Yesterday we shared that U.S. consumer spending unexpectedly dropped 1.1% in July [Source], and today the commerce department is reporting that U.S. housing starts unexpectedly dropped 7% in July [Source]. Stop me when you notice a trend…

The financial pundits continue to attribute these drops to supply chain issues, COVID impacts, material constraints and various ancillary factors that have nothing to do with the underlying and overarching issues – inflation and wages.

The financial pundits continue to attribute these drops to supply chain issues, COVID impacts, material constraints and various ancillary factors that have nothing to do with the underlying and overarching issues – inflation and wages.

As long as skyrocketing food and fuel prices continue to impact the middle-class, forward looking purchasing decisions will be constrained.

We are in an economic era where working class family income priorities are focused on current day survival. “Food, fuel and energy price increases are changing consumer spending habits. Non-essential purchases have stopped….. they haven’t slowed, they have stopped. ←Emphasize this because it is not yet showing up in the data lag.” ~SD

Building permits have been issued, but we are in that period where speculative builders have noticed the consumer plateau and they have proactively stopped the home building process before they get caught upside-down with finished goods and no buyers.

WASHINGTON, Aug 18 (Reuters) – U.S. homebuilding fell more than expected in July, the latest sign that surging construction costs and home prices continued to constrain the housing market early in the third quarter.

The number of houses authorized for construction but not yet started last month was the third highest on record, indicating builders remained hesitant to undertake new projects.

“There is no question that home building has hit some sort of near-term ceiling, with surging home prices reducing affordability and leading to a record drop in the proportion of consumers that feel now is a good time to buy a home,” said Mark Vitner, a senior economist at Wells Fargo in Charlotte, North Carolina.

[…] Homebuilding fell in the Northeast, Midwest and West, but rose in the populous South. Starts increased 2.5% on a year-on-year basis in July. Single-family starts, which account for the largest share of the housing market, fell 4.5% to a rate of 1.111 million units. Starts for the multi-family segment tumbled 13.1% to a rate of 423,000 units. (read more)

I said in June, at a macro level home prices had reached their peak (last two weeks of May, first two weeks of June was apex). Obviously, there are some geographic home value increases still happening as COVID related regional issues and work opportunities are shifting populations. However, there is also a lag and ripple effect that takes time to work through the economy. The macro-apex will not be visible until next year.

People go where the work is, and the work is in the freedom zones (red states/regions). Population shifts keep some area home prices increasing. However, on a national macro-level the apex has been reached. People cannot afford higher mortgage payments and simultaneously deal with massive inflation on essential purchases. (CTH More)

People have no idea what lays ahead. Supply shortages are coming.

My neighbour imports outdoor furniture. Containers have gone from $3500 to $35000. He is pulling his hair out.

Copper for wiring. Transformer. We are seeing a 52 week back order for transformers for a new subdivision build we are working to build.

Food shortages as well. Drought has destroyed wheat crops.

Spot on Sundance. Spot on good sir.

DD

Last I checked from memory an electric car used something like 80 lbs of copper verses 20 lb for a regular car. But you also need transformers to make chargers and more wire to run for the charging station.

And soon China will be in control of all the metals in the mountains of Afghanistan.

Its working to get the monopoly on ALL of the worlds resources.

Wait until you get to a charging station and have to wait in line to charge. Won’t that be fun.

Wait until you have to wait for your assigned day to charge.

Just like in the good old gas shortage days of the ’70s.

And we’ll have fun, fun, fun!

There will be slap-fights break out among the soy boys jockeying for position

Especially when they turn the power off in CA for wildfires!

A woman was interviewed in Calistoga on this mornings news, and the Reporter said PG&E advised her to “plan” for these PSPS Power shutdowns.

The woman answered by saying … “How about the GIANT Energy Corporation do some planning to PREVENT these Safety Power shutdowns?”

It was a BRILLIANTLY delivered response. That woman is my hero

they are too busy going “Green”…the money PG&E could have used in brush clearing and burying their transmission lines was instead poured into green energy schemes that aren’t…wind and power STILL require transmission lines and backup generators to make up for their fluctuating power loads

Logos are thought out and not just scribbled.

