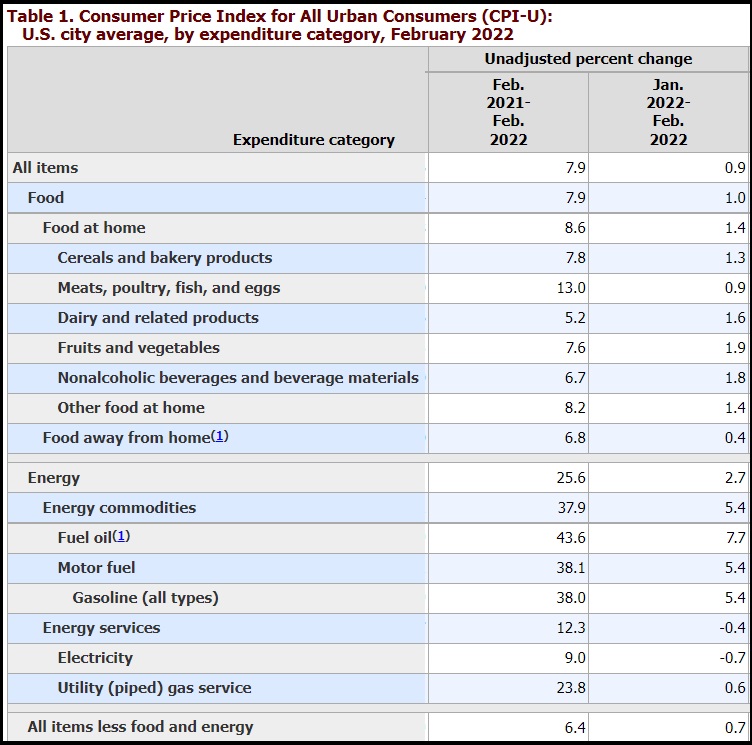

The Bureau of Labor and Statistics (BLS) has released the February capture of the current inflation situation {DATA HERE} – the results are alarming and unfortunately will get worse.

The February rate of inflation was 0.8% (adjusted), an increase from the prior month (Jan 0.6%), and the calculated year-over-year inflation rate is now 7.9 percent and climbing fast. There are some important indicators and aspects that need to be emphasized. [Modified table-1 graphic]

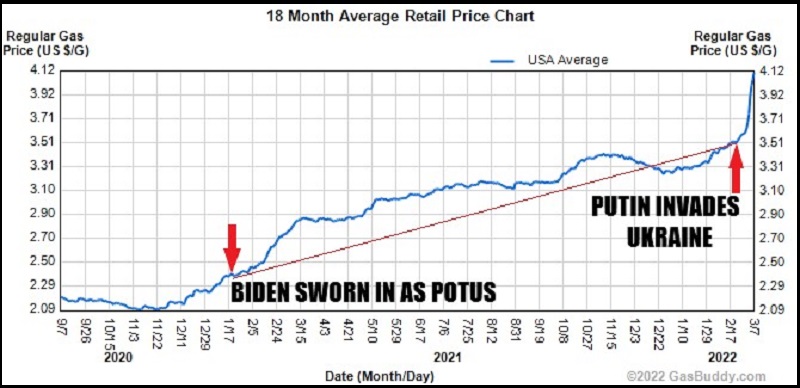

First, the capture of the current February data was BEFORE the Russia-Ukraine crisis came into play. Despite the White House attempting to justify the release data today by blaming it on Russia-Ukraine influence on oil and gas prices, the data itself was assembled before the recent spikes in oil and gasoline. This is an important distinction, because that means what is coming next is even higher.

First, the capture of the current February data was BEFORE the Russia-Ukraine crisis came into play. Despite the White House attempting to justify the release data today by blaming it on Russia-Ukraine influence on oil and gas prices, the data itself was assembled before the recent spikes in oil and gasoline. This is an important distinction, because that means what is coming next is even higher.

