A few days ago, we were discussing the disconnect within the economy as it relates to corporate valuations. The Bureau of Labor Statistics report today [DATA HERE] highlights another economic disconnect, this time with labor. According to the BLS survey 528,000 jobs were added to the economy in July, the unemployment rate drops to 3.5%.

The household data [Table A] shows the number of eligible workers unemployed dropped 242,000; however, the number of eligible workers no longer in the workforce increased by 239,000. The total labor force is shrinking as unemployment drops.

The household data [Table A] shows the number of eligible workers unemployed dropped 242,000; however, the number of eligible workers no longer in the workforce increased by 239,000. The total labor force is shrinking as unemployment drops.

Keep in mind the previous BLS survey of job openings (JOLTS report) showed available jobs dropped 605,000 in July. “On the last business day of June, the number and rate of job openings decreased to 10.7 million (-605,000) and 6.6 percent, respectively. The largest decreases in job openings were in retail trade (-343,000), wholesale trade (-82,000), and in state and local government education (-62,000).” [JOLTS survey]

Going back to today’s release, 303,000 part-time jobs were added in July; these are workers working part-time for economic reasons. The Household Data shows that within the leisure and hospitality sector [Table B-1] restaurants and bars added 74,000 jobs.

If we combine both BLS surveys two days apart is: 605,000 job openings cancelled, and 528,000 new jobs gained.

Of the 528,000 new jobs gained, 303,000 were part time jobs with the largest growth in the jobs in restaurants and bars.

Again, blending data from both reports and focusing on retail. The retail sector cancelled 343,000 job openings in July, and the retail sector added 21,600 jobs in July. Within the retail sector (table B-1), jobs at automotive dealers, furniture stores and clothing/apparel stores dropped by a combined 7,200 jobs.

BIG PICTURE: ♦Energy prices are squeezing consumers and paychecks. ♦Energy driven inflation is high. ♦Rising housing costs, food costs, gasoline costs and energy costs have hit the consumer hard. ♦Credit card balances have jumped (highest increase since ’02). ♦Consumer sales on non-essential items have dropped. ♦Factory activity around the world (Asia and Eurozone) is slowing or has stopped. ♦Durable goods inventories have climbed everywhere. ♦Shippers of durable goods are not shipping. ♦Employment in auto sales, furniture and clothing have all declined. All of these datapoints align.

Everything in that “big picture” is fact based on current data, and it all makes sense. However, there is still a disconnect in the big picture.

How does an economy add over 4 million jobs this year, while simultaneously shrinking?

The value of those jobs has to diminish in proportion to the economic contraction. The disconnect only reconciles if the wages which lead to eventual spending. With wage growth at 5.2% and the cost of everything up 9.1% (inflation), the difference between the two is how the economy shrinks even with more jobs added.

Think of all the activity (buying stuff, eating out, ordering food etc) as units. All of the unit activity costs more money, but the earnings of the workers is only keeping pace with half of the increase in price. Therefore, less units are being engaged made, sold and purchased.

The GDP, which measures the value of everything created in the economy (minus imports) dropped 1.6% in the first quarter and 0.9% in the second. The unit economy is contracting.

As I have said before, “an intentionally managed decline of western economic activity should have a direct impact on the private corporations within those economies. If the politicians are collectively going to stop energy development, raise energy prices (inflation), then use monetary policy to shrink the economy down to the level of energy available, we would normally think corporations were going to make less money.”

However, in our current scenario, as long as price increases (energy inflation) can be passed along and wage gains can remain low, the profitability remains strong. Here’s the worst part of this dynamic. The people investing in the profit get richer, the workers creating the profit get poorer.

