For those who have been following politics for a while, you might have remembered something about $600 and IRS reporting from a decade ago when Obamacare was passed.

Within the 2010 Obamacare mess, “It was added that payments for goods more than $600 in a 12 month period needed to be reported as well as services. Obamacare further provided that, beginning in 2012, payments to non-tax-exempt corporations—which had previously been exempt from the reporting requirement—would be subject to information reporting.” (link)

The 2010 tax law was actually enacted, briefly, and was scheduled to take effect in the 2012 tax year.

The 2010 tax law was actually enacted, briefly, and was scheduled to take effect in the 2012 tax year.

I well remember at the time everyone was like WTF, I’ve got to fill out a 1099 any time I give $600 to a service provider or business?

Yes, the embedded law inside the Obamacare law meant that anyone who paid any person or business $600 or more for a good or service was supposed to fill out a 1099 tax filing reporting the transaction to the IRS.

The political premise of the law was so obvious, stupid and cumbersome in 2011, after Obama’s 2010 mid term election “shellacking“, one of the first acts of a new republican congress was to repeal that ridiculous segment of the law. As it was noted at the time:

[…] “Essentially, with President Obama, signing into law H.R. 4 [2011], the reporting rules now revert back to what they were before the 2010 legislation (Obamacare and Small Business Jobs Act) was passed. We are now back to where we were before the government started monkeying around with things in the first place.” (read more)

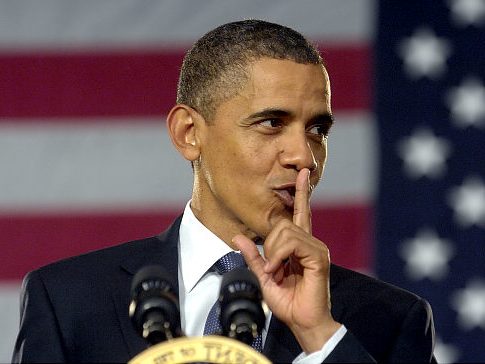

So, for those of you paying attention; and for those of you who realize Joe Biden is just a false front for Obama’s third term; indeed the current 2021 effort by the Treasury Department to require banking notifications to the IRS for $600 transactions looks exactly like what Obama’s team previously tried in 2010.

♦ The difference this time is they are switching the reporting requirement from the individual taxpayer to the financial institution. THE GOAL IS THE SAME.

Here is where you need to remember that Barack Obama and his Alinsky crew used the IRS as a weapon against their political opposition. {GO Deep} The IRS even settled a class action lawsuit in 2018 giving the Tea Party groups $3.5 million in a settlement, and the IRS admitted they were targeting Obama’s political opposition.

The Joe Biden proposal to create an entirely new reporting regime for financial accounts that exceed $600 should be alarming to taxpayers. If this proposal is implemented, it is inevitable that we will see new cases of the IRS targeting and harassing taxpayers.

It is not a coincidence the $600 threshold is the same in the Joe Biden 2021 Treasury Department effort as it was in the Barack Obama 2010 effort. The Alinsky crew know they can then control “who” to apply this target regulation toward.

Just like the DOJ-NSD only targeted Foreign Agent Registration Act (FARA) violations toward the political opposition of Democrats; and predictably just like any OSHA vaccine penalty will only be targeted toward political opposition of Democrats; and just like the IRS was previously weaponized through the DOJ to target political opposition of Democrats; so too will these $600 treasury notifications provide the basis for another round of political targeting.

We have a clear history to fall back on here. This is what Saul Alinsky taught them to do….

[…] The IRS Criminal Investigation Division (IRS-CI) regularly violated taxpayers’ rights and skirted or ignored due process requirements when investigating taxpayers for allegedly violating the $10,000 currency transaction reporting requirements, according to a 2017 report by the Treasury Inspector General for Tax Administration (TIGTA). In addition, less than one in ten investigations uncovered violations of tax law.

These findings should be alarming to taxpayers given that President Biden has proposed creating a new comprehensive financial account information reporting regime which would force the disclosure of any business or personal account that exceeds $600. Not only would this include the bank, loan, and investment accounts of virtually every individual and business, but it would also include third-party providers like Venmo, CashApp, and PayPal. (read more)

SAME for NO coins…Where did all the coins go, disappear b/c of COVID??????

People HOARDING coins??? Makes NO sense but NO biz has coins now….

Simple, MAKE every transaction debit/credit driven to ‘monitor’, track???

Otherwise, you are giving your chg up.

THERE is a GOVT REASON for NO COINS?

Yep. They want no cash so they can track all your transactions.

One world currency for the Great Reset.

We have coins here in Texas? Nothing has changed. What state are you in?

