A slowdown in the housing market is being identified as the primary cause of a significant increase in cancelled homebuyer contracts in the month of June. Bloomberg Report Here and Redfin Report Here. It would appear the inflated housing bubble has popped.

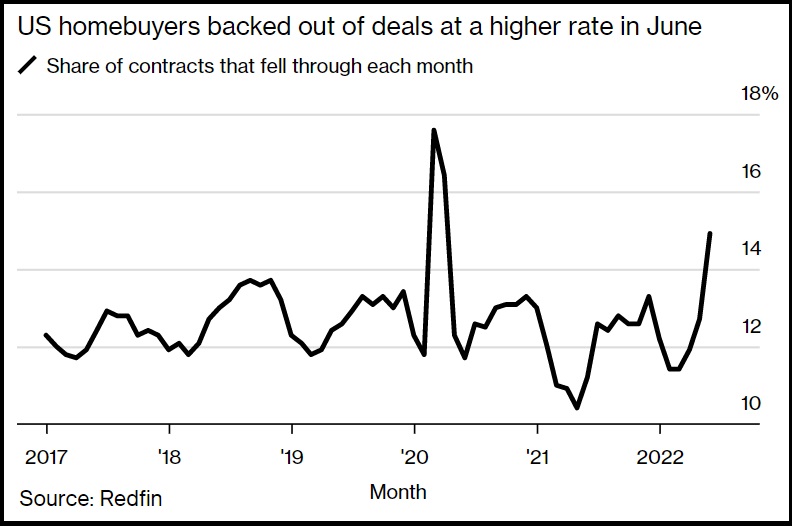

According to the data 60,000 home sales were cancelled while under contract in June, that represents 14.9% of all contracts cancelled by the buyer before the transaction closed. If you take out the forced cancellations due to the pandemic, a 15% cancellation rate equals the highest monthly cancellation rate ever recorded.

According to the data 60,000 home sales were cancelled while under contract in June, that represents 14.9% of all contracts cancelled by the buyer before the transaction closed. If you take out the forced cancellations due to the pandemic, a 15% cancellation rate equals the highest monthly cancellation rate ever recorded.

The economy is contracting, economic activity and consumer purchases have stopped, and the contraction is now fast and sudden.

(Redfin) – Nationwide, roughly 60,000 home-purchase agreements fell through in June, equal to 14.9% of homes that went under contract that month. That’s the highest percentage on record with the exception of March and April 2020, when the housing market all but ground to a halt due to the onset of the coronavirus pandemic. It compares with 12.7% a month earlier and 11.2% a year earlier.

This is according to a Redfin analysis of MLS data going back through 2017. Please note that homes that fell out of contract during a given month didn’t necessarily go under contract the same month. For example, a home that fell out of contract in June could have gone under contract in May.

“The slowdown in housing-market competition is giving homebuyers room to negotiate, which is one reason more of them are backing out of deals,” said Redfin Deputy Chief Economist Taylor Marr. “Buyers are increasingly keeping rather than waiving inspection and appraisal contingencies. That gives them the flexibility to call the deal off if issues arise during the homebuying process.”

Marr continued: “Rising mortgage rates are also forcing some buyers to cancel home purchases. If rates were at 5% when you made an offer, but reached 5.8% by the time the deal was set to close, you may no longer be able to afford that home or you may no longer qualify for a loan.” (read more)

Now, keep in mind that contract cancellations can also be attributed to a hot housing market, where purchasing hysteria and bidding wars end up being factors in the contracts. Some anxious buyers make out-of-town offers without even seeing the house, then use contract exits -contingencies- to cancel the purchase if the home is ultimately not up to their standard.

In my opinion the spike in cancellations is a blend of the two aspects which indicate the apex of home purchasing is behind us. The bubble popped.

Home values are now declining as more available inventory starts to fill up the real estate market. Again, everything is local and regional depending on a myriad of issues; however, if we are looking at it from a macro level, the booming housing market is now over.

City and county tax rates will now benefit from the overinflated real estate sales data. Real estate tax bills (a backward-looking metric) will go up as the curve on home valuation actually starts to drop and drop quickly.

If you did not purchase a home this year, you have not lost money. If you did purchase a home this year, the dropping market will erase tangible wealth.

Redfin also has the top metro-markets for cancellations:

(Source, with Expanded List)

CBS says the best way to survive the Biden economy is not to buy stuff, and young adults should stay living with mom and dad. WATCH:

Saw it coming,…

In addition to citisen uprisings, and avalanches,…economic “busts” happen glacially slowly,…..and then all-at-once.

Its gonna get,…MORE ugly.

Americans in the 1930s at least had FDR’s fireside chats. While his policies were awful..

Will the Corporatist elite allow a free and fair election in 2024?

Things may be so bad, by then, that even the fascists like Bill Gates, or even Soros, will bail.

The window may open, and Trump will surpass George Washington as the greatest American..

Father of the new America? We’re overdue.

I absolutely believe that that is Trump’s destiny. However, first he has to get rid of his considerable rat problem, and then find a way to have DeSantis as his VP. Ron is young and brilliant about the law and government. He will certainly be the president one day, and it won’t be a long 8 year wait, just a short 4 year wait, but it will be one of the most momentous 4 years in our history before Ron becomes the 47th president.