Second, what is surfacing now in the data is what we previously outlined in October and November as the inflation hurricane heading our way. All of this was predictable, given the nature of the inflation, at all three stages of the supply chain (raw material, intermediate and wholesale).

The price of goods is still rising inside the supply chain, and the rate of petroleum price increases (energy and transportation) is making the final products even more expensive.

Third, the forward-looking rate of annualized inflation is higher in almost every category than the year-over-year backward looking data. This means future price increases will be even higher than previous price increases. The rate of inflation monthly (in almost every category) is exceeding the previous rate of inflation.

Stunningly, even Reuters has to give an assessment that is against the interests of the White House:

(Reuters) – […] The broad rise in prices reported by the Labor Department on Thursday led to the largest annual increase in inflation in 40 years. Inflation was already haunting the economy before Russia’s invasion of Ukraine last month, and could further erode President Joe Biden’s popularity.

The Federal Reserve is expected to start raising interest rates next Wednesday. With inflation at nearly 4 times the U.S. central bank’s 2% target, economists are expecting as many as seven rate hikes this year. Lower income households bear the brunt of high inflation as they spend more of their income on food and gasoline.

“Consumers’ shock at rapidly rising gas prices at the pump will continue to put pressure on the Fed and policy makers to do something, anything, to slow down the speed at which prices everywhere are moving higher,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina.

[…] In the 12 months through February, the CPI shot up 7.9%, the biggest year-on-year increase since January 1982. That followed a 7.5% jump in January and was the fifth straight month of annual CPI readings north of 6%. February’s increase in the CPI was in line with economists’ expectations.

Last month’s CPI data does not fully capture the spike in oil prices following Russia’s invasion of Ukraine on Feb. 24. Prices shot up more than 30%, with global benchmark Brent hitting a 2008 high at $139 a barrel, before retreating to trade around $118 a barrel on Thursday (read more)

The perfect storm is upon us.

We already know, from our current reality, that next month’s inflation data will be significantly higher than this report. Disposable incomes are gone, as consumers are now hunkering down to survive skyrocketing food, gas, energy and home living costs.

The rate of inflation in 2022 is going to triple wage growth, at the same time the Fed is claiming they will raise interest rates thereby creating unemployment and putting downward pressure on wages. This is a perfect storm for an unavoidable recession, which -in my opinion- we have been manipulatively avoiding for the past seven to nine months. FUBAR.

You can see the specific category price increases in BLS table-2 HERE. If the trends hold similar to current status, moving forward we are looking at 42% price increases on milk, 15% more for vegetables, 31% inflation on fruits (80% on citrus), 9% price increases for beef, 20% for chicken, 18% inflation on coffee and roughly 35% price increases for butter.

Additionally, keeping in line with what we have predicted would happen with durable goods, the prices of luxury items like jewelry and even automobiles are now starting to drop slowly. This would indicate a demand drop in non essential purchasing as spending is prioritized.

Last point…. the BLS data was collected at about the time of the red arrow in this graphic below (Feb 10 to 15). You can see where the gas price goes from the point at which the inflation data was collected. That 30% spike is what will roll-up into next month’s inflation data.

The White House Press Secretary, Jen Psaki, is lying when she attributes the current February inflation data to the Russian invasion of Ukraine. That impact will not be quantified until next month’s BLS release.

Ed Dowd thoughts from today on Bannon.

https://rumble.com/vx0yfb-edward-dowd-on-future-recession-shocking-findings-in-the-cdc-covid-data-and.html

25-44 year olds’ excess death rate for the second half of 2021 equals all the US military deaths during all of the Vietnam War–58,000. Linkage to the vaccine mandates. Democide.

And, he also said late today that he’s releasing another chart that shows in the Gen X age category that there were over 100,000 excess deaths.