PG&E has an interesting logo depicting a “beam from above” on an orange ampersand.

Elon Musk says that’s a good time to read a book, or have a meaningful conversation … the wait time will “relax” your hectic soul. An e-car will help you get in touch with yourself …

And leftist tools actually “believe” this nonsense.

Even those ultra super duper chargers it still takes a half hour.

Many gas stations are reluctant to spend any money on an electric charger.

How stupid people are to believe in this nonsense

With the decommissioning and NON-REPLACEMENT of many nuclear, coal and gas fired power across the country, there ain’t gonna be no juice to ‘fuel’ all of those ‘green’ electric vehicles.

We are heading full-speed and head-first into whirlwind cluster-f*ck of biblical proportions.

Lots of videos out there of electric car owners bragging about how even though it takes a long time to recharge the car, it’s FREE! I tell them you’re welcome, our tax dollars subsidized your car so you only pay a fraction of its value, and we’re also paying for his electricity to recharge it.

His sense of smugness is exceeded only by his cluelessness.

P.S. – I also love the guys who brag about recharging at home overnight, a low demand period when prices are cheap. That’s only true because electric cars are still mostly a novelty very few people own. If they become widespread nighttime will become a PEAK DEMAND time as all the electric cars are plugged in to recharge.

So you leave out the wire for the gathering grids. Solar and wind require thousands of miles of new power lines. The wind turbines use a lot of copper. They want copper mining shut down.

It’s Atlas Shrugged come to life, yet again.

Copper wire and wheat shortages were both important in the novel.

That was the most prophetic novel I have ever read. If only we could unite and Galt.

Rev 6:5-6

And when he had opened the third seal, I heard the third beast say, Come and see. And I beheld, and lo a black horse; and he that sat on him had a pair of balances in his hand. And I heard a voice in the midst of the four beasts say, A measure of wheat for a penny, and three measures of barley for a penny; and see thou hurt not the oil and the wine.

Wow. What are the prices going to be with those container prices if we can even get stuff?

Supply shortages are HERE.

Look around.

America is turning from the land of plenty to the land of scarcity.

My entire ‘designer outdoor living collection’ was gotten on the side of the road. ?

Dan, I do not see how your anectdotal evidence of continuing DEMAND supports Sundance view of a decline in demand.

Can you reconcile this?

I have no idea if this is true or not, just passing on what I heard from a trucker, who was also just passing it on, not claiming inside knowledge.

Of all those containers that come to America from China, we send only 40% of them back due to the trade imbalance. This also is adding to the backlog in shipping time and costs.

Again, I have no knowledge of whether that is real, 40% is accurate, etc.

But what if the American people are replaced by foreign investors and their immigrant settlers?

This is more great news for China

Foreign workers will also replace those who refuse the vaccine. I’m so tired of this garbage. Why does it seem that the left is just so persistent and capable? My goodness. They have all of the pieces together years before the events are manipulated. Sickening.

DD

I agree. It feels like they check mate us every time. No matter how awful a situation, it pays out in spades for the left.

when you are the player on BOTH sides of the board in chess you will find it very easy to win

I agree it’s all going their way, have they been given the green light, full access?

Who has the power to manage such a complete takeover of practically everything they want?

Persistent, yes. Capable, no. They use mass psychology against us, and too many fall for it.

They know they can’t TRULY finesse Abes maxim about “fooling people”,..but,…

“If we can fool JUST enough, for just long enough, we can seize/secure permanent power, and then it won’t matter!”

So, the longer it canbe delayed (which is why they are in such a hurry) the more people become dissillusioned ‘useful idiots’, useful no more.

And, if they suceed, and then no longer need to “fool” anyone, they run the risk of a Velvet/Singing revolution, where 100 percent of the population reject them. Even the Soviets couldn’t bring themselves to execute 100 percent of the population.

But, maybe the Maoists will.