The 48th president, that is!

I think that would be a golden ticket, but can’t picture them running together. They are both alpha dogs.

I agree, DeSantis is an alpha. It would be a waste to put him in the VP spot when he can do so much more calling the shots in Florida.

I hope Trump runs and wins in 2024, DeSantis can run in 2028 and 2032. We could potentially have 12 years of GOP presidency, and if voters stop voting stupidly we can have GOP House and Senate majorities too which will completely shut down the “green” insanity as well as abortion and threats to gun ownership.

Put him in the VP position to cage the rats.. When he becomes President his enemies will have public faces to go with their communist ideology..

I have felt for 2 years that Trump absolutely has to run this DeSantis. It preps Ron for president and covers Trumps age issue

Lovely wish. I hope it comes true.

what would you do, if you had their power, and knew what you knew was coming?

I’d perfect the perfect vaccinated illness. illnesss the world, vacc the friends.

lots of batches got tested. lots of humans got genetically modified (mRNA vac) where they NOW have a biologic target they were not BORN with

So how might this effect banking and reverse mortgages?

Watch The Big Short, and then watch 99 Homes. You can find them free Online.

There is going to be a lot of people sleeping in cars and tents!

Yes, it’s that “all at once” breakdown in society that I’m worried about. Some people think it can’t get any worse but it can actually get a LOT worse. God help us.

Pessimist, BEING a pessimist, opines;

“It can’t POSSIBLY get any worse!”

But the Optimist, BEING an optimist says;

“Oh, YES it can!”

And, the critical thinker says “Yes, you’re correct!”

The realist says: “Today is the best it will ever be.”

Dutchman,

A wise person once pointed out to me that.. “An optimist is rarely, pleasantly surprised!”

Best,

skipper

Thing are never so bad they can’t get worse.

“It can’t get much worse..” are famous last words.

If the welfare state collapses, we’ll be envying the shoeless Irish peasants of the great potato famine.

Bill Gates, the monster Bill Gates, has this in his sights.

Americans of the 1930s dismissed what Hitler was up to. We just go on..

Never say never.

When they said, “Cheer up, it could get worse, ” I cheered up, and sure enough, it got worse

Watch the bank earnings releases, coming up, for non-propagandized economic perspectives. Are they building their allowance for loan loss reserves, or depleting them. For the past year they were releasing reserves signaling better expectations. If the industry all starts building reserves, then the canary in the coal mine just keeled over.

It’s always darkest before it goes pitch black?

I just compared us to a roller coaster about ready to descend on its first hill. I dunno how long we’ve been trekking up that long slow hill but it’s going to come down fast and hard. Grab on to the life preservers.

Here’s a great read based on gold vs currencies. The author doesn’t even take into account the BRICS nations are pulling away. This has got ugly written all

over it.

https://goldswitzerland.com/paper-gold-price-manipulation-rigged-to-fail/

Yet another reason why we’re going to be made to suffer from the “Midterm Variant”.

I think that ship has sailed. No one is buying what they’re selling with covid any longer!

No, now they are peddling Monkey Pox.

No, this is what the CDC were peddling to happen in April. No coming back from this. There is an outbreak in Ghana

https://www.who.int/health-topics/marburg-virus-disease#tab=tab_1

Isn’t it Marburg that so hot right now?

if they said it tomorrow, you’d stay locked down, and be mad, but would stay down.

its tough to fight a SYSTEM. thats why hillary joined it, and left Alinksky behind.

I don’t think so. Now I know who agrees with me, and how to get hold of them, and figure out together what to do about it. And I think the other side knows people like me know that (although some of them are spectacularly clueless) and that’s why things have happened like Philadelphia’s attempt at re-masking lasting just four days.

Too many anecdotes of harm from the vaccines and mild infections from Covid for people to fall for it again. I hope anyway.

I could never find the article after seeing it one time but during Obama’s campaign in 2007 an interview article surfaced from his early years as community organizer and state senator.

He stated that he and his fellow organizers and Chicago politicians would throw out ideas and scenarios regarding policy to the citizens, to gauge their reactions; if the political players could see a huge groundswell of disapproval coming, they would toss that idea out and throw something else against the wall to “see what sticks.”

So the Democrat cabal may try and lock us down again, but I think with Fauci and others coming out now warning about another virus or more Covid, they are testing the waters.

And now that the 3 branches of govt are totally corrupt, I am sure the Dems would set off a nuke in order to shut us down once and for all.

Pretty sure the dem globalists will have several things up their sleeves to obstruct/disrupt the 2022 mid terms. Why wouldn’t they, there was basically no accountability for the 2020 steal. Who will hold them accountable? The FBI? The UniParty members still don’t acccept the election was stolen.

“Too many anecdotes of harm from the vaccines and mild infections from Covid for people to fall for it again. “

Yes…

I know someone who volunteered to work at a local vax center.

But now,

She has done a complete 180 and is pissed off.

She has watched coworkers and friends have miscarriages and children born with hair lips.

She blames it on the jab.