Yes, he showed it in the 5 o’clock hour… clip is not up yet…

Oh… duh… forgot he’s posting everything on gettr…

https://www.gettr.com/post/pzbwhe7811

🚨Chart 5 dropped on Bannon’s war room.🚨

Unfortunately GenXs excess mortality also shows a clear early-fall mortality

spike, consistent with that of the Millenials. 101k since Aug 2021.

I like gettr, so far no censorship. At least not for me, unlike FB and Twit.

Agree – I am making it a habit of cross-posting Treehouse articles to Gettr (hope sundance doesn’t mind that).

I just combined Edward Dowd’s warroom hit in the same post with this article.

Wow! Thanks for the link.

I’d like to see Dowd interviewed about how the recession will look and about his thoughts on the Great Reset’s prospects.

I am puzzled how food away from home only went up 6.8% year to year. I thought it would be much higher because of higher wages and energy costs and food costs. Maybe the restaurants are eating the costs in lower profits.

Luckily, I have been paying the same price for milk and fish as the previous two years. A loaf of store-baked bread went from $1.79 to $1.89. My food bill went up about 20% in total. We buy a lot of fruit and veggies and whatever meat is on sale/cheapest that day. We are starting to dip into the meat we have frozen.

Good thing my wife and I are good cooks and can adapt very well with whatever ingredients we have.

Good luck to all the conservatives out there. Screw all the freaks who actually voted for this pedophile and those who helped steal the election.

Might be that plummeted demand for food-away-from-home and trapped supply in the food-service supply chain (which Sundance has noted could not be readily redirected to the grocery supply chain) combined to force discounts on unconsumed inventory – particularly the perishables.

Sounds like what Walmart did when the coronapanic hit and the governments were closing down small mom and pop stores. Walmart bought up their stock for somewhere near (I heard) five to ten cents on the dollar and sold it in their stores at one hell of a markup. That’s why you were able to find those jeans that Walmart never carried before in their stores during the covidemic.

Fast-food places have long term contracts for primary foodstuffs. The people taking in the neck are those fulfilling those contracts.

We too cook. and buy at Costco or some local asian supermarkets.

At Costco, the price for a pound of prime grade ribeye steaks is 4 bucks more than Chilean sea bass. That’s is incredible.

A bottle of french Jadot Pouilly Fuisse that had been steady at 17.99 for a couple of years just went up to 24.99. Nuts!

I know all the big box stores are compromised, but I still prefer BJs to Costco.

Recently picked up large bags of walnuts & pecans, and a big container of garlic hummus (though I’m the only one eating it, it won’t go bad!). I keep the nuts in the refrigerator so they won’t go rancid.

They also were restocked with the biggest boxes of the food my cats will eat.

By the way, if you’re in blueMA, good local source for coffee is the New England brand. The roaster is, I hope, still in Malden (I know it was many years ago because when I frequented there the aroma was always in the air). Their price has of course crept up, but only moderately so far, and the availability is always good.

Keep voting for those elected representatives!

Lemme guess?

These guys say, “Trump’s fault.”

You know times are bad when you laugh at this meme harder than you should…but, Im not embarrassed, lol.

Never thought Jimmy Carter would be the good old days!

Their singular focus is on driving people to electric cars, while ignoring the vast majority who will never be able to afford one.

They just do not care how far you will be walking or riding a bike.

Yes, this is intentional to satisfy the climate wackos.

Focus is the same as the early 70’s. They want people using public transportation or riding a bike/scooter. TPTB will still be driving cars.

I can see high-speed rail making a comeback as the infrastructure project de jure.

Those that cannot afford an EV will forced onto mass transit. That’s the goal.

Nearest mass transit to me is 90 miles away.

You’ll have to ride your bike to get there.

Yes, that’s exactly their thinking. The hoi polloi in EV’s or mass transit (also “green”), the “elected representatives” in gas powered vehicles (and their planes). Keep voting for those elected representatives!

Cant charge that electric car if ypu live in an apartment or a towering condo building.