CONmunism; its a CON. And look how many people fall for CONS. For just long enough, for the con artist to make off with your $, or in this case freedom

From a Biblical perspective it is our fallen nature that makes us manipulable and prone to seduction. This is in line with the existential difficulty of being mortal. We crave security, stability, safety, assurance. We wish to manufacture self-visions of ourselves as courageous, committed, informed, powerful, when in truth we are craven, self-interested, fearful, uncertain, ignorant, and powerless. Our minds are however capable of great illusion, and this illusion gains force if shared by many. The harmony of the herd. Where one renounces a Creator, where is one to go for relief from despair and terror? Illusion. Psychopaths know this is the lever to use to manipulate and because they appear to lack human feeling, they are not anxious, but only acquisitive. Our entire culture today is based on this psychopathic outlook. The psychopath also seems to know what he is doing which reassures the terrorized.

Consider; Michael Avenatti, Adam Schiff, Nancy Pelosi, Eric Swalwell, Hillary, Brennan, etc., etc. They are obvious psychopaths and enjoy the support of millions.

The politicians that we elect to stop them and represent our interests persistently fail to do so.

The left is only capable because the right is complicit in helping with their shared goals. It’s an illusion that there are two sides. It’s truly a uni-party and once you understand this fact, it all begins to make sense.

The right has betrayed us far more than the left. Decepticons are way more dangerous than the ones that tell us who they are.

China is buying up resources and land and resettling its people around the globe. Why should the USA be any different?

I live at ground zero btw.

AGRICULTURE

China is buying up American farms. Bipartisan pressure is building to stop foreign nationals from purchasing American farm operations and receiving taxpayer subsidies.

China’s presence in the American food system poses a national security risk.

https://www.politico.com/news/2021/07/19/china-buying-us-farms-foreign-purchase-499893

A number of “fiction” books have made reference to the Chinese half of Australia.

Make you wan to to go hmmmmmm.

Another “unexpectedly “.

Bingo. Ask 10 egghead “economists” a question and you’ll get 10 different answers. Unexpectedly is their favorite word to use, when they completely blow a prediction, and end up getting caught flat footed.

Everyone has watched a bubble grow. People watching the bubble grow doesn’t everyone know the bubble will eventually burst at some point. It certainly is not a surprise when the bubbles does burst. In fact, it is an inevitable expectation.

The Country’s heading into its second only era of economic Stagflation, a Democratic specialty. This is going to be rough but like all hardships in life it’s also going to be a blessing in disguise. It’s going to paralyze the Democrats ability to Print money and coopt countries, organizations, and people. We’re not a little banana republic – China’s not going to be able to come along and subsidize their operations.

See, you can’t Print your way out of stagflation, that’s the source of the problem. Biden thinks he can (and all the dumbass bureaucrats) but they can’t (gone to the well to many times). Like I said it’s going to be rough, he’s going to give us a Crash we can’t get out of utilizing Monetary Policy. Another President might be able to utilize some sort of Productivity oriented Work-Fare but mostly it’s going to have to work itself out naturally according to all the Laws of Economics.

That’s where he’s taking the democratic party, Oblivion. And after Stealing the Election, it’s tough to describe how despised that Entire Generation is going to be.

The complete opposite of their parents. Pure Scum.

I’m willing to suffer to see this take place. Actually a part of would like to see this happen again actually it’s the better option.

People are waiting for lumber prices to go down. I live in a lumber producing area, and insiders in the business say prices will go down soon.

Lumber is going down slightly in our area but metal has skyrocketed. I hope your insiders are right. My husband is a commercial contractor and metal is used more so than lumber but rising costs may change that. We continue to receive notices from our suppliers to brace ourselves for continuing price increases. We’re also noticing a lot of businesses are holding off beginning construction altogether, especially retail businesses and churches. Medical facilities are continuing but aren’t anywhere near what it used to be. Winter is a notorious for having things slow down (although during Trump we didn’t have it) so we have been preparing as best we can. Our main objective is to always keep our men working. In the 50+ yrs. we’ve never had to lay anyone off for lack of work and I’m praying we will be able to continue that.

How?