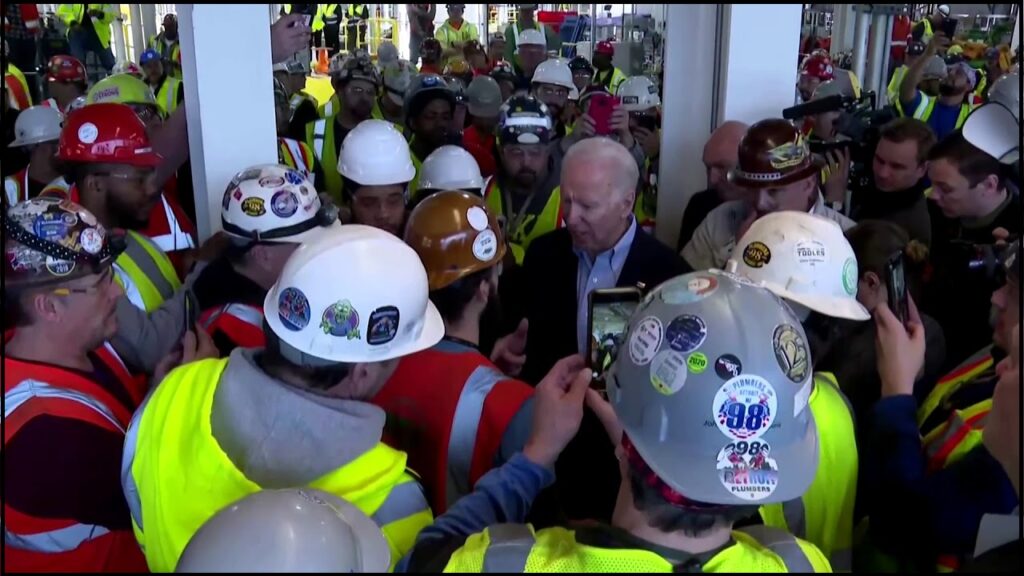

Our Joe Biden economy, and the economy of the western nations that are following this same climate change agenda, is getting smaller. Within the smaller economy, the rich are getting richer and the workers within the Joe Biden economy are getting poorer.

And bad news for the folks in DC, including the Fed, who hate everyone who actually works…. wages are going up pretty fast around here…

I work in the temp staffing biz with mostly unskilled workers. We still are having issues with filling client orders for workers. And the biggest issue is churn or turnover. Our 2nd quarter FUTA and SUTA went through the roof. The reason is churn. Usually by 2nd quarter our unemployment taxes go way down since after $7000 in wages it is exempt from the tax. That isn’t happening now. It wasn’t this bad last year. We just aren’t understanding how these people are surviving. I know that our state (TN) supposedly isn’t handing out unemployment or taxpayer welfare. So, how are people making money?

From my understanding there are still over 3 million less people working than in Q1 2020 so the labor participation rate is way down. I know in my area (Middle TN) the unemployment rate is less than 3%. So, what gives?

I should add that our hourly wage rates are skyrocketing. We have clients now paying $18-$20/hour. It’s insane. The lowest hourly rate with our clients would be $13.50 but those clients have daily and weekly bonuses. Weekly bonuses don’t attract employees since most only work a few days at a time. Hispanics are still our best work force. We are seeing an Egyptian group that is relatively reliable however there are some cultural issues. To clarify we use E-verify to validate legal status. An aside is that E-verify is a cruel joke on the American people.

3.5%. That is the biggest load of BS since “covid”.

They are STILL LIEING to us…LIES LIES LIES

It’s this administration, don’t forget that!!

The jobs report (released on Aug 2) showing the loss of 602,000 openings as of June 30th can be dismissed by the media as old data.

If the BLS can release employment statistics for July during the first week of August, surely it could release the July data for job openings as well.

The BLS has probably always reported job openings with a 30-day lag. Given that modern reporting should now be electronic, the schedule seems designed to obfuscate rather than to inform.

It seems very likely that the July report will show further losses in available jobs.

The offset in reporting between job openings and employment statistics allowed Biden to brag about job creation based on increased employment, because there is no current report on job openings to contradict him.

Fast food places near me are dying with the price increases. Hubby really wanted a FF burger so I took him to Whataburger. They are the only ones that has a line anymore. The line wasn’t moving so we went to Burger King. $18 for a lunch for him. When he saw that he agreed to leave and no problem backing out of the drive-thru cause it was the lunch rush and NOBODY buying. I see these places empty all the time now. Won’t be long before they are permanently closed. Sometimes you get caught and you really need to get something fast but it won’t be an option.

Supply chain, workforce, energy, monetary policy are the 4 big drivers.