as well as this year. I really didn’t think they would germinate but all but 3 plants did. So if you have been storing seeds start a few up to see if they are good. i kept in fridge and freezer all that time.

LOVE hearing personal experiences!!! Please keep sharing!

If you can’t find them locally, try on-line.

Some cities have seed exchanges. Ask at your local library or farmers market.

We are good, but realize that many will be caught short when they try to buy seeds to sustain their groceries. PLEASE keep sharing your best advice and tips to weather what will likely be a very prolonged food crisis.

Territorial Seed Co

Seed Savers Exchange

Gurney

Jung

Some companies that still seem to have plenty of seeds

We already have plenty planted. We have a walkout basement, with an entire wall of windows facing the west. The wonderful, warm sunshine beats in all day long. We are already seeing sprouts, and look forward to planting in our outdoor garden as soon as the soil is ready (much too cold in Western Wisconsin right now). We are extremely grateful for our blessings, and plan to share our seeds and our bounty with our loved ones.

“No relief in sight”…nor is there any intended. I suspect gleeful occupants in DC are patting themselves on their backs for a job “well done”.

Commenter Phflipper asks on the Open Thread “How is your soul today?” I’d like to hear the answers to that from those intent on destroying America.

And I really do pray for all who are struggling at this moment trying to make ends meet with “no relief in sight”.

When does this lead to RECESSION? If the consumer is charged more for necessities, that means there is less for non-essentials. It is already hard to imagine taking a long vacation by car, with gas being close to $100 per fill up. When demand for non-essentials goes down, so does the GDP. A recession is defined as two consecutive quarters of negative GDP. The media will not report it, and the gov’t bean counters will not be honest with the numbers. But the real world will feel it.

RECESSION? You mean REVOLUTION RIGHT?

Saw a sign on a gas pump, why cut down a tree when you can bring down a 5g tower?

There will come a point in time when we have nothing left to loose.

Desperate times will result in desperate measures and desperation never results in reasonableness.

I’ll be watering my garden from the font of liberal tears. FJB.

Buying lots of canned veggies & soups & crackers. Canned chicken can make a ton of dishes. Numanna is a good emergency plan. Make sure you have access to water. I have land but the soil is lousy. Looking into hydroponics. Keep some spare cash & PM if you can afford it. Saw where Israel had a serious internet breach. We’re very vulnerable. How would you like not being able to access your bank or investments online? Oh, stash plenty of brass. Read your Bible. These are very serious (dark) times.

great minds thinking alike and all that…just purchased several cased of canned chicken and downloaded a ton of recipes for canned chicken…you are correct..very versatile!

I have poor land but it supports a few sheep, and their fertilizer is amazing on the garden. They are easy to pen. I use electric poultry netting for the ewes and my chickens, and they were safe from dogs, etc. Sheep can be milked with a human milker. Their meat is the most easily digested meat, likewise their milk. Most rams are destructive buggers that bully the ewes, so if you can, borrow a neighbor’s ram for a week in the fall.

Took me a second. You’re talking about the actual animal when referring to sheep, aren’t you?🙂

ya that canned chicken at Costco ( 6 can pack) was $9 forever, now within the last 6 weeks its increased to $14 ! same as the Kirkland dark roast coffee was always $8.99 now $13.99

In addition to access to water, it’s good to have a way to purify it. Lots of info on YouTube on how to make your own water purifier.

For poor soil, you might look into container gardening. Doesn’t have to be expensive. Again, lots of how-to on YouTube.

In a grid down situation, those cheap solar lights from the dollar store are useful.

Don’t forget a way to cook. Rocket stoves are easy and cheap to build. So are solar ovens.

A small solar generator can be useful to run a small fridge, electric blankets, an Instapot, cpap machine, etc. A good place to learn about small scale solar is CheapRVLiving, again, on YouTube.

Small bills, coins and junk silver can be useful in the immediate aftermath in a grid down scenario. I think junk silver will be good when barter is not possible. Say you need a tooth pulled but your dentist doesn’t need a couple dozen eggs. He might take a few pre-1964 dimes in trade.