My husband is a Lumber Commodities buyer for a lumber yard chain

SOME lumber is going down (by penny’s) not all, but right now he said it’s expected go back up again after the first of the year. He also doesn’t expect lumber to come back down to the same prices and availability that was before Biden.

While builders are backed up with lots of projects (here in western ND) to build right now, Lumber Availability and shipping times and costs are a HUGE PROBLEM.

Another HUGE supply / higher cost problem is the steel industry

I don’t think it’s really known yet how “busy” or “Not busy” contractors will be in 2022. but it’s not sounding good.

I see a repeat of Obama years ahead, my husband lost his job in South Dakota when construction was halted and we ended up in ND because of the oil boom.. Biden has already put an end to that opportunity and economy driver by shutting down the pipeline (our main economy besides Big AG) …

Election Fraud Did It. Covid is the key for 2022 as well.

Nearly 15 Million Ballots Unaccounted for in 2020 Election

The research brief by the Indianapolis-based Public Interest Legal Foundation (PILF) notes that as the nation dealt last year with the CCP virus (which causes COVID-19), various U.S. states “hastily pushed traditionally in-person voters to mail ballots while, at the same time, trying to learn how to even administer such a scenario.”

https://www.theepochtimes.com/nearly-15-million-ballots-unaccounted-for-in-2020-election-report-says_3955184.html

Sundance- the indicators within the housing start #’s are a precursor of what’s happening generally. I can say , without a doubt that the high prices for logs and lumber we’ve all been witnessing for the last 18 months or so is coming to an end now.

Sawmills are fat with high priced inventory and dropping prices as demand softens. Now it will be a steady chase to the bottom of the market. Several mills in my area are taking down time to dry up inventory. This means logs will be introduced into the export market ( China/Japan & S.Korea).

We’ve been here before as an industry and will see it again if one lives long enough. The worst was the spotted owl debacle in the early 80’s.

Big issue is Transportation: right now there are aprx. 2500 loads per truck driver waiting at all times…

So you can be well stocked on a product but good luck getting it to market fast enough.

This is also the “Biden Effect”.

As people lose faith in the US so goes the US dollar.

Hyperinflation? I think is possible

Some may remember this from Friday,

VoteAllIncumbantsOut

August 13, 2021 5:25 pm

“This whole week, the futures markets have not been acting right and I’m beginning to wonder if next week is going to be a pullback or worse. Although, depending on the Capital Flows, they could take off to the upside. I’ll I know is strange things are occurring.”

Does anyone realize that the FOMC meeting occurs two weeks prior to its minute release which of course was today?

As always, the “Big Boys” are never NOT in the know!

If you work on an old computer – better get a newer replacement soon.

When Biden surrenders Taiwan to his CCP-masters, the CCP will cut off our main supply of advanced computer chips.

Yes. Yesterday, a commenter here was saying something to the effect of there are hundreds of thousands of new cars awaiting shipment to dealers but they can’t be shipped due to a lack of computer chips. I’m not entirely sure how that works, that a car could be built and lack a computer chip(s) but that’s what I read here.

60,000-70,000 Ford trucks at Kentucky speedway.

https://www.motorbiscuit.com/a-sea-of-incomplete-ford-f-150-pickups-over-60000-and-counting/

Lol, those trucks are gonna be hoopties with components rusted before they even get bought!

Here is an image for illustrative purposes.

There are microchips (really microcontrollers) in parts like these that control all of the electronic circuits in an automobile. They operate everything from fuel injection and managing fuel-air mixture to running the emissions control system, etc. In short just about everything necessary for a late model vehicle to operate.

Hope that is illuminating and answers a few of your questions.

with the electronics and sensors in a modern automobile there are THOUSANDS of integrated chips in their operation

What was “UNEXPECTED” about it? The prices of building materials have SKYROCKETED, so it’s only natural for builders to anticipate a decrease in demand caused by rising costs.

What was “UNXPECTED” was in fact “Expected” by anyone with half a brain. This of course escapes the media types and “experts”.

Relax Sundance. The Resident with the greatest cognitive abilities ever, is in charge. This is just a minor blip. Everything will be fine. Kabul will not fall.

Shades of Bagdad Bob ??.