It’s already started this am on good morning america (cbs) is pushing boosters hard- new omicron subvariant…must get it—their expert got it…and, yes, risk is different for all so just cuz you are not at risk your neighbors might- get boosted…and the expert finished with “we don’t want another lockdown” but not as direct as that. And now on evening news: covid not done, new large breakout threatens the U.S.

It’s so predictable.

Yep. We are living in a “12 Monkeys” scenario.

Got a nephew who is a supervisor of mortgage staff at a St Louis bank. Told me last week that they’ve had to lay off 3 of their mortgage brokers — 35% of their staff — in last few weeks….and he’s sure more will happen. He said the refi business is dead, and new loans are few and far between.

Thanks Biden!

Wow

The artificially low interest rates pre-date Biden’s presidency. They go all the way back to when Biden was Vice President.

Artificially low cost-of-money below the published inflation rate originated under the Greenspan Fed in 1995 and has continued now for nearly 3 decades. (go to treasury.gov and look at some long-term charts for ‘money supply’)

The inevitable consequences of printing-up “funny money” to compensate for real wealth creation have not been satisfied by the resultant “dot com” mania and bust, the “sub-prime” housing-banking mania and bust, and the more recent “equities”(stock market) mania and current bust. A reckoning is just beginning.

A dishonest monetary ‘system’ will force those that use it’s currency to be dishonest as well.

Agree. It destroyed the traditional savings accounts and CDs that most working class depended on to earn interest securing their investment. Pushed many into the stock market.

They go back to GWB.

I was in banking during the last bubble..and even though I have retired since then am still hyperventilating

Black Rock cant wait to buy everything up.

Worse timing imaginable but nothing I could do to avoid. Trying to sell a house.

How else do you migrate a mix of good and bad voters to a better run State? either way it dilutes the new state – the percentage is not known, but its greater than Zero.

As if open borders werent enough.

yep got to provide plausible deniability to the electoral steal.

we won because of migrators and relocators.

endless supply of hungry mules. Gonna need a lot more then 2,000

Mules sound tastier then bugs !

That may be of interest to their new Board and CEO, once the current crew is fired by their shareholders for losing a quarter of their money (and counting!).

Jacks Magic Coffee Shop where corporate survival is based on your BBB social credit score, not profits.

Just ask the New York Times

So that is the dynamic before us; inflating the currency supply makes things cheap, and deflating the currency supply takes over assets that have too much interest to service the debt vs equity on them. Such is a debt-based currency system that only the stooges of Satan control.

This is all part of you’ll own nothing plan. Being happy? That’s on you if you don’t like eating bugs.

I hope to live long enough to see the son of Nazi Klaus either in the grave or ideally his head on a pike.

I used to think this was a bit of an extreme position, but not now.

How many people are, or will be underwater with their mortgages?

And THEN literally underwater when the ice caps melt!!!!! The Horror!!! /s

Food Water Shelter

.I would think the absence of shelter might be as important as the absence of food for some. batten down the hatches

Water is next. I see the leftists here in California are pushing the hoax draught agenda now manufactured as a result of the global warming hoax.

Food, water, shelter, energy, health.

The ESSENTIALS for life, they are breaking down access to THE ESSENTIALS OF LIFE.

And they fantasize this will turn out,…..how?

Give me my health; all the rest I can then somehow manage.

Agreed.

Most people can afford the mortage that were told. this isnt a subprime thing.

this is a 0 percent interest to get George Floyd protest property, with a known outcome of the Rate having to Swing the other way pendulum style.

known known known

Underwater mortgages? When have we heard that before?

2008

I have been having flashbacks.

The only mortgages that wont be under water are really old ones—prime Colorado River-front properties just upstream from the Hoover Dam

How deep is the “Mariana Trench” in the Pacific..?

Everyone that bought the last four to six months.

I don’t think we’re seeing the crazy loans that were being made under GWB-goosed mortgage market. So it will take a bit of fallback before borrowers have lost their down payment equity. Also don’t think there are as many flippers out there. They instead moved into crypto for their quick buck.

Flippers galore in Florida.

Greater Vancouver is a Real Estate hotbed as a result of “ dirty” offshore money.

Those buyers are ultra wealthy and are not greatly affected.

However..locals sitting on greatly inflated properties having been taking out L.O.C. loans and buying second and third properties in Florida, Arizona Hawaii even, an acquaintance bought a termite infested dump a few years back on the Big Island.

They figured it would be a Goldmine..not sure how that will work out with expensive flights and exorbitant food costs.

We are staying home..

As an aside and a “ feet on the ground “ rental property we own in Southern British Columbia had the property tax jump from $6,000 in 2021 to $9,000 for the 2022 year.

Insane…and several decent folks we know that are ill prepared are anxious.

Cheers!

Same in PA.

Back during the Covid shutdown, I tried to get a new roof put on my house.

I was told that it would be 12 to 18 months before the roofing contractor could get to my roof.

I placed my order and waited patiently.

Then inflation started to hit and, according to the roofer, customers started canceling their contracts.

Since I had already set aside the money for the new roof, I was good to go and, because I had contracted for my new roof last year, I was locked in at last year’s prices for materials and labor.

The contractor told me that many of his customers were forced to reevaluate having their roofs replaced, due to inflation.