I like to have several Bibles on hand. Not to trade, just to give to folks who don’t have one but who want one. Might be good to get extras now, if you’re so inclined, as there seems to be a paper shortage in the offing. And who knows when the powers that be may decide to censor, or even burn them?

One of the more comprehensive explanations and what we might anticipation in the immediate future. I would urge each of you to take the time and listen, I know it’s long but it’s really good information.

https://www.podbean.com/ei/pb-hkjkx-11d1002

Doesn’t have a link to the podcast.

I’ve been thinking about the economy for a long while. For the past two years, I have bought very little except for essentials. I make good money, knock on wood. Food, socks, and underwear. Bought my wife a used smartphone for $400. Saving a lot of money every month. So, inflation really hasn’t affected me at all. I telework and we cook all our food. My food bill went from $400/month to around $480/month. I am saving $80/month on gasoline by teleworking. My utilities increased by $30/month since I live in an apartment. My rent went up $100/month the past two years, matching pretty much the pre-covid rent increases.

I imagine the economy would crash if many people just bought essentials like me. If people quit buying things other than food and essentials, the prices have to drop.

Does it pay in the long run to wait it out and buy only essentials? The whole market crashes and be ready to buy things at cheap prices with the money saved.

Do you have access to a community garden? Or even space for some metal shelving and grow lights? Patios can be a good spot to raise food.

Sounds like your household is really planning well, but it never hurts to raise even just a little of your own food.

We use our balcony for herbs and citrus (two Japanese yuzu trees). And my wife’s absolute necessity: flowers. She chooses flowers over food. I don’t argue or question her logic 🙂 I just let her enjoy her flowers. She gets mean and nasty if I take away her flowers. Less painful for me to starve than get beat down and nagged to death.

So funny!!! You are a good hubby! Thank you for making me giggle.

Wheat or flour! Tomato paste is cheap and lasts. You can make tomato sauce, catsup, BBQ sauce among others. Tomato powder if you’re investing in the long term.

Tomato and other acidic foods are better home canned than bought in tins. The You Tube prepper guys say the acid eats away on tin cans, and so they have a shorter shelf life than non-acid foods. The acid makes them safe to can by water bath method I.E no need for pressure cooker. For mild Italian tomatoes you might have to add a bit of vinegar to be safe.

Keep your attention on Saudi and China coverting oil payments from DOLLARS to Yean!!!

Next, Russia will convert European oil sells from DOLLARS to yean…

Brazil and India will follow,

Canada could join in on the collapse of the DOLLAR…

CHECK MATE…IT’S OVER

Zero has a yen for yuan.

and Putin will get the last laugh apparently

I was going to sell fresh eggs and produce off the farm – this might be a good year to do that.

And that orchard I was thinking about – it’s a go.

I’m NOT bragging. I’m saying I could see the handwriting on the wall and I’ve thrown everything I owned into this farm to get it up and running as soon as possible. I was a city girl, and now I’m shoveling manure. But, I feel like my large family will survive what’s coming because I did this. Again, NOT bragging. If any of you have any ability to get out of the city and get yourself a humble home and some farmland, do it. Just sayin’ y’all.

City girl no longer.

You are a smart city girl!

You go girl!

Ok so I admit it’s petty…but my hubby has been so condescending toward me and my “prepping”. He actually thinks I am crazy…but lately he has not commented as much and I think he is finally figuring out that something is not quite right with the economy.

anyway I decided, after hearing once again how I need medication for my “anxiety” to do all future prepping with food items I LIKE….so guess what….he will be eating a lot of Mexican dishes with cilantro and hot peppers ( bought several cases of green chilis )…which he doesn’t really care for…but oh well……I will enjoy not only the dish…if you get my drift.

Heh Heh

You’re NOT crazy. Keep prepping. Keep it organized.

When the country went crazy for toilet paper, I kept whistling. I always keep stocked up. Always. My grandmother was a child of the great depression. She taught her daughter — my mother. My mother set the standard for how the household runs. And when I was out on my own, if felt weird not having a healthy stock of supplies….everything I use. And when the “toilet paper test” happened, I was fine.