Homebuilding rose in the south AND SOUTHWEST.

No surprise there!

From the minute release…

“With respect to the path of net asset purchases, respondents to the Open Market Desk’s surveys of primary dealers and market participants expected communications on asset purchases to evolve gradually, with signals anticipated over coming months regarding both the Committee’s assessment of conditions constituting “substantial further progress” and details on tapering plans. Almost 60 percent of respondents anticipated the first reduction in the pace of net asset purchases to come in January, though, on average, respondents placed somewhat more weight than in the June surveys on the possi- bility of tapering beginning somewhat earlier. With respect to the pace of tapering, respondents continued to anticipate that the Committee would take a gradual approach.”

Now everyone should always know “Who” the “Participants” are.

Now everyone should know superfluous bullshit when they read it.

But we need more houses to house all our millions of wonderful new Democrat voters pouring in from all over the world across our wide open southern boarder!

I expected it! Lumber is like gold right now.

Asset bubbles all over, it won’t end well.

Unexpected… the favourite media buzzword during Obama’s first two terms. Why would we expect anything different in term three?

Every month with a dem in the WH, all negative indicators are ‘unexpected’.

Before the covidiocy hit, most of the new “middle class” construction in my SWFL area was basically done on the basis of “Liar Loans” to demographics that are essentially living on a thread (shall I say 2-3 families in one single family residence). That is to say the buyers ended up with no skin in the game whatsoever. So, we’re going to be right back where this area was in 2006-2008. Poof….foreclosures.

I should also mention that I’ve watched these places go up and they are built with garbage material (or the lack of stuff like rebar in the concrete) and garbage labor. The true test of all of these issues will be the first hurricane that passes overhead. And, that is guaranteed at some point.

Finally, if I read this correctly the data relates to permits that have been issued but construction (loans) not started. Down here, there is a time limitation on those permits. They have to start or redo the process and fees or have an open permit on the record of the property with no final inspection and Certificate of Occupancy. One way or another the contractor will pay extra.

Some things you just don’t recover from like drinking Draino, going to Mexico to have both legs amputated.

That’s the state we gonna be in if that insane bunch in DC and Congress are not stopped.

I have no answers actually, I do know only God can bring this to a squeaking halt.

And I’m inclined to think He will not answer.

Pray for faith, if you don’t have any you’d better ask God for some.

Faith comes by hearing and hearing by the word of God. 99% of the commentators have no clue as to the reality of current events.

Followers of Christ Jesus, those seeking a knowledge of the truth outside the apostate church (people who actually read and study the Bible) see the situation ever more clearly. Those merely looking for answers from the world will never get truth just increasing darkness. All the unbelievers out there have been played and time is running out.

I started reading the Bible the day after the electoral certification. My friend ask me if any revelations have come from reading it. I tell them that one thing I noticed is that human nature hasn’t changed in thousands upon thousands of years. And that we are in deep trouble.

Amen.

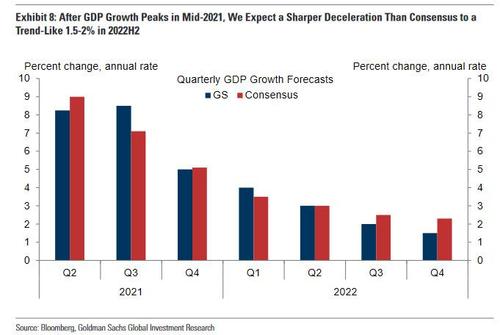

Here Comes Stagflation: Goldman Slashes GDP Estimate For Second Time In 3 Weeks, Sees “Bigger Inflation Surge”

A drop in GDP + “a bigger surge in inflation” = stagflation

18 Aug 2021

https://www.zerohedge.com/markets/here-comes-stagflation-goldman-slashes-gdp-estimate-second-time-3-weeks-sees-bigger

What is stagflation and why is it so dangerous?

https://money.howstuffworks.com/stagflation.htm

The book I’m writing in regards to trading, not a “how to” but a “what to watch out for.”