*isn’t that first sentence missing a word? Should it be “…increase in home contract CANCELLATIONS…”?

You’re probably right. I read right through that without noticing it was missing.

It’s fixed now.

Good grief – stay home with Mom and Dad? That’s their solution?

the 0% interested wasnt to help you or I

People saw the low rate – and wanted to have more, and live the dream – THAT WAS NOT THE INTENT

the 0% interest was to purchase Physical assets by Black Rock/Vanguard prior to a currency change.

The George Floyd protest devalued the city prop – to make the 0%interest loan even better for BlackRockVanguard to purchase the Cities

to make RENTERS. those few that copied Black Rock GOOOOOD ON YOU. – — they will get you through property taxes.

alll BR/VAN has to do is make people hate PDJT, then the pied piper ralllying up Dutch Famers in America is over.

they are doing a better than Poor job

“Mom” and “Dad” did that around 2008 and they want us to do that again?

My realtor said that most were buying these houses as parents and children together. That was how they were getting the higher prices. At least here in South Dak. People are desperate to get out of scum states. Hopefully, they don’t bring their scum ideas with them but I’m not keeping hope in that idea. They are out to get us moved to demoncrat state.

Yeah, that’s how I sold my former farm 2 years ago. 5 bed 4 ba house, was bought by a family of 5 and 3 grandparents. Had a fantastic 1800 sq ft dry basement, they were going to add 2 bedrooms and a bathroom.

It was a cash deal because all grandparents paid for it. Good deal for everyone.

Except for the rabidly increasing out of control property taxes, I’m sure they’re happy they bought when they did.

I have friends that are in their mid 50’s that are still living with mom and dad..My six figure income brother lost everything back then..he came to live with us..sadly he passed in 2015..

And watch “Fake News” 24/7….

Just wunderin.

Would it be the same in savings if me and mama moved in with the kids?

just a comment on why I think..

When you enter a home purchase you see the Rate at that Time – its not finalized until Purchase – and that RATE Climed alot over time.

the final rate at Purchase was a lot more that at the start of contractor home building

depends on how you set up your mortgage….you can typically pay a fee to lock in a rate for 30 or 60 days

You all ate talking about fixed. The variable rate people are SO SCREWED!

When 30 yr rates were in the 3’s, not sure I see a reason to take a variable rate.

Except So. Ca.

The tax issue is not a matter of TAX RATES. Most states have Homestead Type Laws that limit tax rates and peg taxes to being calculated on PREVIOUS YEAR’S TAXES PAID by the PROPERTY OWNER.

This is where most home BUYERS are being burned.

Then there is the home insurance rate requirements the lenders are going to want to see met.

Simple example:

Taxes for Collin County, TX in 2021 were paid against a “hypothetical” $100,000 home value.

The 2022 Taxes can be assessed against a Max Taxed Value of $110,000 or are limited to a 10% increase in taxed Value, even if the Market Value went up over $200,000.

Plus, actual Tax Rate increases are also capped by law.

If Joe Big Tex buys the house for $200,000 … the taxes for Joe Big Tex are calculated against the $200,000 purchase value at the max allowed tax rate limited by law, since Joe ig tex DID NOT pay the previous year’s (2021) taxes levied against the property.

Read those truth in lending statements and be sure to check the tax rates and laws.

Own property in 4 states and all are different. But yes, in many cases existing home owners have appraisal increases applied over time. My property in Cali was bought prior to prop 13 so the prop 13 limit is crazy compared to what someone would have to pay if they purchased it at the current market. But obviously the prospective property tax is a factor in affordability that mortgage originators will look at.

Crunch will come when pre-closing appraisals come in under negotiated purchase price. Seller will have to eat the difference or lose the sale. VA loan appraisors are notorious for low, deal killing appraisals.

I suspect the scenario you describe of the Appraisals coming in under sale price is what is starting now.

This is the 2009 scenario unfolding all over again, with owners sitting under water yet again with massive tax and insurance bills as their “home investments” devalue.

It is still interesting that I we get 5-10 calls per week with cash offers that are still quite high.

In the area of Allen, TX and Collin County where we live it is primarily the Indians buying up the property.

Where I live, some investment company is buying up houses, fixing them up, and then selling them for more that twice what they are actually worth. It’s disgusting because so many of us regular people have been priced out of buying a new home or even an old home. FJB!!!!!!

Commune time almost.

however u spell that.

Houses that used to be $80,000 now going for $300,000+ is the norm nowadays. Only a fool would play this game, the Govt’ loves it though because the taxes are through the roof and the sales get churned more often because people can’t afford the houses and taxes, etc. The more the houses are bought and sold the more Govt’ makes off the peasants.

I’m sure the federal government love those property taxes that any homeowner has to pay for the rest of their lives, especially when houses costs 3 times what they did just a few years ago.. If there was ever such a thing as a tax that’s pure evil, property taxes are it. The hoops you have to jump through, along with all the the taxes, fees, and interest you have to pay until you finally own it outright should be more than enough.

Much of our land is owned outright. Only one small parcel still has any type of mortgage on it. Could pay this piece off but that mortgage is in the 3% range and is in the 20% loan to value range. The taxes however are a whole different story. Just received the new tax assessments. What a total scam. Collectively, all parcels were reassessed at 30+% higher.