A lot of businesses have signs up – especially fast food places – that say something to the effect of “Due to the shortage of coins nationwide, please either round up your purchase to the nearest dollar or pay by debit or credit card.”

Honestly, I have not noticed any coin shortage and generally pay for things with cash, but I know lots of people who think they HAVE to pay by debit or credit because of “the coin shortage.”

Friends in Michigan told me that during 2020 they were told in a lot of stores and fast food places that they had to pay by debit or credit because…COVID. Makes no sense to me because the stores and restaurants have to pay a 3% fee for every debit/credit transaction, which eats into profits.

Don’t know about the States but here in the UK, due to the huge increase in card transactions of low value, the CC companies are now charging on monthly retailer totals rather than on every transaction.

Travel across the Red River to LA and you will see businesses are begging for customers who pay with cash are asked to pay exact cash and change amount due to coin shortage. Should you travel farther East bound across the Mississippi River, you shall find the same story…..

Good God please help us. We know that we are to render onto Caesar what is Caesar’s but do we have to give it all to Caesar? Your Natural Law says otherwise in that what a man has and creates is his and those possessions can and should be defended.

I think the real point is this:

The entire enterprise is a sham cloaked as a “render unto Caesar” ploy, designed to keep people focused on the financial side of it

In reality, it is a much more sinister scheme to enable surveillance, control, and selective punishment of political opponents until none are left.

^^^^^^^^^^^^^THIS^^^^^^^^^^^^^^^^

Started Jan 6th and everything moving forward has been directed at just this…..UNTIL NONE ARE LEFT.

I hate the use of this verse because unlike other countries in America the people are Caesar are at least suppose to be. It is a lack of this little bit of knowledge that allows for the problems we have.

Dear GEM171 Lemming,

You are misinterpreting scripture by taking it out of context. The Jews were trying to entrap Jesus. They were conquered by the Romans and forced to pay taxes. Rome was the official currency at that time. Rome is gone, and Caesar is dead. Now you can point out verses about lawbreakers, obedience to authority etc… however you must take those verses into context. Second you must realize income taxes are 100% ILLEGAL under the U.S. Constitution. Only corporations and imports are to be taxed. Heck, the American Revolution was started because of taxes over tea. The Constitution allows Congress to pass laws to collect taxes YES. However those taxes are required to be APPORTIONED and RATIFIED. The income tax was NEVER ratified. It’s a sham of a law. People pay under duress. All you will ever find is the IRS code book. You will NEVER find 1 Constitutionally passed law authorizing income taxes. Prior to 1913 the US Supreme court ruled several times income taxes were ILLEGAL.

Consider all these facts please before assuming Christians are automatically required to pay income taxes by a private corporation (Federal Reserve, IRS) whose members are not elected and is not our government.

Also consider what they are using your taxpayer money for, wars, abortion, planned parenthood, Blackrock, banker bailouts, etc. etc. then tell me you believe it’s Christian to pay an Unconstitutional Income Tax to a private corporation formed in Delaware.

All of this can be 100% verified. None of this is “conspiracy” or unlawful. Please consider Jesus words in context. If I am wrong or misinterpreting this I will offer my most humble apologies.

So then, is this what it feels like when God removes His restraints and allow for Satan to have his period of time?

It is now much easier for me to see who really is the source of all essential goodness.

The One truly responsible for fairness, love, kindness and mercy.

Remove God’s influence and there is simply none of these wonderful things we have taken for granted.

We are beginning to see when men are left alone in this world without sensitivity to God they will become as evil and wicked as the Devil himself.

Who is a murderer and a liar from the beginning.

Our refuge in these times and the ones to come will be found only in our faith of what God has declared.

Ben Franklin said “If you don’t like the world with God in it, can you imagine it without Him?”.

I believe we are now finding out.

Returning to a cash society.

I’m saying this tongue in check but I think I might switch my public party affiliation to Dim.

Mine always has been. Won’t help.

Never fear. Just look how objectively the targeting of political contributions by non-profits by the IRS went under Lois Lerner.

What could possibly go wrong?

Clearly it was all squeaky clean since nobody was ever punished.

Anyone still not think Obama isn’t related to the Apocolypse?

Unfortunately, the regulatory swamp creatures will only stop when elected congressmen and women and their staff are afraid to return to their home district to see and hear the people who se lives they are destroying.

Most return to mansions in gated community’s with 24/7 security and streets patrolled by golf carts with license plate scanners.

That’s the problem. They almost never have to face the people who’s lives they help destroy. Not in this life. The few instances I know of where people show up at thieir front doorstep has resulted in them backing down at whatever law they have just proposed.