But you know who doesn’t prep? Who don’t have stocks of food and supplies? People who live in tiny places. Cities and densely populated places where the cost of living is too high.

I moved to Northern Virginia for work from Texas. HUGE differences in cost of living. Biggest snow season in decades strikes when I arrive. Store shelves went bare is seconds. Absolutely nuts! All I could think was “these people LIVE here and are always unprepared for what happens every year?!” They will lift their windshield wipers (something I never knew to do) but they won’t stock their shelves… they won’t even HAVE shelves.

I brought my grandmother (in spirit) with me to NoVa. My family was fine. My wife gained an appreciation for my ways. And now as I become more anxious about the situation, my wife goes out and buys more food or other supplies and it helps me to see her do that.

I too am a transplanted Texan…I wound up in Northeast Tennessee. And the first week I arrived I watched as all my coworkers left the building and drove home due to a snow storm….a condition I had NO experience with.

On my scary drive home that day in the snow I drove like 5 mph with my flashers on LOL> I kept passing car after car that had skidded off the road. I thought to myself…these people LIVE HERE..they are used to these driving conditions…and if they can’t get home safely what chance do I have? I made it home safely but wow…what an experience.

I am by nature and profession a planner…my husband is not…he just goes with the flow and rarely thinks ahead.

The reason I have gone “bonkers” with planning/prepping is partially in response to his COMPLETE LACK OF PLANNING ABILITY! I have to overcompensate to keep us safe!

HaHa, married couples always polarize each other. Re: snow driving — I am north of Maine in New Brunswick, Canada. We drive studded tires in winter and get by fine. If I lived further south I would still buy an extra set of rims, put snow tires on them, and swap them out with summer tires every fall.

Coming from military family with 6 kids..and back then pay day was once a month…..

You learn to stockpile. A freezer is a must. First purchase I made when I moved out on my own at 18.

After I got out of the hospital..for two plus months only thing I had anyone bring me was milk and then liquid creamer every week. A salad.

I am mobile once again

..yaaay! So went to store yesterday.

Corned beef and fixings!

I still am stocked up….but want to keep the stockpile full!

Am still recovering from the sticker shock!

Sounds fair, Liberty.

At least he won’t starve!

Thanks Sundance for the data and clear explanation. I’ll be sending it on to my friends and family, at least to those who are behaving responsibly.

Filled up the gas tank in the car today — first time it’s ever topped $ 50.00. Found a station that was selling 10 cents cheaper. Big whoop.

And we need to remember to replenish our storehouses, kind of a rolling supply for as long as goods are available. Keep the faith treepers.

FJB and his entire crew.

Social Security has “Cost Of Living Allowance” which is intended to “allow” for inflation, it INCREASED payments to ALL recipients for 2022 by 5.9 percent.

So, in aggragate, Social Security increased the amount it pays out by 5.9 percent.

With ongoing inflation in 2023, hard to see how next years COLA will be less than 10 percent, so thats an increase of almost 16 percent in the “pay out” over two years.

For 2022, they also increased MEDICARE payments by $35.oo/mo…so giving it out with one hand, and taking part of it back with the other.

My point is, we have long known Social Security is bankrupt, their is no “lockbox” and without reform, is projected to run out of $.

Without a significant increase in ‘ingo’ which can only come from increasing the taxes paid in by current workers and their employers, they are speeding up the demise of Social Security.

Only those who believe in Mindless Monetary Theory would think this is “not a problem, cause the Government can just create more $” don’t see they are destroying the system.

They HAVE addressed the optics of seniors “eating cat food”; by making cat food unavailable, but beyond that,….

Social Security paid out $2,098 BILLION in 2021.

These people are INSANE.

One thing we can count on is our globalist Congress will do absolutely nothing to secure our own home grown produced food supply. They will have no problem selling our produce to China and every other third world country! There will be no bans on exporting our food supply like Brazil, Algiers and other countries have already done. So We The People will bear the brunt of the “world wide food shortage” so Congress can go on the State run leftist msm and virtue signal how we are feeding the world including our enemies while getting absolutely nothing in return! It happens when America is considered last the preferred status of both parties!!! I loathe our Congress, White House, Federal bureaucracy and Federal Judicial system all of which are operating outside of the Constitution! God help us! Hosanna!

