In addition to the contraction in South Korean manufacturing announced last night, European manufacturing and factory activity is also contracting with less output, higher buildup of inventory and fewer orders for finished goods. The global recession is being measured fast and furious.

Every economic outcome is connected to a purposeful decision by the leaders of western industrialized nations to follow the Build Back Better climate change agenda. Higher energy costs, an outcome of the collective policy to stop new production of coal, oil and gas, which has transferred into higher food prices, farm prices, gasoline prices, heating and cooling prices as well as electricity rates, is forcing consumers to stop purchasing non-essential products.

The sale of durable goods collapsed in the first half of this year; however, no policymakers or bankers wanted to admit it and they kept saying there was an excess of demand. Now, with fewer customers for durable goods in the market, global manufacturing and factory outputs are dropping fast. Eventually the central planners are going to have to admit their pretended demand does not exist.

While there is a natural lag in the activity, the rate of factory contraction will be proportionate to rate of the drop in demand. Meaning we have only just begun to see the manufacturing decline that lags a few months behind consumer activity.

LONDON, Aug 1 (Reuters) – Manufacturing activity across the euro zone contracted last month with factories forced to stockpile unsold goods due to weak demand, a survey showed on Monday, adding to concerns the bloc could fall into a recession.

S&P Global’s final manufacturing Purchasing Managers’ Index (PMI) fell to 49.8 in July from June’s 52.1, just ahead of a preliminary reading of 49.6 but its first time below the 50 mark separating growth from contraction since June 2020.

An index measuring output, which feeds into a composite PMI due on Wednesday and seen as a good gauge of economic health, sank to a more than two-year low of 46.3. In June it was 49.3.

“Euro zone manufacturing is sinking into an increasingly steep downturn, adding to the region’s recession risks. New orders are already falling at a pace which, excluding pandemic lockdown months, is the sharpest since the debt crisis in 2012, with worse likely to come,” said Chris Williamson, chief business economist at S&P Global. (read more)

The WEF directed politicians are trying to bring energy demand down to match the energy shortage they have created. The various western government leaders, Biden included, want/need a recession to drop energy demand. The central banks and federal reserve are supporting the policymakers by driving up interest rates into the recession.

The combined effort leads to a shrinking of the global economy.

By lowering the economic activity and forcing their western nations into a joint collaborative and intentional recession, the central planners hope to offset the inflation they created by blocking coal, oil and gas production. By intentionally collapsing demand, the prices of excess non-essential goods will drop; however, there will be no one to purchase those goods at any price because global employment in a global recession is tenuous at best. This is the spiral they are trying to manage.

TOKYO (Reuters) – Japan’s manufacturing activity expanded at the weakest rate in 10 months in July, as pressure from rising prices and supply disruptions hurt output and new orders, suggesting a solid post-pandemic economic recovery is still some way off.

The final au Jibun Bank Japan Manufacturing Purchasing Managers’ Index (PMI) dipped to a seasonally adjusted 52.1 in July from the previous month’s 52.7 final.

That marked the slowest pace of growth since September last year, and was slightly lower than a 52.2 flash reading.

[…] Manufacturing activity suffered from contractions in output and overall new orders as well as a slower expansion in the backlog of work, the PMI survey showed.

[…] But a government official also warned downside risks for output remained as parts supply delays lingered. That is one of many reasons why the Bank of Japan remains resolutely committed to its ultra-low policies despite a global trend of rising interest rates to fight rampant inflation. (more)

It’s incredible how they various western leaders and bankers can still say there is too much demand, when every single economic indicator clearly shows that all consumer purchasing of non-essential goods and services has stopped.

We are seriously looking at a future employment scenario that might be as bad as it was during the economic lockdowns in the pandemic. This time all of the unemployment will have been created by intentional climate change policy.

These ideologues are seriously disconnected from the pain they are inflicting.