Chapter 6

”Up is never down and Down is always up”

As a trader myself, I’ve learned over many years the specific “Words” used such as “Unexpected”, “This was not expected”and so on. For me it’s normal.

Another Chapter Title… “Hear what I’m saying, just don’t listen”. Key words matter but they hope you will not listen to them.

Make America Great Again!

No one who frequents this site will find my comment the least bit surprising or novel, but it bears repeating all the same.

None of what is happening is incompetence (though it may seem that way). It is all by design. It is intended to inflict pain and suffering on us, but also to “groom” us into what lies ahead. We are being acclimated into serfdom–into indentured servitude to the state.

Mask and vaccination mandates, property right restrictions and violations (and soon to be outright property right nullifications), economic sabotage, federal police thuggery, on and on. By any measure, our government is making life more difficult, stressful, and unhappy. And it will only get worse–much worse.

But all this is by design–it is intentional. As the phrase goes, its not a bug, its a feature. For the perpetually optimistic among us, yes, we can change this trajectory. It is possible.

But for the realists among us, I don’t see even a glimmer of pushback or real resistance. Sure hope that changes soon–and last week was not soon enough.

The question is how much more suffering are people willing to endure before they decide they have had enough of it in order to affect a change in circumstances?

The Founders implied that people are long suffering to a fault until that threshold has been passed.

Now these self styled rulers may well have some idea of what that threshold is. They would certainly be evil enough to do things incrementally until it is too late for many, if their plans are a clue. Modern knowledge and tools such as psychology and mass media gives them the means to subtly manipulate many who are unsuspecting.

I am thankful I do not share your pessimism.

You can start with this one but please read everything regarding Stagflation that I already posted for you.

https://www.armstrongeconomics.com/armstrongeconomics101/economics/crisis-of-the-70s-compared-to-the-20s/

Sorry Maximus, this is what I wanted to share with you, it’s disturbingly accurate for what is happening and going to happen minus some far fetched items but anymore, I wouldn’t put it past “Them.”

https://www.docdroid.net/nYx7izy/a-brief-history-of-the-future-jacques-attali-pdf#page=175

Agree with all you say maximus and will just add that joe, kamala, or lassie wouldn’t matter in the oval. They are just decor.

Our compliance and apathy through all of this has scared the crap out of me. I see no real resistance anywhere. An effort here and there by too few to make any difference. Not sure we have it in us.

I always look forward to your comments for they are spot on.

I believe in the Lord Jesus Christ and know that the Bible is with out error. Its the Word of God to Man and what is going to happened.

Unexpectedly?

With the Biden Admin managing things so well?

Say it isn’t so?

This book (Copyright 2006) is Disturbingly coming to fruition, it’s talks of past, present and future events to come.

A “Planetary Constitution”, Transhumanism”, “Fall of America”, United Nations” Global control, etc.

I don’t care for this book much but I see what has been and “Is” currently happening today. If you like reading then be my guest. To me, it’s like a road map with some far fetched visions but not impossible.

https://www.docdroid.net/nYx7izy/a-brief-history-of-the-future-jacques-attali-pdf#page=175

You know I use to be so uncaring about what happened in DC. I had flowers, butterflies, some fun, and unworried peace. My worst problem was getting away from my ex and feeding my children. Then came Trump. He made me realize that there was more then my basic needs. America had needs. Suddenly I find myself in a hot rage over what they have done to this country. We voted these people in. We trusted them. There was no way we could have kept watch on them because they hid/are hiding in a dark deep swamp. Even Trump admitted he didn’t know it was so slimy and cold. A lot of people will blame the voter. You should have kept up on what was going on better. You should have, you should have, you should have but hindsight is a bright light from behind. We’re trying. Many people give us the bad news but few tell us how to achieve dominance over it. Sigh.

Since my service time I have never trusted our government. But since this last week I will never be the same as I was just a week ago.

Our Govt’ looks at us as slaves and a money spigot for them to rob…. nothing more.

Years ago, I learned a great lesson… I learned that when talking to anyone regarding Politics, you never attack the other party because you don’t know who the individual you’re talking with supports that party. You lump them all in together and one day, that individual begins to see for themselves what is transpiring right before their very eyes.