I fled the USA. A small Christian country is my new home. I can definately tell you it is 10000x harder for politicians to get away with what they are doing in the USA when they have to face the people they are doing it to face to face.

They passed a national mask mandate here last year. Well people didn’t just “protest” and go home like they do in the West. They threw fire cocktails, rocks, beat the police with sticks and were barely stopped from breaching the governments House of National Assembly here. ALL the police barely held them back. The next day they apologized back tracked and shelved the law. And they have not tried it again since.

https://billcam.dailyclout.io/?page=1

Nice site for bill info thanks, all in one place!

The plan is of course for all economic transactions to go through the government. A bank deposit, a purchase, a plane ticket will all be vetted according to your social credit score and vaccination status. If you are Zuckerberg or Pelosi or Ginger Goebbels, the sky will be the limit. If you voted wrong or didn’t get the jab or aren’t an LGBTQIAA etc. ally or haven’t done your anti-racism training, no steak or vacuum cleaner or TV for you, your paycheck is confiscated to pay your fine for not masking and, oh, by the way, you’re fired. This is tyranny and the purpose of revolutions is to stop tyranny.

Exactly, I don’t know why even the most truth seeking political commentators don’t point this out. Like Gen. Flynn said the CCP think in terms of years and decades and we, here in America, think in days and weeks. If you play this tape through with what we KNOW is going on and where this will lead, it should shake you to the core. We are almost at the point where it will be too late, life and freedom as we know it will be pulled right out from under us and we will be under the entire weight of a tyrannical, malevolent government.

Where are the voices using their platforms to hammer this home. Wake up! This does not stop until more people realize exactly where we are headed!

I see that #FJB is trending big time.

Seems like “ALL Politicians” are in on the steal and transition of the US into a satellite country of communist China.

I’d love to see #FAP trend just as bigly.

Would this include details of the what the details of the $600 transaction were for? Regardless seems like an unreasonable search….

Most ARs and other weapons are of that price or greater.

Seems like this could be used as cataloging/registration of all your future personal property?

Monthly rent/mortgage payments are higher than $600 a month, this is insane.

You already get a 1098 for the interest, so it isn’t a big stretch, but if you get a 1099 for every payee that got > 600 a year, have fun with that.

My hometown has changed very little – except for the rent. My friend rented a moderate middle class house in the 1990s for $400 per month . That house is now over $3,000 per month. I don’t understand how anyone can afford to live in the USA anymore.

Your credit card companies have been tracking this stuff for decades. Now they will be reporting it to the IRS.

Certainly Joe Biden is a cognitively declining guy . . .

and Barack Obama is in the group behind Joe Biden pushing these “fundamental changes” . . .

and that group, that cabal is effectively making this Barack Obama’s third term . . .

but I think Barack Obama is not really all that sharp, either and perhaps he isn’t even aware of that, but is flattered and cosseted, he gets stroked constantly . . .

I just don’t see how a total pot head and leader of “the Choom Gang” can be anything much intellectually . . . he is a dullard, truly, playing a role

Buraq isn’t that smart, he’s always had the race card to protect him.

I don’t know if he was a legal president, but I doubt it.

Normally I don’t support a 3rd term for an American president, but in Buraq’s case 25 to life sounds about right

With little or no interest (zero or negative interest likely in future) cash and gold and silver will be king. Who needs a bank?

Bitcoin will be hammered by Federal Reserve.

All just another aspect of #0bamagate.

https://i.giphy.com/media/ZEmYj5XWiPoti/giphy.webp

https://www.washingtonexaminer.com/opinion/disgraced-lying-former-fbi-director-andrew-mccabe-has-record-expunged-pension-restored

Turning 80 has been a relief for me, because I know that there’s not much more of this fascist crap to endure. And, I’m too old to revolt.

600 bucks to a non-corp (or any lawyer) has been a long-standing requirement to issue a 1099-misc. What I remember as a landlord was that Obama law was going to make me have to issue many more 1099s and people were up in arms; that’s why Repubs rescinded the requirement. With this new requirement I suppose taxpayer will have to reconcile all these 1099s they get? Maybe like 1099-B reconciliation that results in writing a book for the IRS.

RAPE, PILLAGE, PLUNDER; AMERICA YOU’VE BEEN HAD!

This article is just another example of what’s happening in America that reinforces the confessions/lessons learned first presented in 1989 to the citizens of an old soldier/cop’s community while he was serving as their police chief. The only real change in all the years since 1989 is that the average American is even more the victim of the barrages of propaganda being blasted on them by real time communications systems and the actions of corrupt/incompetent politicians, academicians, bureaucrats, and the media. Each group bent on driving the masses into nothing short of a world wide feudal system.