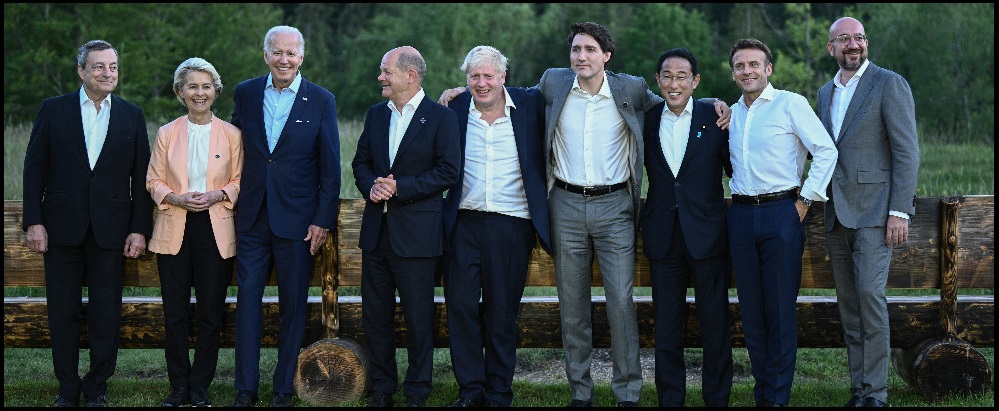

That’s a picture of some of the finest Communists in the world. Making the WEF proud.

I wonder if there’s a growing market for tar & feather’s and pitchforks & torches?

If not, there ought to be. And events scheduled to put them to use.

Hannity thinks Putin is a thug and dictator.

Why would I listen to Hannity, when

the policies he supports are opposed to

what he says?

Hannity says “more energy production”

but his policy preference is to sheet on the

3rd producer of energy globally.

Hannity says, “Putin must go”, yet he supposedly

opposes global war, and MIC proliferation of weapons.

Hannity sucks. He is the most obvious of propagandist gatekeepers.

Sean Hannity should strap it on and go do a reporting gig

from Lukhansk.

Stop listening to /watching Hannity.

Speaking of Li, I always wondered why the eco-zealots and powers that be were pushing electric vehicles. I mean, you have to get the energy from somewhere — like a coal-fired plant pumping electrons into the wall socket.

Then someone mentioned that they don’t plan for us to have cars. And it made sense, in an ugly way.

But you can bet the movers and shakers intend to keep their limos and private jets.

I have to admit it took me quite a while to understand this little (seeming) paradox.

Yup, they don’t practice what they preach, and they wonder why we are resistant (to put it mildly) to all of their plans to destroy us completely.

these oligarchs are scum. everyone of them needs to have their wealth taken away.

Well gosh all golly, it IS a recession but it’s Putin’s recession.

YT Vid today shows Panama without gasoline and heading towards famine. The vulnerable shudder while the parasites thrill to their demonic plans. Never a more degenerate and evil time.

Makes me kind of wonder how secure those ‘expat’ enclaves really are in places like Panama, Paraguay, & Ecuador, given the possibility of large-scale global recession & civil unrest.

The Stansberry group & others were really pushing these hard a few years back.

It’s probably a good time to watch The Big Short again…

https://nypost.com/2022/07/27/big-short-investor-warns-of-last-hurrah-for-corporate-profits/amp/

Good movie but also perpetuated the idea none of the people at the top of the economic food chain had any clue what they were building was going to crash one day…. to which I call — BS.

My uncle is 2 years younger than me. An educated person with degrees in Business + Accounting – but he’s not the brightest bulb in the bunch. Not stupid but not the quickest mind around. — But — he left banking because he said he couldn’t stomach being pressured into giving loans to people he knew couldn’t afford them.

The Big Short + Too Big to Fail want to point the finger at Deregulation + greedy Republicans — when in reality — the 2008 crisis was nurtured for decades thru which the White House + Congress “changed parties” multiple times.

They knew what they were doing made no sense. They knew it was basically a ponsi scheme, but as long as they had the Government guaranteeing to save them with massive bailouts, they were willing to ride the bubble till it burst – as they knew it would eventually….

Next we will that tax receipts to EU governments have “unexpectedly” dropped.

I’ll bet not one of those ideologues will ever go one minute without air conditioning or food or transportation. All of their needs will continue to be met.

If you were Russia, China, India and were concerned about the US and West economies, their currencies, their sanctioning ability, what would you do?

You would make agreements that would circumvent these economies (done). You would lead others off their currencies (done). And then you would expose these fiat currencies by attaching your own currencies to commodities and/or bundling of multiple currencies. (To come).

1.5 billion people have sanctioned Russia thru their governments, 4.5 billion have not.

The only question left to answer is “Will the people in the E.U. freeze to death before the clima-tards starve them to death”?