I have awakened so many over the years because I talk “Factual” things, I read “Factual” items from “Bills being introduced”, “Supreme Court opinions” to anything I can get a hold of that is 100% “Fact!”

When you can awaken your family first, you are on the right path. When you can counter arguments over hearsay, you ar3 on the right path. I became a proud “Nerd” of “Facts” and that is worth its weight in Gold. Take you’re time, it pays off this I promise. That’s how we work together to “save” our country.

you are a brilliant person and I salute you. I’ve tried to read such things but its not in me to understand. Simple person with simple needs. You’re a backbone. You’re one of the people who needs to help those who can’t understand. Thank you.

Wow, thank you for that compliment!

I was and still am a “ Simple” person just like you, I just took my time and reread things to grasp its true understanding. At first, I was considered a “Conspiracy Nut” until I countered with Bills, Laws, SCOTUS opinions and so on. As time passed, people started asking my advice on where things were headed.

Leading that Horse to water has always been easy, it’s the Drinking (Whomever it is) part that is difficult because people sometimes refuse to fully contemplate what is right in front them.

Don’t be discouraged because you think of yourself as “Simple”, get passed that if for anything, to educate yourself.

Good luck.

When you realize how slimy the Democrats are you will understand why nobody should be ruled by them.

What ever happened to BLM riots and the chaos they were committing??? Ohh, Biden stole the WH. Job Accomplished.

Remember after 2008 ‘meltdown’, theivery skyrocketed. People would go on a weeks vaca, and come home to a house stripped of copper, etc.

Catalyctic converters stolen from under cars, etc.

With Bidenomics policies, and Defund policies like no cash bail, we will soon be looking at the kind of theivery free-for-all that happens in SanFran, nationwide.

Guard your s*it, cause they ARE coming for it!

In the big cities around me, I am seeing hijacked and stolen cars in the news on a daily basis now.

All branches of government are working diligently to destroy a once great nation. JoeBama will get the blame and be gone soon only to be replaced by another idiot as bad or worse. We need to clean house and start from scratch with all new bureaucrats who will work twice as hard for half the salaries.

I posted this before, but did not see an answer. In the last stagflation, home prices did not drop. The only drop was briefly during the Reagan administration when they started raising interest rates.

https://fred.stlouisfed.org/series/USSTHPI

Mortgage rates during the Carter administration on 30 year loans were between 8.5%-12.5% During the Reagan years they briefly went over 18%.

https://fred.stlouisfed.org/series/MORTGAGE30US

I 100% agree stagflation is going to happen. My question is why will housing prices drop this time when they didn’t last time? Sincere question here. I am looking at investing in rental homes. Please educate me why this time is different?

Read everything you can a this is one individual I truly trust.

https://www.armstrongeconomics.com/?s=Stagflation+

You can start with this one but please read everything regarding Stagflation that I already posted for you.

https://www.armstrongeconomics.com/armstrongeconomics101/economics/crisis-of-the-70s-compared-to-the-20s/

As the price of food increases greatly along with fuel which is necessary to transport products, people will and are switching to essentials. Entering into crises mode. Its all about survival. The beast behind the bidone mask is tightening its grip. He knows his time is short.

Resistance is not futile.

I entered Survival mode once Bidet stole the WH. I will not contribute to his economy in any manner.

I buy the basics and that is it.

When everyday necessities, starting with food and gas, become too expensive and spending on major items are held back, the only people surprised are those lacking basic education in facing reality (liberals) … these are the people living in fantasyland that can’t handle basic math, such as 1+1=2. A couple more months of this and the real crush hits.

And workers in the tech industry, healthcare, state & local government, etc. are all being told get the vaxx or be fired. Who in their right minds spends money in a dying empire with a demented leader controlled by vicious Marxist globalists and 25% food inflation? Only the idiots that were dumb enough to vote for the demented puppet.

I want to see us crash sooner rather than later.

Check the price of building materials huge increases lately. My buds like to blame everything on Covo so I guess it costs more to produce a sheet of plywood today than a year ago? Yeah right! Oh, oh more people are driving again so fuel costs are up! Dips!