Here in Texas, last year saw a massive increase in land values. Not home values, just land values. Nearly all land values at least doubled. I know some folks whose land value tripled and more. This was done in nearly every county.

Aren’t property taxes paid to the State and in some cases local Govt?

Local, school, county..the state takes a % of the realty transfer tax in PA…

Since the SALT limits placed on deductions, raising property taxes are a “don’t care’ to the feds.

Here they keep the tax mill rate constant and brag they didn’t raise taxes while appraisals are up 20%.

So, one tip to save money is, put off large purchases.

But, Biden’s solution to high gas prices is, for us to buy an expensive electric vehicle!

Way to go Joe!

the sick truth is, everyone is going to get squeeze until they cant buy or pay. the home owners, the land owners – got a better shot of fighting.

that was why this happened.

come and take it – can be said by owners. – cant be said AS EASILY by renters.

You need to be careful with those taxes, some states have changed the laws so that the state may seize the property and sell it at auction. Than they keep both the outstanding taxes and any overage. One state recently got shot down with the method in a State Supreme Court but there was no order as to former owners receiving compensation. That means likely years of lawyers and fees to attempt restitution.

buy an EV with questionable availability of the electrical grid to support charging it…..good luck with a car with no charge

Millions of Americans putting off large purchases = mass lay offs in the near future. I want to believe that these people are just incompetent but they know and are doing this on purpose. Us peasants need to die off by the millions so the rich elites have the entire planet for themselves. Of course, they will keep just enough of us to do all the hard work and to keep things running for them but most of us are slated to die in the name of climate change. FJB!!!!!!

The new world order’s jackboots are streaming across our border every day.

UN openly states “famine makes a man work harder” to get his food.

Yes. Layoffs will kill the economy.

Mass layoffs for Samsung and LG maybe.

And after you purchase your EV then you hope there is sufficient available electricity to charge it.

In Ca, if everyone had an EV, our capacity to supply sufficient electricity is only 2% of all the EV’s per a recent study.

So, ca must keep it’s one remaining nuclear plant open and operational just to meet current supplies.

My Stanley Steamer is up for sale. At least it qualifies as “collectible”.

I fear electric cars will be worth less. Far less..

On the other hand (putting off large purchases), the cost of everything is going up, aluminum, steel, etc.., if you’re in the market for a large purchase, buy NOW. I have been looking at trucks. Dealers are having trouble keeping new trucks in stock or even getting them. Consequently, used truck prices have risen dramatically.

Rarely, does the cost of goods come down. Only in a depression (?).

I have been buying some large steel parts up that I know I want in the future

because I know in the future, I probably won’t be able to afford the shipping

let alone the part itself.

I just sold a spare pick up I had last week

for a lot more then I ever imagined

looking to buy some Krugerrands ASAP to beat the rush!

I sell scrap. Almost all metals are dropping fast. Al, Fe, Cu. Big exception are cats which stay high for the rare metals. This has happened in the last few weeks.

The huge scrap yards can not move what they have because mills have slowed buying because manufacturing is slowing raw materials purchases.

Homes are still selling in SW Missouri, but that may change. Although mortgage rates are high now (5.6% for 30 year fixed), it still has a long way to go to get to my first rate under Carter (11.5%)

We bought our first home with a 12.5% loan. The house cost $60,000 and our payment was something like $750 a month.

Same here. My first rate was the same under Carter.

But a 12% interest rate on $60,000 is a lot different than on $300,000. A $300,000. loan at 5.8% is around 17,000. and a 60,000. loan at 12% is around 7,000. Even if the percentage is less, a higher amount on borrowed money brings the price of the mortgage higher in the end. I think a lot of home buyers are fooled.

No, where people get fooled is that the TIL disclosures take the up front costs and amortize them over the life of the loan, expressed as a percent. But the average loan only lasts 7 years so the effective rate is much higher.

People who bought at Carter mortgage rates bought when home prices were down because of the high interest rates and then refinanced as rates went down and home prices went up. He accidentally made some people large gains in home equity.

Yes. My first house cost $68000 in 1980 and my interest rate was 13.5%…from my father. He gave me a discount.

Thumbs up for Dad.

“He accidentally made some people large gains in home equity.”

Which if you sold, you were hammered by capital gains taxes.

There weren’t any cap gains on personal residence if you bought a new house at equal or greater price. Then after 86 tax act and amendments we now have a $500k CG exclusion if you lived in the house 2 of the prior 5 years with some exceptions.

Mine was so cheap (19K) that I paid the mortgage off in just a few years. Also had a 30% downpayment which cut down on the mortgage.

I’d *much* rather have low prices and high interest rates th/ this ridiculous crap that’s been happening since the 90’s/2000’s.

The home prices in Rolla Missouri were definitely not down in 1978

I got my RE License in 85..we were thrilled when the rates hit 12%..My parents bought a vaca home in 1980..the rate was 18%.

What I have noticed in last week or so….especially in my town.

Realtor fees have been climbing. Was 2% and now I am seeing 2.5% and 3%.

those are negotiable

In Texas, that number is 6% unless the seller is a government entity. There was a lawsuit over this price-fixing. I’m not sure what has happened with that.