Somebody needs to get sent to hell for this.

Thanks Putin! LOL

STICKER SHOCK

After being in the hospital and then on a leash with oxygen after Covid. ….blah..blah..blah. Doing great now!

I had not been to grocery store since November! I went yesterday…..

Oh My Goodness!

In November I filled freezer and filled up cabinets. Thank you Sundance.

Only grocery I have needed was milk and liquid creamer and a salad now and then.

I got corned beef and fixings! And pressure cooker.

Did all my research-been looking at them for awhile. Even made decision on Friday.

Pioneer woman 6qt was 99.00 and regular insta pot 89.00. Don’t need cute..need to cook. And 10.00 for cute..nope.

Got to Walmart…and the plain was 109.00. Pioneer woman was still 99.00. Huh?

Oh well…got the cute one!

Guess they didn’t get memo yet to increase Pioneer woman by 10.00.

Go figure!

Now I have to get busy and replenish what I have used.

Glad to hear you made such an amazing recovery gypsy! (You sound like you gained the energy of three people)

Ad Rem

I am grateful

I am thankful

And I feel blessed!

Faith …and humor -has kept me going through out life.

Family and friends are important too…..but sometimes …chuckle

I extend my heartfelt gratitude for your recovery. I am thrilled to hear that despite your serious medical issues, you have not lost your fighting spirit. The best of wishes to you and yours.

Enough is Enough…

Thanks for your well wishes.

Beautiful to read. God bless!

Thanks….

Glad to hear you feel better. A pressure cooker will transform the toughest cut of meat into fork tender in an hour. And make bone broth from saved up bones kept in the freezer. It’s healthy and very satisfying.

I already made the corned beef. It took less than half the time! And it is delicious!

Energy saver.

I remember my grandmother canning and putting a dish cloth over the vent of the pressure cooker. It all came back…hey I remember this! That memory resurfacing..priceless.

I bought a roll of concrete reinforcement mesh last fall, paid $112 for it. Needed another this spring, asking price was $300!!!

Gonna be a bugger of a year to build anything!

A few things have gone down, for instance, if your a hunter 5.56 has gone down in price by about 30% from last year and the ammo shortage seems to be over, just saying.

Just as a point of information, the Democrats who are all around me in the deep blue state where I live are talking up the alleged necessity for Biden to impose wage-price controls and for the Congress to quickly enact an excess profits tax on the oil companies.

Given the insane things Biden and the Congress have done over the last fourteen months, I wouldn’t put it past them to do something this crazy.

I disagree there is no end in sight, although the new sanctions on Russia will almost certainly cause another rise in this index in March and perhaps April.

However, looking at those figures.

The “Core” Change in Final Demand (Bottom Right of First Table) is at an annual rate of 6.6% – the lowest for four months since October 2021!

Bottom left – the “Total Final Demand” of 0.8% for February – looking back a year, if that continues at that rate it will cause an increase in March (as I suggested), but then a decrease in April & May, steady in June, and then a decrease in July & August.

Next 6 months – at that rate will only cause an increase in March! 1/6 months.

Steady 1/6 months and Down 4/6 months.

If that also starts to decline then you can add a decline in June as well.

From what I see, these numbers aren’t taking off – they are stabilizing, BUT, the latest ructions and rapid increases in energy prices do introduce the possibility there will be another burst of inflation over the next 6 months due to the rapid increases in energy prices (although I will note they have dropped a lot in the last week, so it could be short-lived).

In any event, these inflation numbers mean the Democrats are stuffed in November.

And that’s a good thing.

Joe is racking up one Hell of a “Record Breaking List”, gotta be getting pretty big by now.

As I been saying you ain’t seen nothing yet. It’s gonna get ugly.

Inflation is a lot higher than the phony CPI of 7.9%.