Since retiring in 2011 I have been enjoying my previously neglected hobby of woodworking. You know just building things. I love the smell of fresh sawdust! A lot of my projects use Baltic Burch, imported from Russia and Ukraine. NO, Grandma, there is no US or other substitute. It is a unique material as any wood worker will attest. I recently priced what I would need for a Blanket Box my Daughter-in-Law wanted and found the price of Baltic Burch plywood had more than doubled since my last purchase less than a year ago for some cupboards I built. Checking other materials at both big box and local lumber yards everything had ramped up. Wow that fuel cost is more of a driver than I thought!

I fear we are looking at the “New Normal”. In the meantime my girl may have to use that plastic tote a while longer!

Don’t worry She will get her Blanket Box!

All about the price of energy.

I discovered a broken sewer line on June 17 from my house to the septic tank. It took the plumber until 5 days ago to obtain the pipe he needed (and it wasn’t the recommended schedule 40 he told me he would use back in June).

When questioned about the length of time, he pointed out that PVC is made from waste products produced by petroleum production. China Joe has stopped oil production here in the US. Go figure.

This administration is ruining our country, killing our people, destroying the economy and ruining our lives. If ever a people had just cause to throw off the shackles of a government that does not represent them, we do.

A roll of 14-2 Romex copper wire has gone from $43/250’ to $120.00/250’

And every other building material has similarly shot up 200-300%

IDK how this could be unexpected. Lumber alone has increased 280%. My son bought a lot a year ago, with expectations of building a new home. That all stopped with the Bidenreich…

Working the Pikes Peak marathon this weekend, we are literally scrounging for vans to get half marathoners off the mountain. Rentals all say the same thing, no vans due to lack of computer chips…..that are made in Taiwan.

If China does follow through and attacks Taiwan we’re in deep trouble. Our economy will grind to a halt quickly.

Sundance, I think you are mistaken in interpreting what is happening. It is premature to reach this conclusion.

We need to see the July and August YoY new home sales data. I am looking for a very large increase.

If that does not happen I will concede.

So, I guess we’re back to the Obama tradition of announcing GOOD NEWS, EVERYONE! and then quietly revising the numbers downward shortly after the announcement.

As calmly as I can, things may have to get worse before they get better. Like a drunk , must hit bottom recovery. 40 years of living beyond our means by the grace of the almighty dollar has to end in flames. I don’t know any people that think this borrowing/money printing insanity can go on, some just shrug and weakly deny it cause it hasn’t happened after all theses years and thing the solution is to ignore and keep on. I understand the mentality, the alternative is to face a horrible truth.

One could blame the drop in housing starts to the increased cost and shortages of materials. You don’t a project if you can’t get the basic starting materials. And with plywood at close to $100 a sheet, a new house would be unaffordable. Just a note, check the replacement cost on your homeowners insurance. You may want to increase it.

We have a compromised POTUS and family. He is a suit. Will say and do things and change the next day, week or year. And his family………would sell access to anyone, communist, criminal etc.

Everything done, cancelling pipeline, commodity costs, opening border,homeowner starts, by this POTUS has harmed legal US citizens and aided our foreign competitors.

And then there’s election integrity issues being fought by this same POTUS!

Many in US don’t trust and many allies don’t trust either.

We are in a bad way.

If you are a landlord, you are looking for ways to dump your tenants who haven’t been paying rent for over a year and are now demanding an end to rent altogether.

One way to dump such drags to your personal economy is to convert your property to condos.

A lot of landlords who can do that are doing it.

Non-renters can’t sign an agreement because they haven’t kept their rent payments up to date, so, their units can be sold to new condo buyers.

A lack of need for totally new condos and apartments makes sense when you look at it.

As to individual homes, these mega-buyers like China and a few big corporations also see no need to buy land and build.

Better to hold onto the land until things shake out so they can build what will profit them the best.

I expect we will see more and larger homeless encampments as all this goes on.

Purely the fault of the Biden handlers who love to precipitate crisis so they can profit the most later.