Soldier/Cop/Mercenary, Retired

In light of all the activities of the “Left/Progressives” and many other groups seemingly bent on destroying everything we cops and soldiers have/are ‘supposedly’ spent/spending ours careers and in far too many cases giving/gave our lives defending, can you guess which of the following confession/lessons learned were first presented to the public in 1989 by a soldier/cop/mercenary following 26 years in the army and in his third year as a civilian police chief?

A Soldier/Cop/Mercenary’s Confession/Lessons Learned

*Soldiers (ground combat soldiers, that is) do not fight first and foremost for their country, the flag, motherhood, girls back home, nor apple pie! Before all else, soldiers engaged in ground combat fight for their fellow soldiers and their unit. Why? Because in every war/police action/whatever including WWII the strategies and tactics adopted by mostly incompetent/corrupt military and civilian managers (notice I said mangers not leaders) were designed to maximize the profits of the military/industrial/political complex with little regard for the those personnel charged with employing the same. In short, the American soldier has been nothing more than a “mercenary” since 1969 with the creation of the “All Volunteer Army (VOLAR).

*The Seven C’s of Leadership according to a survey of 1646 Vietnam era ground combat veterans listed of the order of their importance (according to the vets) are; Candor, Competence, Consistency, Commitment, Courage, Compassion, and Courtesy. The reason the soldiers in the survey chose the word “candor” is because to them candor encompasses both omission and co-mission. To a combat soldier lack of absolute candor, be it co-mission or omission, are equal sins! In short, soldiers expect/demand absolute candor from their leaders before all else. Note: The democrats have proven they are masters of co-mission, while republicans have proven they are masters of omission!

* The American people are the most effectively lied to people in modern times thanks primarily to politicians, bureaucrats, academicians, and the media.

* Arrogance plus ignorance equals stupidity (A + I = S).

* The greatest threats to the American people are the corrupt and/or incompetent politicians/bureaucrats/academicians found at every level of government/academia, and the majority of the American so-called media.

* Most of the politicians, bureaucrats, academicians, and media types I have encountered during my years as a soldier/cop/mercenary I most kindly refer to as; self-serving, witless, cowards. Note: I originally refereed to the aforementioned folks as; “Self-serving, witless, cowardly, pissants!” After retiring to the deep woods I dropped pissants once becoming acquainted with the little guys; in that I learned pissants are not self-serving nor witless, and certainly not cowards!

* The American Profession of Arms and our brothers/sisters in the Blue have failed to protect the American people from all of their enemies, both foreign and ‘most especially’ domestic.

* There are only two primary requirements to be a career soldier and/or cop in America. One must be smart enough to do the work and dumb enough to take the job.

* American soldiers and police officers must in addition to mastering all of their professionally mandated tasks learn to accomplish the same with at least one arm tied behind their backs and their vision impaired 50% or more.

* After carefully watching the whole of the political class since May of 1960, I can say without reservation that most of the group will sell their souls and our bodies just to remain in power.

* Want to see what the United States of America will look like if the left takes control of the government? Take your pick: New York City, Baltimore, Chicago, Seattle, San Francisco, Los Angeles, or the complete packages; California, New York, Illinois, etc, etc, etc…..

* If the so-called Progressive movement continues unchecked a number of able veterans are going to be presented with a challenge/decision. Are the American people worth another drop of our sweat and/or our blood?

* The end goal of the elites and their minions is not (nor ever has been) socialism, communism, or capitalism. The elites of world have used all manner of ideologies, religions, terrorism, brute force, etc. to drive the masses/peasants/serfs/whatever in one direction. That direction leads to one of the oldest forms of human control ever employed in the history of mankind. That form of human control is, Feudalism!

Soldier/Cop/Mercenary, Retired

Re: Coins disappearing- It’s not for sanitary reasons.

Around March 2020, the hype about masks seemed terribly flawed. As an RN, these changing “facts” were not what was taught, or implemented in practice.

As the hysteria grew, it seemed only logical we end Mail Service & stop the delivery of spit-laden envelopes, & packages groped by hands covered with Heaven only knows what.

Coins exist to line another’s pockets.

Try not paying a few cents one lacks for a burger & see how real the shortage is. They’ll take a five dollar bill, deduct what’s owed – rounded up to next dollar, giving “germ-free” paper in change, or confiscate the burger.

Not much is dirtier than money or more corrupting.

Soon I go to my irs tax office near me https://irs-offices.com/org/irs-office-in-mobile/ and try to meke more details about it. I think that itis quite bad idea, and tme main disadvantage also fell not only citizens, but government too, when they surface with huge amounts of 1099 forms! But I rely on my IRS office that they refuted this information