Also cant do long road trips.

Seems like they want ele tric vehicles so you cant escape your hellscape. For sure cant escape during blackouts that will inevitable happen when enough people have electric cars plugged in to our electrical grid.

Welcome to the world of Ready Player One.

Electric vehicles will naturally limit how far one can travel. So, as an added bonus, they can also control your travel. As for the inevitable blackouts, they’ll blame them on Russia.

They want you in electric cars because their donors are invested in Green IPO’s….. they will make Trillions off of it.

Not only that, but electric cars can be shutdown anywhere, anytime….. Anytime someone wants to protests, etc… they will shut you down immediately. Once they find out you support Trump….. you probably won’t even be able to drive to work, or the grocery store.

One EMP and nothing works with EV’s!!!

Along with digital and crypto currency.

I could graze several horses on my place, but it would cost me as much as a Prius to install the fencing, and in winter I’d have to buy hay. Then there’s vet bills, farrier bills, und-und-und.

In years past when the economy went south, you could tell people were hurting by how much they were desperately trying to sell whatever they have lying around.

It’s quite shocking to see how fast this is happening now.

Worth following Greg Mannarino –he gets what’s going on, says central banks are in control, politicians are just puppets, knows the plot is to enslave us with central banks’ digital currency (sometimes overly animated with colorful language):

Expect Another MASSIVE BANK BAILOUT.. And Here Is Why! Plus IMPORTANT UPDATES. Mannarino

If the economy gets any stronger, we’ll all be broke.

Unsurprising. The minimum was November 4th.

This’ll help the situation:

….”At least 20,000 port workers say they will no longer load or unload any Russian vessels or Russian cargo coming into or going out of all 29 ports up and down the West Coast.

The International Longshore and Warehouse Union calls it an act of solidarity with the people of Ukraine.”……….

https://abc7.com/west-coast-port-workers-refuse-to-unload-russian-vessels-solidarity-ukraine/11627972/

You know, the sad part about all this is most of the lemmings couldn’t even find Ukraine on a map and didn’t give a shit about it a few days ago, but now all of a sudden it’s let’s get rid of anything and everything Russian. Do you think with such a nation of sheep that there is any hope for this country? It can’t be nuked fast enough, in my opinion.

I couldn’t agree more. No one gave a damn that Kiev had been bombing the Donbass for years , killing civilians !

https://www.lewrockwell.com/2022/02/no_author/hypocrites-on-parade-john-pilger-calls-out-world-leaders-for-ignoring-donbass-shelling-for-years/

To paraphrase something heard on the radio earlier while running errands: “If we just stop driving for two weeks to flatten the curve of gas spikes…”

How much longer do you think before America is near total destruction? The WEF is creating one major crisis and lies one after another, faster and faster. They are ruthless and now doing it in plain sight for the world to see! It is Super duper scary how a tsunami of truth is hitting them and how will they react? What is their next planned crisis? Nukes? No I don’t believe this is in their plans. Release a anthrax or Black Plague virus? A financial collapse? A global depression? A power grid shutdown? Will Biden Create a communist-illegal-alien army to round up all Patriots and put us in their gulags? Who knows but WEF has a list of crises to create and following it diligently.

I don’t think we will survive another year with the multinationals at the world helm. I believe “we the people”, will be forced to fight for our lives when the multinationals, for example, they sell the US food supply to the highest bidder, creating a food crisis. They want good Americans destroyed ASAP so they say “let’s starve Americans to death”! Or create any of the above new crises I stated above. Hopefully “we the people” stand up and fight before they execute their next major crisis in the plan to destroy America.

What major crisis will WEF create next and when will it happen?

Have to admit they have been very creative.