Inflation is well above 25%. Everything from food

to gasoline has gone up. Go see for yourself.

—–

Inflation is causing a massive hardship of constantly

having to change the price of items on Store Websites

and in brick-and-mortar Stores. The price of items is

constantly going up. Price is no longer Stable.

Election Fraud put Joe Biden in the White House.

The Economic Policy of Democrat politicians will economically

cripple the USA and demolish the Supply Chain.

Inflation will obliterate the buying power of the Middle & Lower Class.

Putin, Putin Putin!!!

Russia, Russia, Russia!!!!!

And yet no one in media questions why Biden Administration continues to escalate rather than de-escalate Russia-Ukraine war.

PPI makes it clear, no?

Is OPEC and Iran along with Russia & China funding the “New Green Deal” pushed by the American left wing people because of knowing information stated below? You be the judge :

U.S. OIL SUPPLY…..INCREDIBLE..!!

About 6 months ago, there was a news program on oil and one of The Forbes Bros. was the guest. The host said to Forbes, “I am going to ask you a direct question and I would like a direct answer; how much oil does the U.S. Have in the ground?” Forbes did not miss a beat, he said, “More than all the Middle East put Together.”

The U.S. Geological Service issued a report in April 2008 that only Scientists and oil men knew was coming, but man was it big. It was a revised report (hadn’t been updated since 1995) on how much oil was in this area of the western 2/3 of North Dakota, western South Dakota, and Extreme eastern Montana.

Check THIS out:

The Bakken is the largest domestic oil discovery since Alaska’s Prudhoe Bay and has the potential to eliminate all American dependence on foreign oil. The Energy Information Administration (EIA) estimates it at 503 billion barrels. Even if just 10% of the oil is recoverable (5 Billion barrels), at $107 a barrel, we’re looking at a resource base worth more than $5.3 trillion. “When I first briefed legislators on this, you could practically see their Jaws hit the floor.

They had no idea.” says Terry Johnson, the Montana Legislature’s financial analyzer. “This sizable find is now the highest-producing onshore oil field found in the past 56 years,” reports The Pittsburgh Post Gazette.

It’s a formation known as the Williston Basin but is more commonly referred to as the ‘Bakken.’ It stretches from Northern Montana, through North Dakota and into Canada. For years, U.S. Oil exploration has been considered a dead end. Even the ‘Big Oil’ companies gave up searching for major oil wells decades ago.

However, a recent technological breakthrough has opened up the Bakken’s Massive reserves, And, we now have access of up to 500 billion barrels. And because this is Light, sweet oil, those billions of barrels will cost Americans just $16 PER BARREL!!!!! That’s enough crude to fully fuel the American economy for 2041 years Straight. And if THAT didn’t throw you on the floor, then this next one should – Because it’s from 2006 !!!!!!

U.S. Oil Discovery – Largest Reserve in the World Stansberry Report Online – 4/20/2006. Hidden 1,000 feet beneath the surface of the Rocky Mountains lies the Largest untapped oil reserve in the world. It is more than 2 TRILLION barrels. On August 8, 2005 President Bush Mandated its extraction. In many recent years of high oil prices none has been extracted. With this mother lode of oil why are we still fighting over off-shore Drilling?

They reported this stunning news: We have more oil inside our borders, than all the other proven reserves on Earth.

Here are the official estimates:

8 times as much oil as Saudi Arabia

18 times as much oil as Iraq

21 times as much oil as Kuwait

22 times as much oil as Iran

500 times as much oil as Yemen

And it’s all right here in the Western United States !!!!

HOW can this BE? HOW can we NOT BE extracting this? Because the Environmentalists and others have blocked all efforts to help America become Independent of foreign oil! Again, we are letting a small group of people dictate our lives and our economy. WHY?

Researchers with this study say we’ve got more oil in this very compact area than the entire Middle East, more than 2 TRILLION barrels Untapped. That’s more than all the proven oil reserves of crude oil in the World today reports The Denver Post.

Drill baby drill in America and then top it off with nuclear power plants because they are safe, clean and very cost effective.