Here the local BOR pretty much enforces 3% to buyer and seller agent. Of course, there is no requriement to be a Realtor to get a license as an agent, and you can always go it alone if you think it is easy, or hire a pay-as-you-go agent.

So…if you sold high and bought high is that just a wash? Cash used.

We didn’t use cash but that’s what we did this year. Our motivation was to get out of WA while we still could. We figured this is the last year we would be able to for a long time. Our interest rate is higher but we dropped our note by 90k and got a bigger place with twice the land. Worth it IMO to get out off the west coast.

*Anything * is worth getting off of the West Coast, if you can possibly swing it.

There is no question that inflation broke a lot of budgets from insurances to food. It is across every item. The majority of people’s income is not keeping pace, a couple of years of inflation compounding there is going to be a serious problem that people will find difficult to maneuver around or recover from. Compounded high single to mid double digit inflation with zero interest saving rates and falling asset prices, devestating.

And no increase in salary/wages to help.

Yes but Russia, er, yes but global warming…er, um, look Trump grabbing her by the P!!! Look darn it…look! End quote. Repeat line.

In Florida we were getting killed by Florida hurricane authority insurance, and now after some law changes “sinkhole” insurance has become super expensive, at least in Pasco County which is considered high risk. Same thing in Cali with earthquake insurance, but we are going “bare” so will take our chances.

I had dinner w Florida friends recently. Their oceanfront condos were assessed 2500 per unit for insurance increase. Monthly fees will be going up, too. I just moved back to Florida. I bought a condo Oceanside. Couldn’t believe the cost of my homeowners policy. Most folks aren’t going to be able to hang on. I certainly pray for us all.

No surprise here. This needed a correction. Sorry if you just bought.

CNBC now reporting this report that was circulated around desks all afternoon is in fact fake per BLS

Probably more accurate than the ‘real’ report tomorrow.

He never left. Working on his second mortgage meltdown.

‘The Stupidity Of The American Voter’

The ideology of America’s collapse will require a fall guy.

Biden the imbecile has chosen this role.

But of course, somebody, anybody will be substituted. So Kamala will be the temporary placeholder.

Our filthy, disgusting media will call her critics sexists and racists. Except, the suffering will not end.

So the fanatical leftist socialists and fascists will hand over power to Trump in 2024.

Here’s the greatest problem the world has ever seen, Donald. Have at it.

Perhaps the leftist monster will finally be starved out of existence. Perhaps..

It’s not enough for them to engineer the collapse of America. All those things that gave rise to America must be thoroughly discredited and erased by the same perpetrators before their mission will be complete. Traditional America cannot be suffered in the Liberal World Order.

As I often post, Burns, America was the end to feudalism, and all flavors of leftism represent a desperate return to feudalism. This is why limousine liberals like Bezos now make common cause with leftists like AOC. Feudalism will be restored.

Agreed, yes what was old is new again. That is the plan anyways. I just know that history has a way of rhyming and this time around they may have bit off more than they can chew. I just know they cannot possibly account for all of the unintended consequences.

Then there’s providence. We are living in the most interesting of times, for good or bad.

It seems that the kind of freedom and prosperity we have known since the Founders gave us our magnificent Constitution is not easily sustained. We the people failed to understand our part of the bargain: “The price of liberty is eternal vigilance.” We let the psychopaths, who always migrate to the top of hierarchies, catch us unaware. It takes sterner stuff than we have produced to fend off the thieves and murderers who want everything good that anyone has and will stop at nothing to get it.

And, Raptor, exactly why the leftists love European governance and the EU. The EU is a sugar-coated version of feudalism under the guise of democracy.

He wears a NIKE shirt, supports the sweat shops. SAD

I’ve watched the market change day after day for the past 45-60 days. Four feeds from a realtor in SC each day, one of which is Price Changes. For the past 18 months or so nearly every price change was a price increase. For the past 45-60 days nearly every existing home that appears in the Price Changes category is a price decrease.

They start them high because that’s where the market was. All their neighbors sold out at their asking prices but they don’t see the traffic. They don’t get the people falling over themselves to offer even more than they are asking. And day after day you see the decreases listed.

In the sold category I’m still seeing a good number of sold higher than listed but even that is slowing down. And remember, those offers were generally accepted long ago (ie., closing is not an overnight process especially in a hot market).

Yeah, the tide has turned.

In a hot market, cash and quick closes with no contingencies are king. It’s now that sellers are going to have to accept more iffy contracts. This is where having a good agent is key on both ends of the deal.

We saw a fair amount of that (cash offers) in Fla for quite a while. At least while the value was still present, even a bit beyond. Especially out of New Yorkers.

Vegas is nearly always at the front of the line of homes sales crashing the economy

The house (bank) always wins. Big swings in the market just equal more opportunities for graft of all sorts.

I don’t think banks stuck with lots of repoed property would agree. But, for a buyer, trying to work on a short sale or REO deal with a bank involved is much harder than buying from a private party.