They’re running out of time. Trump cost them 4 years. That’s one big reason they’re still trying to destroy him. The powers above your elected representatives have given them a job and a timetable in which to complete that job, because judgment looms ahead, and it wasn’t pushed back just because Trump was president for 4 years. That’s why the frenzy. The good news is those that survive the tribulation will be cast alive into hell at the separation of the sheep and goats after the tribulation, because by then everyone not a Christian will have taken the mark, and no one that gets the mark can enter the millenium.

Lynnette Zang:

USA LOSING WORLD RESERVE CURRENCY STATUS? What This Means for You

“The perfect storm is upon us.” Elections have consequences. Sometimes terrible destructive consequences.

At least the “unprecedented inflation” is temporary according to Psaki. Temporary means as long as Biden in his stolen position at least.

They still think he really did win. Incredible.

Dayum.

CA. prices in TN.

Yesterday in FL north of Tampa bay it was 4.99.

They don’t care most Biden voters will be compensated via food stamps, or govt’ pay raises.

When joebama was 1st installed, inflation was 1.4%.. looks like they’re following the Venezuelan playbook for marxists

Read up on your history, look up what happened to Argentina in 2001 the evens leading up to and its effects.

Look up Venezuela who is still suffering from hyperinflation.

I think argentina 2001 is closer to our situation.

Be prepared for hell.

Oh joy, hyperinflation is just around the corner?

No Economic Concept Is More Thoroughly Misunderstood Than Inflation

https://www.realclearmarkets.com/articles/2022/01/24/no_economic_concept_is_more_thoroughly_misunderstood_than_inflation_813252.html

“Inflation was already haunting the economy before Russia’s invasion of Ukraine last month, and could further erode President Joe Biden’s popularity.”

Further erode? Biden isn’t popular. Polls claiming popularity, however small the number, are actuallu measuring mere toleration of Biden and hatred for Trump … and us.

Yeah cuz of stupid…F’s.

Starting to get that sinking feeling that this is not transitory!

I know a postmaster who has taken down his covid plexiglass and turned the clock back to the good ole days. Says he could care less if he is fired, that we have to make a stand. Says if the Boss comes down, he will ask what he has done wrong, seeing that Joe is still sniffing folks and not wearing his mask and coughing in his hand.

Not the apocalypse that Doomsday Preppers have been expecting, but a pretty good facsimile if it goes on much longer.

My real concern is that the Davos Crowd might unleash a nuke in the Ukraine… one heck of a “shiny object”.

The end game?

Total economic and government collapse, a new “woke liberal” totalitarian government, a new constitution with no guarantee of liberty or Bill of Rights, and the issuing of a new digital only currency.

Keep voting for those elected representatives! You know, you’d have thought that the lemmings would’ve smelled the coffee at the last debate, when Biden said he was going to shut down the pipeline. I’ll be most of them didn’t believe him. I really thought that was the kiss of death for his winning the presidency, but I was wrong. My second mistake was in believing there were more smarter Americans than there actually are.

Everyone seemingly continues to look at this with the wrong perspective. You have to look at it from the UNELECTED admins perspective. Everything that is going on has been planned. They are not FOR America, for the American people or any of her interests. They have TARGETED America. Everything they have done, plan to do and are doing is for YOUR demise economically, socially, and physically if possible. They HATE you and me. Try looking at everything from that perspective and you will be mad as hell because then it makes sense. STOP wasting time believing they are stupid and incompetent. Hoping they will see the light, come to terms with what is happening and fix it is not happening. YOU,,WE …must get involved either physically by joining groups, volunteering, marching, just participating! OR donate to causes that defend those trying to do something about it. They have millions and millions of foreign and domestic dollars to drag the innocent into court for any cause at all to defeat any efforts to thwart their cause. If you keep delaying, picking a side, getting actively defending that side, you may as well get your gun and go the window because that is what this will lead to.

