The G7 plan to create another economic sanction against Russia by capping the price anyone could pay for Russian oil has a serious downside. If Russia slows down the export of oil, global oil prices will jump dramatically. That policy outcome would mean a massive increase in the price of gasoline for U.S. consumers.

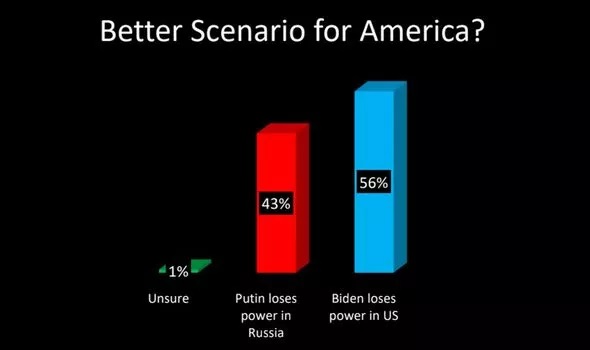

Because the consequences are horrible, that’s precisely the reason Joe Biden might push to have the Russian price cap. Every policy Joe Biden has historically supported, has been the exact opposite of what should have been done. Biden has a profound and innate ability to screw up anything.

Because the consequences are horrible, that’s precisely the reason Joe Biden might push to have the Russian price cap. Every policy Joe Biden has historically supported, has been the exact opposite of what should have been done. Biden has a profound and innate ability to screw up anything.

[Bloomberg] – Global oil prices could reach a “stratospheric” $380 a barrel if US and European penalties prompt Russia to inflict retaliatory crude-output cuts, JPMorgan Chase & Co. analysts warned.

The Group of Seven nations are hammering out a complicated mechanism to cap the price fetched by Russian oil in a bid to tighten the screws on Vladimir Putin’s war machine in Ukraine. But given Moscow’s robust fiscal position, the nation can afford to slash daily crude production by 5 million barrels without excessively damaging the economy, JPMorgan analysts including Natasha Kaneva wrote in a note to clients.

For much of the rest of the world, however, the results could be disastrous. A 3 million-barrel cut to daily supplies would push benchmark London crude prices to $190, while the worst-case scenario of 5 million could mean “stratospheric” $380 crude, the analysts wrote.

“The most obvious and likely risk with a price cap is that Russia might choose not to participate and instead retaliate by reducing exports,” the analysts wrote. “It is likely that the government could retaliate by cutting output as a way to inflict pain on the West. The tightness of the global oil market is on Russia’s side. (link)

I wish Sundance & Company would quit saying that Biden is “screwing up”. ALL of Biden’s decisions are scripted. ALL the bad consequences are deliberate. NOTHING is the result of incompetence. This Brandon Regime is a tragedy in three acts., penned by a demonic author and acted out by a cast of charlatan-puppets.

Soooo…screwing up!! Perfect analogy!!

after all, a screw is a fastener

One step further, I wish people would recognize the brilliance in which this administration successfully operates and administrates policies.

To call them screw ups is to pretend this isn’t our government acting with absolute intent.

I also wish people would stop blaming the supernatural and injecting superstitions as the reason behind it.

This is just what Governments and the men behind them do when left unchecked. There is no divine mass force here in play, it’s just men with political power.

Don’t oversell them or make them bigger than they are by giving them that alter to exist on.

ergo, ego.

STRATEGIC…it’s called a strategy, a plan, a device, a path, an end result…and they carry it out to precision, whether ‘in power’ or ‘out of power’…with Dems, you can never tell who is in power..b/c they don’t stop…..destroying and they are ruthless, godless, destructive…and are proud of it and don’t apologize for it NOR secretive about it…..

Exactly.

DEMS have a PLAN for everything and republicans never, ever have anything….

It’s ALL a scam

1)Ukraine

2)COVID, China

3)Pfizer, Moderna, J&J

4)Elections

5)Congress

6)Russia

Ukraine, Zelinsky RAPED the USA…period. And Congress went whole hog…NO, NONE accountability. We have NO IDEA WHERE the funds go??? However, you can damn well believe a % is RETURNED to USA politicians, on both sides of the aisle.

See where one of the cabinet minister wives CAUGHT at Hungry border with $MILLIONS in suitcases. Hungry intercepted and REFUSED her entry and made her DECLARE….wonder where in tarnation she got all that money???????? Anyone????

And why pray tell would she be LEAVING the country, with said $millions???? Anyone???

COVID was a blight, scam of epic proportion and we have not fully recovered….$$$billions to Big Pharma and direct to the pockets of USA politicians, CDC, NIH, Fauci, et als…. And NOW the side effects and the maladies and illnesses and sickness….but hey, NO ACCOUNTABILITY for Big Pharma…remember????? Thanks politicians….