Also, after the last crash, some states passed legislation to ‘keep owners in their homes’ as much as possible, apparently putting up obstacles to quick and easy foreclosure. California is one of them. Add in the Covid mess and mortgage forbearance and IMO it’s gonna be interesting.

I’m using it as part of financial warfare and taunting the enemy. They might win but I’ll get what I want too. Everything isn’t always about money. I’ll leave it at that.

Orlando as well.

I won’t say it will be as bad as 2006-ish, yet.

The loans back then were really bad – adjustable rates, interest-only, Ninjas, etc. The rates also were not as good as 5 minutes ago. A 5 minute ago rate of 3% is really really low.

Many people today traded an “inflated value” for an “inflated value”. Yes the one we personally bought was “high” but we got up to $200K more for our old house than we were going to list it for just a few months before we actually listed it.

The questions are can one make the monthly payment at the 3% rate through hard times? And how low will valuations go? And if and when will the economy get straightened out again?

There may be more resiliency today. On the other hand, the Fed can’t do the continuous rate decreases over many years thing again. And there was not inflation back in the day like there is today.

I think it will be far worse than 2006, the prices are inflated by a factor of 2-3x

and vehicle prices are more than doubled as well.

It won’t be. for two reasons. First, in the 2005 – 2006 time frame, nearly 50% of mortgages were Adjustable Rate Mortgages (ARM). Today (per the Federal Housing Finance Agency) only 3.7% of outstanding mortgages are ARM’s. The second reason it will not be as bad, is that in 2005 – 2006 there was an oversupply of homes versus today’s undersupply.

Prices will come down, but not like they did in the last cycle.

What makes you think it won’t be as bad, (it will be) when people can’t afford gas, food, or car payments?

It’s not as simple as you make it out to be.

Thanks for the info, Greg. I was wondering if ARMs were still popular, it looks like they are not. That’s good.

Interesting that Redfin is showing the majority of cancellations are happening in FL.

FL is exploding in population & housing prices are rising exponentially so it’ll be an increase in renters.

They’ll be leaving before long, that is if incomes can’t keep up with living expenses.

If you’ll own nothing & be happy eating zee bugs anyway… might as well stay where there’s hope to escape that fate.

There is nowhere to rent. Rents have taken off like the Green Rush in Colorado. Native Floridians are being priced out of our own State.

Interesting observation, that native Floridians are being priced out. It would be interesting to see the average affluence of the migration waves versus historic state averages.

Unfortunately it’s the biggest hazard of living in a free state. Everyone wants to be free but living free isn’t free.

….and fun is not cheap.

We’ve been getting 2-3 cold calls a day from people trying to buy our FL house. Maybe now that will stop.

There are still buyers so the best you might see is that the number of calls won’t go up or down.

I used to get those calls & I’d laugh hysterically & hang up. Word must have gotten around not to call the crazy lady…

Don’t get too cocky. Your day to be humble may be coming quicker than you can imagine.

Your powers of reasoning are sorely lacking.

Housing and related industries are a very large part of the economy. Along with mortgagees, realtors, flippers, manufacturers, lumber companies, contractors and workers there are many that pull equity out. Any downturn in housing will ripple through the entire economy.

Yep, in a shaky economy like we have now, a downturn can destroy it. As an outlier to conventional wisdom, I’m counting on it and working every day to effect that goal. Absent all out warfare, money is the weapon of last resort against a formidable enemy. Else we’ll become slaves. Expect it.

Have not checked the Mrs 401k but our separate and combined totals on IRA accounts are down $60k since January . So the Biden/ Demoncrat greatest economy ever cost me $10 k per month in asset devaluation . I know it’s a paper loss but at 68 my time horizon is up . So the hell with Ukraine and illegals running our border in need of help CHARITY BEGINS AT HOME .

Don’t even think of a tax increase in fact how about a 90% salary and benefit cut for all congress and senate till somebody in DC gets their combined skulls out of their combined asses !

I KNOW DREAM ON

3 fingers of good bourbon tonite !

I second the motion.

We should toast at the Green Dragon Tavern, for old time’s sake.

You are not alone, Robert. Bottoms up!

I am so happy that hubby and I bought our retirement property in 2019 and then sold our other home early this year. Made quite a nice sum and paid off the retirement property 🙂 All thanks to warnings and research done by Sundance. I just feel so lucky that we sold & CLOSED when we did. The market was showing signs of cooling off and I was petrified we’d be stuck. We just squeaked it through in time. Phew!

YOU WILL OWN NOTHING AND BE HAPPY

You’re gonna see people going from a good living with houses and Mercedes Benz, etc….. to riding bicycles and trying to find a place to rent.

Sam,

That’s going to be as ugly as Hell, but I think you are right. Our country is currently run by people who hate the majority of its citizens. It’s damned difficult for a country to prosper when its rulers hate it.

Ma held licenses in MA, for Real Estate and Manicurist.

I co-owned a nail spa and was a realtor, after the baby kettle entered school full time.

Over night 2 things happened in 2005. Listen up.

Minorities with bleak qualifications, were buying houses, Pa and I couldn’t dream of financing because we were such scardy cats of defaulting on the loans. Thus ruining our lives and the state ends up taking our kids.