You are exactly right. But screw marching or joining groups. Do individual things they can’t control or track. They can track and/or block your donations to a certain group, for instance, and infiltrate groups all the time (we know they infiltrated antifa during the riots). Do little things individually. No, it won’t seem like it’s effective. It’ll seem like it’s a piss in the wind. But plant the seeds. Be the foxes that spoil the vine. All that grumbling about misinformation, malinformation, etc, is just their reaction to the truth that keeps dribbling out there screwing up their narrative. Keep dribbling it out. Copy excerpts from articles to FB. No, most of the lemmings won’t read them, preferring instead bubble-headed, empty superficial entertainments, but a few will. And those few will spread.

These power thieves who stole the election should be given just what they like so much. Electricity, in a chair!

There are worse things coming for them.

Serious question. When does Psaki NOT lie? Basically everything she says is a lie.

Yeah, but she thinks she’s telling the truth. They all do.

I liked his view on economy. What he hasn’t considered though is Dems desire to Not have economy change until republicans are elected and in control.

This is true.

I remember the Misery Index. Heard a lot about it during the Carter years. Got curious. It’s still out there, and in use. Feb. 2022 it was 11.67%. Needless to say it’s gone up since then. Need to scroll down a short way to get to the charts.

https://inflationdata.com/articles/misery-index/

7 kids. We go through a loaf of the cheapest “fluffy white bread” a day. Just noticed bread went from 88cents a loaf to 93. No, this 49cents a week isn’t going to break us. It’s just a price of a staple I know. And its up 8%.

I live 10 miles out of town. We drive about 200 miles (about 13gal) on weeks with no extra grocery/appt etc trips. We grocery shop once a week. We are looking at dropping out of some extra curriculars for our family– extra practice sessions are out, will wait another year to add piano lessons.

We used to occasionally get carry-out, but strictly removed it from dining options last October. We’ve pared down on the proteins and 2nds at dinner and added filler and sides, ground beef meals are now often ground turkey meals. We dropped OJ and slimmed down on milk. I don’t have much room for a victory garden, certainly not one that would feed 9, and would only add occasional nutrition and maybe a batch or two of canned goods. Unfortunately our summer travels to family always happens at harvest time anyway-reconsidering that summer trip… kind of… we work and live for family.

There simply isn’t enough space to stock pile for all of us.

I’m anticipating cracking our nest egg on groceries these next couple years.

Looking ahead, without a comfortable nest egg, kids will be more on their own after 18, less help from us for their college/car/first apartment/job pursuits. This is what what inflation looks like to a middle class family.

All this is economics and it feels bleak. But we’ve got God, and He’s always taken good care of us. We’ve got us, and we are happy. I’ve felt especially blessed every night that we’ve had a normal dinner, it’s changed a little but nothing’s missing. God will see us through. I pray all of you put some faith in him and He sees you through too.

Hey, but you can always buy an EV! Ain’t it a great country?! Keep voting for those elected representatives!

Inflation is nothing more than the devaluation of the dollar due to an increase in the number of dollars being (printed) circulated.

The Nobel Prize winning economist Milton Friedman put it most succinctly, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced ONLY [emphasis added] by a more rapid increase in the quantity of money than in output.” (Gordan, 2022, p.1).

The unbridled orgy of spending our federal government indulged in over the last several years is directly and entirely responsible for all of the inflation we are now witnessing.

The crisis in Ukraine may cause an increase in the price of some goods, but that is not the same thing as inflation.

As Sundance has stated, it is these two things together that become a perfect storm of forces which then cause prices to massively increase.

In both cases, our own government is to blame.

References

Gordan, J. S. (2022). Inflation in the United States. Imprimis, 51(1), 1-7.

Yes, it is. But keep voting for those elected representatives!

The Fed will need to raise interest rates aggressively to stop inflation as Volker did in 1981. However it has no willingness to this since it would drastically curb future government borrowing, which in turn would lead to the collapse of the welfare state. So the Fed will raise rates in ineffective drips and drabs, claiming that they are acting responsibly. The Fed, a political institution, NOT an economic institution, will always do too little too late.