Biden wants war and will get war..it’s what the globalists want, desire, need for their greedy hands…..We will be in war before Biden goes in 2Y….he’s the useful idiot, Jill is the useful idiot, Kamala is the useful idiot….BHO is the wizard….behind the curtain.

Dems NEVER plan to stop…2-3% of population is the alphabet soup and yet we have 1 month of celebration and the world supports……They never stop, from birth to death….it’s indoctrination. Gender-hell…is the rule…TV, movies, press, media…politicians, hollywood..>FULL THROTTLE TO DESTROY the family, father, mother, children model…..

And yet we can’t get a majority of the uniparty to care……and won’t. Occasionally, they quibble and they thrash and lash out….the Cruz’s, the Blackburn’s, the Hawley’s, et als…but they in-turn flop like a mop, sway, bend, turn…it’s WHAT THEY DO….ALL were for Ukfraine….KNOWING damn well it was and is a scam and those $$$ are tainted and going to places they have no control over…..nor do they care…we have to be HUMANE….CARE for the world..

.

…yet we just left Afghanistan AFTER 20Y OF WHAT: FAILURE and no more out of there then we are NOW IN UKRAINE…SEE how this works….

Vote in 2022..see how that works out…politicians will take your $$, your votes and your support and they will VOTE however they damn well please and based on whose $$$ they are taking. THEY FEAR $$$/lobby/globalists/Wall St/K St MUCH MORE THAN WE THE VOTERS…

They concerned over $5 gas????? IF so, HOW?????? THey feel OUR pain at the grocery store?? HOW????

IF THEY DID< there would be OUTRAGE….DEMONSTRATION….I’ve SEEN NOTHING, nada…silence….

One nit to pick: “BHO is the wizard….behind the curtain.”

Ummm, no. Ever hear him unscripted? 57 States? Marine Corpse? Sealed transcripts? Hello?

Another useful idiot that is still useful… for now.

All the rest I give 👍👍

Absolutely right on all points

The administration ratchet always tightens, it never loosens.

Correct, and they even have a spare idiot in chief in case FJB doesn’t make it to 2024.

Well, biden is in charge of those people, isn’t he? He knows what’s happening and seems to wholeheartedly approve of the mayhem he’s created from day one in office. He loves the attention, even if it’s bad. He’s a moron.

Soooo…. Biden’s puppeteers are using him to screw up as much as possible. Has anyone figured out who the “Savior” is that they’ll push to “fix” everything while consolidating more power?

Yes. He wants a 4th and 5th term.

Michelle Obama

Watch OPEC+ and BRICS+

They will STARVE the WEST of affordable Oil & Gas.

They will DE-DOLLARIZE and DE-EUROIZE their Economies.

The West will first ECONOMICALLY IMPLODE.

Then PATRIOTS FIRST will DUMP

• Their WEF REGIMES

• The GREEN NEW DEAL

• Their WEF DEBT

… Taking the $$$ from BILLIONAIRE OLIGARCHS

… Breaking up Big Tech, Big Pharma, Big Media

… Breaking down Big Education, Big NGOs, Big ESG

The article states that “…the plan to cap Russian oil prices could seriously backfire…”. It then says that it could result in a reduction of supply which in turn could result in much higher prices. Backfire??? Really??? Reduced supply and higher fossil fuel prices are the stated objectives of the EU, NATO and the handlers of the senile occupant of the White House. The estimates that the disruption of the food supply chain caused by this engineered war could cause 300 to 500 million people in vulnerable countries to starve would fulfill other stated objectives. As far as our “leaders” are concerned it’s not a tragedy, it’s a goal. The operation is going according to the plan. Every statement from every government is Orwellian Newspeak.

Barack Obama’s assessment of Joe Biden’s abilities was spot-on. He is a screwup.

When will the arrests start to be made? And by whom?

With this asshat’s record in the world, why would ANYONE think any government would listen to his sorry ass!!!

HE HASNT BEEN RIGHT ABOUT ANYTHING!

WRONG ABOUT : Energy

Appointments to public office!

Financial responsibility for AMERICA !

”Green New Deal”!

Fuel!

Food!

NOTHING! BILLIONS TO UKRAINE

AMERICA’S BORDERS! NOTHING!

TREASON!

“screw up anything”? That’s the behind the curtain clan orchestrating it all. Sticking to the plan. Joe can’t even wipe his ass by himself and needs Jill or Barry to give him a hand.

This is the most stupid idea I have ever heard of.

I guess most of the world doesn’t realise that India is doing a roaring trade re-exporting Russian oil to the USA and Europe, China will be next.