Overnight in our small hometown, Asians moved into 4 locations within a week and put my very lucrative nail business out of 60% of clients because they underpriced us. Women thought it was cute, they couldn’t understand them and felt it was a charity, to support their business.

I called the State MA inspectors over multiple violations they were executing, against their regulations, as i regulated my whole buisness by and it was met by those shit monkeys, the deaf, the dumb and the blind.

Back to Realtor, I had minority clients, at the same time who brought, frozen bricks of cash to closings. No one flinched.

Well, we know what happened next. BOOM.

And along came Obama.

Sundance i think you are right on the money.. the cities listed above with contract cancellations i think also indicates the cooling of the hottest markets especially in florida.

Talk about bad timing. Just started building a new house for family. Our current home is way to small for the 5 of us (me, wife, 3 kids). Probably overpaying for material, but we will be in the new place for the long haul. Was lucky to get an interest rate at 4.25%. Going to be the only house at the end of our road. Should be nice and quiet for the next 5 years or so, until the other lots in the development get sold.

CUT THE CORD!!!

“If younger move in with your parents?”

WTF? I’m approaching 78 and I am done raising anything

Extended family in one place was commonplace back during the Depression. At my mom’s ranch, when relations would move in, space would be reallocated. She and three of her sisters ended up in bunks in the tankhouse. Hell in winter but very cool during the hot summers with the big water tank next to them.

I believe ten or eleven slept in the house and the four girls in the tank house. She had seven sisters and three brothers plus parents/grandparents, etc, there at one time or another.

“Free beer tomorrow”. A place called Rotten Ralph’s on Anna Maria Island used to have that as their main advertisement. 25 years ago I didn’t know what it meant. After repeating it to myself a couple of times it finally clicked. They went OOB around 10 years ago. Pray and pray more

I know at least 5 people who are fixing up to sell and move

that are going to be sh-t out of luck !

I warned a few that have been dragging their feet for months

on stuff that could of been done already

that time is almost gone and it should be on the market already

they all had lame excuses why they were dragging.

Damn

I’m not the sharpest knife in the drawer

but this web site is making me look like a freekin genius !

nobody I know is on my level of Information

I’m on a island here

they know many parts but have no clue how it fits together

or even what is behind it.

Clickety clack, clickety clack….Ladies and Gents you have just reached the high point in the initial hill on the roller coaster. Up to this point it’s been making that annoying chain (clickety clack) sound. Everyone suck in and take a deep breath; don’t look down. Be strong for those you love and yourself. This is gonna be a doozy.

Most of the cancellations were buyers who did not lock their interest rate when they got into contract. Rates rose so fast, the payments would have been several hundred of dollars more than what they bargained for when they made the offer. The professionals (Realtors and loan officers) that were supposed to guiding them through the process had their heads up their ass and lost heir deals because of it.

I’m in the business and I had zero fall out of contract this year. Yes, I have closed plenty.

Articles like this will hasten the crash because most people lack the ability to look beyond the sensational headlines. I’m ok with that, though. I can roll with the punches and operate in any kind of market.

Bring it on!

I suspect the ones who didn’t lock and cancelled because of rising rates are ones who were buying at the very upper limit of their financial ability. I personally have never done that, I have purchased 4 homes in my life so far and each was well within my means, I wanted to have money for repairs, renovations, and decorating.

Anyone who bought in the last year or maybe 2 who has an adjustable mortgage could end up in the foreclosure category especially if they maxxed out on what they qualified for. When they can’t make payments, can’t refinance because of price drops, and maybe lost a job, they will walk away and it will snowball.

Watch for increase in foreclosures. After 6 months the banks will be liquidating again and when more than 20 or 30% of market becomes repos, there will be big trouble just like 07-09.

I was a county assessor during 07-09 and banks were literally in competition to lower their repo price to see who can unload properties as fast as possible. Buyers/investors knew this and no matter what always offered less than asking price no matter what the price was. The unknown difference now is interest rates.

As an aside, when houses are changing owners, the new owners spend money on other things. It is estimated that people who switch residences also spend an average of $11,000 on improvements, furnishings, etc. The gross sales of those items will dwindle as well.

Powell and Fed will drive assets (stocks, real estate) down. Better to have those with wealth lose some than have those who have $1000 in savings (40%) rioting in streets over food and inflation.

Incredibly, no one is talking/considering effect of the dollar losing its position as reserve currency and impacts this has in our US currency/economy going forward?

Because this is happening now

40% of Americans have less than a $1000 in savings. Mostly these folks vote Democrat.

These folks cannot afford 9% inflation.

Powell and Fed will drive real estate and stocks down to bring inflation down to 2%. Because they can’t afford to pay the true interest they need to on our debt if it’s higher without printing (devaluing) more dollars.

So either have mass protests of poor people or take assets down from folks who can afford it.

That’s your government at work. Choosing who should pay their bill!

Cancellations can also happen when prices are reduced by sellers. A strategy amongst investors at a time like this is to watch for price reductions and just get out if one of those other homes you wanted just reduced their price. One method they use is contingencies based on inspections.

I was recently offered 325k for my house. (paid 170K in 2005)… ..new houses around me are going 400k and up… WTH… i suppose I can move into a 200k trailer park…uh no thanks I will stay put.